DCIN Revenue/Screen - Digiplex Destinations

advertisement

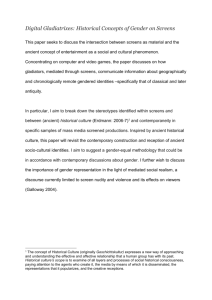

**A Peek Into The Future of Theatrical Exhibition** NASDAQ: DCIN www.digiplexdest.com Forward-Looking Statements Certain statements and estimates in this presentation are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. They include, for example, statements about: expected benefits from the conversion to digital cinema; and the Company’s ability to successfully pursue its strategies. These forward-looking statements are not guarantees of future performance. They are based on management's expectations that involve a number of business risks and uncertainties, including the risks set forth under the heading “Risk Factors” in our 10-K for the year ended June 30, 2012, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. Any estimates or other forward-looking statements provided in this presentation speak only as of the date they were made, and, except to the extent required by law, we undertake no obligation to update or review any estimate and/or forward-looking statement because of new information, future events or other factors. 2 Digiplex Growth Opportunity/Differentiators Fast-growing U.S. exhibitor (founded 2010) led by digital cinema pioneers (Clearview/Cinedigm legacy), transforming movie theaters into digital entertainment centers Current footprint - 18 theaters/178 screens in six states…added 159 screens since April ‘12 IPO Goal - national circuit featuring 100 theaters/1,000 screens in 75/top 100 DMAs Targeting 300 screens by 12/31/13 Acquiring cash flow positive theaters, expanding profitability on digital platform, achieving: Incremental revenue and theater level cash flow generation Cost efficiencies/reductions Unique differentiators include: Alternative programming expertise Social media focus Virtual Print Fee (VPF) receipt (film rent offset)…receiving VPFs on current 85 screens (but probably won’t receive for all future screens) DigiNext JV + other content JVs (in the works) – downstream/ancillary revenue opportunities Secured Start Media JV and Term Loan to assist in support of theater circuit expansion 3 Corporate Strategy 4 Generating Disciplined/Aggressive Screen Growth Strategy: Opportunistically expand DCIN’s footprint by identifying and acquiring solid performing theaters in accretive transactions at reasonable cash flow multiples (~5-6X, including initial CapEx) Mid- to Long-term Goal: 100 theaters/1,000 screens in 75/100 top DMAs (Designated Marketing Areas)… creating national circuit where consumers of entertainment can interact with every form of content owner Progress Update: Significantly grew screen count since April 2012 IPO from 3 theaters/19 screens to 18 theaters/178 screens at 2/1/2013 2 20 11 100% NJ 3 14 7 100% 120 100 80 Acquired Cinema Centers (5 theaters, 54 screens) 60 1 16 - 100% PA 5 54 21 100% Total 18 178 59/33%* 100% 40 20 - *DCIN’s goal is to have 33% of its screens 3-D enabled Dec-10 OH Camp Hill, PA – Theater Exterior View Acquired Lisbon Landing Cinema 12 (1 theater, 12 screens) Feb-13 CT Dec-12 100% Oct-12 15 Aug-12 60 Acquired UltraStar Cinemas (7 theaters, 74 screens) 140 Jun-12 6 160 Apr-12 CA Acquired Solon, OH & Sparta, NJ Theaters (2 theaters, 19 screens) 180 Feb-12 100% 200 Dec-11 5 Digital Oct-11 14 3D (#)/(%) Aug-11 1 Screens Jun-11 AZ Theaters Apr-11 State DCIN Screen Growth (#) Feb-11 DCIN Theater Statistics Selinsgrove, PA – Concessions Area 5 Maximizing Digital Cinema Circuit and Financial Benefits Strategy: Utilizing management’s collective experience and expertise to effectively operate upon state-of-theart digital platform Near-term goal: Achieve circuit-wide operating efficiencies and immediate benefits from transition to DCIN’s digital cinema network Progress Update: DCIN continues to make significant headway transforming each acquired facility into a digital entertainment center that adds incremental value to its operating base through accretive revenue, EBITDA and free cash flow generation July 2012: Completed digital rollout of 54 Cinema Centers Screens September 2012: Completed acquisition Lisbon 12 Multiplex Fiscal Q1’13: First full quarter collecting pre-show ad revenues from National CineMedia (NCM) and December 2012: Completed acquisition of 74 UltraStar Cinemas screens Virtual Print Fees (VPFs) from major studios, which are an offset to film rent expense* *Including Lisbon Landing’s 12 screens for two-day stub period as this acquisition was completed September 29, 2012 January/February 2013: Completed acquisition of 19 screens in Solon, OH and Sparta, NJ Fiscal Q2’13: Revenue rises more than seven-fold to $6.9 million reflecting significant screen growth 6 Alternative Programming Enhanced by Social Media Strategy: Schedule wide range of alternative programming, building awareness and attendance gains through active targeted marketing and comprehensive social media customer engagement initiatives Long-term goal: Generate 20% of total box receipts from alternative content, improving attendance metrics at ~50% higher ticket price…replacing underperforming Hollywood titles on screen Progress Update: Continuing to introduce DCIN’s alternative programming, targeted marketing platform, and active, low-cost social-based outreach strategies that were successfully implemented in its first 3 locations to its newly acquired facilities Alternative programming as a % of total fiscal Q2’13 admissions revenues averaged ~7% at first 3 locations with one location generating ~15% in the quarter Procure Content A diverse range of programming that appeals to wide array of audiences Schedule Programming Ideally Mon.-Thurs., when average cinemas operate at <10% capacity Market Events Create awareness/interest through DCIN’s consumer engagement initiatives: customer targeting, relationship building, fostering a two-way dialog with guests 7 DigiNext Value-Creation Opportunity Unique, specialty content joint venture with Nehst Studios featuring a curated series of documentaries and indie features (hand-selected from world’s leading film festivals) shown on Digiplex circuit and at friendly, noncompeting theaters DCIN receives 50% of all net downstream/ancillary revenues including DVD, digital downloads and international broadcast rights Additional features and unique benefits of DigiNext: Opportunity for innovative live Q&A between audience and cast members Affordable pricing ($7.00 per ticket, or $6.00 if 5-title subscription purchased) ‘Pay it Forward’ – a unique program allowing Digiplex patrons to give back to their community Ten releases/year (excluding high-traffic ‘holidays’) December 2012 January 2013 February 2013 March 2013 8 Alternative Programming Successes Sample Content and Event Grosses Alternative programming consistently outperforming lowest (and often highest) grossing movies…at higher prices Day of the Week Monday Event Offered Opera Encore: Die Walkure Movie Classic: Star Trek 25th Anniversary Opera Encore: Wagner’s Dream Event Gross that Day $452.80 $911.04 $389.07 Highest Grossing Movie that Day $250.39 $283.58 $360.44 Lowest Grossing Movie that Day $0.00 $168.66 $0.00 Event Ticket Price (1 adult) $12.50 $12.50 $12.50 Tuesday Ballet: Nutcracker Live Concert: Rolling Stones Live in 1978 Ballet: Le Corsaire $1,345.26 $672.03 $566.00 $125.40 $89.60 $125.40 $0.00 $9.43 $0.00 $20.00 $12.50 $15.00 Wednesday Broadway: West Side Story Broadway: Love Never Dies Opera: La Traviata $2,425.00 $1,422.00 $1,339.77 $73.36 $107.94 $92.71 $56.07 $0.00 $0.00 $12.50 $12.50 $20.00 Thursday Movie Classic: Singin’ in the Rain Art Show: Leonardo Live Movie Classic: Singin’ in the Rain $2,603.24 $1,591.65 $954.99 $607.84 $272.42 $234.82 $47.64 $19.82 $28.29 $12.50 $12.50 $12.50 Saturday Opera Live: Don Giovanni Opera Live: La Traviata Sports: Mayweather vs. Ortiz $7,073.02 $3,849.56 $1,816.86 $529.97 $1,168.56 $2,037.05 $21.24 $47.64 $44.34 $25.00 $12.50 $18.00 Sunday Opera Live: Phantom of the Opera Ballet: Le Corsaire Los Angeles Philharmonic $1,103.70 $976.35 $479.22 $281.50 $309.48 $309.48 $28.32 $7.55 $7.55 $18.00 $15.00 $18.00 $783.31 $497.05 $76.41 $15.01 Averages: 9 Digiplex Model Summary – “Cinema Reinvented” TRANSFORM CONVERT & INVEST ACQUIRE Cash flow positive theaters Top DMAs Pay reasonable cash flow multiples (including initial CapEx) Convert analog systems Integrate into DCIN digital platform Add additional screens where feasible/profitable Theaters to entertainment destinations Innovative programming + social media = increased seat utilization (especially on slow weeknights) INCREMENTAL REVENUES PRE-SHOW ADVERTISING COST REDUCTIONS Software systems provide flexibility/efficiency/lower expenses Virtual print fees (VPF) benefit theater level cash flows, offsetting film rent Participation on NCM national pre-show ad network (19K+ screens) Generating guaranteed per attendee minimum rate…or better Attendance gains lead to enhanced concession revenues at attractive gross margins 3D (33% of footprint is compatible) Alternative programming (50%+ higher ticket prices) Ad revenues of 17¢ per patron is NCM minimum guarantee 10 Appendix/Financials 11 Experienced Management and Board w/Cinema Expertise DCIN Corporate Officers BUD MAYO, Chairman and CEO (Board Member): Industry veteran with over two decades of experience. Founder and former leader of Cinedigm Digital Cinema Corp. (NasdaqGM:CIDM) and Clearview Cinemas BRIAN PFLUG, CFO (Board Member): Former Controller at Clearview Cinemas and former SVP of Accounting and Finance at Cinedigm Digital Cinema Corp. CHUCK GOLDWATER, Senior Vice President (Board Member): Industry veteran with over two decades of experience (Clearview Cinemas, Loews, Mann Theatres). Former CEO of Digital Cinema Initiatives, the major studio consortium that set digital standards; and was the former Head of Cinedigm’s digital cinema unit JEFF BUTKOVSKY, Chief Technology Officer: Former Senior Vice President and CTO for Cinedigm Digital Cinema Corp DCIN Independent Board Members NEIL ANDERSON, Partner / Of Counsel – Sullivan & Cromwell: Experienced veteran in M&A transactions across the globe, formerly Sr. M&A Partner at Sullivan & Cromwell; frequent speaker and faculty member on professional seminars and programs dealing with M&A RICHARD CASEY, Software Entrepreneur / Founder – The Casey Group: Operating since 1989, IT consulting firm that helps clients leverage technology to gain strategic advantages; Board Member of Affinity Federal Credit Union MARTIN O’CONNOR, II, Managing Partner – O’Connor, Morss & O’Connor P.C.: Law Firm focused on advising clients of strategic planning, wealth management and family offices; specializes in entertainment law. Board Member of Cinedigm and Rentrak CAROLYN ULLERICK, Global Chief Financial Officer, the Legal and Professional Group of LexisNexis: A leading global provider of content-enabled workflow solutions, LexisNexis uniquely unites proprietary brands, advanced Web technologies and premium information sources 12 Case Study: Clearview - IPO/Growth/Successful Sale Clearview Cinemas: Attractive exit return for IPO Investors when sold to Cablevision Share Price Aug 21, 1997 (market open): $ 8.00 Sold for Share Price Dec 8, 1998 (on or about 12/8): $24.25 Hold Time (# of days): ~ 474 Return on Investment (approximate): 233% Clearview Cinemas Corporate Timeline 1995: Acquired 3 theaters and 11 screens 1994 Sep. 1994: Co-founded by Bud Mayo with 4 theaters and 8 screens 1995 Dec. 1994: Received equity from CMNY Capital and added 3 screens 1996: Acquired 9 theaters and 39 screens 1996 May 1996: Received equity investment of $4.5M from MidMark Capital Aug. 1997: IPO – Sold 1.15M shares for $9.2M gross Jan. – Sep. 1998: Acquired 11 theaters and the right to operate one theater for a total of 54 screens 1997 1997: Acquired 14 theaters with 79 screens, added 6 screens to acquired theaters and constructed a 5-screen theater 1998 Dec. 1998: Sale to Cablevision (NYSE: CVC) for $160M, including New York City’s Ziegfeld Theatre PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS: The above information is presented solely for informational purposes, and no representation, warranty or guarantee is being made relative to the future performance of the Company or the trading price of its Class A common stock whatsoever. 13 Long-Term Industry Box Office Success and Stability Cinema Has Performed Well Over Decades Steady (1970-2012) industry growth despite new media outlets and alternative distribution methods U.S. Annual Box Office Performance (billions $US) 2012 $10.8 $12 $11 5% Box Office CAGR* (1970-2011) $10 $9 2012 broke all-time domestic box record set in 2009 by ~$240 million, for a total of $10.8 billion $8 $7 $6 $5 Stable industry with consistent pricing power Inexpensive out-of-home entertainment option typically resilient to economic pressures $4 $3 $2 $1 $0 Commercial Penetration of New Media Forms “Competing” With Box Office: Cable VCR Internet DVD Sources: Box Office Mojo, Box Office Magazine 14 DCIN Operating Metrics Growth Early Success Consolidation strategy and favorable M&A environment are backdrop for opportunistically expanding theatrical footprint and screen count DCIN increased total revenue per screen over last four quarters versus prior-year periods by 18%, 30%, 15%, and 48% respectively DCIN increased theater level cash flow (TLCF)* per screen over last four quarters versus prior-year periods by 82%, 58%, 84%, and 63%, respectively * Non-GAAP measure – reconciliation for Q2‘13 TLCF is on slide 16 Most recent acquisitions via JV will produce an ROI to DCIN of ~30% DCIN TLCF/Screen (thousands) DCIN Revenue/Screen (thousands) 80 2011 18 16 14 12 10 8 6 4 2 0 2012 70 60 50 40 30 20 10 0 DCIN Fiscal Q3 2012 3-months ended Mar-31 DCIN Fiscal DCIN Fiscal Q4 2012 Q1 2013 3-months 3-months ended Jun-30 ended Sep-30 DCIN Fiscal Q2 2013 3-months ended Dec-31 2011 DCIN Fiscal Q3 2012 3-months ended Mar-31 2012 DCIN Fiscal DCIN Fiscal Q4 2012 Q1 2013 3-months 3-months ended Jun-30 ended Sep-30 DCIN Fiscal Q2 2013 3-months ended Dec-31 15 DCIN Summary Financials/Non-GAAP Reconciliation 1)Theater level cash flow and adjusted EBITDA are supplemental non-GAAP financial measures. Reconciliations of these metrics to the net loss for the three months ended December 31, 2012 and 2011, are included are included in the Company’s December 31, 2012 Form 10-Q 2)As of December 31, 2012 and 2011, respectively 3)Total attendance and average per screen attendance for the three-month period ended December 31, 2012 include a contribution from the seven acquired UltraStar theaters based in CA and AZ for the 13-day average stub period prior to 12/31/12. For the six-month period ended December 31, 2012, total attendance and average per screen attendance includes the contribution from UltraStar noted previously, and a contribution from the Lisbon theater in Connecticut for a 94–day stub period prior to 12/31/12. 1)Excludes stock-based compensation and non-recurring organizational and M&A-related professional fees 2)Represents theater level cash flow on a consolidated basis, including the results of the Start Media / Digiplex, LLC joint venture for an approximate 13-day average stub-period prior to December 31, 2012. See Form 10-Q for further information. * Following our acquisition of 74 screens from Ultrastar in December 2012, pro forma annual Revenue, Theater level cash flow, and Adjusted EBITDA is approximately $42 million, $7 million and $4 million, respectively. 16