Decision Making

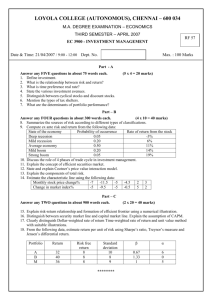

advertisement

Decision Making Decision-making is based on information Information is used to: Identify the fact that there is a problem in the first place Define and structure the problem Explore and choose between different possible solutions Evaluate the effectiveness of the decision Value of Information The value of information used in decision making is: (value of the outcome with the Information) – (value of the outcome without the Information) Types of Decision H. A. Simon classified decisions into Programmed decisions Non-Programmed decisions Classified according to the extent to which decision making can be preplanned These are the extremes of a continuous range of decision types Programmed Decisions Also known as Structured Decisions Characteristics Repetitive, routine, known rules or procedures, often automated, can be delegated to low levels in the organisation, often involve things rather than people Examples - Inventory control decisions, machine loading decisions, scheduling. Non-Programmed Decisions Also known as Unstructured Decisions Characteristics Novel, non-routine, rules not known, high degree of uncertainty, cannot be delegated to low levels, more likely to involve people. Examples - Acquisitions, mergers, launching new products, personnel appointments. Semi-Structured Decisions The most common type of decision May be partially automated Empowerment Authority to take decisions is being delegated down the line especially in modern service industries This process is called empowerment and should enable an organisation to take a variety of decisions more quickly, thus providing a more flexible service Empowerment Decisions should be made: At the lowest possible level, which accords with their nature As close to the scene of the action as possible at the level that ensures none of the activities and objectives are forgotten Empowerment Enabled by systems such as Customer Relationship Management (CRM) Gives call centre staff specialist knowledge about any customer Expert Systems Assists non-experts in making complex decisions Uncertainty Uncertainty arises from incomplete information due to: Incomplete forecasting models Conflicting data from external sources Lack of time Internal data on particular problem not collated The uncertainty of an outcome is expressed as a probability Rational Decision Making The rational model of decision making is a mechanistic approach to decision making It assumes perfect knowledge of all factors surrounding the decision Rational vs. Real Decisions ‘Users tend to explain their actions in terms of rational behaviour, whereas their actual performance may be governed by intuition rather than by rational analysis. Studies of managers at work have shown that there is a discrepancy between how managers claim to take decisions and their actual observed decision-making behaviour’. Argyris and Schon Payoff Matrices The standard way to analyse simple decision problems These are constructed as follows: Identify all available options Identify events which cause an outcome (states of nature) Estimate the likelihood of each state of nature Estimate the value/payoff of each outcome Determine the expected value for each option Choose the option with the highest expected value Example A company must decide on one of three development projects, A, B or C They have identified three possible events relating to market conditions that will effect this decision Event Probability Boom 60% Steady State 30% Recession 10% Example The profit and loss figures (potential payoff) for the three products under the possible market conditions have been forecast as: Decision Event Project A Project B Project C Boom 60% +8M -2M +16M Steady State 30% +1M +6M 0 Recession 10% -10M +12M -26M Which one of the above projects should the company run? Decision Criteria In order to evaluate the alternatives, managers use a number of different criteria: Equally Likely The consequences of each decision are summed and the result divided by the number of events Useful if probabilities are not known Maximax Determine the highest possible profit from each strategy and choose that with the highest overall profit - Usually high risk, but high gain Example Decision Event Project A Project B Project C Boom 60% +8M -2M +16M Steady State 30% +1M +6M 0 Recession 10% -10M +12M -26M Preferred Project is? Equally Likely Maximax Decision Criteria Minimax Choose that action with the smallest maximum possible loss, or the largest minimum profit. Low risk, low gain. Maximum Likelihood Choose the most likely event and then choose the best strategy for that event. Low risk, low gain. Does not make full use of available information. Example Decision Event Project A Project B Project C Boom 60% +8M -2M +16M Steady State 30% +1M +6M 0 Recession 10% -10M +12M -26M Preferred Project is? Minimax Max Likelihood Example Decision Event Project A Project B Project C Boom 60% +8M -2M +16M Steady State 30% +1M +6M 0 Recession 10% -10M +12M -26M Decision Criteria Expected Value A weighted average of all outcomes The weights are probabilities N EV Poutcomei payoffi i 1 Gives the average value of the decision if it were made repeatedly Uses all the information concerning events and their likelihood Example Decision Event Project A Project B Project C Boom 60% +8M -2M +16M Steady State 30% +1M +6M 0 Recession 10% -10M +12M -26M Calculate EV for each option/choice Project A (8M*0.6)+(1M*0.3)+(-10M*0.1) = 4.1M Project B (-2*0.6)+(6*0.3)+(12*0.1) = 1.8 Project C (16*0.6)+(0*0.3)+(-26*0.1) = 7.0 Preferred Project is? C Example 2 Alternative A Alternative B Alternative C Outcome: Proby Profit Proby Profit Proby Profit Optimistic 0.2 5000 0.3 4000 0.1 3000 Most Likely 0.6 7500 0.5 7000 0.7 6500 Pessimistic 0.2 9000 0.3 9500 0.2 10000 Decision Criteria Expected Value Uses all the information concerning events and their likelihood Does not take into account decisionmakers attitude to risk Does not reflect the actual outcomes in the figures Can the company afford to lose 26M? Decision Trees Not all decisions will be taken in isolation A decision will have an effect of future events and outcomes An outcome in turn may effect future decision making Decision Trees Decision trees provide a means of structuring the decision making process to allow for alternative futures Decision Tree Two types of Node Decision Node Represent decision points Decision are made by the organisation Outcome Node Linked to possible outcomes These are uncontrollable Example Boom 60% 8M Steady 30% Recession 10% Project A Boom 60% Project B Steady 30% Recession 10% Project C Boom 60% Steady 30% 1M -10M -2M +6M +12M +16M 0 Recession 10% -26M Example Boom 60% 4.1 Steady 30% Recession 10% Project A Boom 60% Project B 1.8 Steady 30% Recession 10% Boom 60% Project C 7 8M Steady 30% 1M -10M -2M +6M +12M +16M 0 Recession 10% -26M Example Boom 60% 4.1 Steady 30% Recession 10% Project A Boom 60% 4.1 Project B 1.8 Steady 30% Recession 10% Boom 60% Project C 7 8M Steady 30% 1M -10M -2M +6M +12M +16M 0 Recession 10% -26M