US Tax Advice for International Students

advertisement

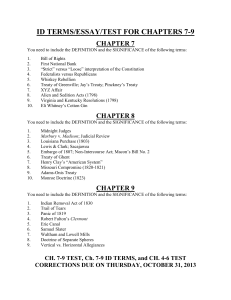

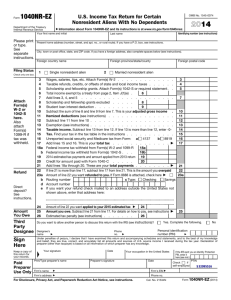

U.S. Taxation of Foreign Students 2006 Tax Year Presented by Paula N. Singer, Esq. Partner, Vacovec, Mayotte & Singer LLP Chairman, Windstar Technologies, Inc. Your Goals Determine your tax filing obligations Submit the correct tax form(s) Claim only allowable deductions and credits Claim only allowable treaty benefits Submit the tax form(s) timely Pay the proper tax General Information Basic Concepts Filing Requirements Tax Forms Due Dates Where to File Penalties / Ramifications of Not Filing Identification Numbers Basic Concepts Tax Return Form you complete and file Computes your tax liability Form depends on your tax residency status Must be filed with the appropriate tax authority Tax Authorities IRS – Internal Revenue Service Mass D.O.R. – Massachusetts Department of Revenue Other states Basic Concepts Tax Year Calendar year: January 1 – December 31 Withholding Taxes withheld from income payments: compensation, taxable scholarships, etc. Advance payment toward tax liability Does not excuse tax return filing obligation Withholding ≠ tax liability Basic Concepts Federal Tax Residency Status Resident Alien (RA) Nonresident Alien (NRA) Dual-status Taxpayer (typically in year of change to H-1B status) State Tax Residency Status Resident Nonresident Basic Concepts Immigration vs. tax definitions of residency Immigration A nonimmigrant is a nonresident An immigrant (“green card holder”) is a resident Tax A nonimmigrant can be either a nonresident (NRA) or a resident (RA) A green card holder is a resident (RA) Basic Concepts: Residents Are subject to tax on their worldwide income Can claim deductions for their dependents: Who are US citizens, US nationals, or US residents, or residents of Canada or Mexico, and Who have a US taxpayer identification number Can claim the standard deduction or itemized deductions if higher Can claim credits available to US citizens except for the Earned Income Tax Credit (EITC) May have disclosure form requirements Basic Concepts: Residents File Form 1040, 1040A, or 1040EZ - Can e-file! File Mass Form 1 (or Form 1NR) Should have income reported on: Form W-2 for taxable wages Form 1099 for dividends, interest, etc. Form 1042-S for treaty exempt income May have disclosure form requirements Form TD 90.22-1 Foreign Bank and Financial Account Disclosure Form 3520 to disclose bequests or gifts from abroad RA Filing Requirements No income or income less than filing threshold: File a tax return if: Single and income is at least $8,450 Married-filing-jointly and income is at least $16,900 Income: 1040, 1040A or 1040EZ MA Form 1 or Form 1NR Basic Concepts: Nonresidents Can only file using single or married-filing– separately status Can claim only one personal exemption amount ($3,300) with a few exceptions Cannot claim the standard deduction (except for residents from India who are students or business apprentices) Only pay US tax on US-source income and income connected to a US trade or business Basic Concepts: Nonresidents File Form 1040NR or 1040NR-EZ tax return Cannot e-file! Mass Form 1-NR (or Form 1) Should have income reported on: Form W-2 for taxable wages Form 1042-S for taxable scholarships, prizes, gambling winnings, treaty exempt income including wages But may also have income reported on Form 1099-INT or 1099-MISC File Form 8843 information return if they are “exempt individuals” in F, J, M, or Q status NRA Filing Requirements Who doesn’t have to file? Nonresidents whose only income is wages that do not exceed $3,300 don’t have to file a Form 1040NR-EZ or 1040NR But if you had taxes withheld, you must file to claim a tax refund But if your wages or scholarship are exempt under a treaty, you must file But you may still have to file Form 8843 Mass residents or nonresidents whose income is less than the no tax status amount NRA Filing Requirements Who must file? All nonresidents with effectively connected income Employment wages Self-employment income Taxable scholarship and fellowship grants for recipients in F, J, M, or Q status Even nonresidents whose income is exempt under a tax treaty must file a tax return Even certain dependents in F, J, M, or Q status with no income must file Form 8843 NRA Filing Requirements What to file: No Income: Income: Form 8843 (F, J, M, Form 1040NR or Q status Form 1040NR-EZ individuals) Form 8843 attached Form 1040EZ-T to tax return Possibly MA Form 1 or MA Form 1NR Tax Forms You May Receive Form Form Form Form W-2 1042-S 1099-INT 1099-MISC Tax Forms You May Need to Complete Federal Form Form Form Form Form 8843 1040NR 1040NR-EZ 1040 W-7 State Form 1 Form 1-NR Obtaining Tax Forms The best way to obtain tax forms is to download them from the Internet: Federal Forms: http://www.irs.gov/formspubs/index.html MA Forms: http://www.dor.state.ma.us/forms/FormsMenu2.htm Your international office may also have copies. Due Date April 15 if you for RAs and NRAs with taxes Otherwise, June 15 for NRAs. withheld recorded on Form W-2 For 2007: April 17 Where to File Nonresident Federal Tax Returns: Internal Revenue Service Center Austin, TX 73301-0215 (But see special tax return submission rules if you or a dependent needs to apply for an individual taxpayer identification number.) For all other returns: Check filing instructions Penalties / Ramifications of Not Filing Penalties based on the tax due: If no tax is due, no monetary penalty is imposed Possible immigration consequences File to obtain refund of withheld taxes Taxpayer Identification Numbers Work Authorized: Social Security Number To obtain the number, you must contact the nearest Social Security Administration office for an interview F-1 and J-1 Students must have a job or job offer and letter from DSO/RO Taxpayer Identification Numbers Not Work Authorized: Individual Taxpayer Identification Number (ITIN) for a tax administration purpose To obtain an ITIN, submit Form(s) W-7 with required documentation (certified) and original signed tax return to: Internal Revenue Service ITIN Unit PO Box 149342 Austin, TX 78714-9342 Residency Status Residency Status Green Card Test Substantial Presence Test Exempt Individual Time Limits on Exempt Status F & J students J “teachers and trainees” (i.e., nonstudents) Measuring Years Green Card Test A lawful permanent resident or “green card” holder is a resident for U.S. tax purposes Tax residency begins on the notice date approving the application One remains a tax resident even if he or she leaves the U.S. One remains subject to U.S. tax reporting requirements Substantial Presence Test (2006 Computation) Physical presence in the U.S. for: 31 days in 2006, and 183 days during a 3-year period counted as follows: All days in 2006 1/3 of days in 2005 1/6 of days in 2004 “Exempt Individuals” Exempt Individuals F or J students J nonstudents Exempt from counting days of US presence for substantial presence test (SPT) Not exempt from tax under this rule But may be exempt from tax under a tax law or tax treaty Time Limits on Exempt Status F or J students: Five (5) calendar years J nonstudents: 2 out of 7 calendar years 4 out of 7 calendar years if ALL income foreign source Time Limits on Exempt Status Must count prior calendar years in F, J, M, or Q exempt individual status Can become an RA sooner because of earlier years EXAMPLES Taxation Based on Residency Status Taxation Based on Residency Status Income Wages / Salary Non-employee Compensation Scholarships / Fellowships Interest Dividends Capital Gains Exempt Income Income Residents: Taxed on worldwide income Wages Scholarships Investment income Nonresidents: Taxed only on US source income NRA - Wages / Salary Source based on where services performed Principal exceptions Income received from a foreign payer by a F or J visaholder while nonresident Income exempt by treaty Non-employee Compensation From services as an independent contractor (self-employment) Usually reported on: Caution: most nonimmigrants cannot freelance Form 1099-MISC for RA recipients Form 1042-S (income code 16) for NRA recipients Sourced based on location of services Scholarships / Fellowships Sourcing based on location of payer not location of recipient Nontaxable non-US source includes scholarships / fellowships from: Foreign governments International organizations Even if managed by U.S. agent US source Divided into taxable and nontaxable U.S. Source Scholarships: Nontaxable Tuition Fees required for enrollment in an educational organization Fees, books, supplies, and equipment require for enrollment in a particular course at an educational organization Tuition reductions awarded to graduate teaching and research assistants, unless the reduction represents payment for services U.S. Source Scholarships: Taxable Fees for room, board, and incidental expenses Any amount paid for services, even if similar services are required of all candidates for a particular degree Value of room and board received for work performed Exception for Resident Assistants Graduate assistantship stipends Withholding at 14% or exempt under a tax treaty Interest Bank interest Not taxable to NRA unless connected to U.S. trade or business even if reported on Form 1099-INT Portfolio interest Dividends U.S. source dividend income is taxed at a flat 30% rate Except if the rate is reduced by an income tax treaty Must still be tax resident in treaty country Mutual funds generally pay dividends, not interest Capital Gains Generally, an NRA will not be subject to tax on sale of capital assets such as shares of stock Applicable only if individual is the U.S. less than 183 days during the year of sale Gains on the sale of real estate and U.S. business assets are subject to tax Other Nontaxable Items Gifts Loans Form 8843 Only Required to file Form 8843 to document exempt status for residency test Not required to file a Form 1040NR-EZ or 1040NR No W-2 No 1042-S No reportable investment income Tax Withholding Tax Withholding Payroll Taxes Federal Income Tax FICA Tax Exceptions to FICA Tax State Income Tax Sample Form W-2 Investment Income Scholarships to NRAs Tax Withholding Points Payroll Taxes Withheld by employer Federal Income Tax Graduated rates: 10%-35% Based on Form W-4 submitted to employer Reported in Box 2 of Form W-2 Payroll Taxes – FICA Tax Social Security Tax 6.2% of wages up to annual limit The annual limit in 2006 was: $94,200 Reported in Box 4 of Form W-2 Medicare Tax 1.45% of wages Reported in Box 6 of Form W-2 Exceptions to FICA Tax Lawfully employed nonresident F-1, J-1, M-1, and Q-1 visaholders Services performed by an enrolled student for the school he/she regularly attends Services performed for state or local government, unless an agreement with the federal government is involved Services provided for a foreign government Services provided for an international organization Exceptions do not apply to F-2 or J-2 visaholders Payroll Taxes – State Taxes Income Tax Withholding based on Form W-4 or state equivalent Reported in Box 17 of W-2 Investment Income Interest, dividends, capital gains Resident aliens Generally no withholding for U.S. citizens or resident aliens Reported on Form 1099 at yearend Nonresident aliens Flat 30% withholding unless an applicable tax treaty allows a lower rate Reported on Form 1042-S at year-end Scholarships to NRAs Qualified tuition No withholding No reporting required No reporting required on tax return Scholarships amounts for room and board & other non-qualified expenses Flat 14% withholding tax unless exempt by treaty Reported to recipient on Form 1042-S Recipient required to report 1042-S taxable amounts on Form 1040NR or Form 1040NR-EZ Tax Withholding Points Three important points to remember are: 1. Having tax withheld does not excuse you from the obligation of filing a tax return. 2. The withholding is not your exact tax liability. You could owe more tax with the return, or, more typically, you will receive a refund of amounts withheld in excess of your actual liability. 3. If you have had excess income tax withheld, the only way you can receive a refund is by filing a tax return. Income Tax Treaties Income Tax Treaties Overview Treaty Information Student Treaty Benefits Example Treaty Benefits Tables People’s Republic of China France Italy Teacher / Researcher Treaty Benefits Claiming Exemptions Overview Income Tax Treaties: Agreements between the United States and foreign countries on the taxation of various types of income Based on tax residency status (not citizenship) Must be a tax resident of the other country immediately before coming to the U.S to qualify for the student/trainee or teacher/researcher treaty benefits Must continue to be tax resident in treaty country for all other treaty benefits (i.e., dividends, interest, rents, royalties, etc.) Always check the applicable article of the treaty to determine eligibility for benefit Treaty Information Consult: Actual treaty texts Search www.irs.gov for tax treaties New: http://www.ustreas.gov/offices/taxpolicy/ www.windstar.com for easy-to-read text abbreviated texts Protocols amending the treaty Technical Explanations to the treaties IRS policies and rulings about treaties Treaty Information IRS Summary Information IRS Publication 901, U.S. Tax Treaties IRS Publication 519, U.S. Tax Guide for Aliens IRS Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entitles But IRS Publications do not explain IRS Policy requiring establishing treaty country residency between treaty claims Disallowance of treaty claims if entered for one purpose (i.e., F-2) and changed to another purpose (i.e., F-1) Student Treaty Benefits Treaties with exemption for all or part of scholarship or fellowship grant: Belgium, People’s Republic of China, Former Cyprus, Czech Republic, Egypt, Estonia, France, Germany, Iceland, Indonesia, Israel, Japan (old), Kazakhstan, Korea (South), Latvia, Lithuania, Morocco, Netherlands, Norway, Philippines, Poland, Portugal, Romania, Russia, Slovak Republic, Slovenia, Spain, Thailand, Trinidad & Tobago, Tunisia, Ukraine, USSR/NIS (Limit $10,000), Venezuela Student Treaty Benefits Treaties with exemption for compensation during training: Maximum Countries / Year $3,000 Belgium, Cyprus, Iceland, Indonesia, Japan (old), Korea (South), Morocco, Netherlands, Norway, Poland, Romania, Trinidad & Tobago Egypt, Israel, Philippines, Thailand $4,000 Tunisia $5,000 People’s Republic of China, Czech Republic, Estonia, France, Germany, Latvia, Lithuania, Pakistan, Portugal, Slovak Republic, Slovenia, Spain (less personal exemption amount), Venezuela $2,000 Significant Exceptions and Limitations Typically limited to 5 taxable years Germany compensation benefit lost retroactively if 4-year period exceeded Students engaged in teaching or research under OPT or academic training can only use student/trainee article Student Treaty Benefits: India Special benefit for residents of India who are students under Article 21(2) of the treaty with India and Rev. Proc. 93-20 Can claim standard deduction ($5,150) if higher than actual deductions Can claim personal exemption amount for spouse Can claim personal exemption amount for children who are US citizens Cannot use married-filing separately rates Student Treaty Benefits: Canada Student Article limited to payments from abroad for education or training But Dependent Services Article XV allows a treaty benefit if the employee: Is an NRA and Was paid $10,000 or less during the years and Remained tax resident in Canada Teacher / Researcher Treaty Benefits Treaties with articles containing benefits for teachers and / or researchers: Belgium, People’s Republic of China, Czech Republic, Egypt, France, Germany, Greece, Hungary, Iceland, India, Indonesia, Israel, Italy, Jamaica, Japan, Republic of Korea, Luxembourg, Netherlands, Norway, Pakistan, Philippines, Poland, Romania, Slovak Republic, Slovenia, Trinidad & Tobago, United Kingdom, USSR/NIS, Venezuela Significant Exceptions and Limitations Benefits only allocated for teachers and professors, not researchers: Benefits retroactively denied if benefit period physically exceeded two years: Greece, Pakistan Germany, India, Luxembourg, Netherlands, Thailand, United Kingdom Benefits allowed for three years: China, Greece (but lost if become an RA) Significant Exceptions and Limitations Prospective loss of benefits articles if stay “anticipated to exceed 2 years” One-time use Back-to-back limitation – cannot claim benefit if claimed student benefit in the immediately preceding period Claiming Tax Treaty Exemption Exemption from withholding is claimed by submitting the appropriate form to the payer of the income Form W-8BEN Form 8233 Interest Dividends Noncompensatory scholarships or fellowships Form W-8BEN only used by NRA Compensation of services provided by a student, trainee, teacher Independent contractor Form W-9 must be used to claim a treaty benefit while an RA Claiming Tax Treaty Exemption In order to claim a tax treaty benefit for compensation for services or scholarship or fellowship income, you must file a US tax return Document your eligibility for the benefit by completing one of the following: Form 1040NR: Form 1040NR-EZ: Page 5, Item M Page 2, Item J Claiming Tax Treaty Exemption If you did not receive a Form 1042-S for your treaty exempt income, document your eligibility for the exemption using a statement with the information requested by Form 8233 for compensation for services with certifying statement (see IRS Pub. 519) or Form W-8BEN for a scholarship or fellowship grant. Example Treaty Benefits Table: People’s Republic of China Excerpt from: IRS Publication 515 or 901, Table 2 Example Treaty Benefits Table: France Excerpt from: IRS Publication 515 or 901, Table 2 Example Treaty Benefits Table: Italy Excerpt from: IRS Publication 515 or 901, Table 2 Nonresident Alien Tax Returns Nonresident Alien Tax Returns Tax Return Requirements Applicable to NRAs Deductions Allowed Tax Forms Form 1040NR-EZ Form 1040NR Form 8843 Attachments Sample Tax Return Tax Return Requirements Applicable to NRAs Form: Filing Status: Taxable Income: 1040NR or 1040NR-EZ Single or married-filingseparately U.S. source only Exemptions Allowed: Only one for yourself ($3,300 for 2006) Treaty Exceptions: Residents of Canada, Mexico, and Korea (South) & students from India may be allowed additional exemptions Deductions Allowed NRAs must itemize Exception Students from India allowed to claim standard deduction if higher 2006 standard deduction: Single: $5,150 Married-filing-separately: $5,150 Deductions & Exemptions Itemized Deductions State & Local Income Taxes Gifts to U.S. Charities Note: Refund of state & local taxes deducted in current year is taxable income in year refund is received. Also registered Canadian, Mexican, and Israeli charities as allowed under the tax treaties Casualty & Theft Losses Unreimbursed Employee Business Expenses (Form 2106) Tax Preparation Fees Education Expenses Deductions & Exemptions Other Deductions Moving Expenses (Form 3903) – must be job related Qualified Scholarship or Fellowship Grant reported as income IRA Contributions Qualified Student Loan Interest Tax Deductions for Educational Expenses Usually applies only to MBA students and students sent by employers to short-term programs If not already employed when expense incurred or qualifies student for new profession – nondeductible Law school and medical school considered new professions Must have income in same calendar year in order to use deduction Deductible Expenses Tuition, fees, books for training, which: Is required by employer or by law or regulations to keep present job, salary or status, OR Maintains or improves skills required in present work from which the employee has taken a temporary (one year or less) leave of absence Travel and temporary living expenses Must be for one year or less Deductions & Exemptions – Personal & Spouse Personal Exemption - $3,300 for 2006 Spouse – Only allowed for: Residents of Canada, Mexico, Korea (South) and students and business apprentices from India eligible for treaty benefits of Article 21(2) of the tax treaty Spouse must have a SSN or ITIN Spouse has no gross income for U.S. tax purposes Spouse cannot be claimed as a dependent on another U.S. tax return. Residents of Korea (South) only – spouse must have lived with you in the U.S. at some time in 2006. Deductions & Exemptions – Dependents Exemption for a dependent can only be claimed by U.S. Nationals and residents of Canada, Mexico, and Korea (South) and students and business apprentice from India whose dependents are not admitted on a n F-2, J-2 or M-2 visa Dependent must meet the other tests for a qualifying child or relative. Test for Qualifying Child Son, daughter, stepchild, foster child Under age 19 or under age 24 and a full time student, or permanently and totally disabled Must have lived with you more than half of the year Child must not have provided more than half of his or her own support for the year Telephone Excise Tax Refund (TETR) One-time refund in 2006 of $30 for single taxpayers who paid long-distance telephone excise taxes for 41 months (March 1, 2003 through July 31, 2006) $40-$60 depending on number of personal exemptions for dependents on return Use Form 8913 for actual telephone excise taxes paid if did not pay for 41 months or actual taxes higher Use Form 1040EZ-T if eligible for refund but have no return filing obligation Form 1040NR-EZ You may file Form 1040NR-EZ if all the following apply: No dependents No taxable investment income Income less than $100,000 No tax credits except federal telephone excise tax refund credit No itemized deductions other than state income tax and student loan interest Form 1040NR Must be used to report: Taxable interest on dividends, capital gains Nonemployee compensation (Form 1099-MISC) Personal exemption for spouse or children, if allowed Itemized deductions Form 8843 Must be filed by F-1, F-2, J-1, and J-2 visaholders to document nonresident status If no tax return is filed, Form 8843 should be filed with the Austin Service Center If tax return is filed, Form 8843 should be attached to the back of Form 1040NR or Form 1040NR-EZ and filed with the Austin Service Center Attachments Staple Copy B of Form W-2 to page 1 of Form 1040NR or Form 1040NR-EZ Staple Copy C of any Forms 1042-S to page 1 of Form 1040NR or Form 1040NR-EZ Attach any required statements behind Form 1040NR or Form 1040NR-EZ Sample Student Tax Return - Facts F-1 student Citizen and resident of Ethiopia Work study wages of $4,285 Scholarship for full tuition and $3,000 for room and board Interest from U.S. bank account Sample Student Tax Return - Facts F-1 student Citizen and resident of PR China Work study wages of $9,285, $5,000 of which is treaty exempt Scholarship for full tuition and $3,000 for room and board which is treaty exempt Interest from U.S. bank account State Income Taxation State Income Taxation Overview Massachusetts Taxation Income Not Subject to Massachusetts Income Tax Determination of Residency Sample Form 1-NR Overview Income received for services performed at a location in a state is sourced in that state States that tax income: Tax state residents on all income Tax state nonresidents on income sourced in the state Tax part-year residents on all income during the resident period and state source income during the nonresident period Massachusetts Taxation Filing Requirements Residents with gross income of $8,000 or more Nonresidents whose Massachusetts source income is more than the smaller of: $8,000 or The personal exemption to which the nonresident is entitled after apportionment Part-year residents with Massachusetts source income for entire year of $8,000 or more Income Not Subject to Massachusetts Income Tax Qualified scholarship received by Massachusetts residents Scholarship income received by Massachusetts nonresidents including room and board Massachusetts source income received by a nonresident who is a tax resident from a foreign country that is excluded from federal income by a tax treaty Determination of Residency Resident: Nonresident: Part-year Resident: A person domiciled in Massachusetts or a person who spends more than 183 days of the taxable year in Massachusetts and maintains a permanent place of abode in Massachusetts. A person domiciled outside the state for the entire year. Neither a Massachusetts resident or nonresident for the entire year. Determination of Residency Technical Information Release 95-7 interprets the Mass residency law See 1996 article, “Massachusetts Broadens the Definition of Residency” Resources www.windstar.com Articles in archives of e-newsletter, A View from the Crow’s Nest Resources/Articles Federal Telephone Tax Refund Claims by Nonresident Aliens Ten Common Tax Return Errors and the Foreign Nationals Who Make Them U.S. Taxation of Foreign Students and Scholars: A Roadmap to Your Tax Return Shopping.windstar.com for tax guidebooks