File - lewisminusclark

advertisement

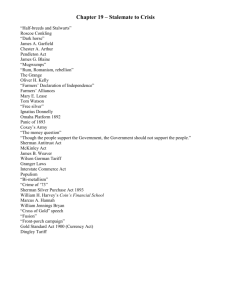

Concise Tariff History Tariff Date Name President 1789 Washington 1816 Madison Provisions Tariff in imports solely for revenue purposes. Congress rejected Hamilton's proposal for a protective tariff; but it raised rates slightly for revenue purposes. First protective tariff in U.S. History; a strongly protective trend was started by this tariff and appetites of war stimulated. Calhoun supported this tariff with the hope that the South would gain in manufacturing; Webster opposed highly protective duties as manufacturing in New England had not yet pushed shipping into a back seat; he feared a yet pushed shipping into a back seat; a direct tariff would interfere with shipping. In the early 1820s Henry Clay proposed the American System which called for a protective tariff; the revenues from which provide funds for internal improvements improvements such as roads and canals 1824 1828 Monroe Tariff of Abominatio ns John Q. Adams Increased the protective tariff of 1816 to 37% of the value of dutiable goods. dutiable goods Supporters of Jackson rigged up a tariff bill more concerned with manufacturing a president than with protecting manufacturing. Duties of 45% were levied on certain manufactured items and a heavy tariff was placed on wool. It was assumed New England would reject the tariff because of the duties on wool. The plan backfired. The over cropped lands of the Old South were petering out at the time and the price of cotton was falling sharply. It was the Old South which most vigorously protested the tariff he South Carolina Exposition and Protest was written by Calhoun in response to the Tariff of Abominations. Calhoun said that the tariff as unjust and unconstitutional and proposed that the states should nullify it. 1832 1833 Compromis e Tariff 1842 1846 Walker Tariff 1857 Jackson Reduced tariffs to 35% Jackson Reduced tariff of 1832 by 10% over a period of 8 years. By 1842 rates would be about 20-25% of the value of dutiable goods. Henry Clay engineered the compromise Tyler Tyler had no fondness for a protective tariff but realizing the need for additional revenue he reluctantly signed the bill. The pressure for additional revenue and higher tariffs lessened as the country worked itself out of the Panic and Depression of 1837 Polk Lowering the tariff was one of Polk's 4 major objectives as President. excellent revenue producer because its its passage was followed by boom times and heavy imports. This tariff was passes several months before the Panic and Depression of 1857. Responding to pressure from the South the new law reduced duties to about 20% of dutiable goods- -the lowest point since the War of 1812. Buchanan Northern manufacturers blamed all their misfortune on the low tariff. The tariff of 1857 gave the new Republican Party one of two sure fire issues for the election of 1860 "protection and unprotected" and "farms for the farmers". 1861 Morill Tariff Act Lincoln Superseding the Tariff of 1857, the Morill Act increased existing customs duties 5-10%; however, the duties were soon pushed sharply upward by the war The increases were designed partly to raise additional revenue and partly to provide protection to manufacturers who had been hurt by the Tariff of 1857. Duties were raised as high as 48.33 % From this point forward, the protective tariff became identified with the Republican Party 1872 Grant Reduced high Civil War duties to 45.1% By 1881 the treasury's annual income was $145 million in excess of expenditures. Most of the government's revenue came from the tariff. Cleveland wanted a reduction of the tariff to more manageable levels. When he lost, the high protectionist Republicans prepared to push the tariff schedules higher. The idea of keeping protection high brought new problems to the farmers. 1890 McKinley Tariff Harrison Raised rates to 48.4% and paid bounties to sugar producers Since 1833 the administration in Washington has rarely survived a major tariff overhauling except where was has intervened. In 1892 Cleveland was re-elected. Malcontents among laborers and agrarians were aroused by this bill and merged into the Populist Party. Wilson1894 Gorman Bill Cleveland Lowered tariff of 1890, but only to 41.3%. This tariff included a 2% tax on incomes over $4,000.00. Cleveland regarded the tariff as a gross betrayal of Democratic campaign pledges and he let the bill become law without his signature. In 1895 the Supreme Court in a 5- 4 decision struck down the income tax provision of the Wilson-Gorman Tariff. This tariff which had blasted the Republicans out of the House of Representatives in 1890, now dislodged the Democrats with help from the Panic and Depression of 1893 1897 Dingley Tariff McKinley Because the Wilson-Gorman Tariff was not raising enough revenue to cover the annual treasury deficits, this tariff raised rates to 46.5% over 850 amendments were tacked on to the bill Agitation for sharp reduction on the Dingley Tariff gained momentum during the Roosevelt administration. The clamor for tariff reform was part of the Progressive Movement. Taft called Congress into special session in 1909 to reduce the tariff. 1909 PayneAldich Tariff Taft Duties were reduced from 46.5% to 40.8%' Bob LaFollette led the fight against the bill which he thought was still too high; the bill also contained a 1% tax on corporation profits. This bill seemed like a betrayal of Taft's promise to substantially reduce the tariff, but instead of condemning the bill, Taft vigorously defended it. Underwood -Simmons Tariff Wilson Fordney1922 McCumber Tariff Harding 1913 Reduced rates from 40.8% to 27% and reduced duties on more than 900 items Though still protective, it achieved the first genuine tariff reduction since the Civil War This tariff accelerated the trend toward high protection. Duties on farm products were increased. The president was authorized to reduce or increase duties by as much as 50%. In 6 years Harding and Coolidge authorized 32 upward changes including dairy products, chemicals, and pig iron. There were only 5 reductions. American tariff walls also prolonged post war confusion in Europe and forced Europeans to raise their tariffs. 1930 1934 HawleySmoot Tariff Reciprocal Trade Agreements Act 1953 1955 1962 Hoover Roosevelt Eisenhower Eisenhower Trade Expansion Act Kennedy Began as a measure to help farmers but turned out after 1,000 amendments to be the highest protective tariff in peacetime history. Duties were raised from 38.5% to 55.3%. Hoover signed and defended the bill, reversing a trend toward reasonable rates Empowered the president to lower duties by as much as 50%; by 1939, 21 countries countries agreed to the reciprocity agreement Renewed a limited Reciprocal Trade Agreements Act Signed into law a 3 year extension of the Reciprocal Trade Agreements Act Gave the President new powers to reduce tariff rates on imports to the U.S.This authority was granted by Congress in order to provide the President with a bargaining lever for mutual tariff concessions by members of the European Common Market and other free nations of the world, The act also provide for financial trade adjustment assistance to American companies and workers injured by increased imports of competitive products resulting from tariff reductions.