Best Practices Portfolio Builder

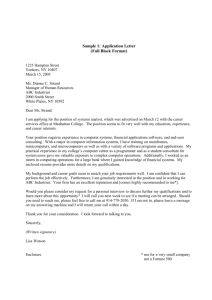

advertisement