CUI Lin, Chief Representative for China, International Tin Research

advertisement

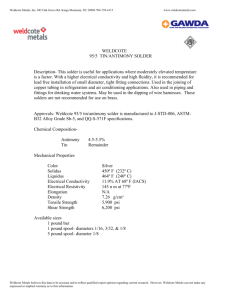

A Changing Global Tin Market May 29, 2015 Cui Lin Chief Representative of International Tin Research Institute in China Price comparison between tin and other LME metals Tin Comparison of price between April 2015 and April 2014 Zinc Zinc Aluminum Index Aluminium Lead Lead Copper Copper LME Nickel Nickel LME and tin price index (2000 =100) Tin Tin -40% -30% -20% -10% 0% 10% Moves in trend and the confusions! Tin has ever been one of the most popular LME metals, but now tin price has the worst performance Downsizing becomes the biggest concern of stakeholders for the tin market, but the tin consumption recovered slightly in the last two years China was one of the fastest growing consumers, but now (thanks to Burma) it has become the fastest growing producer No one would expect that Indonesia may cut its output——but it indeed happened! It is expected that 2015 will see a short supply-dominated pattern again—— despite that the error rate of estimation may be very high Critical tin statistics in 2014: forecast error Comparison between results and prediction for 2014 Global balance Indonesia’s output China’s output Global demand 000 tons The figure compares the output/consumption forecast for February 2014 with existing data The global tin consumption is better than the original expectation The global tin consumption is better than the original expectation The main shock comes from China’s output growth The slump of Indonesia’s output (including overseas re-refining) is slower than expected Output in other regions is the same as expected The global balance situation was changed from the expectation that the undersupply would exceed 10000 tons to the fact that the oversupply is more than 5000 tons Global tin consumption growth trend Tin concentrate (kt) Fitting trend curve: The annual growth rate is 1.9% ITRI’s tin consumption survey covers the past 11 years Data:ITRI Above-trend demand growth Tin consumption according to filed of application Ton Consumption of each application field Solder Tinplate Chemicals Brass and bronze Float glass Others Total Change range % LME metal consumption’s global growth situation 240 220 Global consumption index, and the base number in the year of 2000 = 100 Alumin Aluminium um Copper Copper 200 180 Nickel Nickel 160 Lead Lead 140 Zinc Zinc 120 Tin Tin 100 Data source: tin data come from ITRI, and data of other LME metals come from CRU 80 2000 2002 2004 2006 2008 2010 2012 2014 Tin consumption of different industry sectors 消费电子 Consumer electronics 交通 Transportation Solder-electronics 包装 建筑 工业 其他 焊料 - 电子 Solder-industry Packaging 焊料 - 工业 Tinplate 马口铁 Building Chemicals 化工 黄铜 青铜 Brass& and bronze Industry 浮法玻璃 Float glass 其他 Others 0 20,000 Others 40,000 60,000 80,000 100,000 120,000 Change of proportions of global mines’ output 350 300 kt Decline in Indonesia and Peru 印尼和秘鲁下滑, Growth in Myanmar (and Africa) 缅甸(及非洲?)增长 China China 250 Indonesia Indonesia 200 Malaysia Malaysia 150 Bolivia Bolivia 100 Peru Peru 50 Other ROW 0 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 2013 regions Indonesia’s export has been declining 12-month moving total of metals examined before export 110,000 Lowest price in August 2012 105,000 100,000 95,000 90,000 85,000 Global financial crisis Jan-15 Sep-14 May-14 Jan-14 May-12 Jan-12 Sep-11 May-11 Jan-11 Sep-10 May-10 Jan-10 Sep-09 May-09 Jan-09 Sep-08 May-08 Jan-08 60,000 Sep-13 65,000 New export laws implemented since July 1st, 2013/August 30 and November 2014 May-13 70,000 Jan-13 75,000 Export suspension-4th quarter of 2011 Sep-12 80,000 Impact of Indonesia’s new export laws 14,000 Total volume examined before export since implementation of new export laws 其他 Others 12,000 焊料 Solder 10,000 Tin ingot 锡锭 8,000 6,000 4,000 2,000 0 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Mar-15 Output of South America’s mines 80 Tin content in tin concentrate (kt) 70 Bolivia Bolivia 60 50 Brazil Brazil 40 30 Peru Peru 20 10 0 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 2013 Import volume of concentrate from central Africa 总重(千吨) Total weight (000 tons) 25,000 Other Other countries* 20,000 China China countries* 15,000 Thailand 泰国 Thailand 10,000 Malaysia Malaysia 马来西亚 5,000 0 2004 2006 2008 2010 2012 2014 * India, Russia, Germany and Bulgaria Small mining operations are at high cost Cash cost in 2014 after ITRI deducted the cost of by-product (US dollar/ton tin) Small and manual mining operations Cost (US dollar/ton) –Mostly in Indonesia –Mostly in Indonesia Emerging Burma’s supply channel: Lack of data, but rapid expansion may indicate low cost % in the cumulative tin output The base price fell in 2015, but it will rise in the next years Cash cost after ITRI deducted the cost of by-product (US dollar/ton tin) 2019 ~ 21,000 USD Cost (US dollar/ton) 2014 ~ 17,200 USD 2015 ~ 15,900 USD Falling oil price and strong dollar lower the cost in 2015 % in the cumulative tin output The base price of about 16,000 USD is based on the assumption that the market is caught in an oversupply (market equilibrium price would be higher) Besides, other fixed costs must be considered The model predicts that the long-term market equilibrium price is about 25,000 USD Full costs of ITRI in 2019 after deduction of by-product costs (USD/ton tin) Cost (US dollar/ton) Long-term market equilibrium price is about 25,500 USD % in the cumulative tin output 100%≈300,000 tons China’s raw material supply pressure is largely mitigated China’s raw material source kt 180 Import volume of crude tin for refining purpose 用于再精炼的粗锡进口量 160 Output of recycled refined tin 再生精锡产量 Import of concentrate 精矿进口量 140 Unreported mine output 未报告的矿山产量 120 Reported mine output * 报告的矿山产量* 100 80 60 *Reported output after 2013 (inclusive); the official did not announce mines’ output after 2013 40 20 0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Data source: ITRI, CRU,CNIA Significant increase of concentrate import Import volume of China’s tin concentrate (material object) 中国锡精矿进口量 (实物量) • Mainly from Burma • Grade of 60%-70% imported concentrates is 10%; and that of the rest is 20%-35% • Low price and seasonable factors caused a decline of import value for consecutive five months 35,000 Myanmar Others 缅甸 其他 30,000 25,000 20,000 15,000 10,000 Jan-15 Oct-14 Jul-14 Apr-14 Jan-14 Oct-13 Jul-13 Apr-13 Jan-13 Oct-12 Jul-12 Apr-12 Jan-12 Oct-11 Jul-11 Apr-11 Jan-11 Oct-10 Jul-10 Apr-10 0 Jan-10 5,000 Significant increase of tin concentrate output China’s tin concentrate output ton ton Refined tin output Data source: ITRI, CNIA year-on-year growth Slowing growth of China’s consumption China’s tin concentrate consumption structure, 2014 China’s tin consumption ton 1% 9% 3% 4% Solder 焊料 马口铁 Tinplate 化工 Chemicals 11% Brass& and bronze 黄铜 青铜 Glass 玻璃 9% 63% Lead-acid battery 铅酸蓄电池 Others 其他 China’s tin consumption year-on-year change Declining growth of electronic industry Year-on-year growth rate of the output of main electronic products in China % 50 40 家用洗衣机 Domestic washing machine 30 家用电冰箱 Household refrigerator 20 Mobile telephone 移动通信手 持机 电子计算机 Computer-complete machine 整机 微型计算机 Microcomputer 设备 Colour TV set 彩色电视机 10 0 -10 Data source: State Statistics Mar-15 Dec-14 Oct-14 Aug-14 Jun-14 Apr-14 Jan-Feb-14 Nov-13 Sep-13 Jul-13 May-13 Mar-13 Dec-12 Oct-12 Aug-12 Jun-12 Apr-12 -30 Jan-Feb-12 -20 New areas of demand are showing their potential Year-on-year growth of consumption in all areas in the last three battery years Lead-acid • In 2014, the new Access Conditions to China Lead-acid Battery Industry started to be implemented, which stipulates that the tin content should be increased from 0.2% to 1.2%. The large scale lead-acid battery market, • relatively low tin price increased the market competitiveness of tin chemical products, the turnabout of economy in Europe and US drove a significant growth of export of tin chemical products used for building purposes. Brass and bronze Tin chemistry Tinplate Solder • A shifting relationship between growth of LED and auto electronics and the miniaturization of electronic products; There is still large inventory ton 国内库存的变化 Domestic inventory change 15,000 13,000 11,000 9,000 7,000 5,000 3,000 1,000 -1,000 -3,000 -5,000 -7,000 -9,000 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 The trend of trade becomes subtle and depends on interest margin between two markets * *export volume predicted ton net import 进口 3,500 based on import of other countries; the recent months’ data are incomplete export data net export 口 3,000 2,500 2,000 1,500 1,000 500 0 -500 -1,000 Mar/15 Jan/15 Nov/14 Sep/14 Jul/14 May/14 Mar/14 Jan/14 Nov/13 Sep/13 Jul/13 May/13 Mar/13 Jan/13 Nov/12 Sep/12 Jul/12 May/12 Mar/12 Jan/12 Nov/11 Sep/11 Jul/11 May/11 Mar/11 Jan/11 Nov/10 Sep/10 Jul/10 May/10 Mar/10 -2,000 Jan/10 -1,500 Arbitrage space reappears and the import increase is predictable Domestic import price=LME spot price + 3% tariff + 17% VAT Arbitrage space LMB spot price, USD/ton, Domestic spot price, USD/ton LME March futures closing price, USD/ton Domestic import price* Shanghai-Tin March futures closing price, USD/ton Influence of tin futures listing on SHFE Yuan/ton Number of futures contracts traded in March at SHFE lots • Large price fluctuating range • Open interest and trade volume expand quickly, comparable to LME daily trading volume • The single-day trade volume on May 7 reaches 51604 lots! (1 lot=1 ton) Influence of tin futures listing at SHFE 1. The domestic market’s investment and speculation factors increase and the fluidity is speeding up 2. The domestic price fluctuating range is greater 3. Change of domestic pricing model Bargaining pattern based on spot quotation price+premium/discount? Futures 4. Enhanced linkage between domestic and overseas markets 5. Investment demands alleviate the inventory pressure Market outlook China’s supply and demand balance forecast 2011 Ton 吨 Output 产量 Adjusted net export 调整后的净出口 China’s refined tin consumption 中国精锡消费量 Market equilibrium 市场平衡 2012 2013 2014 2015e 160,000 152,000 158,100 175,000 178,000 8,134 -11,835 359 4,729 2,000 156,700 149,700 156,400 162,700 167,800 -4,800 14,100 1,300 7,600 8,200 Data source: ITRI, China Customs, GTIS 2015 critical forecast matters China and Burma China’s tin concentrate output was increased from 175,000 tons in last year to 178,000 tons this year, and the mining quantity in Burma was increased from 30,000 tons to 35,000 tons. Indonesia The mining quantity was decreased from 86,000 tons to 78,000 tons, of which 73,000 tons were tin concentrate. Other supply quantities Output in South America keeps stable (slight increase in Brazil and Bolivia being set off by output decline in Peru). Slight increase in Australia and Africa Demand Global tin concentrate consumption quantity was increased to 367,300 tons, a growth rate of 1.7%. China’s growth rate (+3.1%) is greater than other regions of the world (+0.5%) A predicted short supply (with high error rate) Table for global refined tin supply/demand balance Forecast (000 tons) Global Global refined tin output _ Selling quantity of DLA Global refined tin consumption Global market equilibrium Report stock LME Manufacturer Consumer and others Total Global sales-to-stock ratio (weekly consumption) Recent “generally consistent” tin price prediction (Reuters survey made in April 2015) 2015=19,070 USD/ton 2016= 21,465 USD/ton Complex mid-term viewpoint (1) The mining industry and metal price will rebound strongly by 2019, while chemical fertilizer will lag behind* 34 mining industries, metals and fertilizers covered by CRU Hot Warm Zinc, CPC, tin, nickel, coal tar, sulfuric acid, cobalt, Palladium, bauxite, metallurgical coke, metallurgical coal, copper , potassium carbonate Aluminum, lead, platinum, thermal coal, phosphorite ferrochrome, chrome ore, urea, crude oil and Brent crude oil Mild Lead , silicon Cool magnesium Cold Phosphate, DAP, ammonia, silicon-magnesium and gold Froze n Metal, molybdenum, iron ore, sulfur and silver Complex mid-term viewpoint (2) Figure 4. Schedule for supply quantity of emerging raw material in urgent need on metal market Next six months 1-3 years Zinc Chrome ore Nickel Platinum family metals Bauxite Copper Metallurgical coal Iron ore Silver Thermal coal Gold Manganese ore Lead Steel Ferrochrome Aluminum Tin NB: Exceeding projects already putting into production Data source: Macquarie research, May 2015 5 years above 3-5 years Uranium Price outlook before 2023 USD/ton 60,000 Central Forecastvalue (2014) Middle predicted 50,000 (2014) Weak demand scenario (2014) Weakening in demand (2014) 40,000 Supply supply constraint scenario Limited quantity (2014) (2014) 2020–2023 Predicted range: 20,000 -40,000 USD/ton 30,000 20,000 Latest likely path The mostmost possible path recently 10,000 0 2007 2009 2011 2013 2015 2017 2019 2021 2023 No.1003, Jianwei Building, No.66, South Lishi Road, Beijing Tel: + 86 10 6808 6625 E-mail: cuilin@itri.co.uk WeChat ID: ITRIChina Please scan the twodimension code below to key an eye on International Tin Research Institute