Section 3 “The Commitment”

ABA Section of Real Property, Probate and Trust

Online Interactive Educational Program

Title Transfer & Title Insurance

Training Session 1 Covering:

Conveyancing & Title Commitments

menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Introduction

Welcome to the American Bar Association’s Continuing Legal

Education Program on

Title Transfer and Title Insurance skills training.

The program is separated into 3 training sessions and is designed to introduce you to the basics of how real property is conveyed and explains what a title insurance policy does. While each part covers distinct information about our topic, it is important to complete all three part in order to develop a complete understanding of the topics.

The 3 Training Sessions are:

• Conveyancing & Title Commitments

• Basic Policy Terms and Coverages

• Endorsements to the Title insurance Policy

This begins Training Session 1 “Conveyancing & Title Commitments” back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Disclaimer

The discussion of title conveyances, title commitments, and title insurance coverage in this work is, necessarily, general and is intended only for informational purposes. It should not be construed as representing the position of any particular title insurance company under any particular set of circumstances.

The policies and endorsements discussed herein speak for themselves. Their provisions, not the views of the author, govern the coverages which they provide.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

How To Get The Most From This Program.

This program uses consistent mechanisms to provide information.

A variety of blah blah blah.

Underlined words and phases offer a web site link for additional information.

Highlighted words have definitions that appear when a cursor hovers over the word.

Resource information is Highlighted and Underlined ; clicking on these will open a new window with the information or a menu of documents to download.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

How To Get Them Most From This Program.

cont.

This program is meant to provide a logical approach to understanding

Training Session 1: Title Commitment & Conveyencing. We recommend that you proceed though the program in a linear approach so as not to miss any important material.

IMPORTANT!

To receive a CLE certificate for self study on this program you must complete the course and cover all the material. This program monitors your time, and tracks your progress. A CLE Certificate will not be provided unless you have met the minimum requirements.

QUIZZES MUST be completed to receive a CLE certificate. back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Training Session 1: Title

Commitment & Conveyencing

Training Session 1 is organized into three sections.

Section one is a brief overview of the topic. This contains useful basic information to create a foundation for understanding the topic.

Section two will introduce you to the various types of estates in land, and how title to real estate is conveyed.

Section three addresses the title commitment or binder, and explains how to use the information contained in the title commitment to facilitate a real estate closing.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Main Menu

• Introduction

Click description to go to topic

• How To Get The Most From This Program

• About “ALTA”

• Training Session 1 “Overview”

• Training Session 2 “Conveyancing”

• Training Session 3 “The Commitment”

Note to developer: menus to expand when clicked to keep menu simple, clean and easy to navigate.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Main Menu

• Introduction

Click description to go to topic

• How To Get The Most From This Program

• About “ALTA”

• Part 1 “Overview”

• Concept of Title To Land

• Types of Property Rights and Ownership

• Fee Simple

• Estates for Years

• Leases

• Licenses

• Minerals

• Air Rights

• Easements

• Specific Utility Easements

• Utility and Drainage Easements

• Cable Easements

• Natural Gas Or Petroleum Easements

• Defined Electric Power Line Easements

• Drainage Easements

• Sewer Easements

• Easements Dealing With Access and Use of the Property

• Access And Parking Easements

• Sign Easements

• Encroachment Easements

• Party Wall Easements And Agreements

• Construction And Temporary Easements

• Reciprocal Easement Agreements

• Permitted Uses

•Quiz back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Main Menu

Continued

Click description to go to topic

• Introduction

• How To Get The Most From This Program

• About “ALTA”

• Part 1 “Overview”

• Part 2 “Conveyancing”

• Deeds

• Warranty Deed

• Special Warranty Deed

• Quit-Claim Deed

• Trustee’s Deed

• Personal Representative Deed

• Lease Agreements

• Mortgages and Deeds of Trust

• Quiz

• Training Session 3 “The Commitment”

Click description to go to topic back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Main Menu

• Introduction

Click description to go to topic

• How To Get The Most From This Program

• About “ALTA”

• Part 1 “Overview”

• Part 2 “Conveyancing”

• Part 3 “The Commitment”

• How to Choose a Title Company

• Opening the title order

• Legal description of the property

• Name of the seller and purchaser

• Sales price or mortgage amount

• Anticipated closing date

• Reviewing the Title Commitment

• Schedule A

• Form of Policy(ies)

• Amount of Policy

• Proposed Insured

• Estate Covered By The Commitment

• Legal Description of the Land

• Schedule B

• Part 1

• Part 2

• Conditions

• Paragraph 1

• Paragraph 2

• Paragraph 3

• Paragraph 4

• Paragraph 5

• Summary

• Quiz back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview

Welcome to the American Bar Association’s On-Line Continuing Legal

Education program on Conveyancing & Title Commitments. This program will introduce you to the basics of how real property is conveyed, and what a title commitment does.

The following material should provide an overview of the composite parts of the bundle of rights which comprises real property. Sometimes the language in the deed records is not as clear as we may hope and ambiguity can create havoc for the purchaser or developer of the property. Look at the text of the document, not just its title, to determine the rights conveyed or reserved. back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

The Concept Of Title To Land

Since medieval England, the concept of title to land has evolved significantly.

It might be better now to think of real property as a bundle of rights, which can be parceled up, conveyed, leased, licensed or otherwise "unbundled" at the pleasure of the owner.

This bundle of rights is comprised of rights in time and rights to specific portions of property, whether by cutting up a tract of land or by cutting up uses and benefits that can be derived from the land.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Types Of Property Rights And Ownership

There are many types of property rights and ownership . These range from fee simple title, to leaseholds, to easements, and to lesser possessory and nonpossessory estates.

Fee Simple

Fee simple ownership is the most comprehensive ownership one can possess. The owner of a property in fee simple has unconditional power over the property’s disposition, including the right to possess, use and enjoy the property. This ownership can be passed on to the party’s heirs when the party dies (in perpetuity). Fee simple is the most common type of ownership for both homeowners and commercial property owners. “Fee” is the largest bundle of property rights.

Joanne owns land in fee simple. She develops the land into a strip mall and parking lot. In her will she leaves this land to h er heirs “in fee simple.”

When she dies, her heirs can decide whether to keep the land as a strip mall or turn it into something else. back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Types Of Property Rights And Ownership

Estates for Years

It is possible for several people to own different pieces of a fee simple title simultaneously. For example, some deeds might be for a length of years, ("estate for years") or for the life of the grantee (called a "life estate") after which the property reverts back to another party. Those holding these "reversionary" interests wait for a key event (expiration of the time for which the estate has been granted) at which time the fee simple interest automatically vests in them. The holder of the estate for years owns all of the sticks in the bundle for the time period set forth in the deed, while the holder of the reversionary interest holds a nonpossessory interest during the term of the estate for years, and comes into possession upon the termination of the estate for years.

Joanne owns land in fee simple. She develops the area into a strip mall and parking lot. Each lease includes a clause stating that shop owners cannot sell food or beverage. Deciding to take a long vacation, Joanne executes and delivers to Kim and John a valid deed conveying the mall "to

Kim for one year, then to John for life, remainder to Joanne." Kim enjoys the property as an "estate for years." She allows the bookstore tenant to serve coffee. Joanne is furious, but unable to do anything. When Kim's year term expires, John takes over his "life estate." He allows a doughnut shop to lease space. Joanne stops speaking to John, but cannot alter his policy. When John dies, the property reverts to Joanne in fee simple.

Joanne breathes a sigh of relief and reinstates her no food or beverage policy.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Types Of Property Rights And Ownership

Leases

Leases are similar to estates for years, in that they are usually for a specific period of time. However, leases differ in that the rights of the tenant are limited to those specifically granted in the lease.

For example, the use clause in the lease might restrict use of the property to a particular use, and any other use would violate the lease and be an event of default. Also, lease rights are derivative of the fee simple right and are always a “lesser” estate, even if the term is for 99 years. Leases are sometimes protected in the public records by recordation of an instrument called a

Memorandum of Lease, which indicates basic provisions of the lease and puts other parties on notice of the existence of the lease.

Joanne owns land in fee simple. She develops the area into a strip mall and parking lot. Each lease includes a clause stating that shop owners cannot sell food or beverage. The bookstore begins to sell coffee. This is a violation of the lease and Joanne can terminate the lease if the tenant does not stop selling coffee.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Types Of Property Rights And Ownership

Licenses

Licenses are an even lesser estate, and are usually framed to be terminable at the discretion of the granting party. In fact, licenses are not really considered “estates” in the true sense, and are better thought of as granting temporary possessory rights.

Licenses are usually personal to the benefited party and are usually not recorded.

Joanne owns land in fee simple. She develops the area into a strip mall and parking lot. The bookstore requests that Joanne reserves five parking spaces for its customers. Joanne agrees to paint 5 spaces as reserved for bookstore customers.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Types Of Property Rights And Ownership

Minerals

Mineral rights are rights to dig into the ground and remove minerals that might be buried beneath the surface. Minerals reservations can be for any mineral, such as for oil and gas (Texas and Oklahoma), copper and iron (Rocky Mountain states), and coal (Pennsylvania). The document granting the right might give the lessee unfettered rights to excavate the minerals, but as a practical matter, these rights are usually limited by deed or common law to require reasonableness on the party exercising the right.

Joanne owns land in fee simple. She converts the area into a strip mall and parking lot. She is later approached by an oil company, who tells her that buried beneath the property is a strong oil supply. Joanne sells her mineral rights by way of an Oil and Gas Lease for a large, regular sum of money over a five-year term.

Minerals rights can either be reserved in a deed from the seller, or can be conveyed separately through the use of a special form of conveyance, such as an Oil and Gas Lease in Texas. Although the document is termed a lease, it is a conveyance of the right to all the oil and gas located under the surface of the land described in the lease.

SAMPLE LEASE: http://contracts.onecle.com/international-coal/buchanan.lease.1996.02.28.shtml

back menu continue

* Janice questions copyright at above link - will she provide an alternate source?

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Types Of Property Rights And Ownership

Air Rights

Air rights are the right to construct and use portions of the bundle of property rights above ground, usually specified by feet above sea level or other commonly recognizable measuring formula.

Some buildings around the country, particularly those above subway stations or tunnels are in fact permitted by air rights only, the underlying fee title to the ground belonging to a governmental authority. Air rights are especially important for condominium owners and cooperative owners as generally they have no right other than the area encompassing their unit.

Joanne owns land in fee simple. She converts the area into a strip mall and parking lot. She is later approached by a cell phone company, who wants to construct a cell tower on the top of her building. Joanne exchanges her air rights for a large, regular sum of money over a five-year term. back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Types Of Property Rights And Ownership

Easements

Easements are a right to use land owned by another for a particular purpose and are also called “Restrictive Warrants”. Restrictions are conditions put on the land that are usually negative, prohibiting certain use of the land. Most

Easements are affirmations in nature authorizing the grantee to use the grantor’s land.

Easements are created by: i.

ii.

An express easement agreement such as a partial wall agreements between adjoining landowners. Recordation of a plat in the public records showing easement rights or declaration (SHOW EXAMPLE);

A reservation in a deed The deed reserved an easement for right of way along the northern boundary of the County Road 95, giving the

County Road 95 access to Gainer Street. ; and iii.

By implication or necessity (most rare and least reliable) Simon cannot access his land without entering from Theodore’s property.

There are various types of easements that are commonly encountered in real estate. They can be grouped into two categories. click specific information in each category.

• Specific Utility Easements

• Easements Dealing With Access and Use of the

Property http://homebuying.about.com/cs/easementsrow/a/easement_faq.htm

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Specific Utility Easements

Utility and drainage easements

Utility easements are commonly found on title to most developed property. Sewer, water and power easements are essential for any improved property. If the property is adjacent to a public right-of-way

(a road which is built by the governmental authority), and there are utilities within the road bed, an easement may not be necessary.

When examining the desirability of a particular site for residential or commercial development the attorney will check for the presence and/or location of utilities serving the property, and to seek assurance that the utility does not cross any "private" land. If the utility line crosses "private" land without a proper easement, then the owner of the "private" land has the right to cut off the utility line.

Power companies routinely use broad form general or “blanket” easements when installing electric power lines. A blanket easement can cover an entire piece of land as opposed to just a strip of land where the power line is to be located. Such broad rights of entry can impact future development.

Containment letters are routinely provided by power companies limiting the location of the power line to a specific area once it has been built.

continued back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Specific Utility Easements

These type of easements include:

• Cable easements

• Natural gas or petroleum easements

• Defined electric power line easements

• Drainage easements

• Sewer easements

Click easement type for specific information.

continued back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Specific Utility Easements

Cable Easements

Cable easements are found generally in single family residences, apartment complexes, condominiums, and town homes. The easement might be accompanied by a reservation of rights to the installed cable equipment.

continued back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Specific Utility Easements

Natural Gas Or Petroleum Easements

Natural gas or petroleum easements are often created for the installation of related distribution lines. Due to the nature of the material being transported through the easement , it is necessary that they be clearly marked, and permit limited surface development (parking areas, driveways). continued back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Specific Utility Easements

Defined Electric Power Line Easements

Defined electric power line easements give the power company the right to run their power lines over or under the land. The terms of the easement will control rights to develop at, under or near the utility lines.

continued back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Specific Utility Easements

Drainage Easements

All property needs drainage rights. Development authorities monitor drainage as part of development approval. By law, property owners have the right to drain “downhill” but if a raw piece of land is developed, the parking and other surface areas do not absorb as much water, and “runoff” increases. This can lead to detrimental effects on neighboring properties. One solution is retention ponds and detention areas, which slow the rate of flow. Specific rights to use these areas are often granted, with a corresponding obligation to contribute to the cost of maintenance.

continued back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Specific Utility Easements

Sewer Easements

Sewer easements are generally described by a metes and bounds description, or by reference to a centerline, so a surveyor can plot these specifically.

continued back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Specific Utility Easements

Sewer Easements

Sewer easements are generally described by a metes and bounds description, or by

A metes and bound description means the measurements and boundaries of the land, beginning at a certain point in the boundary of the property to be described, and then reciting the directions and distances from point to point entirely around the property.

continued back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Easements Dealing With Access and Use of the Property

Easements are also used to deal with the shared use of the property with another party.

Originally created to provide one party with the right to use the property of another in a specific way, these are more general than the utility easements, and are often seen in commercial real estate.

Various types of these easements include:

• Access and parking easements

• Sign easements

• Encroachment easements

• Party wall easements and agreements

• Construction and temporary easements

• Reciprocal Easement Agreements

• Permitted Uses continued

Click easement type for specific information.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Easements Dealing With Access and Use of the Property

Access And Parking Easements

Most developed projects grant or reserve access easements for vehicular and pedestrian access to and from the development and adjoining public streets, and sometimes over all driveways located on the development. The extent of access granted may depend on the projected use of the project and the particular needs or restrictions which tenants impose on the landlord/developer. Because the title insurance policy insures only the legal right of access, and not the quality of that access, it is vital that the purchaser’s attorney satisfy herself that the access is adequate for the purchaser’s development.

With regard to parking, some uses require more parking than others and granting parking rights might impose undesirable burdens on other parcels in a project. For example, movie theatres require more parking than other tenants, and this use of the shared parking facilities might infringe on other tenants parking. Parking easements can also impact zoning compliance.

back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Easements Dealing With Access and Use of the Property

Sign Easements

Sign easements provide for visible signage along a well-used thoroughfare for maximum exposure of businesses. The easement may be limited to the right to be on a pylon in a shopping center, or the right to install signage on a street corner. The easement may include maintenance and replacement rights. Signage should always comply with then existing codes and ordinances. Obnoxious signage impacts development surrounding a site, so the easement should specify the kind of signage permitted, and limit offensive uses.

back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Easements Dealing With Access and Use of the Property

Encroachment Easements

Encroachment easements are used to rectify problems where improvements on one parcel protrude or encroach over the boundary or lot lines onto an adjoining parcel. In some cases, they are “anticipatory” — in advance of development to permit minor encroachments over property boundaries. If an encroachment exists, an encroachment easement allows the encroachment to remain, subject to the limitations contained in the easement.

back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Easements Dealing With Access and Use of the Property

Party Wall Easements And Agreements

Party wall easements and agreements describe rights and obligations of neighbors who share a wall. They are used in tight urban environments, or in condominiums, or any circumstance where you have a wall separating two properties. Maintenance and repair of the wall is the large issue, requiring care and forethought. If one party fails to repair, the other should have the right to do so, and share the expense with the other party wall owner. Lateral support must be maintained by each party to prevent damage or destruction of the wall.

back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Easements Dealing With Access and Use of the Property

Construction And Temporary Easements

Construction and temporary easements often accompany other easements granting the right to construct the actual facilities described in the easements. The area usually extends 10 or 20 feet around the perimeter of the easement areas, and terminate at a specified date, usually within a year of the date of the easement, which grants time for construction to be completed.

back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Easements Dealing With Access and Use of the Property

Reciprocal Easement Agreements “REAs”

Reciprocal Easement Agreements (“REAs”) provide for mutual easement rights flowing to the benefit of owners of adjacent properties. They are often used in shopping center developments to coordinate traffic flow and utilities between the main center and outparcels. They are also often used in other large development contexts. Larger developments anticipate easement needs and incorporate them into an REA. Look for express easements contained in the REA benefiting or burdening your property.

back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview continued

Easements Dealing With Access and Use of the Property

Permitted Uses

Another part of the bundle of property rights is permitted uses. Restrictive covenants that restrict the permitted use on a property can be created by deed or other document.

They are often found inside a Declaration of Covenants, Conditions and Restrictions.

Architectural restrictions are common in large developments, thereby enabling the developer or “Declarant” to maintain control over the overall appearance of improvements constructed by others within the development. Other types of restrictions may involve prohibited uses, building setback requirements, and sometimes conservation easements or light and air easements for scenic beauty.

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview – Summary Questions

If title to real property can be compared to a bundle of sticks, which can be unbundled and conveyed in pieces, which of the following estates has the most rights or sticks?

Easement

Estate for years

Fee simple

True or False: A Lessee has only the right of possession as granted under the

Lease Agreement.

True

False

True or False: When reviewing the title, it is not necessary to check for access if the property is next to a road or street.

True

False

Submit back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section One “Overview”

Overview – Summary Questions

If title to real property can be compared to a bundle of sticks, which can be unbundled and conveyed in pieces, which of the following estates has the most rights or sticks?

Fee Simple

True or False: A Lessee has only the right of possession as granted under the

Lease Agreement.

False, a lessee may have other rights granted under the Lease Agreement, such as an options to purchase.

True or False: When reviewing the title, it is not necessary to check for access if the property is next to a road or street.

False, the fact that there is a road or street adjacent to the property does not guarantee that the road is a public or dedicated road, or that access will be adequate for the purchaser’s development.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

Conveyancing is the transfer of an ownership interest in land.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

Deeds

A fee simple interest in real estate is transferred by a deed. The deed can transfer all or part of the interest in the property. There are various forms of deeds, but basically a deed accomplishes one of two things: it conveys the ownership interest in the property and, in most instances, it also provides some sort of guarantee or warranty as to the encumbrances that exist against that title.

There are several types of deeds listed, Click on the deed type to see its description.

• Warranty Deed

• Special Warranty Deed

• Quit-claim Deed

• Trustee’s Deed

• Personal Representative Deed

• The Attorney’s Role

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

Deeds – Warranty Deed

A Warranty Deed conveys the greatest interest the land, the entire bundle of sticks. The warranties in a Warranty Deed relate to the common law covenants of title:

1. Covenant of Seisin (the Grantor owns the property);

2. Covenant of the right to convey (the Grantor has the capacity to convey the property);

3. Covenant against encumbrances (there are no encumbrances such as mortgages, liens or restrictions use of the land);

4. Covenant for Quiet Enjoyment (Grantor undertakes to defend the grantee against all lawful claims of the grantor himself or of third persons who would evict the grantee); and

5. Covenant for Warranty (same as the Covenant for quiet enjoyment).

In most states, simply using the statuatory form of Warranty Deed, or using word

“Warrant” in the conveyance, will cause the deed to include by reference the above warranties.

Practice Tips: When representing a seller, make certain to insert appropriate exception language because most properties are subject to some interest, including easements, covenants, and restrictions.

When representing a buyer . . . be sure to check the title commitment to familiarize yourself with any exceptions to title, and to determine which, if any, can be cleared or removed from the title. back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

Deeds – Special Warranty Deed

The definition of a special warranty deed (or limited warranty deed) varies from state to state. In general, special warranty deeds afford greater protection to the grantee than a quit claim deed but less protection than a general warranty deed.

Greatest Protection -> Least Protection

General Warrantee Deed Special Warranty Deed Quit Claim Deed

The seller will usually argue that he has only limited knowledge of the status of the title to the property and/or has not been in actual possession of the property, but that he is willing to give the grantee greater protection than would be available by delivery of a quit claim deed.

Special warranty deeds provide that the grantor warrants only that it has not created or suffered any defect during the period that he had title to the property. In other words, the grantor warrants against its own acts or omissions and agrees to defend the grantee against any action by another party claiming that it has a superior title to the property that was conveyed to the grantee. back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

Deeds – Quit-claim Deed

A Quit-claim Deed contains no warranties. It merely transfers to the buyer whatever interest the seller had. So, for example, if the seller had no interest in the property and signed a quit claim deed, the buyer would get no title. It requires the buyer to make certain, usually through title insurance, that the seller really does have an interest in the property.

The use of quit-claim deeds can be varied. They are often used to clear up potential title defects, such as where a prior deed may or may not have been properly executed. In several Western states, Quit-claim deeds are a common method of conveying real estate, while in some other states, such as Texas, a grantee under a quit-claim deed cannot be a bona fide purchaser for value.

Practice Tip: When representing a buyer, it is important to have a through title check done in order to determine what, if any, estate the grantor is conveying.

back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

Deeds – Trustee’s Deed

A trustee's deed is a deed from a seller who happens to be a trust. Again, unless the deed explains it on its face, generally trust law in the particular state where the deed is granted will define what exactly the trust is warranting. In some states, for example, a trustee's deed is the equivalent of a quit claim deed for all interests that exist in the property except for interests that have been created by the trustee.

back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

Deeds – Personal Representative Deed

(EXAMPLE)

A personal representative deed is a deed granted by a personal representative acting on behalf of an estate that actually owns the property. Personal representative deeds may be quit claim deeds or they may be a deed that grants a limited warranty only against the acts of interest that a personal representative has given.

Practice Tip: When representing a buyer, it is important to make sure that the proper court has authorized the personal representative to execute and deliver the deed.

back

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

Lease Agreements

Leases grant the right to occupy specific property for a defined period of time. The extent of that use and the extent of time are specified in the lease contract. If the lease is insufficient to define what lessee's rights are, state statutes will often supplement the terms. In any event, the lease document must provide at least a minimal definition as to what those rights are. A minimum explanation of the lessee's rights usually means including sections such as the terms of tenancy and limits on occupancy. Although a state statute might identify what happens in the absence of a written provision if a tenant stays on the property or "hold[s] over" after the end of a lease term, it will not imply terms beyond those contemplated by the parties such as an option to purchase or other renewal provisions.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

Mortgages and Deeds of Trust

In some states, granting a security interest in real estate is accomplished by executing and recording a mortgage against a property. In other states, a deed of trust (sometimes also called a security deed or deed to secure debt, depending on the state) assigns the ownership of the property to a trustee who holds the ownership of the property in trust for the lender and, when the loan is paid off, requires reconveyance or release back to the owner. Notwithstanding the fact that this language is worded as a deed, a deed of trust is, in fact, just a security interest. There are many terms in the deed of trust itself and in the statutes of the state that use this method to explain who has the right to the beneficial use of the land.

continued back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

The Attorney’s Role

Practice Tip: Be an advocate for title insurance. When you are representing a client in a purchase, sale or mortgage of real estate, your client is relying on your expertise regarding what is necessary for him to receive good title to the property. Most residential home buyers are unfamiliar with the important role that title insurance plays in their transaction. Therefore it is up to you, the attorney , to help them understand why title insurance is a valuable product. The title commitment provides important information about the property that an attorney can use to protect his client during the mortgage or sale transaction. continued back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

The Attorney’s Role

continued

The title commitment provides important information about the property that an attorney can use to protect his client during the mortgage or sale transaction.

The title commitment will tell you:

the status of the title

encumbrances against it (such as delinquent taxes, liens, and easements).

what is necessary in order for your client to receive good and indefeasible [insert link here to definition of “indefeasible”] title,

whether there are serious defects in the title, (such as outstanding interests held by spouses, ex-spouses, or unknown heirs) that render the title unmarketable [insert link here to definition of “unmarketable”]

.

what liens are outstanding against the property

what is necessary for a new lender to have a first priority lien. continued

In order to issue a title policy in accordance with the commitment terms, the title company will:

Require proof that the requirements have been satisfied.

Record the appropriate documents to effectuate the transfer.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

The Attorney’s Role

continued encumbrances against it, such as delinquent taxes, liens, and easements. The indefeasible [insert link here to definition of “indefeasible”] title, or whether there are serious defects in the title, (such as outstanding interests held by spouses, ex-spouses, or unknown heirs) that render the title unmarketable [insert link here to definition of

“unmarketable”]

.

The commitment will also show what liens are outstanding against the property, and what is necessary for a new lender to have a first priority lien. After satisfaction of the requirements in the title commitment, and recordation of the appropriate documents to effectuate the transfer, the title company will issue its title policies in accordance with the terms of the commitment.

continued back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

The Attorney’s Role

continued

The title commitment will tell you the status of the title, and inform you of the encumbrances against it, such as delinquent taxes, liens, and easements. The commitment will tell you what is necessary in order for your client to receive good and indefeasible [insert link here to definition of “indefeasible”] title, or whether there are serious defects in the title, (such as outstanding interests held by spouses, ex-spouses, or unknown heirs) that render the title unmarketable [insert link here to definition of

“unmarketable”]

. accept it in the normal course of business.

continued

Black’s law Dictionary, Fifth Ed., 1979 back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing

The Attorney’s Role

continued

Title policies are available for all parties involved in the transaction: a loan policy insures the lender’s interest an owner’s policy insures the purchaser, and a leasehold policy insures a tenant’s interest in the case of a leasehold estate.

Practice Tip: It is important for each party to the transaction to have his/her own title policy because coverage in a particular policy extends only to the party named as the insured in the policy. For example, a loan policy insures only the interest of the lender, not the purchaser/owner.

An Owner’s title policy

[link] will:

• provide your client with peace of mind regarding the title.

• indemnify the insured for loss in the event title is not as shown in the title policy.

• carry only a one-time premium.

• will continue to insure the purchaser for so long as they own the real estate, no matter how long.

To learn how to order a title commitment for your client, read the next section, "The Commitment.“ back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing – Summary Questions

1. Put the following in order of least to greatest protection:

• General Warrantee Deed

• Quit Claim Deed

• Special Warrantee Deed

True or False

2. Sellers in all states must use General Warranty Deeds with common law covenants of warranty to convey fee simple title

True

False

3. If a lease is insufficient to define what lessee’s rights are, state statutes will often supplement the terms.

True

False

Submit

4. The Commitment will show what liens are outstanding against the property, and what is necessary for a new lender to have a first priority lien.

True

False back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 2 “Conveyancing”

Conveyancing – Summary Questions

Put the following in order of least to greatest protection:

• Quit Claim Deed

• Special Warrantee Deed

•

General Warrantee Deed

True or False

A Special Warranty Deed (or limited warranty deed) has a consistent definition from state to state.

False, while a General Warranty Deed with common law covenants is recognized in all 50 states, the form and wording required to convey a fee simple title varies from state to state.

If a lease is insufficient to define what lessee’s rights are, state statutes will often supplement the terms.

True

The Commitment will show what liens are outstanding against the property, and what is necessary for a new lender to have a first priority lien.

True back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Overview:

Obtaining a title insurance commitment is the first step in the title insurance procedure.

But, first, you must decide where to place your order.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

How to Choose a Title Company

Multiple factors are in play when selecting a title company.

In residential transactions, the customer has the right to choose the title company. The customer is the one paying the premiums for the title policy, so in those areas where it is customary for the seller to provide the title policy, they will be the one to choose the title company. In areas where the purchaser pays for the title policy, they have the right to choose the title company. Real estate brokers, agents, and attorneys can make recommendations but ultimately must defer to the customer to choose.

In commercial transactions, while it is still the rule that the party paying the premium has the right to choose the title company, the choice of the title company plays a more important role in the contract negotiations. This is because one party may have a longtime working relationship with a particular title company, or because one title company may have offices dedicated to commercial transactions. The sophistication of the title examiners and closers, as well as the financial strength of the title company, are important considerations when dealing with multi-million dollar properties. back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Opening the title order

The process of obtaining a title insurance policy begins with placing the order for a

Commitment for Title Insurance with the local title company. This may entail simply delivering a copy of the signed contract to the title officer, along with any additional information necessary to the title company, such as names of surveyors, proposed lenders, and closing dates.

The Commitment (sometimes called an “interim binder”) is a contract by the Title

Insurance Company to insure the title to the property in accordance with the terms and the information contained in the Commitment. Title commitments and policies are issued by title insurance agents who are authorized to issue title policies on behalf of the title insurance company, or by direct operations or branches owned by the Title

Insurance Company. back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Opening the title order continued

W hen the title company receives an order, it will perform a title search, which means it will search the public records [insert link here to Marjorie’s discussion of public records] for all owners, lien-holders, creditors, judgment holders, easements, restrictions, etc. which may affect the title to the property. Based on the results of the title search, the title company will issue its commitment, which will set forth the results of the title search, and indicate the conditions under which the title company is willing to insure the title. back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Opening the title order continued

When you place your order for title insurance, the title company will want to know the following information:

• Legal description of the property

• Name of the seller and purchaser

• Sales price or mortgage amount

• Anticipated closing date

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Opening the title order

continued

Legal description of the property

If you do not know the legal description, you can often find it on the deed into the seller, or the title company can find the legal description by searching the land records under the name of the seller or street address. back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Opening the title order

continued

Name of the seller and purchaser

Name of the seller and purchaser, if a sale; or borrower and lender, if a refinance.

The title company will search the land records for any liens or encumbrances on the property, as well as any easements. It also will perform a name search on the current owners to determine if there are any judgments, divorces, or bankruptcies against the seller or borrower. If the search discloses any of these problems, it will be necessary to obtain releases or perhaps special court orders before the title can be insured.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Opening the title order

continued

Sales Price Or Mortgage Amount

The premium for the title policy is based on the amount of liability, which is the sales price of the real property, or the mortgage amount.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Opening the title order

continued

Anticipated Closing Date

Since the title commitment will be effective as of a certain date and time, there is a period of time, or “gap” between this date and the date that the documents executed at closing will be recorded. The final policy will be dated as of the date and time of recording of the documents. It is possible that during the gap, a document may be recorded that will affect the title to the property. That’s why it is important that the title company bring down the title as close as possible to the date of the closing.

Practice Tip: Information on the title order must be accurate. The lender, its attorneys and the escrow company will rely on the information on the title commitment to prepare the deed, the loan documents and the closing statements.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment

The Commitment, Policy and Endorsement forms used by title companies are, for the most part, drafted by the American Land Title Association (“ALTA”) , a national association of title insurance underwriters, agents and affiliates. Based in Washington

D.C., the ALTA is responsible for formulating the most commonly issued policy forms and endorsements. They are issued in over 35 states, with very little variation, and are clearly the industry standard. Some states have state specific formats such as those issued in California , Texas and New York . Other states have adopted only certain ALTA forms and coverages, such as Florida .

On May __, 2006, the ALTA adopted new policy and commitment forms. In many states, these new forms may be used immediately. However, in other states, these new forms must be filed or approved by the state before they can be issued. Therefore, while we will be using the new forms for our discussions, links to the previous forms are provided for reference. [Link here to ALTA 1992 forms previously shown on this slide].

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

It is important to remember that, unlike other lines of insurance, the issuance of a title commitment or binder is not the same as a title insurance policy. It is only an agreement to insure once all the conditions, stipulations, requirements and exceptions are met.

The commitment is made up of the Agreement to Issue Policy, the Schedules and the

Conditions. Click on the components to view.

• Agreement to Issue Policy

• Schedules

• Conditions

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Agreement to Issue Policy

The Agreement to Issue Policy delineates that the title company agrees to issue a title insurance policy to you, in accordance with the terms, schedules and requirements set forth in the

Commitment. It also makes it clear that if the conditions and requirements of the Commitment are not met within a specific time period, the obligations of the title company under the

Commitment expire.

A Commitment is not valid unless Schedules A

(EXPLAIN) and B (EXPLAIN) are attached and the Commitment is be signed. The Commitment is also subject to the terms set forth in the

Conditions, which are found on the last page of the Agreement to Issue Policy .

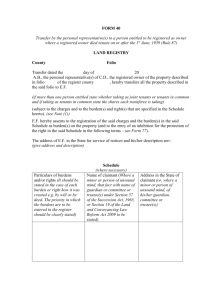

Insert image of

1 st Page of Commitment

Agreement to Insure

File:

FirstPage of Commitment.doc

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule A

Schedule A shows:

• the effective date and time of the commitment,

• the forms of policies to be issued,

• the amounts of policies to be issued,

• the proposed insured,

• the estates or interests covered by the commitment,

• the record owner of the estate as of the effective date, and

• the legal description of the land.

Insert image of

Schedule A

File:

Schedule A -Blank.doc

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule A continued

Effective date and time: the date and time through which the title search was made, the last date searchable in the public records.

It is important for the title company to show the time through which title has been searched. That is because documents are recorded throughout the day, and something affecting the title could be recorded on the same day.

For example, if the date and time shown on the

Commitment are: December 12, at 3:20 p.m., and if the recorder’s office accepts documents until

5:00 p.m., something could be recorded after

3:20, and before 5:00 that would affect title.

Link or Insert image to show

Schedule A with paragraph 1 sample date and time filled in and highlighted

Note: [Use date of December 12,

2005 @ 3:20 p.m.]

File:

Schedule A -Date of Policy.doc

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule A continued

Form of Policy(ies) to be issued: The policy or policies to be issued should be identified here.

The most commonly issued policies are:

•

Owners Policy

•

Homeowners Policy

•

Loan Policy

Link or show image to Schedule A with paragraph 2, choice of forms highlighted.

File:

Schedule A -Form of Policy.doc

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule A continued

Amount of Policy : The Owner's Policy (link) will be issued in the amount of the sales price of the land and any improvements located thereon which constitute real property. Personal property is not insured under a title policy. The l oan policy will be issued in the amount of the loan.

Show Schedule A with Amount of

Policy filled in and highlighted

File:

Schedule A -Amount of Insurance.doc

Practice Tip: In cases where the final purchase price or loan amount is subject to ongoing negotiation, the policy may be issued "In an amount to be Determined", but the amount must be specified by time of closing.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule A continued

Proposed Insured: The person or entity who will be the insured under the title policies, either the owner or lender.

Show image of Schedule A with proposed insured filled out and highlighted

Practice Tip: The title commitment cannot be used to find the status of the proposed insured.

For example, it will not commit to insure "ABC

Corporation, a Delaware corporation" until the necessary corporate proofs have been submitted for examination by the title company.

File:

Schedule A - Proposed Insured.doc

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule A continued

Estate Covered By The Commitment:

Generally the estate is held in fee simple.

However, the commitment also may cover a leasehold estate.

Show Schedule A with paragraph 3 filled out and highlighted

File:

Schedule A - Estate Covered.doc

Title insurance only insures real property.

Therefore, the insured estate must be a land interest recognized under the law of the state where the property is located (the situs). Personal property (i.e. fixtures) is not covered by a title policy.

[Use "Fee Simple"]

“Harry and Sally Doe”

The commitment also will show who is currently in title.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule A continued

Legal Description of the Land: The legal description, either by reference to a recorded subdivision (define) , or a metes and bounds

(define) description of the land, which will be insured by the title policy. The legal description is one adequate enough under state law to provide constructive notice of the boundaries and extent of the land to be conveyed under the deed or mortgage.

continued

Show Schedule A with sample legal description in paragraph 5 and highlighted

File:

Completed Schedule A.doc

[Use the following legal description:

Lot 56, Block C, Country Acres

Subdivision, as shown on plat dated

March 22, 1986 and recorded April

25, 1986 in Book 231, Page 15 of the

Plat Records of Maricopa County,

Virginia.] back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule A continued

Legal Description of the Land: The legal description, either by reference to a recorded subdivision, or a metes and bounds description of the land, which will be insured by the title policy.

The legal description is that description which under state law is adequate to provide constructive notice of the boundaries and extent of the land to be conveyed under the deed or mortgage.

continued

Show Schedule A with sample legal description in paragraph 5 and highlighted

File:

Completed Schedule A.doc

[Use the following legal description:

Lot 56, Block C, Country Acres

Subdivision, as shown on plat dated

March 22, 1986 and recorded April

25, 1986 in Book 231, Page 15 of the

Plat Records of Maricopa County,

Virginia.] back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule A continued

Legal Description of the Land: The legal description, either by reference to a recorded subdivision, or a metes and bounds description of the land, which will be insured by the title policy.

The legal description is that description which under state law is adequate to provide constructive notice of the boundaries and extent of the land to be conveyed under the deed or mortgage.

continued

Show Schedule A with sample legal description in paragraph 5 and highlighted

File:

Completed Schedule A.doc

[Use the following legal description:

Lot 56, Block C, Country Acres

Subdivision, as shown on plat dated

March 22, 1986 and recorded April

25, 1986 in Book 231, Page 15 of the

Plat Records of Maricopa County,

Virginia.] back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule A continued

Legal Description of the Land: continued

Show sample Schedule A, showing all the blanks filled in.

If a new survey has been obtained and provided to the title company, the legal description on the survey can be compared to the last deed of record to determine if the new description can be used here (EXAMPLE).

File:

Completed Schedule A.doc

Practice Tip: If you are combining several parcels of land to create a larger single parcel, referring to this description could prove very helpful .

Alternatively , the commitment will use the legal description shown on the last deed of record.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule B

Show sample Schedule B, Part 2

Consists of Part 1 and Part 2:

Show sample Schedule B, Part 1

Part 1 sets forth the conditions that the underwriter requires to be satisfied before it will issue its policy in accordance with the terms set out in Schedule A .

Files To Use:

Schedule B, Part 1:

Commitment Sch B-1.DOC

Part 2 lists the various exceptions to title that the underwriter proposes to exclude from coverage.

Schedule B Part 2:

Commitment Sch B-II.DOC

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule B-1

Part 1: Schedule B-1 will list preprinted and specific requirements that the title company requires to be satisfied prior to insuring the title. Preprinted (or universal) requirements are usually generic in nature, because the title company will not know the full details of the transaction at the time the commitment is issued.

Examples of universal requirements are:

• Instruments In Insurable Form Which Must Be

Executed, Delivered And Duly Filed For Record i.e.,

Warranty Deed, Mortgage Or Deed Of Trust, Etc.

• Payment Of All Taxes And Assessments Owing On

The Property.

continued

Show B-1 with requirements filled in and highlighted.

File:

Schedule B-1- Completed.doc

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule B-1

Part 1: If these matters are not taken care of prior to or at closing, they will appear as exceptions to the title in the policy.

Show B-1 with requirements filled in and highlighted.

Although many of the requirements in this section will be within the Seller’s power to cure, it is up to the parties t o the transaction to determine who is responsible for satisfying each requirement in this section.

File:

Schedule B-1- Completed.doc

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule B-2

Show B-2 with gap exception filled in and highlighted.

Part 2- Exceptions: The Exceptions listed in Schedule

B-2 are matters that must be addressed and removed from the title or they will show in the

I.

II.

policy. These items take several forms:

Gap Exception continued

Survey Matter(s) Exception

III.

Easement(s) Exception

IV.

Unfiled Mechanic’s Lien(s) Exception

V.

Parties in Possession Exception

VI.

Tax and Special Assessment Exception

VII.

Property Specific Exceptions

File:

Schedule B-II-Gap exception.doc

[Use “1. Defects, liens, encumbrances, adverse claims or other matters, if any, created, first appearing in the public records or attaching subsequent to the effective date hereof but prior to the date the proposed Insured acquires for value of record the estate or interest or mortgage thereon covered by the Commitment.”] back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule B-2

Show B-2 with gap exception filled in and highlighted.

Part 2- Exceptions: I. Gap Exception

Generally, the first exception will be the "Gap

Exception," which may read, "Defects, liens, encumbrances, adverse claims or other matters, if any, created, first appearing in the public records or attaching subsequent to the effective date hereof but prior to the date the proposed Insured acquires for value of record the estate or interest or mortgage thereon covered by the Commitment."

The name for this exception is derived from the gap in time that usually occurs between the date of the last title search and the recordation of the new documents creating the estate to be insured. In some places, the title company will assume the risk over any matters that appear in the gap if they are provided with an affidavit from the seller. In other places, the title companies assume this risk as part of their coverage, without the requirement of an

File:

Schedule B-II-Gap exception.doc

[Use “1. Defects, liens, encumbrances, adverse claims or other matters, if any, created, first appearing in the public records or attaching subsequent to the effective date hereof but prior to the date the proposed Insured acquires for value of record the estate or interest or mortgage thereon covered by the Commitment.”] back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule B-2

Part 2- Exceptions: II. Survey Matter(s) Exception

The next general exception is one for survey matters, i.e., things that would show on a current survey.

Examples include:

• Easements (define/example),

• building set-back lines

(define/example),

• conflicts in boundary lines and

• Encroachments

(define/example).

Show B-2 with survey exception filled in and highlighted

File:

Schedule B-II-Survey exception.doc

[Use: "2. Encroachments, overlaps, boundary line disputes, and any other matters which would be disclosed by an accurate survey and inspection of the premises."]

"Encroachments, overlaps, boundary line disputes, and any other matters which would be disclosed by an accurate survey and inspection of the premises."

This exception can be removed if the title company is provided with a current ALTA survey from a licensed surveyor certified to the underwriter. However, any defects indicated by the survey, such at encroachments, non-record easements or rights of ways, will be excepted from coverage.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule B-2

Part 2- Exceptions: III. Easement(s) Exception

Another exception that may be included on the commitment, especially where the property is unimproved land, is the easement exception.

Show B-2 with easement exception filled in and highlighted.

File:

Schedule B-II-Easements.doc

"Easements or claims of easements, not shown by the

Public Records." [Use: "3. Easements or claims of easements, not shown by the Public

Records."]

Like the general survey exception, this can be removed if the title company has been provided with a current

ALTA survey for use in eliminating the general survey exception. Any indications of easements shown by the survey will be exceptions on the title policy unless released or abandoned.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule B-2

Part 2- Exceptions:

IV. Unfiled Mechanic’s Lien(s)

Exception

The fourth general exception is the standard exception for unfiled mechanic's liens. Deletion of this exception will depend on state law; however, if no construction has occurred on the subject property within the statutory lien period, the title company is generally willing to delete this exception.

"Any lien, or right to a lien, for services, labor, or material, heretofore or hereafter furnished, imposed by law and not shown by the Public Records."

Show B-2 with mechanic's lien exception filled in and highlighted.

File:

Schedule B-II-Unfiled Mechanic's liens.doc

[Use: "4. Any lien, or right to a lien, for services, labor, or material, heretofore or hereafter furnished, imposed by law and not shown by the Public Records."] back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule B-2

Part 2- Exceptions: V. Parties in Possession

Exception

The fifth general exception is for "Parties in

Possession". This exception excludes from coverage the claims of any persons who are in possession of the premises, including any tenants in possession under any recorded or unrecorded leases. The title company may be willing to limit the exception to rights of tenants in possession under the terms of written leases if this information is disclosed to the title company in writing prior to the closing. If there are any options granted to the tenants in the leases, the title company will make specific exception to those rights.

"Rights or claims of parties in possession not shown by the

Public Records."

Show B-2 with possession exceptions filled in and highlighted

File:

Schedule B-II-Parties in Possession.doc

[Use "5. Rights or claims of parties in possession not shown by the

Public Records." "Rights of parties in possession under unrecorded leases."] back menu continue

"Rights of parties in possession under unrecorded leases.“

This language is used frequently in commercial real estate,

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule B-2

Part 2- Exceptions: VI. Tax and Special

Assessment Exception

The final general exception is for taxes and special assessments not yet due and payable. In many jurisdictions, this exception cannot be modified because the taxes become due on the first day of the year, but may not be payable until later in the year.

The general solution is for the parties to the transaction to pro-rate the taxes to the date of closing, leaving the purchaser liable for the payment of the taxes.

Show B-2 with tax exception filled in and highlighted.

File:

Schedule B-II-tax exception.doc

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Schedules – Schedule B-2

Show a completed sample of

Schedule B-2, showing all exceptions listed below.

Part 2- Exceptions: VII. Property Specific

Exceptions Following the general exceptions will be additional exceptions that are specific to the subject property, such as utility easements, property restrictions, and any assessments that may affect the title to the property.

File:

Schedule B-II-Completed.doc

[Use the following: "7. Assessments of

Country Acres Subdivision Homeowners'

Association for the years 2005 and subsequent years."

8. Virginia Power underground utility easement along northerly property line.

9. Encroachment of rear garage roof over easterly property line as shown on survey dated December 22, 2004 by Generic

Surveyors.

10. Encroachment of front porch and steps into front building setback line as shown on survey dated December 22, 2004 by

Generic Surveyors.

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Conditions

The Commitment will contain a page of Conditions and Stipulations that affect and control the obligations of the title company under the

Commitment. These are not the same as the

Conditions and Stipulations that will be in the actual title policies (example of full sample

Conditions and Stipulations) . The most important paragraphs are:

• Paragraph 2 “Knowledge of the

•

Insured and Later Defects”

Paragraph 3 “Limitation of our

Liability”.

Insert image of

Conditions Portion of Form

File:

Conditions and Stipulations.doc

back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Conditions

Paragraph 2

– Knowledge of the Insured and

Later Defects

This paragraph allows the title company to amend

Schedule B (link) to show any defects, liens or encumbrances that first appear in the Public

Records between(?) the Date of the Commitment and the closing date, and to add any additional requirements which may arise by reason of any new items.

Highlight image of

Conditions Portion of Form

File:

Conditions and Stipulations.doc

Paragraph 2 – Later Defects

Same as previous page back menu continue

Title Transfer and Title Insurance

Training Session 1: Conveyancing & Title Commitments

Section 3 “The Commitment”

The Commitment

Reviewing the Title Commitment continued

Conditions

Paragraph 3 - Limitation of Our Liability