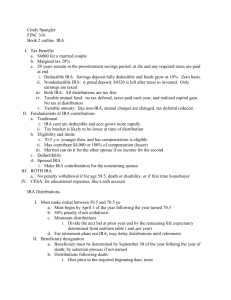

Roth IRAs

advertisement

Generating New Business During Tax Season Presented by Robert S. Keebler, CPA, MST, DEP Virchow, Krause & Company, LLP Phone: (920) 739-3345 Fax: (920) 733-6022 rkeebler@virchowkrause.com Key Developments • • • • • • • • • Status of estate and gift tax legislation New preparer penalties Family Limited Partnership issues Recent IRA Private Letter Rulings Non-spousal post-mortem IRA rollovers Charitable IRA contributions Roth IRAs Non-Qualified Deferred Compensation Retirement plan planning for the small business owner 2 Gift/Estate Tax Status 3 New Preparer Penalties 4 New Preparer Penalties Key Highlights • Preparer penalties are now extended to the preparation of estate, gift, excise, exempt organizations and employment tax returns. • Under prior law, a preparer penalty could only be imposed when the position did not have a "realistic probability of success" (i.e. one-third or greater chance of winning). However, under the new tax act, this standard now requires a "more-likely-than-not" chance of success (i.e. greater than fifty-percent chance of winning). – Notwithstanding the above, the new tax act states that the preparer penalty will not be imposed if the position is disclosed on the return (using either IRS Form 8275 or IRS Form 8275-R) and there is a "reasonable basis" for the position taken (i.e. one-third or greater chance of winning). • A new twenty-percent additional penalty is imposed on the excess of the amount of a claim for refund or credit over the amount allowable, except if the claim had a reasonable basis. 5 New Preparer Penalties Key Highlights • The "first-tier" penalty (relating to an understatement of tax from taking a "unrealistic" position) is increased from $250 to the greater of: (a) $1,000 or (b) 50-percent of the income derived (or to be derived) by the tax return preparer from the preparation of a return or claim with respect to which the penalty is imposed. • The "second-tier" penalty (relating to an understatement of tax due to a willful attempt to understate tax or a reckless or intentional disregard of the rules or regulations) is increased from $1,000 to the greater of: (a) $5,000 or (b) 50-percent of the income derived (or to be derived) by the tax return preparer from the preparation of a return or claim with respect to which the penalty is imposed. 6 New Preparer Penalties Standards Matrix IRC §6694 (PRIOR RULE) IRC §6694 (NEW RULE) STANDARD % STANDARD More Likely Than Not > 50% No Disclosure Required No Disclosure Required Realistic Possibility (Old Standard) 331/3-50% No Disclosure Required Disclosure Required Reasonable Basis (New Standard) 20-331/3% Disclosure Required Disclosure Required Frivolous Return <20% Cannot Sign Cannot Sign 7 Family Limited Partnership Issues 8 FLP Issues Valuation - Adjustments Particular types of unit’s value are adjusted based on partnership agreement terms Adjustments available Typical discount ranges Lack of Control 15% - 20% Lack of Marketability 15% - 20% 9 FLP Issues Valuation – Gifts vs. Estate • Gifts – Values determined based on actual asset transferred, not other assets owned by donor or donee – Tax exclusive - value of gift is not reduced by amount needed to pay tax • Estate – Values determined as a lump sum - not as individual assets passing to multiple people – Tax inclusive - value of estate is reduced by the amount needed to pay tax 10 FLP Issues Gift Tax Reporting • Gift tax returns need to be filed for year of gift • Valuation reports must be completed to substantiate value of gifts • Subject to three-year statute of limitation, if properly disclosed • Subject to adjustments indefinitely, if not adequately disclosed 11 FLP Issues Gift Tax Reporting – Adequate Disclosure • Description of the property transferred • Identity of and relationship between donor and donee • If to trust - trust’s EIN and description of terms of trust • CUSIP number for transfers of securities • Method to determine fair market value - or appraisal by a qualified appraiser 12 FLP Issues Gift Tax Reporting – Qualified Appraiser • Holds self out to the public as an appraiser or performs appraisals on a regular basis • The appraiser qualifications, that are in an attached description, the appraiser is qualified to make appraisals of the property transferred • The appraiser is not the donor, donee or a family member 13 FLP Issues IRS Audit Issues IRS Position Gift-onformation Valuation issues Retained life estate Difference between the gross and discounted values of partnership units gifted is an additional gift from the transferor to the transferee • Valuation discounts greater than 30% are not valid • Combined discount: 15 – 20% range (typical) Includes all of the partnership in the transferor’s taxable estate if: • Transferor has too much control • Disproportionate distributions are made to the grantor 14 FLP Issues Mitigating IRS Audit Risk • Set up separate bank accounts and/or other financial accounts in the partnership’s name • Ensure that there is not a commingling of business and personal assets in the partnership • Establish a formal accounting system whereby all income, expenses, receipts and disbursements are timely recorded • Ensure that all distributions made to partners are pro-rata with their ownership interests 15 FLP Issues Mitigating IRS Audit Risk • Ensure that all loans to partners are evidenced by a formal loan agreement that is strictly adhered to • Establish a protocol as to how business affairs should be handled and ensure that this protocol is adhered to • Ensure that all income and expenses are of a business nature and do not have any kind of personal nature • Establish a formal procedure for determining when and how income should be retained and/or disbursed 16 Recent IRA Private Letter Rulings 17 Recent IRA PLRs • PLR 200742026 - Because decedent failed to designate an IRA beneficiary who was a living person at time of his death, his daughter/sole representative of his estate cannot be treated as Code Sec. 401(a)(9) “designated beneficiary” of his IRA. Therefore, the minimum required distributions for the stated year and all subsequent calendar years cannot be calculated based on the daughter's remaining life expectancy and instead must be calculated on the remaining life expectancy of the decedent. • PLR 200707158 -Taxpayer/ IRA Beneficiary will not be subject to gift tax under Code Section 2501, upon entering into a settlement agreement which reformed the beneficiary designation or the IRA account so that his sibling was the 18 sole beneficiary of account at the decedent's death. Recent IRA PLRs • PLR 200719017 - For purposes of determining how much of net settlement proceeds payable to married taxpayers should be treated as representing IRA losses incurred by taxpayers, the amount should be allocated between taxpayers' IRAs and non-IRA account in proportion to losses incurred in each account. If allocations which represent recoveries of IRA losses are contributed to stated IRAs, allocations will be considered restorative payments not subject to limitations on contributions. • PLR 200720023 - Trustee-to-trustee transfers between IRAs (one of which was a SEPP IRA) constituted a modification to a series of substantially equal periodic payments. As a result, such modification resulted in the imposition of the 10% additional income tax. 19 Recent IRA PLRs • PLR 200736036 - IRS declined to waive the 60-day rollover requirement where the taxpayer, despite a misunderstanding of how to create an IRA online, did not show that his failure to timely accomplish a rollover was attributable to any factors outlined in Rev. Proc. 2003-16. 20 Non-Spousal PostMortem IRA Rollovers 21 Non-Spousal IRA Rollovers Pension Protection Act of 2006 • Non-spouse beneficiaries are permitted to roll over a qualified retirement plan (e.g. 401(k) plan), via trustee-to-trustee transfer, into an inherited IRA. • “Designated beneficiary” trusts are also permitted to roll over qualified retirement plans into inherited IRAs. • Effective for tax years beginning after December 31, 2006 CAUTION: The inherited IRA must be set up under the decedent qualified plan owner’s name (e.g. “John Smith, Deceased, IRA f/b/o Jane Smith, beneficiary) 22 Non-Spousal IRA Rollovers Pension Protection Act of 2006 EXAMPLE 1 – Inherited IRA Held by Beneficiary On March 15, 2007, Betty Smith passes away, naming her son Dave as sole beneficiary of her 401(k). On August 3, 2007, Dave transfers his mother's 401(k) to an inherited IRA for his benefit via a trustee-to-trustee transfer. Under the new tax law, Dave is permitted to make this postmortem transfer to an inherited IRA for his benefit, thereby allowing him to stretch the IRA withdrawals over his life expectancy. 23 Non-Spousal IRA Rollovers Pension Protection Act of 2006 EXAMPLE 2 – Inherited IRA Held by Qualified Trust Assume the same facts as Example 1, except that Betty named a trust, for the benefit of Dave, as beneficiary of her 401(k). In this case, the trustee would be permitted to make a post-mortem trustee-to-trustee transfer of the 401(k) into an inherited IRA for Dave's trust’s benefit. 24 Non-Spousal IRA Rollovers Notice 2007-7 • Non-Spouse rollovers only allowed if plan allows for such rollovers. • If under the five-year rule because of optional plan provision or beneficiary election, must perform rollover by December 31st of year following year of death to switch to life expectancy method under IRA. 25 Non-Spousal IRA Rollovers Notice 2007-7 Year of Death Applicable Payout under the Plan Amount Allowed to be Rolled Over Applicable Payout under the IRA 2002 and earlier 5-year rule None (Notice 2007-7, A-17(b)) NA – No Rollover Permitted 2003 2005 5-year rule Amount not already distributed from Plan as long as rollover completed before year containing fifth anniversary of death (Notice 20077, A-17(b)) 5-year rule (Notice 2007-7, A-19) All Life Expectancy All, minus prior and current year RMDs (Notice 2007-7, A-17(c)(1)) Life Expectancy (Notice 2007-7, A-19) 2006 and later 5-year rule under Treas. Reg. § 1.401(a)(9)-3, Q&A 4(b) or (c) (optional plan provision or election by beneficiary) All, minus prior and current year RMDs (Notice 2007-7, A-17(c)(2)) Life Expectancy of Beneficiary if rollover occurs prior to the end of the year following the year of death (Notice 2007-7, A17(c)(2)). Otherwise 5-year rule. 26 Non-Spousal IRA Rollovers Notice 2007-7 • Example 1 – John dies in 2002. George inherits John’s qualified plan. Under the plan, the five-year applies. George cannot perform a rollover to an inherited IRA. 2002 = No Rollover • Example 2 – John dies in 2004. George inherits John’s qualified plan. Under the plan, the five-year rule applies. George can perform a rollover to an inherited IRA, but must still use the 5-year rule. 2003-2005 = Rollover + Five Year Rule 27 Non-Spousal IRA Rollovers Notice 2007-7 • Example 3 – John dies in 2004. George inherits John’s qualified plan. Under the plan, George can utilize his life expectancy. George can perform a rollover to an inherited IRA and continue to utilize his life expectancy. • Example 4 – John dies in 2007. George inherits John’s qualified plan. Under the plan, the 5-year applies. If George performs a rollover to an inherited IRA by December 31, 2008, he can utilize his life expectancy for RMDs from the IRA. 28 Charitable IRA Contributions 29 Charitable IRA Contributions Pension Protection Act of 2006 • Effective for distributions made after 12/31/2005 but before 1/1/2008, taxpayers may choose to exclude from gross income, on an annual basis, “qualified charitable distributions” from IRAs to the extent that the aggregate amount of such distributions does not exceed $100,000 in any given tax year. CAUTION: This provision only applies to distributions from traditional IRAs (not SEPs or SIMPLE IRAs) and taxable distributions (i.e. non-qualified distributions) from Roth IRAs. 30 Charitable IRA Contributions Pension Protection Act of 2006 • A “qualified charitable distribution” is an otherwise taxable distribution from a traditional IRA or Roth IRA which is: – Made directly by the IRA trustee to an IRC §170(b)(1)(A) charitable organization (other than a IRC §509(a)(3) private foundation or a IRC §4966(d)(2) donor advised fund) AND – Made on or after the date in which the IRA owner has attained 70½ 31 Roth IRAs 32 Roth IRAs • 100% of growth is tax-exempt • No required minimum distributions at age 70½ – NOTE: Distributions from Roth IRAs cannot be used to fulfill the RMD from a traditional IRA • $100,000 Modified Adjusted Gross Income (MAGI) limitation • RMDs on Inherited Roth IRAs • Roth 401(k) plans 33 Roth IRAs • Starting in 2010, the $100,000 Adjusted Gross Income (AGI) limitation no longer applies – The taxable income recognized on a Roth IRA conversion in 2010 may be spread over the following two tax years (i.e. 2011 and 2012) • Married Filing Separately taxpayers can convert to a Roth IRA 34 Roth IRAs Mathematics of Roth IRA Conversions • Critical decision factors – Tax rate differential • Year of conversion vs. withdrawal years – Use of “outside funds” (i.e. non-qualified retirement accounts) to pay the income tax liability – Time horizon – IRC §691(c) “effect” 35 Roth IRAs Roth IRA Conversion Timeline 1/1/2007 – First day conversion can take place Conversion Period Recharacterization Period 2007 2008 12/31/2007 – Last day conversion can take place 4/15/2008 – Normal filing date for 2007 tax return / last day to recharacterize 2007 Roth IRA conversion 10/15/2008 – 12/31/2008 Latest filing date for 2007 tax return / last day to recharacterize 2007 Roth IRA conversion 36 Non-Qualified Deferred Compensation 37 NQDC Advantages & Disadvantages • Advantages – Company – – – – Can be discriminatory Generally non-regulated by ERISA, DOL and IRS Customized and unlimited benefits Can be forfeited • Disadvantages – Company – No current income tax deduction for accrued liability and expense of benefits 38 NQDC Advantages & Disadvantages • Advantages - Employee – Deferral of tax until benefits are received • Disadvantages - Employee – – – – Security of future benefits Risk of forfeiture Subject to Social Security and Medicare payroll taxes No rollovers available 39 NQDC Consequences of Improper Deferral • All plan deferrals are included in gross income as soon as they are no longer subject to a substantial risk of forfeiture • Deferrals subject to 20% additional tax, plus interest equal to the IRS underpayment rate plus 1% • Form defects may affect all plan participants • Operational defects affect only those that benefit 40 NQDC Deferral Requirements • Restrictions on distributions • Timing of deferral elections – Initial – Subsequent • No acceleration of benefits • Rules related to funding 41 NQDC Permitted Distributions • • • • Employee’s separation from service Death Disability Specified time or fixed schedule established at deferral – Occurrence of an event is not considered specific time (e.g., child enters college) • Change in control • Unforeseeable emergency 42 NQDC Timing of Initial Election • Election must be made in preceding tax year – Election is prior to services being performed – Exception: 30 days after date of initial eligibility • Performance-based compensation – Election must be made 6 months before service period ends – Service period must be at least 12 months • Distribution timing and form specified at deferral 43 NQDC Funding Restrictions • Offshore trusts – Assets in offshore rabbi trust are taxable immediately − Exception for assets in foreign jurisdiction if substantially all services were performed in such jurisdiction • Financial health triggers 44 NQDC IRC §409A Effective Dates • Effective for amounts deferred in tax years after 2004 • An amount is considered deferred before 2005 if: – Service provider has legal binding right to payment and – Amount is earned and vested before that date • Grandfather rule • Effective if plan materially modified after 10/03/04 • Effective date for earnings the same as the deferrals 45 Retirement Plan Planning for the Small Business Owner 46 Retirement Plan Planning 2007 Contribution Limits 401(k) maximum elective deferral - $15,500 Maximum catch-up 401(k) deferral (taxpayers > age 49) - $5,000 Roth 401(k) maximum elective deferral - $15,500 Maximum catch-up Roth 401(k) deferral (taxpayers > age 49) - $5,000 Compensation cap - $225,000 Defined benefit maximum - $180,000 Defined contribution maximum - $45,000 SEP compensation limit - $225,000 Maximum SIMPLE contribution - $10,500 Maximum SIMPLE catch-up contribution - $2,500 “Highly compensated employee” earnings threshold - $100,000 “Key employee” earnings threshold - $145,000 47 Retirement Plan Planning 2007 Contribution Limits Maximum traditional IRA contribution - $4,000 Maximum traditional IRA catch-up contribution (owner > 49) - $1,000 Deductible traditional IRA AGI phase-out amounts: Single/Head of Household: $52,000 - $62,000 Married filing jointly*: $83,000 - $103,000 Married filing jointly**: $156,000 - $166,000 Married filing separately: $0 - $10,000 Maximum Roth IRA contribution - $4,000 Maximum Roth IRA catch-up contribution (owner > 49) - $1,000 Roth IRA AGI phase-out amounts: Single/Head of Household: $99,000 - $114,000 Married filing jointly: $156,000 - $166,000 Married filing separately: $0 - $10,000 * Applies when both taxpayers are considered “active participants” in an eligible employer retirement plan ** Applies when one spouse is not considered to be an “active participant” in an eligible employer retirement plan 48 Retirement Plan Planning Comparison of Plan Types SEP SIMPLE IRA 100 or fewer employees with at least $5,000 of compensation for the prior calendar year. DESIGN-BASED SAFE HARBOR 401 (k) PLAN Eligible Employers No limit on number of employees. Plan Year Must be calendar Must be calendar year. year or fiscal year of employer. Can be established after end of employer’s fiscal year. Any 12 month period. Document Form 5305-SEP Qualified plan document. Form 5305-SIMPLE or Form 5304-SIMPLE, prototype or individually drafted. No limit on the number of employees. 49 Retirement Plan Planning Comparison of Plan Types SEP SIMPLE IRA DESIGN-BASED SAFE HARBOR 401 (k) PLAN Other Qualified Plans? Yes, if using prototype SEP document. No-Must be the only plan-covering employees. Yes Related Employer Rules Apply? Yes Yes Yes Eligible Employees May impose age 21 requirement, but must contribute for any employee who earned at least $500 in 3 of last 5 years. May exclude union employees Any employee who received $5,000 of compensation in any prior 2 years and is expected to receive $5,000 in current plan year. No age limit permitted. May exclude union employees. Qualified plan rules apply. Can require age 21 and one year of service. May exclude union employees. 50 Retirement Plan Planning Comparison of Plan Types SEP SIMPLE IRA DESIGN-BASED SAFE HARBOR 401 (k) PLAN Coverage testing Does not apply. Does not apply. Applies. Elective Contributions N/A 2007 limited to $10,500 per calendar year, then indexed. 60-day election period required prior to beginning of plan year. Limited $15,500 per calendar year; notice must be provided within “reasonable” period prior to beginning of plan year. Catch up contributions for individuals age 50 and over. N/A $2,500 in 2007 Indexed for inflation. Over and above 402(g) limit the lesser of 1) $5,000 in 2007. Indexed for inflation. 2) participants compensation for the year reduced by other elective deferrals for the year. (Not subject to ADP/ACP) 51 Retirement Plan Planning Comparison of Plan Types DESIGN-BASED SAFE HARBOR 401 (k) PLAN SEP SIMPLE IRA Matching Contributions N/A Dollar for dollar match, up to 3% of compensation. May be reduced down to 1% cap in 2 of 5 years. Dollar for dollar match, up to 3% of compensation plus $0.50 on the dollar from 3 – 5% of compensation. (May not impose a last-day rule or 1,000 hours of service rule for active or terminated participants.) 100% immediate vesting. Non-elective contribution Lesser of 25% compensat ion or $45,000 gross. In lieu of match, 2% of compensation for all participants with at least $5,000 of compensation. In lieu of match, 3% of compensation for all participants. (May not impose a last-day rule or 1,000 hours of service rule for active or terminated participants.) 100% immediate vesting. 52 Retirement Plan Planning Comparison of Plan Types SEP SIMPLE IRA DESIGN-BASED SAFE HARBOR 401 (k) PLAN Subject to ADP/ACP testing N/A NO No, if matching or nonelective safe harbor contributions are made. Other Employer Contributions Permitted? N/A No-only deferrals and required match or nonelective contribution may be made. Yes, contributions such as profit sharing may be made and may be subject to 1,000 hour/last day requirements and a vesting schedule. Vesting Allowed? NO NO Yes, except for safe harbor contributions. 53 Retirement Plan Planning Comparison of Plan Types SEP SIMPLE IRA DESIGN-BASED SAFE HARBOR 401 (k) PLAN Top Heavy Rules YES NO Yes, but both 3% nonelective & match contribution made to satisfy safe harbor may be used to satisfy the topheavy minimum contribution. Loans No No Yes Rollovers May be rolled to qualified plan, §403(b) plan or a governmental §457 plan. Accepts SIMPLE IRA rollovers only. May be rolled to a qualified plan, §403(b) plan or a governmental §457 plan. Qualified plan rules apply. 54 Retirement Plan Planning Comparison of Plan Types DESIGN-BASED SAFE HARBOR 401 (k) PLAN SEP SIMPLE IRA Withdrawals Permitted anytime, subject to 10% penalty if under age 59 ½. Permitted anytime, but 10% penalty increased to 25% if employee is under age 59 ½ and withdrawal is in first 2 years of plan. Terms of plan control. Section 401(k) deferral restrictions apply. Minimum Distributions Must start by April 1 of the year following calendar year in which age 70 ½ is attained. Same as SEP. Must start by April of year following later of 1)calendar year age 70 ½ is attained or 2) calendar year retires, if employee is not a 5 % owner, the rule is same as for SEP and SIMPLE IRA Form 5500 NO NO YES 55 Retirement Plan Planning Comparison of Plan Types SEP SIMPLE IRA DESIGN-BASED SAFE HARBOR 401 (k) PLAN Trust Accounting NO NO YES Transmittal of Elective Contributions N/A Earlier of: 1) 30 days after close of month or 2) earliest date employer is able to segregate from its assets. Earlier of: 1) 15th business day of the following month or 2) earliest able to segregate. 56 Conclusion 57