Cost and Marginal Analysis PPT

advertisement

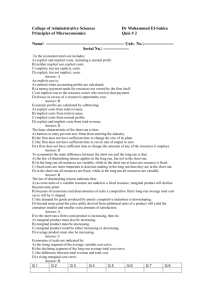

Unit V Costs and Marginal Analysis (Chapter 9) In this chapter, look for the answers to these questions: Why are implicit as well as explicit costs important in decision making? What is the difference between accounting profit and economic profit? Why is economic profit is the correct basis for decisions? What is the principle of marginal analysis? What are sunk costs? Total Revenue, Total Cost, Profit • We assume that the firm’s goal is to maximize profit. Profit = Total revenue – Total cost the amount a firm receives from the sale of its output the market value of the inputs a firm uses in production Costs: Explicit vs. Implicit • Explicit costs – require an outlay of money, e.g. paying wages to workers • Implicit costs – do not require a cash outlay, e.g. the opportunity cost of the owner’s time – A cost that represents the value of resources used in production for which no actual (monetary) payment is made. • Remember The cost of something is what you give up to get it. Explicit vs. Implicit Costs: An Example You need $100,000 to start your business. The interest rate is 5%. • Case 1: borrow $100,000 – explicit cost = $5000 interest on loan • Case 2: use $40,000 of your savings, borrow the other $60,000 – explicit cost = $3000 (5%) interest on the loan – implicit cost = $2000 (5%) foregone interest you could have earned on your $40,000. In both cases, total (exp + imp) costs are $5000. Opportunity Cost of Capital • The available return on the next best alternative investment (financial capital or labor). – economists consider this a cost of production, and it is included in our cost examples Economic Profit vs. Accounting Profit • Accounting profit = total revenue minus total explicit costs • Economic profit = total revenue minus total costs (including explicit and implicit costs) • Accounting profit ignores implicit costs, so it’s higher than economic profit. Economic Profit vs. Accounting Profit Accounting Profit Total sales revenue $120,000 Costs of T-shirts Clerk’s salary Utilities Total (explicit) costs 63,000 Accounting profit 57,000 $40,000 18,000 5,000 Implicit Costs Accounting profit $57,000 Forgone interest $ 1,000 Forgone rent 5,000 Forgone wages 22,000 Forgone ent. Income 5,000 Total implicit costs 33,000 Economic profit 24,000 Accounting, Economic and Normal Profit Normal Profit • Normal Profit - Zero economic profit. A firm that earns normal profit is earning revenue equal to its total costs (explicit plus implicit costs). This is the level of profit necessary to keep resources employed in that particular firm. – The cost of doing business A C T I V E L E A R N I N G 1: Economic profit vs. accounting profit The equilibrium rent on office space has just increased by $500/month. Compare the effects on accounting profit and economic profit if a. you rent your office space b. you own your office space A C T I V E L E A R N I N G 1: Answers The rent on office space increases $500/month. a. You rent your office space. Explicit costs increase $500/month. Accounting profit & economic profit each fall $500/month. b.You own your office space. Explicit costs do not change, so accounting profit does not change. Implicit costs increase $500/month (opp. cost of using your space instead of renting it), so economic profit falls by $500/month. Efficiency • Marginal Benefit – Marginal benefit is the benefit a person receives from consuming one more unit of a good or service. – We can measure the marginal benefit from a good or service by the dollar value of other goods and services that a person is willing to give up to get one more unit of it. – The concept of decreasing marginal benefit implies that as more of a good or service is consumed, its marginal benefit decreases. Efficiency • The graph shows the decreasing marginal benefit from each additional slice of pizza, measured in dollars per slice. Efficiency • Marginal Cost – Marginal cost is the opportunity cost of producing one more unit of a good or service. The measure of marginal cost is the value of the best alternative forgone to obtain the last unit of the good. – We can measure the marginal cost of a good or service by the dollar value of other goods and services that a person is must give up to get one more unit of it. – The concept of increasing marginal cost implies that as more of a good or service is produced, its marginal cost increases. Efficiency • This graph shows the increasing marginal cost of each additional slice of pizza, measured in dollars per slice. Efficiency • Efficiency and Inefficiency – If the marginal benefit from a good exceeds its marginal cost, producing and consuming more of the good uses resources more efficiently. Efficiency • If the marginal cost of a good exceeds its marginal benefit, producing and consuming less of the good uses resources more efficiently. Efficiency • If the marginal cost of a good equals its marginal benefit, resources are being use efficiently. • Allocative efficiency will occur when MB = MC Sunk Cost • A cost incurred in the past that cannot be changed by current decisions and therefore cannot be recovered. CHAPTER SUMMARY Implicit costs do not involve a cash outlay, yet are just as important as explicit costs to firms’ decisions. Accounting profit is revenue minus explicit costs. Economic profit is revenue minus total (explicit + implicit) costs. According to the principle of marginal analysis, the optimal quantity—the quantity that generates the maximum possible total net gain—is the quantity at which marginal benefit is equal to marginal cost. A cost that has already been incurred and that is nonrecoverable is a sunk cost. Sunk costs should be ignored in decisions about future actions—they have no effect on future benefits and costs.