Equilibrium National Income

Chapter 22

EQUILIBRIUM NATIONAL

INCOME

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

1

Economic Principles

Aggregate expenditure

The equilibrium level of national income

The relationship between saving and investment

The income multiplier

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

2

Economic Principles

The relationship between aggregate expenditure and aggregate demand

The paradox of thrift

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

3

Equilibrium National Income

Equilibrium price is determined by the equal contribution of both demand and costs of production. In particular, it is their interaction that determines equilibrium price.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

4

Equilibrium National Income

Similarly, the interaction of aggregate expenditure and aggregate supply contribute to equilibrium national income. In this case, however, aggregate expenditure plays a stronger role than aggregate supply.

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

5

Interaction Between

Consumers and Producers

Aggregate expenditure

• Spending by consumers on consumption goods, spending by businesses on investment goods, spending by government, and spending by foreigners on net exports.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

6

Interaction Between

Consumers and Producers

Recall that the amount of consumer income spent on consumption and saving is represented by:

Y = C + S

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

7

Interaction Between

Consumers and Producers

And recall that the amount of production goods and investment goods produced by producers is represented by:

Y = C + I i where the subscript i indicates intended as distinct from actual.

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

8

Interaction Between

Consumers and Producers

If, by chance, what producers intend to produce for consumption turns out to be precisely what consumers intend to consume, the match between intended investment and savings is written as: i

I = S

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

9

Interaction Between

Consumers and Producers

The I = S equation describes the economy in macroequilibrium. No excess demand or supply exists.

Aggregate expenditure equal aggregate supply.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

10

The Economy Moves Toward

Equilibrium

The national economy, if not already in equilibrium, is always moving toward it.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

11

The Economy Moves Toward

Equilibrium

Equilibrium level of national income

• C + I i

= C + S, where saving equals intended investment.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

12

The Economy Moves Toward

Equilibrium

Unwanted inventories

• Goods produced for consumption that remain unsold.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

13

The Economy Moves Toward

Equilibrium

Actual investment (I a

)

• Investment spending that producers actually make, which is, intended investment

(investment spending that producers intend to undertake) plus or minus unintended changes in inventories.

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

14

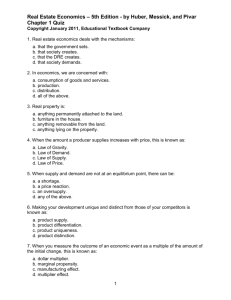

EXHIBIT 1 CONSUMERS’ AND PRODUCERS’

INTENTIONS AND ACTIVITIES, BY STAGES,

WHEN Y = $900 BILLION

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

15

Exhibit 1: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $900 Billion

Suppose the economy is at Y = $900 billion, autonomous consumption

= $60 billion, MPC = 0.80 and producers’ intended investment is $100 billion.

16

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 1: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $900 Billion

1. What are consumers’ consumption expenditures and savings in

Exhibit 1?

• If Y = C + S and C = a + bY, then consumption expenditures (C) = $60 billion + 0.8 ($900 billion) = $780 billion.

17

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 1: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $900 Billion

1. What are consumers’ consumption expenditures and saving in

Exhibit 1?

• If S = Y – C, then saving (S) = $900 billion

– $780 billion = $120 billion.

18

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 1: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $900 Billion

2. What is intended production by producers?

• If C = Y - I i and I i

= $100 billion, then intended production = $900 billion - $100 billion = $800 billion.

19

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 1: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $900 Billion

3. What is the difference between consumers’ consumption expenditures and producers’ intended production?

• Producers’ intended production ($800 billion) – consumers’ consumption expenditures ($780 billion) = $20 billion.

20

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 1: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $900 Billion

3. What is the difference between consumers’ consumption expenditures and producers’ intended production?

• The $20 billion difference is described as unwanted inventories and must be absorbed as investment.

21

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 1: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $900 Billion

3. What is the difference between producers’ intended production and consumers’ consumption expenditures?

• Producers’ actual investment ($120 billion) ends up being greater than what they had intended to invest ($100 billion).

22

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

EXHIBIT 2 CONSUMERS’ AND PRODUCERS’

INTENTIONS AND ACTIVITIES, BY STAGES,

WHEN Y = $700 BILLION

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

23

Exhibit 2: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $700 Billion

Suppose national income changes to Y = $700 billion, but MPC, autonomous consumption and intended investment all remain the same.

24

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 2: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $700 Billion

1. What are consumers’ consumption expenditures?

• C = $60 billion + 0.8 ($700 billion)

= $620 billion

25

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 2: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $700 Billion

2. What is intended production by producers?

• C = $700 billion – $100 billion = $600 billion

26

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 2: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $700 Billion

3. What is the difference between consumers’ consumption expenditures and producers’ intended production?

• Consumers’ consumption ($620 billion)

– Producers’ production ($600 billion)

= $20 billion

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

27

Exhibit 2: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $700 Billion

3. What is the difference between consumers’ consumption expenditures and producers’ intended production?

• The $20 billion difference must be converted from intended investment to consumption goods to meet demand.

28

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 2: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $700 Billion

3. What is the difference between consumers’ consumption expenditures and producers’ intended production?

• Actual investment ends up being less than intended investment.

29

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

EXHIBIT 3 CONSUMERS’ AND PRODUCERS’

INTENTIONS AND ACTIVITIES, BY STAGES,

WHEN Y = $800 BILLION

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

30

Exhibit 3: Consumers’ and

Producers’ Intentions and Activities, by Stages, When Y = $800 Billion

What is the difference between production and consumers’ expenditures in Exhibit 3?

• Production and consumption are equal at

$700 billion. The economy is in equilibrium.

31

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Equilibrium National Income

Aggregate expenditure curve (AE)

• A curve that shows the quantity of aggregate expenditures at different levels of national income or GDP.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

32

Equilibrium National Income

Aggregate expenditure curve (AE)

• The intersection of the 45 ° income curve and

AE identifies the economy’s equilibrium position.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

33

Equilibrium National Income

• When I i

> S, producers hire more workers to replace depleted inventories. Y increases and continues to increase until I i

= S.

• When S > I i

, inventories build up and producers lay off workers. Y decreases until I i

= S.

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

34

EXHIBIT 4A THE EQUILIBRIUM LEVEL OF NATIONAL

INCOME

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

35

EXHIBIT 4B THE EQUILIBRIUM LEVEL OF NATIONAL

INCOME

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

36

Exhibit 4: The Equilibrium Level of National Income

At a national income of $700 billion, aggregate expenditure is ____ the national income in panel a of Exhibit 4.

i. Greater than ii. Less than

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

37

Exhibit 4: The Equilibrium Level of National Income

At a national income of $700 billion, aggregate expenditure is ____ the national income in panel a of Exhibit 4. i. Greater than ii. Less than

38

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Changes in Investment Change

National Income Equilibrium

As long as the consumption function and the investment demand function remain unchanged, there is no reason to suppose that the level of national income would move away from equilibrium.

39

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Changes in Investment Change

National Income Equilibrium

Functions do change, however.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

40

EXHIBIT 5 CONSUMERS’ AND PRODUCERS’

INTENTIONS AND ACTIVITIES, BY STAGES,

WHEN INVESTMENT INCREASES TO $130

BILLION AND Y = $800 BILLION

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

41

Exhibit 5: Consumers’ and Producers’

Intentions and Activities, by Stages, when Investment Increases to $130

Billion and Y = $800 Billion

What happens to the equilibrium level of national income when intended investment increases in Exhibit 5?

• When intended investment increases, the supply of consumption goods decreases to

$670 billion.

42

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 5: Consumers’ and Producers’

Intentions and Activities, by Stages, when Investment Increases to $130

Billion and Y = $800 Billion

What happens to the equilibrium level of national income when intended investment increases in Exhibit 5?

• Consumers’ consumption expenditures remain at $700 billion. Consumers’ demand is greater than producers’ production.

43

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 5: Consumers’ and Producers’

Intentions and Activities, by Stages, when Investment Increases to $130

Billion and Y = $800 Billion

What happens to the equilibrium level of national income when intended investment increases in Exhibit 5?

• In an effort to meet consumers’ demand, producers hire more workers and national income increases. The equilibrium also increases.

44

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

EXHIBIT 6A DERIVING EQUILIBRIUM AT Y = $950 BILLION

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

45

EXHIBIT 6B DERIVING EQUILIBRIUM AT Y = $950 BILLION

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

46

Exhibit 6: Deriving Equilibrium at Y = $950 Billion

What is the equilibrium level of national income when intended investment increases to $130 billion in Exhibit 6?

• The equilibrium level increases to

$950 billion, where I i

= S.

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

47

Changes in Investment Change

National Income Equilibrium

The formula Y = (a + bY) + I i can be used to calculate equilibrium national income when specific values for autonomous consumption, MPC and intended investment are known.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

48

The Income Multiplier

While consumption spending, MPC, and autonomous consumption have all remained relatively stable over time, investment spending has been volatile.

49

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

The Income Multiplier

Economists identify changes in aggregate expenditure, in particular investment spending, as the key to our understanding of why national income changes.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

50

The Income Multiplier

Income multiplier

• The multiple by which income changes as a result of a change in aggregate expenditure. It is written as:

Multiplier = (Change in Y)/(Change in AE)

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

51

The Income Multiplier

The size of the multiplier depends on the marginal propensity to consume.

An initial change in investment sets in motion a chain of events that creates a larger change in national income.

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

52

The Income Multiplier

For example, suppose a business owner decides to invest $1,000 in a new technology. The producer of the technology receives an increase in income of $1,000. If MPC = 0.80, the technology producer’s consumption spending increases by $800.

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

53

The Income Multiplier

Suppose the $800 is then spent on a custom-made water bed. The carpenter that makes the water bed receives $800 of additional income.

Based on MPC, we know that she will spend $640 and save the rest.

The chain of events continues.

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

54

Changes in Foreign Trade Change

National Income Equilibrium

The influence of foreign trade on national income determination is less obvious than are the other components of aggregate expenditure. It includes both exports and imports, which have offsetting effects on the direction a national economy takes.

55

Gottheil — Principles of Economics, 6e

EXHIBIT 7 IMPACT OF FOREIGN TRADE ON NATIONAL

INCOME EQUILIBRIUM

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

56

Exhibit 7: Impact of Foreign Trade on National Income Equilibrium

In panel a, the AE curve shifts upward by $60 billion of exports, increasing national income to $1,100 billion.

• This is effect those exports have on theU.S. economy’s equilibrium.

57

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 7: Impact of Foreign Trade on National Income Equilibrium

In panel b, the AE curve shifts downward by $20 billion of imports, decreasing national income by $100 billion.

• This is the impact of imports on aggregate expenditure.

58

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

Exhibit 7: Impact of Foreign Trade on National Income Equilibrium

In panel c, the combined effect of exports and imports shifts the AE curve upward by $40 billion ($60 –

$20) of foreign trade, increasing national income by $1,000.

• That is, what was once AE = C + I is now AE

= C + I + (X - M).

59

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

EXHIBIT 8 THE MAKING OF THE INCOME MULTIPLIER

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

60

Exhibit 8: The Making of the

Income Multiplier

The additions to national income in

Exhibit 8 become _____ as economic activity progresses through successive rounds.

i. Smaller and smaller ii. Bigger and bigger

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

61

Exhibit 8: The Making of the

Income Multiplier

The additions to national income in

Exhibit 8 become _____ as economic activity progresses through successive rounds.

i. Smaller and smaller. For example, in round 2,

$800 is added. In round 3, $640 is added.

ii. Bigger and bigger

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

62

The Income Multiplier

The formula to determine the income multiplier is written:

1/(1 – MPC)

Since (1 – MPC) = MPS, the formula can be written:

1/MPS

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

63

The Income Multiplier

For example, for a $1,000 change in investment, when MPC = 0.80, the income multiplier is:

1/(1 – 0.80) = 1/(0.2) = 5

A $1,000 investment leads to a

$5,000 change in national income.

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

64

The Income Multiplier

Just as increases in aggregate expenditure stimulate the economy, cuts in aggregate expenditure drag it down.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

65

The Income Multiplier

Changes in the price level shift the

AE curve, creating changes in the equilibrium level of national income.

As the price level decreases, national income increases.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

66

EXHIBIT 9

CONVERTING

AGGREGATE

EXPENDITURE TO

AGGREGATE

DEMAND

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

67

Exhibit 9: Converting Aggregate

Expenditure to Aggregate Demand

What happens to the equilibrium national income when the price level decreases from AE

100 to AE

75

?

• A decrease in the price level leads to an increase in aggregate expenditures and movement downward along the aggregate demand curve. National income increases from $800 billion to $1,000 billion.

68

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

EXHIBIT 10

THE MULTIPLIER

EFFECT IN THE AE

AND AD MODELS

OF INCOME

DETERMINATION

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

69

Exhibit 10: The Multiplier Effect in the AE and AD Models of

Income Determination

If aggregate expenditure increases but the price level remains the same, what happens to aggregate demand?

• Aggregate demand increases, which results in an increase in national income.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

70

The Paradox of Thrift

Some people believe that putting a higher percentage of their income into saving will provide greater economic security. This is not necessarily the case, however. By trying to save more, people may actually end up saving less, or at least saving no more.

71

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

The Paradox of Thrift

The paradox of thrift

• The more people try to save, the more income falls, leaving them with no more and perhaps even less saving.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

72

The Paradox of Thrift

The intention to save more causes the saving curve to shift upwards. Saving then becomes greater than intended investment (S > I i

). The equilibrium level of national income falls.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

73

The Paradox of Thrift

• If the level of intended investment curve is horizontal, then the level of saving remains unchanged.

• If the intended investment curve is upward sloping, then the level of saving declines.

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

74

EXHIBIT 11 THE PARADOX OF THRIFT

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

75

Exhibit 11: The Paradox of Thrift

1. What happens to national income and saving when the saving curve shifts from S to S′ in panel a of

Exhibit 11?

• National income falls from $800 billion to $650 billion. Saving remains unchanged.

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

76

Exhibit 11: The Paradox of Thrift

2. What happens to national income and saving in panel b when the saving curve shifts from S to S′?

• The equilibrium level of national income falls from $800 billion to $550 billion.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

77

Exhibit 11: The Paradox of Thrift

2. What happens to national income and saving in panel b when the saving curve shifts from S to S′?

• Because the intended investment curve is upward sloping, the shift in the saving curve causes a decline in the level of investment as well.

Gottheil — Principles of Economics, 6e

© 2010 Cengage Learning

78

Exhibit 11: The Paradox of Thrift

2. What happens to national income and saving in panel b when the saving curve shifts from S to S′?

• Saving falls from $100 billion to $75 billion.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

79

The Paradox of Thrift

Increased saving is not always detrimental to our economic health. If accompanied by increased investment, increased saving is both inevitable and desirable.

© 2010 Cengage Learning

Gottheil — Principles of Economics, 6e

80