Modern Real Estate Practice in Texas, 13th Edition

advertisement

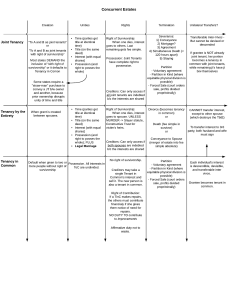

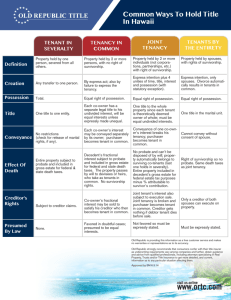

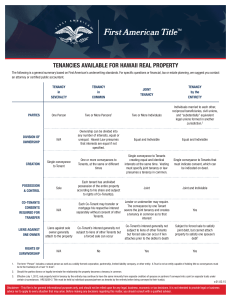

Modern Real Estate Practice in Texas, 16th Edition Chapter 9 Answer Key 1. a 2. b 3. d 4. d 5. a 6. b 7. c 8. c 9. a 10. a 11. b 12. c 13. b Timesharing permits multiple purchasers to buy undivided interests in real property whereby each purchaser has the right to use the property for a fixed or variable time period. The grantees in a deed must be identified explicitly as joint tenants or Texas will presume the interest is held as tenants in common. A joint tenant (Shari) may convey his or her interest to a non-joint tenant (Sandra). The remaining owners still hold title as joint tenants with right of survivorship (Martin and Eduardo); however, they now have a tenancy in common relationship with Sandra. Common law dictates that four unities are required to create a joint tenancy: time, title, interest, and possession. Cooperative ownership involves the purchase of stock shares in a corporation that holds title to a building. In return for purchasing stock, the stockholder receives a proprietary lease granting him or her the right to occupy a specific unit in the building and use the common areas. The right ceases when the stock is resold to the corporation, often at the original purchase price of the stock. Title to real estate vested in one entity (i.e., one person or a business) is ownership in severalty. A business (partnership, corporation, or limited liability company) holds title to property in severalty when title is held in the name of the company rather than in the names of individual people. The right of survivorship is one of the distinguishing characteristics of joint tenancy. Ownership in severalty exists when title is vested in one entity. A corporation in Texas must be registered with the Secretary of State and is considered to be a legal entity (artificial person). One of the distinguishing characteristics of a land trust in Texas is that the public records do not indicate the beneficiary’s identity. The beneficiary (original trustor) retains management and control of the property through the trustee. A land trust generally continues for a definite term. In a trust, the trustor (the entity creating the trust) conveys title to the trustee, the entity entrusted with carrying out the trustor’s instructions regarding the purpose of the trust. The beneficiary is the person who benefits from the trust. On the death of a tenant in common, there is no right of survivorship for the remaining tenants in common. Instead, the interest of the deceased tenant (Gwen) passes to her heirs or to whomever she specifies in her will (the devisee). Community property consists of all property, real and personal, acquired by either spouse during the marriage—with the exception of property acquired by gift, inheritance, purchase from separate funds, sale of separate property, personal injury settlement, or written contract with a spouse. Under the Texas Uniform Condominium Act, as an owner of a condominium unit, Harold would hold fee simple title to his unit and a specified share (in this case, 5%) of the indivisible parts of the building and land (i.e., the common elements) with the remaining 19 owners. ©2014 Kaplan, Inc. Modern Real Estate Practice in Texas, 16th Edition 14. a A trust is a device by which one person (trustor) transfers ownership of property to someone else (trustee) to hold or manage for the benefit of a third party (beneficiary). 15. a Community property is a system of property ownership based on the theory that each spouse has an equal interest in all property acquired during marriage; therefore, it is a form of co-ownership involving husband and wife. 16. a Creating a condominium requires the owner or developer to first file a condominium declaration (setting out the rights and obligations of each unit owner) and a condominium regime plat (description of how the land and buildings are subdivided into units, including the fractional shares of the common elements assigned to each unit). 17. b The creation of joint tenancy in Texas must be by written agreement specifically stating the intention to create the joint tenancy. In addition, the grantees in the deed must be explicitly identified as joint tenants. 18. c Conveyance of homestead property requires the signature of both spouses, even if the homestead is separate property of one spouse. 19. c Although states’ community property laws vary widely, they all recognize two kinds of property: separate property (owned prior to marriage) and community property (acquired during the marriage, with some exceptions). 20. c The members of an LLC enjoy the pass-through tax advantages of a partnership and the limited liability offered by a corporate form of ownership. Neither the members nor managers are liable for company debts, obligations, or liabilities. 21. b Income earned from separate property is generally classified as community property. Separate property includes property acquired during marriage by gift, inheritance, purchase from separate funds, sale of separate property, settlement or judgment for personal injury, or written contract with a spouse. 22. d A sole proprietorship exists when a single individual operates a business, owns all the assets, and assumes personal liability for all debts. It is the simplest form of business organization. A sole proprietorship may have employees, but only one person controls the business. All profits and losses from a sole proprietorship are reported directly on the sole owner’s personal income tax return. 23. c A partnership is an association of two or more people who operate a business as co-owners and share in the business’s profits and losses. Title may be held in the names of the individual partners (as tenants in common or as joint tenants) or in the name of the partnership (as owners in severalty). In a general partnership all partners participate in the management of the business and may be held jointly and severally liable for all business losses and obligations. A limited partnership includes general partners as well as limited partners. Limited partners do not participate in the management and their liability is limited to the extent their investment. Partnerships, whether general or limited, may be continued after the death, withdrawal, or bankruptcy of one of the partners. ©2014 Kaplan, Inc.