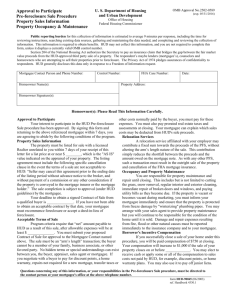

to see a diagram of the short sale overview process

advertisement

Purchase Contract for Purchase and Sale/Authorization to Release Hardship Letter/ Fin Form/ 2 yrs Tax Returns/ 2 month bank statements/ last 2 pay stubs/ Copy of Mortgage Statement Repair estimate/ Listing Agreement/ Comparable Sales/2 REO, 2 Pending, 2 Sold Current Market Analysis Other items to gather from real estate agent, contractor or others Gather from Homeowner Fax Cover Letter/ Authorization/ Cover Letter/ Contract for P&S/ HUD 1/ Listing Agreement/ Financial Form FDMC/ Hardship Letter/ Last 2 pay stubs/ Last 2 bank statements Last 2 years Tax Returns Pre-approval letter Send complete package to each mortgage holder Send just P&S and HUD 1 to Lien Holders SEE "Art of the BPO" Ask Mitigator "what did the BPO come in at?" BPO low enough to buy outright? 1st mortgage = 80-100% of BPO Increase offer price thru negotiations Buy - Fix Sell OR Quickturn? 2nd mortgage = 5 -20% of balance owed All counter offers must be made in writing with P&S and HUD 1 Buy - Fix Rent Property needs re-marketed to find end buyer 3rd mortgage = 5 - 10% of balance owed HUD 1 and P&S agreement price must match Buy - Sell Simultaneous Quick turn Liens = 5 - 10% of balance owed Fax P&S and HUD 1 to loss mitigator for approval