South African Reserve Bank

advertisement

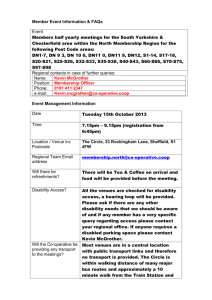

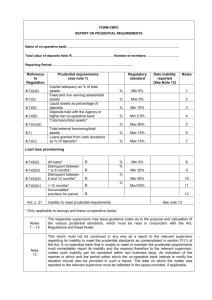

Combined Annual Report of the Supervisors of the Co-operative Banks Development Agency and the South African Reserve Bank 2010/11 Select Committee on Finance Outline Introduction Application of the Act – types and service Legislative framework History of the Act 2002-2008 Preparation 2008-2010 Implementation from 2010/2011 Primary reason for failure to register Co-operation and co-ordination agreement Issues requiring attention 2011/2012 Introduction Section 52 of Co-operative Banks Act 2007 requires the Supervisor in the CBDA and Supervisor in the SARB submit to the Minister of Finance annual report on the exercise and performance of their powers and functions in terms of the Act and report on the implementation of their co-operation and coordination plan. Powers and functions include: – Register and de-register co-op banks – Issues rules, guidance notes and directives – Penalties – Carry out inspections – Take any steps necessary to protect publics funds Application of the Act Application of Act: S 3: (1) This Act applies to all co-operative banks registered under this Act and to any— (a) primary co-operative registered under the Co-operatives Act that takes deposits and has 200 or more members and holds deposits of members to the value of one million rand or more and (b) secondary or tertiary co-operative registered under the Cooperatives Act, whose members consist of at least— (i) two or more co-operative banks; (ii) two or more financial services co-operatives that take deposits; (iii) one co-operative bank and one financial services cooperative that take deposits. Types Types of Co-operative Banks: Primary savings banks Primary savings and loans banks Secondary co-operative banks Tertiary co-operative banks Services (Primary Savings) May only provide, participate in or undertake the following banking services: (a) deposits from its members; (b) open savings accounts for its members; (c) borrow money from the Agency and members (subject % by MoF); (d) open a savings/cheque account in the name of cooperative bank; (e) make, draw, accept, endorse, or negotiate negotiable instruments; (f) trust or custody services; (g) additional banking services prescribed by MoF and (h) invest money in investments prescribed by the Minister. (See regulations) Services (Primary Savings and Loans) A primary savings and loans co-operative bank may only provide the following banking services: (a) Any of the banking services referred to previously; (b) grant secured and unsecured loans to members to a maximum aggregate value prescribed by the Minister (see regulations) and (c) conduct any additional banking services and invest money deposited with it in any investments prescribed by the Minister. Services: Secondary and Tertiary A secondary co-operative bank may only provide the following banking services: (a) Any of the banking services referred to previously; (b) trading financial instruments on behalf of its members; (c) open an account with a bank registered under the Banks Act to facilitate foreign currency transactions; (d) conduct such additional banking services and invest money deposited with it in any investments prescribed by the Minister. A tertiary co-operative bank may provide the following banking services: (a) Any of the banking services referred to previously; (b) conduct such additional banking services and invest money deposited with it in any investments prescribed by the Minister SARB Co-operative Banks Act > 20 million SARB < 20 million CBDA R 1 000 000 and 200 members Financial services Housing Worker Social Agricultural Burial society Consumer Marketing/Supply Service dti Co-Operatives Act History 2002 -2008 Fin Sector Summit- (NEDLAC principles to reform sector, including access to finance 2002) Pres. Growth Summit-(support to co-ops as part of strategy to create work opportunities 2003) Co-op Act replaced 2005 Responsibility transferred to CIPRO Payout process (following collapse of FSCs 2004) 2004 Co-op Banks Bill (2004) Exempt. Notices (2006 & 2008) Preparation 2008-2010 Preparation 2008-2010 Act (August 2008) Draft Regulations. (August 2008) CBDA Board (August 2008) MD CBDA appointed (March 2009) CBDA Supervisor appointed (May 2009) SARB Supervisor appointed (July 2009) Regulations (July 2009) SARB CBSU (August 2010) Roodevallei Consultative Conf. (Dec 2009) Implementation from 2010/2011 Rules (Jan 2010) GN1/2010 (Jan 2010) 17 eligible applicants Assessment • 13 by CBDA • 4 by SARB (Including 1 secondary) • Total deposits: R 160 million • Total members: 28,034 11 completed applications Ditsobotla Savings and Credit Co-operative Bank Ltd first to be registered 17 Feb 2011 Approval given to second co-op bank by SARB. Awaiting registration Primary Reasons for failure to register Inadequate capital levels Regulations require 6% CAR Most have been operating at losses and not making (adequate) provisions Weak governance and operational capacity Committees not meeting No AGMs Poor systems in place Poor accounting and MIS Few qualified accounting staff Few computerised CBDA and SARB Co-operation and co-ordination agreement sent to Minister of Finance include: Co-ordination of supervisors’ approach in exercising their powers and functions in terms of the Act Engaging with each other in activities of research, publication, education, staff development and training Engaging with each other in staff exchanges or secondments Provide technical assistance or expertise to each other Activities engaged in 2010/2011 Activities included Weekly co-ordination meetings Jointly meeting stakeholders (i.e NCR, FIC, samaf, SACCOL Input into regulations Joint publication of rules Commenting on relevant financial and co-op bills Issuing of guidance notes Commenting on discussion documents Assessment of applications Co-ordination of manuals and administrative systems Presentation to international and local seminars Issues requiring attention 2011/12 Banks Act exemption notices Deposit insurance fund Potential abuse of the Act Appeals board Submission of prudential returns “Twin Peaks” model for financial regulation Application of Basel Core Principles on banking supervision for deposit taking Microfinance activities Questions THANK YOU ! Supporting slides Co-ops Act Exemption Notice SACCOL/NASSASA/SAMAF Co-ops Act COB Act CBDA Co-ops Act COB Act SARB Secondary and Tertiary < R 1 mil R 1 mil < R 20 mil Financial Services Cooperative Co-operative Bank Co-operative Bank Limited liability Limited Liability Limited Liability May receive Agency assistance Deposit Insurance Deposit Insurance Agency assistance NPS > R 20 mil Regulations: Investments Only in following deposits with a bank deposits with secondary or tertiary co-operative banks government co-operative retail savings bonds participatory interests in portfolios of collective investment schemes approved by the Registrar of Collective Schemes as determined by the supervisor by notice on its official website bonds and debentures determined by the supervisor Minimum Capital Adequacy Only the following qualify as capital – membership shares indivisible reserves non-distributable reserves (excluding provisioning) and non-distributable funds of a permanent nature approved by the supervisor in writing Must be at least 6 percent of total assets held by cooperative bank Liquidity Max 5 percent of total assets may be held in fixed and nonearning assets Minimum 10 percent of total deposits must be held in “prescribed investments” with a tenure not exceeding 32 days and convertible into cash at any time In addition, minimum of 2,5 % of total deposits must be deposited with the Agency or a higher tier co-operative bank balance of deposits must be held in prescribed investments or (for savings and loans) balance granted as loans up to a maximum of 80 percent of total assets (loans granted to members that are sourced from cash donations may not exceed 15% of total deposits.) Large exposures Hold no deposit from any one member or related person, exceeds the lesser of 10 percent of the total assets held by or 25 percent of the capital of the co-operative bank A co-operative bank may not make an investment with any one person or related person or grant a loan to any one member or related person, which exceeds the lesser of 10 percent of the total assets held by or 25 percent of the capital of the co-operative bank