Chapter 14 Guidelines

advertisement

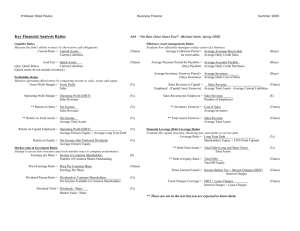

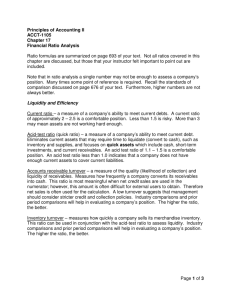

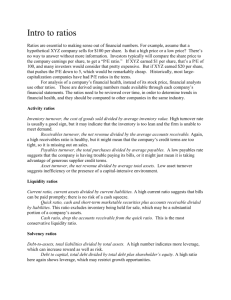

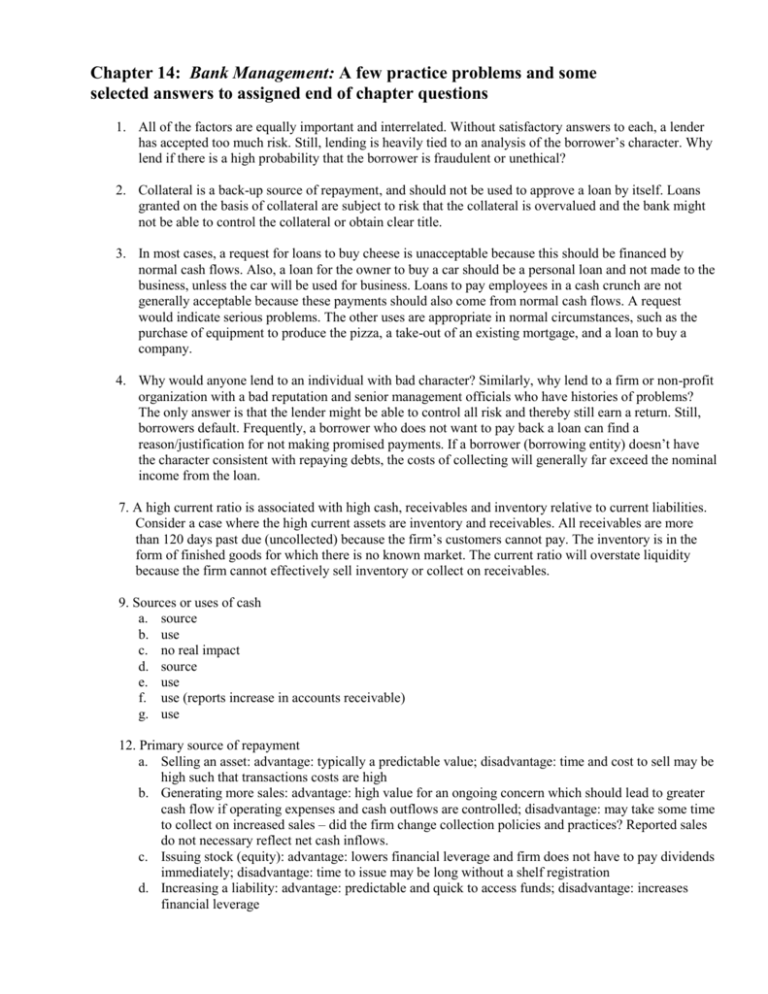

Chapter 14: Bank Management: A few practice problems and some selected answers to assigned end of chapter questions 1. All of the factors are equally important and interrelated. Without satisfactory answers to each, a lender has accepted too much risk. Still, lending is heavily tied to an analysis of the borrower’s character. Why lend if there is a high probability that the borrower is fraudulent or unethical? 2. Collateral is a back-up source of repayment, and should not be used to approve a loan by itself. Loans granted on the basis of collateral are subject to risk that the collateral is overvalued and the bank might not be able to control the collateral or obtain clear title. 3. In most cases, a request for loans to buy cheese is unacceptable because this should be financed by normal cash flows. Also, a loan for the owner to buy a car should be a personal loan and not made to the business, unless the car will be used for business. Loans to pay employees in a cash crunch are not generally acceptable because these payments should also come from normal cash flows. A request would indicate serious problems. The other uses are appropriate in normal circumstances, such as the purchase of equipment to produce the pizza, a take-out of an existing mortgage, and a loan to buy a company. 4. Why would anyone lend to an individual with bad character? Similarly, why lend to a firm or non-profit organization with a bad reputation and senior management officials who have histories of problems? The only answer is that the lender might be able to control all risk and thereby still earn a return. Still, borrowers default. Frequently, a borrower who does not want to pay back a loan can find a reason/justification for not making promised payments. If a borrower (borrowing entity) doesn’t have the character consistent with repaying debts, the costs of collecting will generally far exceed the nominal income from the loan. 7. A high current ratio is associated with high cash, receivables and inventory relative to current liabilities. Consider a case where the high current assets are inventory and receivables. All receivables are more than 120 days past due (uncollected) because the firm’s customers cannot pay. The inventory is in the form of finished goods for which there is no known market. The current ratio will overstate liquidity because the firm cannot effectively sell inventory or collect on receivables. 9. Sources or uses of cash a. source b. use c. no real impact d. source e. use f. use (reports increase in accounts receivable) g. use 12. Primary source of repayment a. Selling an asset: advantage: typically a predictable value; disadvantage: time and cost to sell may be high such that transactions costs are high b. Generating more sales: advantage: high value for an ongoing concern which should lead to greater cash flow if operating expenses and cash outflows are controlled; disadvantage: may take some time to collect on increased sales – did the firm change collection policies and practices? Reported sales do not necessary reflect net cash inflows. c. Issuing stock (equity): advantage: lowers financial leverage and firm does not have to pay dividends immediately; disadvantage: time to issue may be long without a shelf registration d. Increasing a liability: advantage: predictable and quick to access funds; disadvantage: increases financial leverage e. Decreasing expense: advantage: long-term effect if successful; disadvantage: difficult to achieve during the near term f. Reducing dividends: advantage: predictable; disadvantage: loss in share price and perceived stockholder value. 13. Ratios: a. Current ratio: $1,280/$980 = 1.31X b. Days accounts receivable = $700/($9,125/365) = 28 days c. Inventory turnover = $6,100/($500) = 12.2X d. Days accounts payable outstanding = $400/($6,100/365) = 23.9 days; need to know purchases; assume that inventory is unchanged for the period. If so, purchases equal cost of goods sold or $6,100. e. Long-term debt / equity = $550/$970 = 0.57 f. Times interest earned = ($9,125-$6,100-$2,550)/$101 = 4.7X g. ROE = $216/$970 = 22.27% h. $9,125/$2,500 = 3.65X 14. a. Debt service requirements with prime at 8% (effective rate at 10%) are: Principal + interest + dividends = Year 1: $500,000 + $150,000 + $140,000 = $790,000 = Year 2: $500,000 + $100,000 + $140,000 = $740,000 = Year 3: $500,000 + $50,000 + $140,000 = $690,000 Cash flow from operations – (principal + interest + dividends) Year 1 = $750,000 - $790,000 = -$40,000 Year 2 = $780,000 - $740,000 = +$40,000 Year 3 = $800,000 - $690,000 = +$110,000 b. If prime equals 9%, interest payments increase by: $15,000 in Year 1; $10,000 in Year 2; and $5,000 in Year 3. Net cash flow in Year 1: -$55,000; Year 2: $30,000; Year 3: $105,000 If prime equals 10%, interest payments increase by: $30,000 in Year 1; $20,000 in Year 2; and $10,000 in Year 3 with corresponding changes in net cash flow. 15. A partial list of questions would include: a. What is the experience level of the firm's officers? b. If Marcus Wade were to die, who would take over as president? c. Who are the minority owners? d. How many people does Wade's employ? Are they unionized? e. What companies are major suppliers to Wades? Has the firm ever had difficulty obtaining raw materials? Can the bank inspect the inventory? f. Why did Wade's sales increase so dramatically in 2008? g. What is the nature and timing of the firm's production process? h. How does Wades recognize bad debts and uncollectible receivables? i. What are Wade's terms on credit sales? j. Why does Wades not pay dividends? Chapter 14 Sample Questions: Evaluating Commercial Loan Requests and Managing Credit Risk 1. According to information from the Federal Reserve Board, delinquencies at commercial banks on “all loans and leases” peaked in ________: a. 2007 b. 2008 c. 2009 d. 2010 e. 2011 2. According to information from the Federal Reserve Board, delinquencies at commercial banks on “all loans and leases” have fallen to levels last seen in ________: a. 2007 b. 2008 c. 2009 d. 2010 e. 2011 3. As of mid October of 2011, the largest bank by assets in the United States was: a. JP Morgan Chase b. Bank of America c. Wells Fargo d. Citibank e. Goldman Sachs 4. As of the end of 2010, the largest bank by assets in the United States was: a. JP Morgan Chase b. Bank of America c. Citibank d. Goldman Sachs e. Wells Fargo 5. As of mid October of 2011, the second largest bank by assets in the United States was: a. JP Morgan Chase b. Bank of America c. Wells Fargo d. Citibank e. Goldman Sachs 6. Which of the following is not one of the essential issues in evaluating commercial loan requests? a. The structure of the borrower’s board of directors. a. The character of the borrower. b. The use of the loan proceeds. c. The source of repayment for the loan. d. The amount the customer needs to borrow. 7. All of the following are basic sources of cash flows except: a. liquidating assets. b. cash flows from operations. c. issuing new equity. d. liquidating liabilities. e. issuing new debt. 8. Which of the following characteristics should collateral have? a. The value of the collateral should not exceed the value of the loan. b. The collateral should be highly liquid. c. The lender must be able to perfect a lien on the collateral. d. a. and b. only. e. b. and c. only. 9. Which of the following is not part of the four-stage process for evaluating the financial aspects of commercial loans? a. An analysis of the firm’s management, operations, and industry. b. Performing financial ratio analysis. c. Analyze the firm’s cash flow. d. Examining the backgrounds of the sales force. e. Project the borrower’s financial condition. 10. Which of the following is a correct interpretation of a total asset turnover of .33 (one-third)? a. For each $1 of sales generated by the firm it requires $3 in assets. b. For each $1 of assets owned by the firm it generates $3 in sales. c. For each $3 of sales, the firm makes $1 in net profit after taxes. d. The firm completely replenishes its available assets 3 times per year. e. The firm completely replenishes its available assets every 3.0 days. 11. Your company had net sales of $70,000 over the past year. During that time, average receivables were $10,000. What was the average collection period? a. 7 days b. 12 days c. 30 days d. 43 days e. 52 days 12. Which of the following items is included as part of a company's current assets? Accounts payable. a. Inventory. b. Accounts receivable. c. d. Statements b and c are correct. All of the statements above are correct. e. 13. All else being equal, which of the following will increase a company's current ratio? An increase in accounts receivable. a. An increase in accounts payable. b. c. An increase in net fixed assets. d. Statements a and b are correct. e. All of the statements above are correct. 14. 14. Which of the following alternatives could potentially result in a net increase in a company's cash flow for the current year? 15. a. a Reduce the days sales outstanding ratio. b. . Increase the number of years over which fixed assets are depreciated c. Decrease the accounts payable balance. d. a Statements a and b are correct. e. . All of the statements above are correct. 15. How efficiently a firm is using its assets is measured by: a. liquidity ratios. b. market value ratios. c. profitability ratios. d. activity ratios. e. leverage ratios. 16.A firm’s mix of debt and equity is measured by: a. liquidity ratios. b. market value ratios. c. profitability ratios. d. activity ratios. e. leverage ratios. 17. A firm’s ability to meet its short-term debt obligations is measured by: a. liquidity ratios. b. market value ratios. c. profitability ratios. d. activity ratios. e. leverage ratios. 18. Which financial ratio measures a firm’s ability to pay current interest and lease payments with current earnings? a. Fixed charge coverage ratio b. Return on equity c. Current ratio d. Inventory turnover e. Debt to total assets ratio 19. A firm has the following financial statement data: Sales = $1,000, COGS = $400, Operating Expenses = $200, and Taxes = $200. What is the firm’s profit margin? a. 10% b. 20% c. 30% d. 40% e. 60% 20. A firm has the following financial statement data: Sales = $2,000, COGS = $800, Operating Expenses = $600, and Taxes = $400. What is the firm’s profit margin? a. 10% b. 20% c. 30% d. 40% e. 60% 21. Cash flows from a firm’s normal business activities are reflected in: a. cash flows from investing. b. cash flows from financing. c. cash flows from operations. d. cash flows from income. e. cash flows from budgeting. 22. All of the following are sources of cash except: a. an increase in long-term debt. b. a decrease in inventory. c. a new equity issue. d. a decrease in notes payable. e. an increase in accounts payable. 23. Which of the following is not a use of cash? a. A decrease in accounts payable b. An increase in inventory c. An increase in accounts receivable d. The payment of cash dividends e. An increase in wages payable Use the fFollowing information on Dylan Enterprises for questions 24- 29 Income Statement Revenues Less: Cost of Goods Sold Gross Profit Less: Operating Expenses Less: Depreciation Operating Profit Less: Interest Expense Net Profit Before Taxes Less: Taxes Net Income $320,000,000 $162,000,000 $158,000,000 $120,000,000 $11,000,000 $27,000,000 $8,500,000 $18,500,000 $6,290,000 $12,210,000 Earnings Available to Common Dividends Paid (60% of EAC) Addition to Retained Earnings $12,210,000 $7,326,000 $4,884,000 Earnings Per Share Assets Cash Marketable Securities Accounts Receivable Inventory Pre-Paid Expenses Total Current Assets Long-Term Assets Total Assets Liabilities Accounts Payable Short-Term Debt Total Current Liabilities Long-Term Debt (8%) Total Liabilities Common Stock ($1 Par) Paid-In Capital Retained Earnings Total Equity Total Liabilities and Equity $6.11 Balance Sheet Current Year $1,500,000 $1,500,000 $57,000,000 $106,000,000 $8,400,000 $174,400,000 $148,000,000 $322,400,000 Prior Year $3,000,000 $3,200,000 $44,000,000 $99,000,000 $11,000,000 $160,200,000 $154,000,000 $314,200,000 Change ($1,500,000) ($1,700,000) $13,000,000 $7,000,000 ($2,600,000) $14,200,000 ($6,000,000) $8,200,000 Current Year Prior Year Change $8,716,000 $102,000,000 $110,716,000 $115,000,000 $225,716,000 $2,000,000 $65,000,000 $29,684,000 $96,684,000 $322,400,000 $6,400,000 $105,000,000 $111,400,000 $111,000,000 $222,400,000 $2,000,000 $65,000,000 $24,800,000 $91,800,000 $314,200,000 24. What were Dylan's cash receipts during the year? a. $307,000,000 b. $320,000,000 c. $323,000,000 d. $424,000,000 e. $482,000,000 Cash Receipts From Sales = Net Sales – Change in Accounts Receivable Cash Receipts From Sales = $320,000,000 - $13,000,000 = $307,000,000 $2,316,000 ($3,000,000) ($684,000) $4,000,000 $3,316,000 $0 $0 $4,884,000 $4,884,000 $8,200,000 25. What is Dylan's cash flow from operations? a. -$2,874,000 b. $8,126,000 c. $12,210,000 d. $19,126,000 e. $23,210,000 Cash Flows from Operating Activities Net Income Adjustments to Net Income Deprecation Change in Accounts Receivables Change in Inventory Change in Pre-Paid Expenses Change in Accounts Payable Total Net Cash Provided (Used) by Operating Activities $12,210,000 $11,000,000 ($13,000,000) ($7,000,000) $2,600,000 $2,316,000 ($4,084,000) $8,126,000 26. What is Dylan's current ratio for the current year? a. 1.36 b. 1.44 c. 1.58 d. 1.68 e. 1.71 Current Ratio = Current Assets/Current Liabilities = $174,400,000/$110,716,000 = 1.575 27. What is Dylan's return on assets for the current year? a. 3.8% b. 5.1% c. 5.4% d. 12.6% e. 13.3% ROA = Net Income/Total Assets = $12,210,000/$322,400,000 = .0378 28. What is Dylan's equity multiplier for the current year? a. 0.30 b. 0.63 c. 1.52 d. 2.67 e. 3.33 Equity Multiplier = Total Assets/Common Equity = $322,400,000/$96,684.000 = 3.33 29. What is Dylan's return on equity for the current year? a. 3.8% b. 5.1% c. 5.4% d. 12.6% e. 13.3% Return on Equity = Net Income/Common Equity = $12,210,000/$96,684,000 = .1263 Or Return on Equity = ROA * Equity Multiplier = .0378 * 3.33 = .1258 30. At a minimum, cash flow from operations should cover: a. interest on long-term debt. b. dividends plus mandatory principal payments on debt. c. capital expenditures plus dividends. d. the change in marketable securities. e. dividends plus interest. 31.Under which category are dividends classified on the statement of cash flows? a. Cash From Investing Activities b. Cash From Operating Activities c. Cash From Financing Activities d. Cash From Profit Activities e. None of the above 32. Which of the following would cause a firm's ROE to be high, but its ROA to be low? a. A low gross profit margin but a high net profit margin. b. Financing a relatively large proportion of assets with equity. c. Paying very low interest rates on the firm's debts. d. Leasing a large amount of equipment. e. Financing a relatively large proportion of assets with debt. 16. 17. c . 18. d . 19. e .