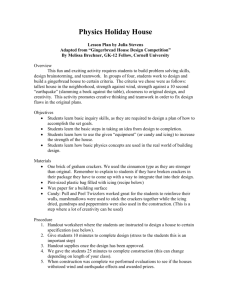

BUSN 307 PRODUCTIONS AND OPERATIONS MANAGEMENT

advertisement

BUSN 307 PRODUCTIONS AND OPERATIONS MANAGEMENT QUIZ-2 January 8, 2015 1. Bernard Callebaut operates a chocolate shop in Kensington. The annual demand for chocolate-covered cherries is 2,500 units. The setup cost is $15 per order. The holding cost per unit per year is $0.25. a. What is the optimum number of units per order? b. What is the expected number of orders per year? c. Assuming a 250 day working year, what is the expected time between orders? d. What are the total annual inventory costs? e. If delivery of the chocolates takes 2 days, at what level of stock should a new order be placed? ANSWER Q* = 2DS = H N = D / Q* = T = Days per year / N = TC = (D / Q) S + (Q / 2) H = ROP = dL = 2. Karlstad cakes is a manufacturer of a specialty cakes, which has recently obtained a contract to supply a major supermarket chain with a specialty cake in the shape of space rocket. It has been decided that the volume required by the supermarket warrant special production line to perform the finishing, decorating and packing of the cake. This line would have to carry out elements shown in table 1, which also shows precedence diagram for the total job. The initial order from the supermarket is for 5000 cakes a week and number of hours worked by the factory is 40 per week. a. Find the cycle time, required number of stages and match elements and stages. b. Calculate the balance efficiency. A De-tin and trim 0,12min B Reshape with off-cuts 0,30min C Clad in almond fondant 0,36min D Clad in white fondant 0,25min E Decorate, red icing 0,17min F Decorate, green icing 0,05min G Decorate, blue icing 0,10min H Affix transfers 0,08min I Transfer to base and pack 0,25min ANSWER a. Find the cycle time, required number of stages and match elements and stages. cycle time=production time per day/output per day (40*60)/5000=0,48 Required # of stages = Sum of task times/ CT (0,12+0,30+0,36+0,25+0,17+0,05+0,10+0,08+0,25)/0,48=1,68/0,48=3,5 b. Calculate the balance efficiency = sum of task times/(cycle time* number of stages) 1,68/(0,48*4)=0,875 A De-tin and trim 0,12min B Reshape with off-cuts 0,30min C Clad in almond fondant 0,36min D Clad in white fondant 0,25min E Decorate, red icing 0,17min F Decorate, green icing 0,05min G Decorate, blue icing 0,10min H Affix transfers 0,08min I Transfer to base and 0,25min pack 3. Stage 1. Stage 2. Stage 4. Stage 3. A producer of consumer goods wants to analyze its product range. The goal of this analysis is to evaluate which product is of particular importance and which products are less important. The management has decided to use the annual consumption value as the key figure to assess the product range. An ABC analysis shall be conducted according to data in table. (P.S: Annual consumption values are already calculated, just find the ratios and classify the products) 4. Dorian Auto manufactures luxury cars and trucks. The company believes that its most likely customers are high-income women and men. To reach these groups, Dorian Auto has embarked on an ambitious TV advertising campaign and has decided to purchase 1-minute commercial spots on two types of programs: comedy shows and football games. Each comedy commercial is seen by 7 million highincome women and 2 million high income men. Each football commercial is seen by 2 million highincome women and 120 million high-income men. A 1-minute comedy ad costs $50,000, and a 1-minute football ad costs $100,000. Dorian would like the commercials to be seen by at least 28 million highincome women and 24 million high-income men. Use linear programming to determine how Dorian Auto can meet its advertising requirements at minimum cost. (P.S: Do not solve with graph just model the problem) ANSWER 5. The investor Mic Risky has just purchased a textile factory and now he is considering three possible decisions: 1. Expand the factory to produce army uniforms. 2. Still produce the same cotton textiles (Status Quo), but there are a lot of competitors. 3. Sell the factory immediately. In the case of the first and second alternatives the factory will be sold after one year. The profit will depend on the conditions on the market, which are either good(state of nature θ1) or poor (state of nature θ2). Mic estimates that the probabilities of good and poor market conditions are 0.7 and 0.3, respectively. Summarized data for Mic’s decision problem is below; State of nature Good conditions Poor conditions Actions on the market on the market Expand $800000 $500000 Status quo $1300000 $-150000 Sell $320000 $320000 Prior probability 0.7 0.3 Draw Mic’s decision tree and find the best choice. ANSWER 6. The owner of Cookies Inc., Zoya, is contemplating adding a new line of cookies, which require leasing for a monthly payment of $4,000. Variable costs would be $2 per cookie, and cookies retail price for $6 each. How many cookies must be sold in order to break-even? ANSWER FC=$4,000; VC=$2 per cookie: Rev.=$6 per cookie; Q=FC/(Rev-VC); Q=$4,000/($6-$2)=1000 cookies/month