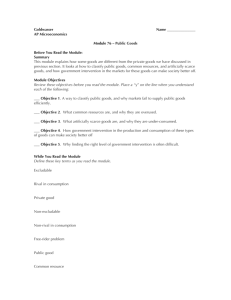

Public Goods

advertisement

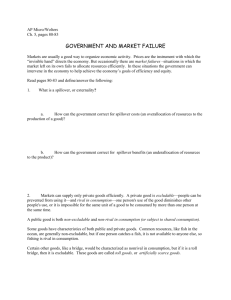

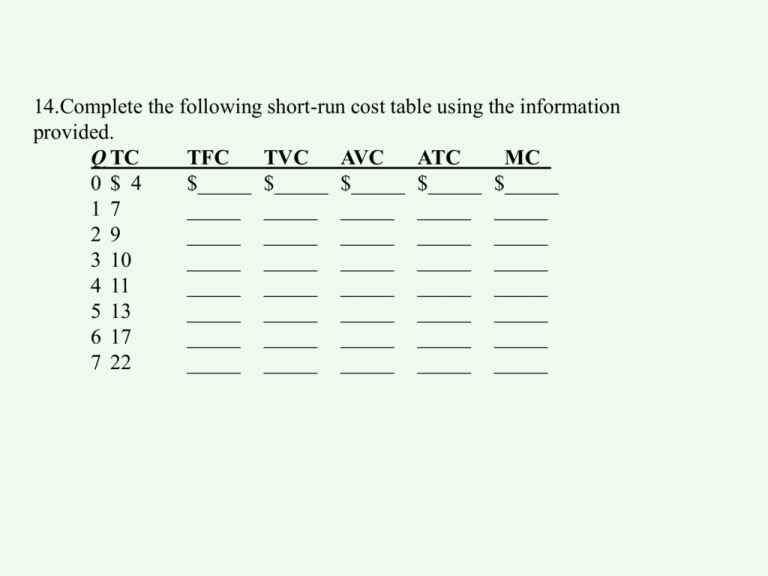

14.Complete the following short-run cost table using the information provided. Q TC TFC TVC AVC ATC MC 0$ 4 $_____ $_____ $_____ $_____ $_____ 17 _____ _____ _____ _____ _____ 29 _____ _____ _____ _____ _____ 3 10 _____ _____ _____ _____ _____ 4 11 _____ _____ _____ _____ _____ 5 13 _____ _____ _____ _____ _____ 6 17 _____ _____ _____ _____ _____ 7 22 _____ _____ _____ _____ _____ • • • 15. Consider the two diagrams below. Diagram A represents a typical firm in a purely competitive industry. Diagram B represents the supply and demand conditions in that industry. (a) Describe the price, output, and profit situation for the individual firm in the short run. (b) Describe what will happen to the individual firm and the industry in the long run. Show the changes on diagrams A and B. • • • Consider the graph below: Suppose the price of coffee is $1/cup and the price of sweaters is $20. How much is the consumer’s budget? (show your work) sweaters 5 3 IC3 IC2 IC1 40 100 cups of coffee P MC ATC D = MR = P $7 $5 $3 200 • Q What is the profit maximizing price and quantity of the FIRM? Economic Theory, Markets, and Government • Economic Theory • Market Failure • The Role of Government I. Economic Theory • Elements • objectives • constraints • choices objectives • what do we want to do? • people: maximize satisfaction • firms: max. profits • gov't: max. re-election or budget constraints • limits on how we achieve objectives • physical (PPC) • financial (budget constraint) • legal (property rights) choices • a statement about likely choice • law of demand • law of supply key assumption • people are rational • • people make best decision give their objectives and constraints rational decisions are • consistent • forward-looking rationality • full • • use all available info when making decisions bounded • limited ability to process information rationality & objectives • self-regarding preferences • • maximize own satisfaction other-regarding preference • max. own and others' satisfaction • care what others think Theory vs. observation • combine theory with observation • simplest theory, • consistent with observation What if observations do not match theory? • modify theory • • have we allowed for all constraints? • are the objectives correct? unwilling to change • preferences • rationality assumption II. Market failure • Usually market allocates resources optimally • directs resources to best uses • market outcome is efficient • market failure results when • market outcome is not efficient • too little of good is produced OR • too much of good is produced When does this happen? • externalities • public goods • lack of competition Externalities • 3rd party gets costs or benefits from good • production or consumption • OTHER than buyer/seller • External benefit = positive externality • External cost = negative externality example: flu shot Flu shot • I pay $10 for a flu shot • I am less likely to get the flu • AND • you are less likely to get the flu • external benefit So what’s the problem? • My decision to get flu shot based on only MY benefits • underestimate total benefits of shot • too few people get shots • markets under-produce goods with external benefits So what’s the solution? • Government subsidy of flu shot -- price is cheaper -- more people get flu shots Other goods with external benefits • education • antilock brakes • landscaping Example: electricity production • Profits for utility company • costs to utility company • external costs -- air pollution -- water pollution So what’s the problem? • Electricity cost reflects production • cost not pollution costs • underestimate total costs • electricity is too cheap • markets over-produce goods with external costs So what’s the solution? • Government pollution regulation • increase costs of electricity • less power generated Other goods with external costs • Cigarette smoking • loud music • careless driving Public goods • nonexclusive • cannot exclude those who do not pay from getting benefits • nonrival • my consuming good does not prevent you from consuming it • Private good: candy • if I eat it, you cannot • Public good: missile defense shield over city • everyone here can use it So what’s the problem? • If I buy the shield, you benefit • so I wait, hoping you buy the shield…. • nobody buys the shield • free rider problem • market alone will fail to produce the public good So what’s the solution? • Gov’t levies taxes to fund production of public good • society better off Other public goods: • law enforcement • fire protection • roads, bridges Lack of Competition What is it? • Firm is large or only supplier • firm is able to influence price With no market power Perfect competition • many firms • max output at lowest price So what’s the problem? • Firms w/ market power restrict output • increasing prices • anti-competitive behavior • no incentive to improve quality So what’s the solution? • Antitrust laws • regulate BEHAVIOR • case against Microsoft III. Role of Government • dealing with market failures • • • • regulation subsidies/taxes anti-trust laws provision of goods/services problems • rent-seeking • government failure rent-seeking • parties lobby gov’t for laws to protect their interest at expense of others • tariffs/quotas • tax credits • patent/copyright extention government failure • law of unintended consequences • policies have other effects • is the cure worse than the disease? Private Goods—and Others What’s the difference between installing a new bathroom in a house and building a municipal sewage system? What’s the difference between growing wheat and fishing in the open ocean? In each case there is a basic difference in the characteristics of the goods involved. Bathroom appliances and wheat have the characteristics needed to allow markets to work efficiently; sewage systems and fish in the sea do not. Let’s look at these crucial characteristics and why they matter… Characteristics of Goods Goods can be classified according to two attributes: whether they are excludable and whether they are rival in consumption A good is excludable if the supplier of that good can prevent people who do not pay from consuming it. A good is rival in consumption if the same unit of the good cannot be consumed by more than one person at the same time. Characteristics of Goods A good that is both excludable and rival in consumption is a private good. When a good is nonexcludable, the supplier cannot prevent consumption by people who do not pay for it. A good is nonrival in consumption if more than one person can consume the same unit of the good at the same time. Characteristics of Goods There are four types of goods: Private goods, which are excludable and rival in consumption, like wheat Public goods, which are nonexcludable and nonrival in consumption, like a public sewer system Common resources, which are nonexcludable but rival in consumption, like clean water in a river Artificially scarce goods, which are excludable but nonrival in consumption, like pay-per-view movies on cable TV Characteristics of Goods There are four types of goods. The type of a good depends on (1) whether or not it is excludable— whether a producer can prevent someone from consuming it; and (2) whether or not it is rival in consumption—whether it is impossible for the same unit of a good to be consumed by more than one person at the same time. Why Markets Can Supply Only Private Goods Efficiently Goods that are both excludable and rival in consumption are private goods. Private goods can be efficiently produced and consumed in a competitive market. When goods are nonexcludable, there is a free-rider problem: consumers will not pay producers, leading to inefficiently low production. When goods are nonrival in consumption, the efficient price for consumption is zero. But if a positive price is charged to compensate producers for the cost of production, the result is inefficiently low consumption. Public Goods A public good is the exact opposite of a private good: it is a good that is both nonexcludable and nonrival in consumption. Here are some other examples of public goods: Disease prevention. When doctors act to stamp out the beginnings of an epidemic before it can spread, they protect people around the world. National defense. A strong military protects all citizens. Scientific research. More knowledge benefits everyone. Providing Public Goods Because most forms of public good provision by the private sector have serious defects, they must be provided by the government and paid for with taxes. How Much of a Public Good Should Be Provided? The marginal social benefit of an additional unit of a public good is equal to the sum of each consumer’s individual marginal benefit from that unit. At the efficient quantity, the marginal social benefit equals the marginal cost. The following graph illustrates the efficient provision of a public good… Providing Public Goods No individual has an incentive to pay for providing the efficient quantity of a public good because each individual’s marginal benefit is less than the marginal social benefit. This is a primary justification for the existence of government. Cost-Benefit Analysis Governments engage in cost-benefit analysis when they estimate the social costs and social benefits of providing a public good. Although governments should rely on cost-benefit analysis to determine how much of a public good to supply, doing so is problematic because individuals tend to overstate the good’s value to them. The Problem of Overuse Common resources left to the free market suffer from overuse: a user depletes the amount of the common resource available to others but does not take this cost into account when deciding how much to use the common resource. In the case of a common resource, the marginal social cost of my use of that resource is higher than my individual marginal cost, the cost to me of using an additional unit of the good. The following figure illustrates this point… The Efficient Use and Maintenance of a Common Resource To ensure efficient use of a common resource, society must find a way of getting individual users of the resource to take into account the costs they impose on other users. Like negative externalities, a common resource can be efficiently managed: by Pigouvian taxes (tax or otherwise regulate the use of the common resource) by making it excludable and assigning property rights, or by the creation of a system of tradable licenses for the right to use the common resource. Artificially Scarce Goods An artificially scarce good is excludable but nonrival in consumption. Because the good is nonrival in consumption, the efficient price to consumers is zero. However, because it is excludable, sellers charge a positive price, which leads to inefficiently low consumption. It is made artificially scarce because producers charge a positive price but the marginal cost of allowing one more person to consume the good is zero. The problems of artificially scarce goods are similar to those posed by a natural monopoly. Artificially Scarce Goods In this example the market price is $4 and the quantity demanded in an unregulated market is QMKT. But the efficient level of consumption is QOPT, the quantity demanded when the price is zero. The efficient quantity, QOPT, exceeds the quantity demanded in an unregulated market, QMKT. The shaded area represents the loss in total surplus from charging a price of $4. • A Policeman’s Lot 1. Law enforcement is an example of: A) a public good. B) a private good. C) a negative externality. D) moral hazard. • A Policeman’s Lot 1. Law enforcement is an example of: A) a public good. B) a private good. C) a negative externality. D) moral hazard. • A Policeman’s Lot 2. The security and alarm system at a bank is an example of: A) a public good. B) a private good. C) a negative externality. D) moral hazard. • A Policeman’s Lot 2. The security and alarm system at a bank is an example of: A) a public good. B) a private good. C) a negative externality. D) moral hazard. • A Policeman’s Lot 3. People in a community would not be likely to voluntarily “chip in” for a security team that would patrol the entire community because: A) most people are not rational consumers. B) they can be free-riders. C) they believe that crime cannot be prevented. D) they believe it would be an inefficient production of the service. • A Policeman’s Lot 3. People in a community would not be likely to voluntarily “chip in” for a security team that would patrol the entire community because: A) most people are not rational consumers. B) they can be free-riders. C) they believe that crime cannot be prevented. D) they believe it would be an inefficient production of the service. HINT • Four Types of Goods DEFINITIONS There are four types of goods, depending on whether or not the good is excludable and whether or not it is rival in consumption. They are: • Private goods: these are rival in consumption and excludable • Common resources: these are rival in consumption and nonexcludable • Artificially scarce goods: these are nonrival in consumption and excludable • Public goods: these are nonrival in consumption and nonexcludable Goods that are nonexcludable suffer from the freerider problem: individuals have no incentive to pay for their own consumption and instead will take a “free ride” on anyone who does pay. TEST YOUR UNDERSTANDING 4. Which of the following goods best fit the characteristics of a private good? A) national defense B) clean water C) a pizza D) police protection TEST YOUR UNDERSTANDING 4. Which of the following goods best fit the characteristics of a private good? A) national defense B) clean water C) a pizza D) police protection TEST YOUR UNDERSTANDING 5. Which of the following goods is most likely a public good? A) the Internet B) a public park C) a pair of pants D) fire protection provided by the local fire department TEST YOUR UNDERSTANDING 5. Which of the following goods is most likely a public good? A) the Internet B) a public park C) a pair of pants D) fire protection provided by the local fire department SUMMARY • Law enforcement is a public good because the benefits of tracking down criminals and bringing them to justice, and of policing public areas, accrue to all law-abiding citizens. HINT • The Marginal Social Benefit Curve DEFINITIONS Public goods are both nonexcludable and nonrival in production. At the efficient quantity of a public good, the marginal social benefit is equal to the marginal social cost. Governments provide public goods because an individual’s marginal benefit is less than the marginal social benefit, and so individuals do not have an incentive to pay for providing the efficient quantity of the public good. TEST YOUR UNDERSTANDING 4. No individual is willing to pay for providing the efficient level of a public good since the: A) marginal cost of production is zero. B) good will be nonrival, and thus underconsumed. C) individual's marginal benefit is less than the marginal social benefit. D) marginal benefit of allowing one more individual to consume the good is zero. TEST YOUR UNDERSTANDING 4. No individual is willing to pay for providing the efficient level of a public good since the: A) marginal cost of production is zero. B) good will be nonrival, and thus underconsumed. C) individual's marginal benefit is less than the marginal social benefit. D) marginal benefit of allowing one more individual to consume the good is zero. TEST YOUR UNDERSTANDING 5. Public goods should be produced up to the point where the marginal cost of production equals: A) the maximum price any individual is willing to pay for that unit. B) the sum of the individual marginal benefits from all consumers of that unit. C) zero, which is the marginal cost of allowing another individual to consume the good. D) the highest marginal benefit from any individual consumer of the good. TEST YOUR UNDERSTANDING 5. Public goods should be produced up to the point where the marginal cost of production equals: A) the maximum price any individual is willing to pay for that unit. B) the sum of the individual marginal benefits from all consumers of that unit. C) zero, which is the marginal cost of allowing another individual to consume the good. D) the highest marginal benefit from any individual consumer of the good. SUMMARY • The problem with the government provision of public goods is that everyone wants a project that benefits his or her property—if other people are going to pay for it. • In the United States, the Army Corps of Engineers has undertaken projects that cannot be justified by any reasonable cost-benefit analysis. HINT • A Common Resource DEFINITIONS A common resource is nonexcludable and rival in consumption. As a result, common resources left to the market are likely to suffer from overuse. There are three fundamental ways to induce people who use common resources to internalize the costs they impose on others: • Tax or otherwise regulate the use of the common resource • Create a system of tradable licenses for the right to use the common resource • Make the common resource excludable and assign property rights to some individuals TEST YOUR UNDERSTANDING 4. Common resources tend to be overused because: A) individuals tend to ignore the cost of their use of the resource to others. B) the individual marginal cost is greater than the marginal social cost. C) common resources are nonrival and nonexcludable. D) the marginal cost of allowing 1 more unit of consumption is zero. TEST YOUR UNDERSTANDING 4. Common resources tend to be overused because: A) individuals tend to ignore the cost of their use of the resource to others. B) the individual marginal cost is greater than the marginal social cost. C) common resources are nonrival and nonexcludable. D) the marginal cost of allowing 1 more unit of consumption is zero. TEST YOUR UNDERSTANDING 5. One way the government of Alaska could prevent overuse of waters for crab fishing would be to: A) subsidize fishermen to create more competition. B) sell exclusive licenses for the right to fish. C) offer tax breaks for more efficient boats. D) do all of the above. TEST YOUR UNDERSTANDING 5. One way the government of Alaska could prevent overuse of waters for crab fishing would be to: A) subsidize fishermen to create more competition. B) sell exclusive licenses for the right to fish. C) offer tax breaks for more efficient boats. D) do all of the above. SUMMARY • A common resource is nonexcludable and rival in consumption. As a result, common resources left to the market are likely to suffer from overuse. • One way to avoid this is to make the common resources excludable and assign property rights to some individuals through, for example, licenses to fish. HINT • An Artificially Scarce Good DEFINITION An artificially scarce good is excludable but nonrival in consumption. Because the good is nonrival in consumption, the efficient price to consumers is zero. However, since the good is excludable, sellers charge a positive price, which leads to inefficiently low consumption. TEST YOUR UNDERSTANDING 4. Which of the following is an example of an artificially scarce good? A) diamonds, because their supply is artificially restricted by monopoly producers B) music that is downloadable from the Internet for a fee C) a daily newspaper D) hot dogs in a sports stadium because the number of suppliers is restricted TEST YOUR UNDERSTANDING 4. Which of the following is an example of an artificially scarce good? A) diamonds, because their supply is artificially restricted by monopoly producers B) music that is downloadable from the Internet for a fee C) a daily newspaper D) hot dogs in a sports stadium because the number of suppliers is restricted TEST YOUR UNDERSTANDING 5. Artificially scarce goods are inefficiently consumed because the market price is zero. A) True. B) False. TEST YOUR UNDERSTANDING 5. Artificially scarce goods are inefficiently consumed because the market price is zero. A) True. B) False. SUMMARY • Games are blacked out at the insistence of team owners who don’t want people who might have paid for tickets staying home and watching the game on TV instead.