Name Microeconomics Unit Exam 2 Elasticity Elastic vs Inelastic

advertisement

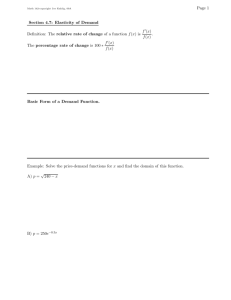

Name _____________________________ Excise Tax Microeconomics Unit Exam 2 Tax Incidence Elasticity Economic Impact of Taxes Elastic vs Inelastic Marginal buyers & sellers Influences of Price Elasticity of Demand (5 Tests of Price Celling Elasticity) Price Floor - Availability of close substitutes - Necessities vs luxuries - Definition of a market - Time Horizon - Percent of Income Binding vs Non Binding The Costs of Taxation Elasticity Coefficient Tax Wedge Elasticity of Demand Curves Deadweight Loss Midpoint Formula (Arc Elasticity) Income Elasticity of Demand International Trade Cross-Price Elasticity Free Trade Elasticity of Supply Tariffs Determinants of Price Elasticity of Supply World Price Vs Domestic Price a. If domestic price < world price Market Interventions Sin Taxes b. If domestic price > world price How exporting country is affected by trade How importing country is affected by trade Excludable vs Non-excludable Effects of a tariff Rival vs Non-Rival Price Quotas Public Goods Common Resources Externalities Quasi-Public/Collective Goods Positive Externalities Private Goods Negative Externality Free-Riders Market Equilibrium (when good has a positive or Cost-Benefit Analysis negative externality) Social Cost Tragedy of the Commons Ways to “internalize” the externality Social Benefit Command and Control Policies How tradable permits work Pigovian Tax (Corrective Tax) Pigovian Subsidy Coase Theorem Spillover Costs Common Goods and Resources Market Failures Be Able To Graph Elasticity Graphs Tax Graphs Elasticity Graphs Tariff Graph International Trade Graph Chart 4 Types of Goods with a G or S