The smallholder tea sub

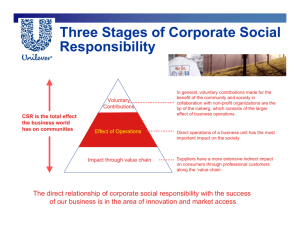

advertisement

The Smallholder Tea Sub-Sector in Kenya FAO/IGG Meeting 5th to 7th November, 2014 Bandung, West Java - Indonesia Alfred Njagi, General Manager (Operations) – KTDA Ltd 1 Outline 1. Background 2. How the smallholders are linked to the processing factories 3. Production 4. Total quantity of tea accounted by the smallholders 5. The pricing structure 6. How the smallholders are linked to the value chain History of Tea In Kenya 1903 - Tea introduced to Kenya at Limuru. 1924 - Commercial large estates tea farming started. 1950 - Formation of Tea Board of Kenya to regulate the tea industry. 1954 - Smallholder cultivation commenced under the Swynnerton plan. 1957 - First small holder tea factory established in Ragati, Nyeri. 4 The First Tea Bush In Kenya - Limuru 1903 5 Kenya Tea Industry Structure MINISTRY OF AGRICULTURE POLICY TEA DIRECTORATE REGULATORY TEA RESEARCH FOUNDATION OF KENYA Smallholder Sub-sector (KTDA & NTDC) Plantation Sub-sector (KTGA & Independent Tea Growers) EATTA (Brokers, Warehousemen, Buyers & Packers) RESEARCH PRODUCERS TRADERS Small Holder ownership structure KTDA Holdings FACTORIES FARMERS • A private company owned by 54 corporate shareholders (factory companies) • KTDA Board appointed by the 54 corporate shareholders • The 54 factory companies owned directly by the farmers as individual shareholders • Directors appointed by the farmers • Management through Management agreements • Each farmer is a shareholder of the respective factory company • Shares allotted based on Green Leaf delivery to the factory between 1988 -1996 A unique model that empowers the farmer from the grassroots, a world’s first. 7 KTDA GROUP STRUCTURE NB: TEA FACTORY COMPANIES These investments have been made along the tea value chain to manage costs more efficiently, add value to the services to the small scale tea KTDA (Holdings) LTD KTDA (MS) LTD CHAI TRADING CO.LTD Factory Companies management MAJANI INSURANCE BROKERS LTD Tea trading & warehousing KENYA TEA PACKERS LTD Insurance Brokerage farmers and distribute the surplus revenue to the shareholders. GREENLAND FEDHA LTD Tea blending, Packing and marketing KTDA POWER LTD TEA ENGIN. KTDA & MACHI. FOUNDATION CO. LTD (TEMEC) MicroPower finance Generation services Group CSR Engineering & Fabrications KTDA (MS) Operational Structure KTDA MS Region 1 Region 2 Region 3 Region 4 Region 5 Region 6 Region 7 12 Tea Factory Companies 9 Tea Factory Companies 8 Tea Factory Companies 8 Tea Factory Companies 13 Tea Factory Companies 12 Tea Factory Companies 4 Tea Factory Companies Total - 68 processing factories (66 in Kenya and 2 in Rwanda) 9 Factory Structure FACTORY COMPANY BOARD Elected by and from among the farmers to handle policy issues FACTORY MANAGEMENT STAFF Professionals to handle managerial and operational issues FACTORY EMPLOYEES Assigned none managerial duties within the various factory operational areas 10 What are the linkages? FARMER Plucks Green Leaf and delivers to collection centre FACTORY Collects Green Leaf and Processes it into Made Tea Produce, Dispatches Tea to the Market WAREHOUSE Receives Made Tea & Stores it until the Made Tea is Sold AUCTION Factory Brokers Sell The Tea to Interested Buyers BUYER Buyers collect purchased tea and ship to their destination Direct Sales Overseas The KTDA transformation Year Activity in Phase 1950’s Small-holder cultivation commences 1957 1. First Small-holder Tea Factory started in Ragati, Nyeri 2. Factory management through a management agreement with multinational tea companies 1960 Special Crops Development Authority established 1964 1991 1999 2000 1. The Kenya Tea Development Authority established under the Agriculture Act (Cap 318) Section 191. (Legal Notice No.42). 2. KTDA (authority) takes over small-holder management from multinational tea companies. Parastatal Reform Strategy Paper developed, listing KTDA among other Strategic Parastatals for privatization. KTDA Order revoked through Legal notice No.44 enacted as a result of recommendations of Sessional Paper No. 2 of 1999. KTDA (Authority) was transformed into a private company, KTDA (Agency) 12 Ltd on 30th June 2000 & registered under the Companies Act. (45 factories) 12 KTDA Group Overview 2014 Annual sales turnover •Over Kshs52.97 Billion; ( $ 600 million) 67% paid to farmers (2013/14) •Over Kshs 69.2 billion; ($ 790 million) 75% paid to farmer (2012/13) NB Drop of 24% attributed to decline in tea prices Established staff Approximately 10,000 across the Group No. of growers Over 560,000 small-holder farmers, also shareholders Managed Companies 68 Kenya Tea Factories, KTDA Farmers Company a company 100% owned by small-scale tea farmers), and 2 Tea Estates (Kagochi & Kangaita farms). 1. KTDA Management Services Ltd (KTDA MS Ltd) 2. Chai Trading Company Ltd (CTCL) 3. Majani Insurance Brokers (MIB), 4. Kenya Tea Packers Ltd (KETEPA), 5. Greenland Fedha Ltd, 6. KTDA Power Company Ltd. 7. Tea Machinery & Engineering Co. Ltd (TEMEC) 8. KTDA Foundation (handles CSR Initiatives) Subsidiary Companies Principal Activities Average factory turnover Leaf Husbandry, Field Logistics, Processing, Procurement, Quality Assurance, Warehousing, Blending, Packaging, Trading, Marketing, Customer-Service, Consultancy, and Insurance brokerage. Kshs1 Billion ( $11 million) per year 13 13 TEA PRODUCING CONTINENTS AFRICA 643 m kg13% SOUTH AMERICA 95 m kg, 2% PRODUCTION, AREA AND AVERAGE YIELD OF TEA (2009-2013) YEAR ( CALENDAR YEAR) 2009 2010 2011 2012 2013 AREA (‘000 Ha.) Smallholder....…………….. Estates…………….................. 107.3 51.1 115.0 56.9 123.3 64.5 124.9 65.7 127.3 71.3 TOTAL 158.4 171.9 187.8 190.6 198.6 PRODUCTION (‘000 Tonnes) Smallholder…………………… Estates…………………………………….. 172.6 141.5 225.0 174.0 218.6 159.3 218.5 150.9 249.8 182.6 TOTAL 314.1 399.0 377.9 369.4 432.4 AVERAGE YIELD(Kg/Ha)*** Smallholder…………………… Estates………………………………. 1,862.0 2,909.0 2,291.0 3,412.0 2,040.0 3,149.0 2,036.3 2,953.0 2,172.0 3,209.1 Source: Economic Survey, 2014 Kenya Tea Production 1963 - 2013 Smallholder vs Estates Volume KENYA TEA PRODUCTION – KEY PLAYERS - % SHARE FINANCIAL YEAR 2013/14 Unilever 8.6% Finlay's 6.5% Eastern P. 7.8% Williamson 4.0% Other 13.8% KTDA 59.3% 17 KTDA MARKET OUTLETS- SALES (B) KSH Msa auction, Msa auction, 39.9 50.7 B 74% KETEPA KETEPA 0.6 0.3 B B 1% 0% 75% FDS 1.1 FDS 2% 1.1 2% DSO DSO 11.6 11.5 B 21% 17% DSLDSL 0.9 2% 3.8 B 6% MSA AUCTION PRICES PER ORIGIN – USD/KG 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0.00 2004/05 2005/06 2006/07 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13 2013/14 KTDA 1.67 1.96 1.91 2.18 2.50 3.12 3.08 3.18 3.19 2.37 Other Kenya 1.43 1.67 1.67 1.85 2.39 2.52 2.40 2.53 2.64 2.27 Other Africa 1.39 1.64 1.69 1.85 2.41 2.55 2.42 2.50 2.67 2.29 KTDA Other Kenya Other Africa KTDA AVERAGE SELLING PRICE TREND IN USD/KG- 5 YRS 3.50 3.11 3.07 3.20 3.26 2.43 2.50 1.50 0.50 2010 2011 2012 2013 2014 Avg. % PAYOUT TO THE FARMER 2014 2013 Financial costs Labour Selling Expenses 3% Furnace oil Admin costs Mgt Fees 4% 3% Admin costs HO 2% Admin costs FF 2% packing expenses 3% leaf collection 2% Fuel wood 4% Electricity 4% Furnace oil 0% Labour 6% Total GL payment 67% 2% 3% 2% 2% 2% 2% 1% 3% 4% 0% Electricity Fuel wood leaf collection 75% packing expenses Admin costs FF Admin costs HO Admin costs Mgt Fees Financial costs 4% Selling Expenses Total GL payment % RETURN TO FARMER 2006-2014 76% 75% 75% 75% 75% 74% 72% 70% 70% 68% 67% 66% 65% 65% 2007 2008 64% 64% 62% 60% 58% 2006 2009 2010 2011 2012 2013 2014 Percentage return to farmers has improved from 64% in 2006 to 75% in 2010 and 5 maintained in 2011 to 2013.This has dropped to 67% in 2014 Avg. % cost of production excluding GL payment-2014 Labour 16% Selling Expenses 8% Furnace oil 1% Electricity 14% Financial costs 13% Fuel wood 11% Admin costs Mgt Fees 9% Admin costs HO 6% leaf collection 5% Admin costs FF 8% packing expenses 9% Challenges • Fluctuating tea prices, exchange rates, interest rates and other business variables • Input cost inflation (Energy, Fertilizer, Labour and others) and improved productivity • Coping with climatic changes • Decreasing tea farm sizes • Certification across a huge supply base Factory Mechanization 2. Weigh Feeders 1. CFUs OUTPUT 3. Driers • Consistent product. • Smooth operations. • Hygienic. • Reduction in Cost . 4. Grading 25 Environmental/Waste mgt Green Treatment and elimination of effluent from the factories. Establishment of wetlands and compact system for treating and eliminating effluent from the factories. 26 Mini Hydro Projects 1. Diversion of the River to the canal 3. Power House 2. The head pond Out put – 0.9MW Factory requirement – 0.5MW 27 Energy Initiatives Wood fuel Land Development Firewood Sheds Efficient Boilers KTDA –MS: Seeking Growth and Operational Excellence 28 End Thank you