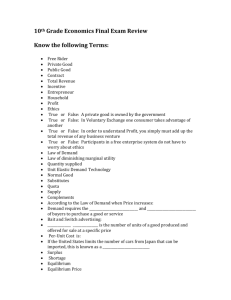

unit 3 7 28

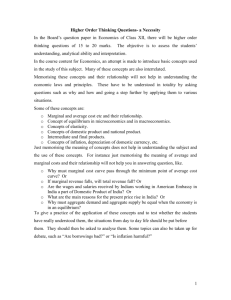

advertisement