Cash Expense Refund tutorial

advertisement

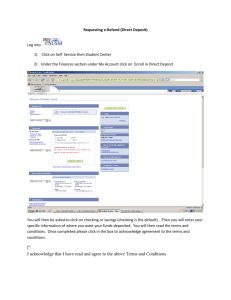

CASH EXPENSE REFUNDS Treasury Management Finance and Accounting 1 Cash Expense Refunds • Cash Expense Refunds are: Refunds Reimbursements Rebates Returned funds from a Vendor 2 Cash Expense Refunds • Cash expense refunds ALWAYS relate to an expense paid for by UF • Expense refunds must be returned to the ChartField of origin • Use the original ChartField string info from the expense as the ChartField string of the deposit • Expenses with a prior year accounting date are an exception… 3 Cash Expense Refunds Prior year refunds depend on the fund of the original expense: Fund of original expense: Deposit to: Life to date funds: 171,173,179 Construction funds: 5XX Grant Funds: 201, 209, 211, 212, 213, 214 Use the same ChartField as the original expenditure IFAS Funds 221 and 222 Dept ID 60010000; Fund 221 or 222; Program 2100; Account 530000; Bud Ref CRRNT State Funds: 101, 102, 103 and 105 Bud Ref CRRNT Dept ID 74060000; Fund 111 (for 101 or 105); 112 (for 102); 113 (for 103); Program 6100; Account 530000; Bud Ref CRRNT State funds: 101, 102, 103, 105 Bud Ref CYFWD Use the same ChartField as the original expenditure All other funds Use the same ChartField as the original expenditure EXCEPT use account 530000 4 Cash Expense Refunds Example 1: Date Dept ID Fund Program Account Source Project 2/18/2009 65010000 209 2200 732100 G000900 00087357 Exp Rfnd 65010000 209 2200 732100 G000900 00087357 Example 2: Date Dept ID Fund Program Account Bud Ref Flex ID 6/15/2010 13500600 149 8700 791000 CRRNT 1350ADM Exp Rfnd 13500600 149 8700 530000 CRRNT 1350ADM Example 3: Date Dept ID Fund Program Account Bud Ref Flex ID 7/31/2009 57760000 101 2100 734200 CRRNT 57760850 Exp Rfnd 74060000 111 6100 530000 CRRNT 5 Cash Expense Refunds • All cash expense refunds must be accompanied by a cash expense refund form (http://fa.ufl.edu/forms/pdf/fa-pds-cer.pdf) • The cash expense refund form must be fax imaged to the original voucher, expense report, or journal ID • If the expense refund relates to a travel expenditure or a grant fund, forward the check and the cash expense refund form to travel, grants, or office of research to complete the deposit 6 Cash Expense Refunds 7 Cash Expense Refunds 8 Cash Expense Refunds 9 Cash Expense Refunds 10 Cash Expense Refunds: Record Deposit 11 Cash Expense Refunds In myUFL, we must: 1. Record Deposit 2. Create Accounting Entry 3. Print Deposit Transmittal Form 12 Cash Expense Refunds Record Deposit Navigation: Accounts Receivable Payments Online Payments Regular Deposit Select Add a New Value to begin a new Deposit 13 Cash Expense Refunds Record Deposit Deposit Unit = “0500” Deposit ID will be assigned by myUFL Click: Add 14 Cash Expense Refunds Record Deposit Accounting Date Bank Code = “WACH” (default) Bank Account = “UFV” Deposit Type = “K” (Check) 15 Cash Expense Refunds Record Deposit Click: “Payments” Enter the Count Enter the Control Total Amt 16 Cash Expense Refunds Record Deposit Enter: Payment ID Enter: Pymt Ref (Optional) Enter: Amount Check: Journal Directly Click: Save 17 Cash Expense Refunds: Create Accounting Entry 18 Cash Expense Refunds In myUFL, we must: 1. Record Deposit 2. Create Accounting Entry 3. Print Deposit Transmittal Form 19 Cash Expense Refunds Create Accounting Entry Navigation: Accounts Receivable Payments Direct Journal Payments Create Accounting Entries Click: Search 20 Cash Expense Refunds Create Accounting Entry 21 Cash Expense Refunds Create Accounting Entry 22 Cash Expense Refunds Create Accounting Entry 23 Cash Expense Refunds Create Accounting Entry Click the lightning bolt to create accounting entry 24 Cash Expense Refunds Create Accounting Entry Click the Complete checkbox Click Save 25 Cash Expense Refunds: Print Deposit Transmittal Form 26 Cash Expense Refunds In myUFL, we must: 1. Record Deposit 2. Create Accounting Entry 3. Print Deposit Transmittal Form 27 Cash Expense Refunds Deposit Transmittal Form Navigation: Accounts Receivable Payments Reports Deposit Transmittal Use Find an Existing Value if you have created a Run Control ID before 28 Cash Expense Refunds Deposit Transmittal Form Use Add a New Value if you have never created a Run Control ID before Enter a Run Control ID Click Add 29 Cash Expense Refunds Deposit Transmittal Form Enter your Deposit Unit Enter a Deposit ID Click Run 30 Cash Expense Refunds Deposit Transmittal Form Click: OK 31 Cash Expense Refunds Deposit Transmittal Form Click on Process Monitor to see the status of the process 32 Cash Expense Refunds Deposit Transmittal Form Click Refresh until Run Status and Distribution Status read Success and Posted Run Status and Distribution Status should read Success and Posted 33 Cash Expense Refunds Deposit Transmittal Form Click the Details link to see Process Details 34 Cash Expense Refunds Deposit Transmittal Form Click View Log/Trace to see the log files 35 Cash Expense Refunds Deposit Transmittal Form Click the PDF file link to open the DTF 36 Cash Expense Refunds Deposit Transmittal Form Header information from Control data 37