Washington Marketplace Fairness

advertisement

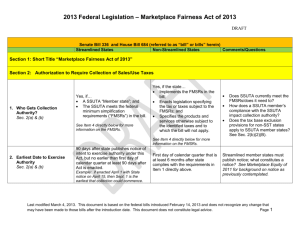

Marketplace Fairness Act Communication Plan Plan Owner Carol Dedrick, TPS Jenny Smith, TPS Start Date January 4, 2012 Purpose This plan will identify the audiences and determine the strategies needed to inform all parties of the implementation of the remote seller collection authority under federal law. Background The Marketplace Fairness Act (S. 1832) addresses remote seller collection authority under federal law. Key components of bill: Provides SSUTA member states collection authority over those who make retail sales into their state but don’t have a physical presence in the state. Provides collection authority to states that are not SSUTA members once the state has implemented the minimum simplification requirements. Provides a small seller exception threshold: preceding calendar year gross US remote sales of $500,000 or less. Implementation requirements Establishes a federal framework for seller agents that would act on behalf of sellers in collecting sales and use tax on a multi-state and in-state basis. These agents are referred to as "consolidated providers” and “single providers." This is similar to Certified Service Providers provided for under the Streamlined Sales and Use Tax Agreement. Requires that local sales tax rates change only on the first day of a calendar quarter. Remote sellers and providers must be given 30 days notice of rate changes. Remote sellers are held harmless for errors or omissions made by their single or consolidated based on information provided by the state. Relieve remote sellers from liability for collection of the incorrect amount of sales tax if it was caused by using information provided by the state. There are two options to achieve collection authority Streamline member option Page 1 of 7 SL12026 FL13002 Marketplace Fairness Act Communication Plan o o o o Grant of collection authority: Authority is granted to member states compliant with the Streamlined Sales and Use Tax Agreement. Nothing must be done. Commencement of authority: the first day of a quarter at least 90 days after enactment of the bill Requires Streamlined simplifications: Under the bill, collection authority is granted to states maintaining compliance with the Streamlined Sales and Use Tax Agreement simplifications. Sourcing: Allows member states to continue using the sourcing rules under the Streamlined Sales and Use Tax Agreement. Non streamline member option o o o o Audiences Grant of collection authority: Authority is granted on a State’s implementation of the federal minimum simplifications (below). Commencement of authority: 6 months after enacting the federal minimum simplifications. Must be on the first day of a quarter Federal minimum simplifications: Any state seeking collection authority must provide for remote and/or all sellers: A uniform tax base Central state-level tax administration A single return filed with a state agency A single audit for state and local taxes Notice of local tax rate changes Adequate certified software and services to allow sellers or their agents to collect tax, including rate information Hold harmless and relief of liability provisions Sourcing: Sets up a federal destination-based sourcing regime for remote sales The communication activities are directed toward: External audiences Any business subject to sales tax and does not have a physical presence (primarily businesses selling online, by phone or via catalogues). Any Washington business the makes retail sales into states where it doesn’t have a physical presence (web retailers, catalogue companies, TV/phone sales, business to business, businesses that sell contracts) Individual consumers, business consumers Business associations (WRA, AWB, IBA, AWC, Chambers of Commerce, EDC, Commerce, digital product assoc.) Tax professionals FTA, MTC Retail industry leaders association (RILA) National retail federation Page 2 of 7 SL12026 FL13002 Marketplace Fairness Act Communication Plan Direct marketing association Local taxing jurisdictions Marketplace sellers (Ebay, Amazon, Overstock, NewEgg, Google, Ubid, etc) Other state Departments of Revenue Consolidated service providers Certified service providers (SSUTA) Internal audiences Out of state employees (Out of state auditors may develop tax discovery process) BLS (registration fees?) Business registration staff TI&E/TAA – way to identify businesses that register as a result of this bill TIC Operations and policy divisions General key messages States can now require sellers to collect their sales or use tax on retail sales in their state regardless of whether the seller has physical nexus in that state. Examples: o If an online seller sells to a Washington buyer, the seller may be required to collect and remit Washington sales tax whether the seller has nexus in WA or not. o If a furniture store in Oregon sells into Washington and delivers, through a common carrier, shipping company, or their truck, the seller may be required to collect and remit Washington sales tax. This law applies to all retail sales, including sales transacted through the mail, over the phone, on the internet, and sales delivered from one state to another by a shipping company or any other means. All retail sales include anything subject to retail sales tax such as tangible personal property, digital products, and retail services. If a seller makes $500,000 or less in annual gross remote US sales, they are excluded from the requirement to collect sales/use tax. Sales in states where the seller has a physical presence would be excluded from the calculation of annual gross remote US sales. Don’t assume that just because a sale is not a taxable transaction in Washington, that it isn’t a taxable transaction elsewhere. For Washington, collection authority begins effective (date). More information can be found on dor.wa.gov/marketplace. Sellers interested in knowing which states have exercised their remote tax collection authority can find a list at (FTA website). Page 3 of 7 SL12026 FL13002 Marketplace Fairness Act Communication Plan Definitions Remote sales is a term that means a sale of goods or services attributed to a state in which a seller does not have adequate physical nexus to establish nexus under Quill Corp v. North Dakota, 504 U.s. 298 (1992). SSUTA (Streamlined sales and use tax agreement) member states are states that have been determined by the Streamlined Sales Tax Governing Board to have changed their sales tax administration law so that they meet all of the requirements set forth in the Agreement. Targeted key messages Businesses making retail sales (in state and out of state) In-state businesses making sales outside of Washington: o (Checklist) Do you make interstate sales that are subject to sales or use tax? Did you sell more than $500K in gross remote US sales last year? (Define remote sales.) (Other questions?) If yes, you should contact the state to determine if you need to register in that state and collect and remit their sales tax. If you are not required to register at this time, you need to revisit the (FTA website?) to see if the state has begun to assert its collection authority. o (Central registration and registration with other state(s)—processes are in development) o For states that are members of SSUTA, you will find a list of taxable products (taxability matrix) for each state at streamlinedsalestax.org. For products that are not listed, contact the state directly. For a list of Washington products subject to sales tax, go to dor.wa.gov/XXX. o If you make remote sales into non-member states, contact each state to determine if/how your sales are taxed. o Don’t assume that just because a transaction is/is not taxed in Washington that the same treatment applies in other states. Out-of-state businesses making sales into Washington: o (Checklist) Do you make remote sales that are subject to sales or use tax in Washington? Did you sell more than $500K in gross remote US sales last year? (Define remote ssles.) (Other questions?) If yes, you must collect and remit Washington sales tax unless an exception applies. o If your total remote sales for 2011 was less than $500,000, you do not have to collect Washington sales tax (small seller exception) o Businesses need to revisit the FTA? website to see if states that were not participating have begun to assert their collection authority. o This federal legislation only affects sales and use tax collection. It does not affect your obligation, if any, to pay other taxes in Washington. o Don’t assume that just because a transaction is/is not taxed in your state, the same treatment applies in Washington. o For a list of taxable products in Washington, see the taxability matrix found at dor.wa.gov/XXX Page 4 of 7 SL12026 FL13002 Marketplace Fairness Act Communication Plan Consumers (education effort using the media) Many businesses selling over the internet, through catalogs, over the phone, etc., will now be collecting sales tax on purchases made in Washington State. These purchases have always required the payment of sales or use tax. This is not a new tax. This bill makes it easier for your neighborhood stores to compete. This bill will generate additional revenues for the state and local government. Estimates of the state and local sales tax that will be collected are: o 2011-2013 Biennium: $170.3 million state and local gain o 2013-2015 Biennium: $483.0 million state and local gain Local taxing jurisdictions This legislation will increase local sales tax revenues. This federal legislation only affects sales and use tax collection. It does not affect nexus for purposes of any other tax or fee imposed at the state or local level. This may affect mitigation payments. Internal Audiences Many businesses will be registering with Washington directly or through central registration. An indicator will be added to BRMS to businesses registering under the Marketplace Fairness Act. TAA will be adding these businesses to our system. Consolidated service providers will be new for Revenue. Audit will develop certification standards. Businesses using a CSP will have a unique indicator for BRMS. Non-streamlined member states Businesses in your state may have an obligation to collect sales tax on remote sales. Please help your business community become aware of this potential obligation. Unresolved issues Can the state impose registration fees? How will we identify businesses that are remitting tax exclusively as a result of this bill? (Indicator?) “Agency” question regarding marketplace seller. Would they have an obligation to collect taxes for sellers who don’t have nexus but exceed the small seller threshold? How are foreign sellers impacted? (Import exemption?) Are there industries that we don’t tax that are taxed in other states? For example, funeral services. What about drop shipments? If a product is ordered by a person in state A from a company in state B who then ships the product to state C and then sends the bill to the customer’s billing address in state D, which state’s sales tax does the company collect? Page 5 of 7 SL12026 FL13002 Marketplace Fairness Act Communication Plan What will the registration process be for WA businesses to register in other states? Will we be able to identify which businesses are remitting sales tax as a result of Marketplace Fairness Act when providing information to local jurisdictions? Is the fact that a business is reporting as a result of this law disclosable? Will these businesses show up on the 105 screen in BRD? Each state may have different registration requirements, e.g. minimum thresholds for collecting sales tax, different remote sales thresholds or don’t impose a sales tax. Some states my not meet the simplification requirements under Marketplace Fairness or may not have asserted their authority to collect the tax. Action Items # Task Task Owner Due Date 1. Develop a media plan Date Completed Notes News release, editorial boards, radio/TV interviews 2. Send state tax info to FTA for inclusion on the list 3. Partner with other states for information sharing 4. Create a Special Notice 5. Create a marketplace fairness web page—link from home page 6. Develop Q&A for consumers 7. Develop Q&A for businesses 8. Listserv msgs 9. Develop messages for Dept. publications 10. Social media (twitter, facebook, rss) 11. My account alert 12. Secure message Ensure their websites include WA information General Info, Tax Facts, LSU To businesses that take the interstate sales deduction? 13. WebEx seminar 14. Front office posters/literature 15. 16. Page 6 of 7 SL12026 FL13002 Marketplace Fairness Act Communication Plan 17. 18. 19. 20. 21. 22. Page 7 of 7 SL12026 FL13002