Ch09 Lecture graphs

advertisement

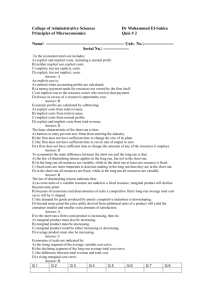

MAKING DECISIONS—BENEFITS AND COSS OF MAKING A DECISION The core of ECONOMICS is the analysis of benefits and costs of decisions made by individuals, households, firms, governments, and other organizations. The decisions involve making choices among various alternatives—how to allocate scarce resources among different alternatives. What is the optimum allocation of resources? Optimum allocation of resources means, in making a decision, compare the benefits and costs of the various choices and choose that option which maximizes the net benefit (Cost – Benefit). The Nature of Costs In economics all costs are defined as opportunity costs. The true cost of getting or producing something is what one must give up to obtain or produce that thing. Explicit costs versus implicit costs Explicit costs are costs that are reflected in exchange or transactions between two parties and typically involves monetary outlays. Implicit costs reflect the opportunity cost of resources owned. They do not involve an outlay of money. Implicit cost of capital Capital assets are buildings, machinery, tools, inventory, and financial assets. The implicit cost of capital is the opportunity cost of capital—the income (return) realized from the best alternative use of the capital assets. Page 1 of 6 Explicit and implicit costs of operating a woodworking workshop Explicit costs Implicit costs Staff wages and benefits $100,000 Forgone income from capital Wood and other supplies 150,000 Implicit rent on the workshop Utilities 6,000 Forgone alternative salary Insurance 4,000 Depreciation allowance 10,000 Total explicit cost $270,000 Total explicit cost Total opportunity cost = Explicit costs + Implicit costs = $14,000 36,000 80,000 $130,000 $400,000 Total market value of capital equipment = $200,000 Prevailing annual interest rate = 7% Accounting Profit versus Economic Profit Accounting profit is determined as revenue minus explicit costs (including depreciation allowance). Economic profit is determined as revenue minus total opportunity cost. Total revenue from sale of furniture products Explicit costs (including depreciation) $420,000 $270,000 Accounting profit $150,000 Explicit costs (including depreciation) Implicit costs Total opportunity cost $270,000 $130,000 $400,000 Economic profit Page 2 of 6 $20,000 Making “How Much” Decisions: The Role of Marginal Analysis Most decisions are made at the margin by comparing the additional cost of the action (marginal cost) to its additional benefit (marginal benefit). As long as Bob’s furniture manufacturing business is making a profit by, say, making 100 pieces of furniture a month, his concern is if he is maximizing profits by producing 100 units. If he can add to his profits by producing more, then he is not maximizing his profits. His output of Q = 100 is not optimal. To determine if he can add to his profit by expanding his output to say 110 units, he must compare the additional cost of expanded production to the additional revenue (benefit) from increased sales . He would thus be comparing marginal cost to marginal revenue. Explaining “optimal” decision using a little math Benefit function: Cost function: Quantity Q 0 1 2 3 4 5 6 7 8 9 Page 3 of 6 B = 45Q – 3Q² C = 5Q + 2Q² Total benefit B = 45Q – 3Q² $0 42 78 108 132 150 162 168 168 162 Total cost C = 5Q + 2Q² $0 7 18 33 52 75 102 133 168 207 Marginal benefit MB = ∆B ⁄ ∆Q $42 36 30 24 18 12 6 0 -6 Marginal cost MC = ∆C ⁄ ∆Q $7 11 15 19 23 27 31 35 39 220 200 180 160 C and B 140 120 100 80 60 40 20 0 0 1 2 3 4 5 Q Page 4 of 6 6 7 8 9 10 Marginal Benefit and Marginal Cost for Very Small Changes in Quantity Using the first derivative of the B and C functions. B = 45Q – 3Q² C = 5Q + 2Q² Quantity Q 0 1 2 3 4 5 6 7 8 9 Page 5 of 6 MB = = 45 – 6Q MC = = 5 + 4Q Total benefit B = 45Q – 3Q² $0 42 78 108 132 150 162 168 168 162 Total cost C = 5Q + 2Q² $0 7 18 33 52 75 102 133 168 207 NB = B – C 35 60 75 80 75 60 35 0 -45 Marginal benefit MB = 45 – 6Q 45 39 33 27 21 15 9 3 -3 -9 Marginal cost MC = 5 + 4Q 5 9 13 17 21 25 29 33 37 41 220 Q 0 1 2 3 4 5 6 7 8 9 MB 45 39 33 27 21 15 9 3 -3 -9 TC 0 7 18 33 52 75 102 133 168 207 MC 5 9 13 17 21 25 29 33 37 41 200 180 160 140 B and C TB 0 42 78 108 132 150 162 168 168 162 120 100 80 60 40 20 0 0 1 2 3 4 5 6 7 8 9 10 Q 50 45 40 35 MB and MC Q 0 1 2 3 4 5 6 7 8 9 30 25 20 15 10 5 0 0 1 2 3 4 5 6 7 8 9 10 Q Page 6 of 6