Slides for thirteenth class

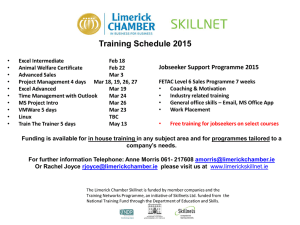

advertisement

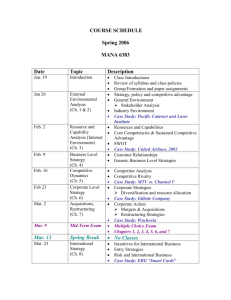

International Monetary Economics Mar 18 2004 Lesson 13 By John Kennes Asset Markets and International Money Mar 18 2004 Asset Markets and International Money Mar 18 2004 – To have an impact on economic conditions, monetary policy must also affect real interest rate – The other channel of monetary policy is the exchange rate – We will examine the links between short-term nominal rates, the exchange rates, the longer-term interest rate, and the value of shares and bonds, all of which are determined on f. Markets – A central theme is the no-profit condition of efficient markets Short and Long-term interest rates Mar 18 2004 – – – – – Short-term interest rates change frequently, because monetary policy can change. If short-term interest rates are expected to increase over the next two years, the longer term interest rates will also rise. A two year loan can be arranged in a number of ways: one loan of two years maturity, or two succesive loans one year loans. The no-profit condition implies that these combinations are equivalent Therefore, if the interest rate is expected to increase next year, then the two-year rate must also increase, today More generally Mar 18 2004 – – – – Consider a long-term interest rate of L years maturity. Ignoring the maturity and risk premia, it is equivalent to a succesion of one year loans which are rolled over If the annualized interest rate on the long-term loan is iL, the return is (1+ iL)L(by the rule of compound interest rates). If the one-year interest rate expected to prevail t years from now is ite, where the superscript e denotes an expectation, the return from such loans is (1+i1)(1+ i2e)...(1+ ite)... (1+ iLe) The no-profit condition implies that these returns should be equal More Generally (2) Mar 18 2004 – As a first approximation, this equality states that the long rate at time t, itL is an average of expected future short rates, plus a possible risk premium, YtL itL= (1/L) S it+ie + YtL • – summed over L periods Note: The risk premium explains the general tendency of the term structure of interest rates to be upward sloping A Basic Conclusion: Central Bank’s actions, both current and anticipated, affect interest rates of all maturities. How do interest rate changes affect Bond Prices? Mar 18 2004 – – – – Loans can be directly arranged by large borrowers in fancial markets. They take the form of bonds, i.e recognition of debt by borrower along with a schedule of payments concerning both interest and principal. Bonds can be traded like any other asset What determines the price at which bonds sell? Pricing Bonds (1) Mar 18 2004 – – – – – The bond price represents the present dscounted value of the payments agreed upon at the time the bond was issued. Consider the simplest case of a bond which pays € 100 in one year’s time. (A pure discount bond) If the interest rate is 5%, what is the value of the bond today? It is the amount B invested that yields 100 next year. B(1+0.05)=100 So that B= € 90.70. Pricing Bonds (2) Mar 18 2004 – A payment at in a future year t, n years from today is worth an/(1+r)n – The present value, p, of a consul, a bond that promises an infinite stream of payments, a, per year is worth p = a/r – – The price of a consul is clearly inversely related to the interest rate. Other bonds have finite maturity so the formula is a bit more complicated. General principal: higher real interest rates imply lower bond prices Pricing Bonds (2) Mar 18 2004 – A payment at in a future year t, n years from today is worth an/(1+r)n – The present value, p, of a consul, a bond that promises an infinite stream of payments, a, per year is worth p = a/r – – The price of a consul is clearly inversely related to the interest rate. Other bonds have finite maturity so the formula is a bit more complicated. General principal: higher real interest rates imply lower bond prices Bond Prices and Yields Mar 18 2004 Description of the payment stream Price in euros given yield i Yield given price P One year pure discount bond paying 1 euro 1/(1+i) 1/P-1 Ten-year pure discount bond paying 1 euro in 10th year 1(1+i)10 1/P1/10-1 Bond paying a coupon each year of C euros for two years plus a payment of 1 euro in 2nd year (C<1) C/(1+i)+(1+C)(1+i)2 (4P(C+1)+ C2)1/2/2P-(1-C/2P) Consul paying 1 euro per annum, forever 1/i 1/P Computer needed for complicated bonds Real interest rate arbitrage in the long run Mar 18 2004 • • • • The UIP conditions, with and without risk aversion, link nominal interest rate at home and abroad Does the arbitrage argument extend to real interest rates, which is decisive for intertemporal decisions It turns out that a purchasing power parity condition (PPP) implies real interest rate at home and abroad will be roughly equal However, like PPP, this is likely to hold only in the medium to long run. PPP and the Real Exchange Rate Mar 18 2004 • • • To compare prices of goods produced at home with those produced abroad, we need to express them in a common currency. If S denotes the exchange rate (say dollars per €1) and P* is the price of the foreign goods expressed in the foreign currency (say $) then the domestic price of the foreign good is P*/S. Conversely, if P is the price of domestic goods in domestic currency, their price in the foreign currency is SP. PPP and the Real Exchange Rate Mar 18 2004 • The real exchange rate, the relative price of foreign gods in terms of domestic good, is s = P/(P*/S) Both prices in domestic currency – = SP/P* both prices in foreign currency As long as goods prices P* and P remain unchanged or move together, the nominal and real exchange rates move together. PPP and the Real Exchange Rate Mar 18 2004 • • • Over short horizons, the nominal and real exchange rates tend to fluctuate in tandom In the longer run, nominal and real exchange rates seem to have lives of their own Notes: – – Real exchange rates are much more volatile in the short run It might be worth studying how real exchange rates are measured in practice. Big Mac index at the Economist, etc The Real Exchange Rate Mar 18 2004 – – – The real interest rate parity condition follows from the assumption that UIP holds: the inflation differential is the expected rate of appreciation of domestic currency In the medium and long run, relative PPP implies that the future rate of depreciation is equal to the future inflation differential (St+1-St)/St = p*t+1-pt+1 If forecasts of inflation at home and abroad are consistent with PPP, the definition of the real interest rate rt= i - tpt+1 and r*t= i – * tp t+1 implies the international Fisher equation rt = r*t Stock Prices Mar 18 2004 – – – – Shares in firm (stocks) are held by households (and their intermediaries) and are issued by firms to aquire resources for capital expenditure. Stocks are risky assets because they represent a claim to a share of future profits after costs - wages, interest payments, rent, and other expenses - are paid How are stocks valued? Once again, we make use of a no-profit condition, comparing now a riskless treasury bill paying a constant yield r per annum with a traded share in a company that pays all its profits out at the end of each period as dividends, dt . Stock Prices Mar 18 2004 – – The hitch is that while the T bill pays a fixed yield, the stock investment consists of the dividend plus possible capital gains or losses when the share price changes. If qt is the share price at the beginning of period t, the rate of retrun on the company shares is the dividend yield dt/qt plus the anticpated capital gain (qt+1-qt)/qt. The no-profit condition implies r = dt/qt + (qt+1- qt)/qt Yield on T Bill = dividend yield + capital gain – Which means stock prices depend inversely on r qt = (dt + qt+1)/(1+r) Rational Pricing of Stock Prices Mar 18 2004 – – – – – If qt depends on qt+1 and qt+1 depends on qt+2 will such an endless repitition converge to anything sensible? If stock prices dont grow faster than the real interest rate r, the current stock price is well defined qt = S(1/(1+r))i dt+i summed over i=0 to infinity Which expresses the current stock price as the present value of future earnings only. The role of the future price disappears. Market value is based on what it expects to earn now and in the indefinite future Formula called fundamental valuation of an asset. Do stock prices reflect rational pricing of future company profits? Nominal Exchange Rates and National Money Markets Mar 18 2004 – – – – The exchange rate can be thought of as the realtive price of national monies Much as share price changes affect the return on stock, the exchnage rate affects the opportunity cost of holding various currencies, and assets denominated in these currencies The interest rate parity condition UIP bears a telling resemblence to the share price equation We want to relate this the financial integration line in IS-LM analysis: i.e the required foreign rate of return i* Nominal Exchange Rates and National Money Markets (2) Mar 18 2004 – – – – – The UIP condition without risk aversion is given by St = ((1+i*t) / (1+i*t)) (tSt+1) The current spot exchange rate St is now determined by the domestic and foreign interest rates and by the market’s current expectation of next period’s interest rate, tSt+1 Like all asset prices, the nominal exchange rate is forward looking. What happened in the past are bygones. The exchange rate is totally free to jump (a non-predetermined variable) An appreciation in the future shows up immediately in the current exchange rate. Nominal Exchange Rates and National Money Markets (3) Mar 18 2004 – – – – – As with stock prices St is driven by expectation of St+1 which is driven by expectation of St+2 and so on. To keep thngs simple, ignore uncertainty, we get St = ((1+i*t) / (1+i*t)) ((1+i*t+1) / (1+i*t+1)) (tSt+2) And repeat n times St = ((1+i*t) / (1+i*t)) ((1+i*t+1) / (1+i*t+1)) ... ((1+i*t) / (1+i*t))(tSt+n+1) As with stock prices, the current exchange rate reflects all current and future interest rates at home and abroad, and its own long run value It shows how tight monetary in the future (i is expected to rise) can lead to an appreciation today (S increases). Resolving an apparent contradiction Mar 18 2004 – – – Suppose interest rates at home rise unexpectedly. According to our equation, an appreciation should result. Yet we know from UIP that higher interest rates at home should be associated with a depreciation of our currency (S falling) Is this a contradiction? Resolving an apparent contradiction (2) Mar 18 2004 – – The contradiction is only apparent, once we recognize that we are implicitly assuming that the exchange rate does not rise in the long run. The two ways of reasoning are reconciled in the following figure An increase in the domestic interest rate Mar 18 2004 i i*,i S Time Resolving an apparent contradiction (2) Mar 18 2004 – – – – As the domestic interest rate rises above the world rate i* the exchange rate appreciates temporary, but is expected to depreciate back to its initial value As required by UIP, an expected depreciation of the domestic currency (a capital loss) offsets the interest rate advantage at home. Holding the future expected exchange rate constant, the only way for the current exchange rate to depreciate in future periods is to appreciate now. Capital movements are not necessary as long as asset returns are equalized. The outcome of integrated efficient fin. markets. Next class Mar 18 2004 – – How do fundamentals determine the nominal exchange rate? Market efficieny or Speculative mania? Implications for international money • • Noise traders Bubbles – Exchange rate determination in the short run • • • • • Mussa stylized facts and the asset behaviour of exchange rates Money and goods market equilibrium: Mt /Pt =L(Y, it ) Insert UIP for it Overshooting: Basic Dornbusch (1976) result. IS-LM interpretation