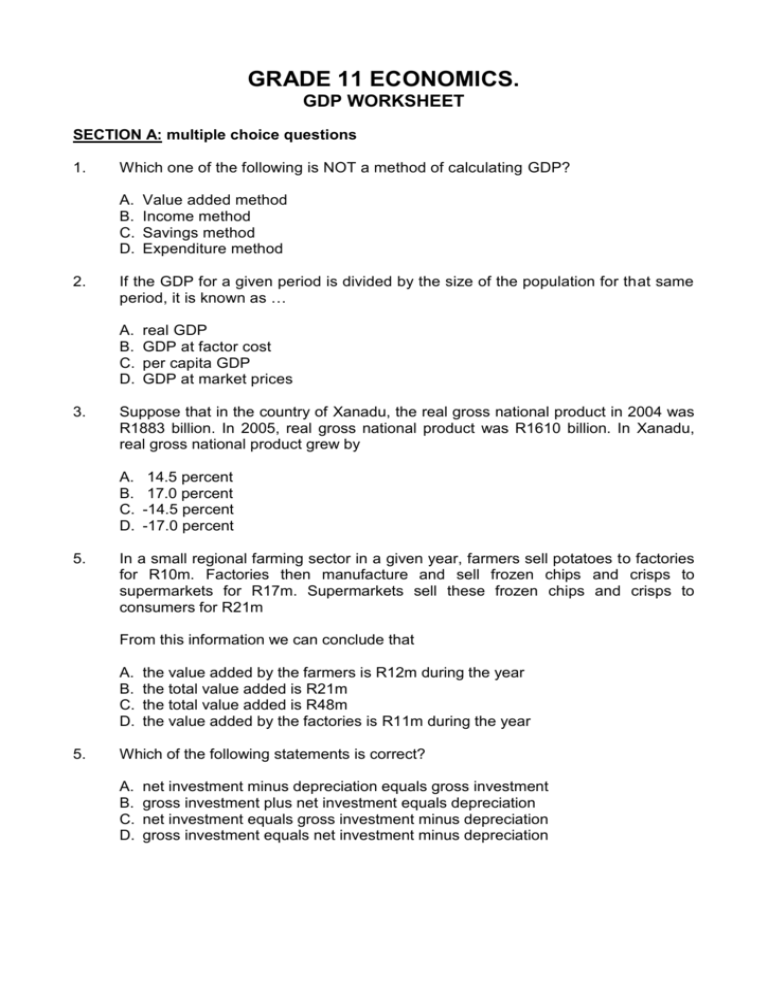

grade 11 economics. gdp worksheet

advertisement

GRADE 11 ECONOMICS. GDP WORKSHEET SECTION A: multiple choice questions 1. Which one of the following is NOT a method of calculating GDP? A. B. C. D. 2. If the GDP for a given period is divided by the size of the population for that same period, it is known as … A. B. C. D. 3. real GDP GDP at factor cost per capita GDP GDP at market prices Suppose that in the country of Xanadu, the real gross national product in 2004 was R1883 billion. In 2005, real gross national product was R1610 billion. In Xanadu, real gross national product grew by A. B. C. D. 5. Value added method Income method Savings method Expenditure method 14.5 percent 17.0 percent -14.5 percent -17.0 percent In a small regional farming sector in a given year, farmers sell potatoes to factories for R10m. Factories then manufacture and sell frozen chips and crisps to supermarkets for R17m. Supermarkets sell these frozen chips and crisps to consumers for R21m From this information we can conclude that A. B. C. D. 5. the value added by the farmers is R12m during the year the total value added is R21m the total value added is R48m the value added by the factories is R11m during the year Which of the following statements is correct? A. B. C. D. net investment minus depreciation equals gross investment gross investment plus net investment equals depreciation net investment equals gross investment minus depreciation gross investment equals net investment minus depreciation 6. The following information is taken from the national accounts of Zambibia: C I G X Z = R200 million = R50 million = R150 million = R200 million = R180 million Gross Domestic Expenditure is A. B. C. D. R400 million R420 million R600 million R380 million SECTION B: direct questions 1. Define “Gross Domestic Product” 2.1 Calculate the value added to production using the figures below which were taken from a firm’s income and expenditure statement. [2] Wages and salaries Rent paid Interest paid Intermediate goods and services Revenue from sales [2] R20,000 R5,000 R3,000 R8,000 R43,000 2.2. Using figures from the table above, explain “double counting” and why it is important to avoid it when compiling the national accounts. [3] 3. Study the table below which gives figures for a hypothetical economy and answer the questions which follow: Investment expenditure Government expenditure Imports Capital consumption Indirect taxes on products and production Consumption expenditure Indirect subsidies on products and production Exports Compensation to employees Factor income receipts from abroad Factor income payments abroad R400 R600 R50 R200 R25 R2,000 R30 R100 R2,400 R85 R120 Showing all your working, calculate: 3.1. GDP (at market prices). [3] 3.2. NDP (at market prices). [2] 4. You have to measure the nominal GDP for a country in the three ways shown above with the given information. Production in Nambabwe(1995) Total clothing production R2 million Total salaries R15 million Total sheep production R1 million Total expenditure on housing R17 million Total housing production R17 million Total wages R5 million Total expenditure on clothes R2 million Total expenditure on meat R1 million Total cloth production (used in the production of clothes) R0.5 million a) Calculate GDP using the output-method, and provide an explanation for the items you include in the calculation. b) Explain the concept of double-counting. In the example, which item should be left out so as to avoid the problem of double-counting? c) Calculate GDP using the income method, and provide an explanation for the items you include in the calculation. d) Calculate GDP using the expenditure method, and provide an explanation for the items you include in the calculation. 5. a) To make one piece of furniture, the carpenter buys wood at R324.56, but sells the item for R650. The timber mill paid the farmer R198.76 for the raw material. What is the correct amount for the inclusion in the national income figures? b) Which two methods/rules could one use to be absolutely certain that the correct amount is being included in the national figures? 6. A Dalton sugar farmer burns and cuts his cane crop of 4 hectares at 100 tons of cane per hectare. He transports it to the Noodsburg Sugar Mill where he receives an amount of R900 per ton of sucrose extracted from the sugar cane. A good cane crop delivers about 14% sucrose per ton of sugar cane. The sugar mill processes the cane and delivers a range of products that are passed on in the production chain to the wholesaler. The sugar is packaged and sold to retail outlets for R150 000. The combined price to the end consumers is a mark-up of 60% on the cost to the retailer. Calculate the value added in the above example. Tabulate your answer showing both the selling price and the value-added at each stage in the production process. 7. Sweetdream Island is a closed economy in which the inhabitants make a living from producing sugar and cakes only. As the Finance Minister on the island you need to calculate the national income figures for publishing in the next release of government figures. Using the production, expenditure and income methods, set up three tables incorporating the following information to help you arrive at the national income figure for this quarter. The wheat farmers sell their crop to the millers for R2000 and their wages amount to R800, leaving profit at R1200. The millers sell all their flour to the bakeries on Sweetdream Island for R6000. They claim R1500 in wages and therefore their profit was R2500. The bakeries sell their cakes to the public for R10 000. Wages amounted to R2200 and profit to R1800. The sugar farmers receive R1000 for their produce with wages adding up to R400 and profit R600. The sugar mills process the cane and sell the outcome to the wholesalers for R3000. Wages amount to R1200: the sugar mills’ combined profit was therefore R800. The middlemen sell their sugar products to retailers for R12 000. Wages are R3500 and profit is R5500. Finally the retailers sell the sugar to the public for R24 000 with wages being R5000 and therefore profit equals R7000. 8. The total production of a shoe factory is sold for R500 000. Compensation to employees is R300 000. The value of the factory machinery depreciates by R80 000 during the production process. The net operating surplus amounts to R120 000. a) The GDP at factor cost in regard to the shoes is: i. ii. iii. 9. R420 000 R500 000 R380 000 How are Gross National Product figures converted to Gross Domestic Figures?