My Resume - MyCareerHighlights.com

advertisement

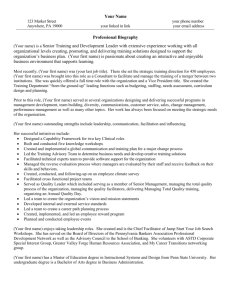

WILLIAM P. TULLIS www.mycareerhighlights.com/williamtullis williamptullis@gmail.com (510) 325-0456 VP, SALES - CONSUMER GOODS A highly accomplished CPG Sales and Marketing executive within the Food and Beverage (Kraft/Nabisco, Nestle, DelMonte) and OTC Pharmaceutical industries. A proven track record for delivering both top and bottom line results increasing shareholder value. Possesses a broad array of experiences managing businesses across multiple channels and supply chains including DSD, warehouse and refrigerated going to market via direct, broker and distributor sales teams. A motivational leader with high Emotional Intelligence and exceptional skill sets in strategic planning at both the corporate and business unit levels coupled with a strong bias for results via superior in-market execution. Operates with a high degree of passion, integrity, trust, accountability and responsibility. CORE COMPETENCIES: Strategic Planning, Sales Organization Management, Marketing, Customer Management, Financial Management, Negotiating, Organizational Design, Change Management, Talent Planning, Customer Relationship Management (CRM) Systems, Oracle BI (Business Intelligence), Oracle Data Warehouse, Siebel Trade Promotion Management System, Microsoft Office KEY ACCOUNTS: Wal-Mart, Target, Costco, Sam’s, BJ’s, Walgreen’s, CVS, Rite-Aid, Dollar General, Family Dollar, PetSmart, Petco, Kroger, Safeway, Giant, 7-11, Core-Mark, McLane, Military, Amazon CAREER ACCOMPLISHMENTS Pharmavite's business at Wal-Mart was significantly underdeveloped as they only carried their own brand. Used share data to show they were losing sales to other retailers. Executed an in-store test to determine which national brand they should carry: Grew Wal-Mart’s total VMS category sales by 30% during the test. Secured Pharmavite's full-line (35 SKUs) in all 3,400 Supercenters delivering an incremental $225M in annual revenue. Grew Target's Rx business by 12.5% and Pharmavite’s sales by 8%: Used in-store intercepts to ask customers about the Rx department - most had no idea Target had an in-store Pharmacy. Remerchandised Target's entire VMS and OTC categories, dropping shelving sight lines to "expose" the Pharmacy, created permanent VMS/OTC lifestyle end-caps effectively leading customers down the aisle to the Pharmacy. Reduced cost of sales by 50 basis points while over delivering quota: Inherited a Pharmavite Sales organization that was missing revenue goals while SG&A costs were increasing. Restructured the entire sales organization, streamlined HQ sales team, added resources to the Field replacing brokers with direct customer teams for the largest, most strategic customers, and renegotiated remaining brokers' commission rates. At a time when center store grocery business was declining, dedicated part of DelMonte’s sales organization into "Alternate Growth Channels" creating Club, Dollar and Pet Specialty Field Customer Marketing teams. Developed channel/customer specific packs: The Alternate Channels Sales Area recorded growth of 25% delivering $200M in incremental revenue and attaining $1B in annual revenue. WILLIAM P. TULLIS PAGE TWO CAREER ACCOMPLISHMENTS (continued) Tasked with reducing DelMonte's trade spending without negatively impacting volume, launched an ROI review of all trade events, created an HQ-based Sales Finance function and Sales Planning Center of Excellence to train Field Sales, revamped entire customer planning process, shifted all spending to accrual based pay for performance only, and launched a Siebel trade promotion management system: Delivered $45M trade spend reduction at or above quota. Delivered an incremental $20M in annual revenue while improving Del Monte’s margins by 20%: Challenged by Costco to add value to their branded canned tomato category - a highly competitive yet commoditized, low-margin category. Partnered with Marketing, Finance and Supply Chain and within 18 months launched a line of higher quality, higher margin, organic tomatoes for the more affluent Costco members. Nabisco’s Stella D'oro brand was losing $1M per year in metro NY due to the collective bargaining agreement of Teamster route sales drivers. Aggressively renegotiated the agreement, even taking a strike and flawlessly executing a contingency plan that grew sales with Nabisco management drivers: The Union signed a new agreement with a 33% reduction in drivers. Restored profitability in the market for the first time in 5 years, delivering $1.5M in profits in year one. Planters’ sales had declined by 17%. Launched a category management initiative convincing retailers the snack nut category needed only one national brand alongside their private label brand. Performed a price gap analysis and reduced Planters’ price gap: Over a two-year period grew Planters annual volume by 28%, from $625M to $800M, ultimately reaching $1B/year. Nestlé’s Juicy Juice was on the verge of extinction. Conducted consumer research and uncovered that consumers thought Juicy Juice was just another juice drink like Hi-C and Hawaiian Punch and could not justify its premium price, and kids did not like the taste. Executed a comprehensive re-launch including a new 100% juice formula, new packaging and a crystal clear advertising campaign: Grew sales from $25M to $125M. Gained #1 share position within the category. Doubled Juicy Juice sales to $250M: Though the re-launch was successful, identified a unique phenomenon - 8 legacy broker markets were outperforming direct Nestle Sales. Learned brokers controlled the category and the Nestle sales organization was more interested in selling a $100 case of coffee versus a $10 case of juice. Gained approval to take the brand 100% broker. Inherited a team of field-based Directors that was underperforming (95 index vs. quota) and graded “low” potential. Further, their prior VP created a toxic culture with HQ. Led a transformational culture change focused on “customer first”, shared accountabilities, and partnering with HQ: Delivered 102 index vs. quota by year two with 5 of 8 recognized as “Sales Masters.” PROFESSIONAL EXPERIENCE PHARMAVITE LLC, Los Angeles, CA 2011 - 2012 $1B US manufacturer of Nature Made vitamin brand, owned by Japan’s Otsuka Pharmaceutical, Inc. Executive Vice President, Sales - Head of Sales for the US sales organization and member of the Executive Team, reporting directly to the COO. Responsible for delivering AOP sales and share objectives across all channels and key customers (Wal-Mart, Target, Costco, Walgreens, CVS, Rite-Aid) while also shaping the strategic direction of the company with the Board of Directors. 7 direct reports. WILLIAM P. TULLIS PAGE THREE PROFESSIONAL EXPERIENCE (continued) DEL MONTE FOODS CORPORATION, San Francisco, CA 2003 - 2010 $4B domestic manufacturer of Del Monte, StarKist, Milk Bone, Kibbles ‘n Bits, 9Lives, Meow Mix, Pupperoni, Nature’s Recipe brands. Area Vice President, Sales, Alternate Channels - Responsible for delivering $1B in annual revenue across the Club, Drug, Dollar, Convenience, Military and Pet Specialty channels. Led a field-based sales team of 40 employees (8 direct reports) including two cross-functional teams: Sales Finance and Field Customer Marketing. Promoted from Vice President Corporate Customer Marketing & Sales Strategy and Vice President Customer Marketing. KRAFT/NABISCO, East Hanover, NJ 1993 - 2003 $55B international manufacturer of brands including Oreo, Ritz, Oscar Mayer, Kraft Cheese, Planters, Maxwell House. VP Field Sales, Nabisco Biscuit Company - US Sales leader for the $7B biscuit brands. Managed sales across 3 sales/supply chains: Route Sales Drivers, DSD and Distributors, with 6 direct reports. Promoted from Senior Business Director Club Channel, Director Customer Marketing, Senior Product Manager, New Products, Product Manager, and Regional Marketing Manager, Northeast. NESTLE USA, Purchase, NY 1985 - 1993 $98B international manufacturer of brands including Crunch, Toll House, Juicy Juice, Libby, Stouffer’s, Carnation, Nescafe Regional Broker Manager, Nestle Beverage Company - Responsible for $25M in sales with 8 direct reports. Rapidly promoted from Retail Sales Representative, Marketing Assistant, Associate Product Manager, and Product Manager. EDUCATION ST. JOSEPH’S UNIVERSITY, Philadelphia, PA BS, Food Marketing, 1985 LEADERSHIP DEVELOPMENT PROGRAMS The University of Pennsylvania, Wharton School of Business, Executive Education Program Emotional Intelligence McKinsey & Co.’s Trade Promotion Efficiency & Effectiveness Consultative Services Talent & Succession Planning: 9 Box Grids Myers Brigs MBTI AFFILIATIONS National Association of Chain Drug Stores (NACDS), Retail Advisory Board Neighborhood Guard, Inc., Vice-Chairman