Chapter 1

advertisement

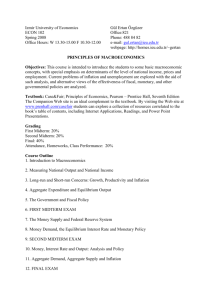

Norton Media Library Chapter 13 Financial Policy Dwight H. Perkins Steven Radelet David L. Lindauer Chapter 13 Outline • – – – – • – – – – • • – – – – – • – – – – – 1.The Function of a Financial System Money and the Money Supply Financial Intermediation Transformation and Distribution of Risk Stabilization 2.Inflation and Savings Mobilization Inflation Episodes Forced Mobilization of Savings Inflation as a Stimulus to Investment Inflation and Interest Rates 3.Interest Rates and Saving Decisions 4.Financial Development Shallow Finance and Deep Finance Shallow Financial Strategy Deep Financial Strategy Panic, Moral Hazard, and Financial Collapse Informal Credit Markets 5.Monetary Policy and Price Stability Monetary Policy and Exchange-Rate Regimes Sources of Inflation Controlling Inflation through Monetary Policy Reserve Requirements Credit Ceilings Financial Policy: Introduction • Financial policy deals with all measures intended to affect growth, efficiency and use of diversified financial system to meet it objective. It is also called Monetary Policy • There are 4 basic functions of a financial system: • 1. medium of exchange, &store of value, • 2.Moblize savings from various sources and channel it to investment-financial intermediation. • 3. Transfers and distributes risk across the across the economies • 4. serves as policy instruments of stabilization Functions of Financial System • 1. Medium of exchange: Money supply • Transfer deposits, checking & demand deposits, time deposits, • Money Supply: M1= narrow money (C +D) • Broad Money M2= includes time deposits (T) • Broadest Money=M3 includes liabilites of specialized institutions • Summary: M1=C+D, M2= M1 +T, M3 =M2+ O Concepts of Macro-finance • Financial ratio= financial assets/GDP • Financial Intermediation: Measure by flow of funds-accounts or liquid/Asset Ratio • Risk Transformation and distribution: A perfectly working Financial system will reduce risk with exception of disasters. • Stabilization function- to control inflation and recession Inflation and Saving Mobilization • 1. Prevent severe inflation and deflation or hyperinflation such as Zimbabwe. • Moderate inflation rate should be within the range of 8 to 12% • Inflation episodes (see table 13.2 for history of inflation in various countries) • Inflation in major regions of the world including global inflation ( see table 13.1) • Case study: Hyper-inflation in Peru: 1988-90 Saving Mobilization cont. • 1. Forced mobilization of savings – reduce money supply: Germany 1922-23, Peru 1988-90 • 2. Inflation as a stimulus to investment. Inflation of about 10% may be OK even helpful • 3. Inflation and interest rates: Rate offered to on deposits of savers in a bank- subject to control • 4. Real interest rate= nominal rate adjusted for inflation: real rate (r )= (1+i)/(1+P)-1 • Example: In Malaysia: i=7% inflation was 5% so the real rate is 7%-5%= 2% (1992) Financial Development • Deep Finance: Promotes growth in the real size of the economic system. Growth of financial system is greater than income growth • Shallow Finance : Ratio of liquid assets to GDP grows slowly on not at all or falls Financial Strategy • • • • • • • • Shallow Finance Strategy: high reserve requirements on commercial banks, non-price credit rationing , negative interest rate Deep Finance Strategy: Mobilies larger volume of savings for domestic economy , enhance fund accessibility, secure efficient allocation of savings, permit financial process that requires positive real rates solved by rasing nominal rate to curb inflation, Finance, Moral Hazard and Financial collapse: Rapid withdrawal of funds and panic some what like now but classic case of 1995 Pesso Crisis in Mexico, or financial crisis of East Asia in mid 1990s.. Moral Hazard: An effort to protect people and institutions from risky behavior actually leads people to take more risky activities. What is needed is prudential regulation Informal Credits; Many in Africa- Like the money lender See Case of Credit and Saving Inflation: Bangladesh and Indonesia Grameen Bank found by Mohammad Yunus is a classic case. Imposes social descipline Monetary Policy and Price Stability • Monetary Policy Exchange Rate Regimes • Fixed, pegged, managed, flexible ( see figure 13.1 for prototypes) • Sources of Inflation: Money Supply • M=DC +IR= Domestic stock+ Intern. Reserves • Change in M= change in DC = change IR • Government can only control DC not much control IR Strategies of Controlling inflation • 1. Open market operations: direct control on reserves by central banks • 2. Increase legal reserve requirements of bank reserves • 3. Increase discount rates so commercial banks can borrow less. • 4. Moral suasion: Exhortation of monetary officials • 5. Credit ceiling imposed by Central Banl • 6. Adjustment in allowable nominal rates on deposits and loans Chapter13 : Financial Policy Learning Objectives • • • • • • • • • • • The functions and characteristics of the financial systems in developing countries. The definition of money and liquid assets. The diversity of inflation experience in developing countries and the pros and cons of using inflation as a device to mobilize forced savings. How inflation affects real interest rates and how real interest rates, in turn, affect savings and the demand for liquid assets. The characteristics, causes, and consequences of deep finance versus shallow finance. The character of informal credit markets in developing countries. How management of monetary policy depends on the exchange-rate regime. The causes and consequences of excessive money supply growth. The main tools of monetary policy in developing countries. The causes and consequences of financial panics. Chapter 13: Summary • • • • CHAPTER OUTLINE I. Financial policy in developing countries encompasses all measures intended to influence the size, structure, and operation of financial markets and the system of financial intermediaries. The financial system plays a key role in development by supplying financial assets (including money, variously defined), by mobilizing and allocating savings (financial intermediation), by distributing risk, and by providing monetary authorities with tools for managing economic stability. The ratio of broad money (M2) to GDP is a common measure of financial development. 2 The most obvious problem of financial policy in developing countries has been controlling inflation. The text distinguishes among chronic, acute, and runaway (hyper-) inflation, and then reviews the sad history of high-inflation episodes over the past half century. Usually, the source of inflation can be traced to unmanageable government budget deficits. 3. Some economists argue that moderate inflation can be beneficial, as it forces the mobilization of savings by effectively taxing money balances. Some also contend that inflation may be tolerable as a by-product of keeping aggregate demand buoyant to stimulate investment. Yet, high inflation may have the opposite effects. First, the inflation tax augments domestic savings only if the government has a higher marginal propensity to save than the private sector, which is improbable. In any case, inflation is a very distortionary form of tax. Second, high inflation often is associated with negative real interest rates. While the link between interest rates and savings is weak, there is no doubt that negative real interest rates strongly affect the form in which savings are held. In particular, negative real interest rates reduce the demand for liquid assets; this impedes monetization and financial intermediation. In Chapter 13: Summary cont. • 4. Indeed, negative real interest rates is a hallmark of a shallow financial system. Shallow finance results from policies involving repressive interventions, which retard development of the financial system. In contrast, deep finance can be achieved by liberalizing financial markets and avoiding sharply negative real interest rates and rapid inflation. A deep finance strategy puts the financial system to work mobilizing and allocating savings. It also accelerates the development and efficiency of the financial system and helps reduce dependence on informal credit markets. • 5. The final section examines the relationship between monetary policy and inflation. From the balance sheet for the banking system, one can derive the fact that money supply growth is determined by the expansion of domestic credit and changes in international reserves: ∆M =∫ ∆DC + ∆IR. This shows that money supply expansion, and thus inflation, is linked to credit expansion for financing government deficits and private investments and to the balance of payments. The second term on the right-hand side of this identity implies that monetary policy is affected by the choice of exchangerate regime. In a small, open economy with a fixed exchange rate, the monetary authority must buy and sell international reserves to stabilize the foreign exchange market; but this means that it cannot independently control the money supply. Similarly, the need to finance large fiscal deficits may cause the central bank to lose control of money supply growth. To the extent that monetary authorities have an independent role in stabilization policy, they influence the volume and cost of credit by determining reserve requirements and the rediscount rate, by managing credit controls, and by using moral suasion to influence the banking system. W. W. Norton & Company Independent and Employee-Owned This concludes the Norton Media Library Slide Set for Chapter 13 Economics of Development SIXTH EDIT ION By Dwight H. Perkins Steven Radelet David L. Lindauer