HiddenIncome_NCASFAA..

advertisement

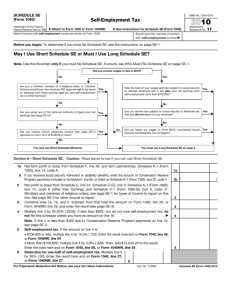

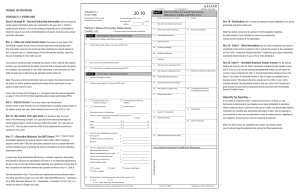

Hidden Income: Beyond the AGI Lisanne Masterson Director, Financial Aid Brevard College 828.882.8487 lisanne@brevard.edu Session Objectives • Who, What, Why, How & When – – – – Institutional Methodology Purpose Policies & Procedures Income vs. Assets • Documents – – – – Tax Returns Depreciation Passive vs. Non-passive Loss Business Balance Sheet & Statement of Owner’s Equity First Things First • Verification – Includes reconciling conflicting information • Professional Judgment – Special Circumstances • Institutional Methodology Who, What, Why, How & When • Why make these changes • Write policies and procedures to match your purpose • Used only for calculating an EFC using Institutional Methodology • Reviewing income, assets or both? Purpose (Why?) • What is your purpose in calculating an Institutional Methodology? – Limited resources, equity…. • Are you looking for just hidden income or personal “choices”? Institutional Methodology • Remember, this is not “verification” & does not change federal eligibility • Institutional policy backed by research • Calculate internally or externally? • The key is P&P & consistency Policies & Procedures (What & How) • Type of changes you will make – Income – Assets • Who will make the changes • What process will you use to make changes • How/will the student be notified • Consistency Federal Tax Return • Line items with potential “hidden income” – – – – – 8a: Interest Income (Schedule B) 9a: Dividend Income (Schedule B) 12: Business Income (Schedule C) 13: Capital Gain/Loss (Schedule D) 17: Rental Real Estate, Royalties, Partnerships, S Corps, Trusts (Schedule E) – 21: Other Income (Foreign Income Exclusion) • Personal “Choices” – Schedule A Supplemental Schedules • Not required for verification • If you have them, you must resolve conflicting information • They may help in making professional judgment decisions, as well as finding hidden income Schedules A & B • Schedule A – Itemized Deductions • Medical/Dental Expenses • Home Mortgage Interest • Gifts to Charity • Schedule B – Interest & Dividends • 1040 or 1040A, Lines 8a/8b & 9a/9b • 1099-INT; 1099-DIV • Asset Business Financial Statements • Income Statement – Revenue – Expenses = Net Income • Statement of Owner’s Equity – – – – Beginning Capital Net Income Withdrawals Ending Capital • Balance Sheet – Assets = – Liabilities + Owner’s Equity Schedule C • Profit/Loss From Sole Proprietorship • Distinguish Between “Paper” Losses and Actual Losses (i.e. Depreciation – Part 2, Line 13) • Request Business Financial Statements • Net Profit/Loss, Line 31 => 1040, Line 12 Schedule D • Capital Gain/Loss Distinguish Between “Paper” Losses and Actual Losses (i.e. Passive vs.Nonpassive Income) Actual Gain/Loss Within That Calendar Year? Schedule E • Supplemental Income/Loss • Part 1, Rental Real Estate – Are there any assets? – Depreciation • Parts 2 & 3, Income/Loss from Partnerships, S Corps, Estates & Trusts » NOT income/wages » Non-passive Loss, Schedule K-1 Schedule E • Partnerships & S Corporations – No tax at entity level but tax at partners’ level • Form 1065 – US Return of Partnership Income) => Schedule K-1 => Schedule E => 1040 Line 17 Income/Tax Form/Documents Finances 1040 Documentation Employment Wages Sole-Proprietorship Line 7 Schedule C W-2 Form Accounting Books Trade/Business Partnership S Corp Schedule E Schedule E K-1 of Form 1065 K-1 of Form 1120S Investment Income Interest/Dividend Capital Gains Rentals/Royalties Trust Funds Schedule B Schedule D Schedule E Schedule E Form 1099 INT/DIV Form 1099-B Accounting Books K-1 of Form 1041 Income/Tax Form/Documents Retirement Funds Pension/Sharing Plans IRA Non-Qual. Compensation Line 16 Line 15 Line 7 or 16 Form 1099R, Broker/Bank Broker/Bank W-2, 1099-B, Broker/Bank Education Funds Hope/Lifetime Learning Qualified Tuition Line 49 N/A Form 1098-T Broker/Bank Personal Expenses Medical Student Loan Interest Mortgage State Income Tax Property Tax Schedule A Line 33 Schedule A Schedule A Schedule A Bank Lender statement Form 1098 W-2, Bank Tax Assessment statement QUESTIONS!