BNY Mellon knows the Level I ADR Universe and is fully committed

advertisement

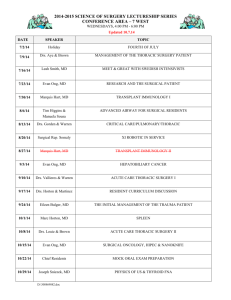

Financial Markets and Treasury Services Sector October 20, 2009 Access to US Capital Markets: Opportunities in Challenging Times Presented by Nuno da Silva, DR Head of Latin America & Jason Paltrowitz, DR Head of Global Capital Markets Section I. BNY Mellon Overview 2 Highlights of BNY Mellon $20.2 trillion assets under custody and administration $928 billion in assets under management $11 trillion in outstanding debt serviced Strong financial ratings: S&P AA-; Moody’s Aa2; Fitch AA- As of December 31, 2008 3 Why is BNY Mellon Hosting this Seminar? BNY Mellon knows the Level I ADR Universe and is fully committed to its growth and development Level I Sponsored Program Market Share Others 23% 523 Clients 77% BNY Mellon’s Experience with Level I Programs is Unparalleled 4 Section II. Demystifying ADRs 5 6 Myth 1: “ADRs are no longer necessary, because investors can invest in my local shares easily” 7 The importance of ADRs continues to grow ADR Trading Volume US$ Billions US$ 4,4 trillion In 2008, investment and trading volume of ADRs reached record levels. 8 Myth 2: “Level I ADRs are only for small, unknown companies” 9 Many of the largest companies in the world have Level I ADR programs Level I ADR programs traded in the OTC market: 10 Nestle Largest food company in the world Volkswagen Largest auto company in Europe BASF Largest chemical company in the world Gazprom Largest Oil & Gas company in the world Usiminas Largest steel producer in Latin America JBS Largest meet producer in the world Wal-Mart de Mexico Largest retail company Myth 3: “A Level I ADR program will enhance the visibility of our company in the US” There is a key distinction bewteen “access” and “visibility” Access and Visibility: ADR Characteristics Investor Relations DTC Settlement Settlement in US$ Quoted in US$ Real time quotations Familiar brokerage and clearing Broker conferences Roadshows Media relations/advertising OTCQX Investor events ADR PROVIDES ACCESS 12 IR INCREASES + VISIBILITY Myth 4: “There is limited demand for Level I ADRs, so it’s not worth the effort” 13 New Level I ADR Programs received over US$ 1 Billion No. of ADR Programs 3,078 programs More than US$ 1 billion in 1Q09 Through 1Q09, 700 new Level I ADR programs attracted over US$ 1 billion 14 Myth 5: “An ADR program will split the liquidity of my shares” 15 Empirical evidence shows that ADRs increase share liquidity The average positive impact to liquidity of local shares is 48%: Hundreds of ADR programs were analyzed between 1980-2007 16 Section III. ADR Overview 17 Depositary Receipt Market Highlights • At year-end more than 2,900 DR programs from 80 countries were available to investors, up from 2,200 a year ago • 2008’s trading value reached $4.4 Annual DR Trading trillion in U.S. and non U.S.-listed U.S.-Listed programs as well as OTC-traded DRs, 4,800 120 exceeding the record set in 2007 4,000 100 80 • Issuers from 16 countries completed 41 3,200 2,400 60 initial public offerings (IPOs) and follow- 1,600 40 800 20 on offerings in 2008 Value ($bb) Volume (bb) 0 0 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 In 2008, DR program trading and investment reached record levels. 18 Depositary Receipt Market History 2,500 2008 – Unprecedented Volatility Regulatory change Unsponsored growth – more DR supply 2003 to 2007 - Markets Rebound and Grow 2,000 Falling U.S. dollar, low interest rates drive DR prices Total Number of DR Programs International equity markets outperform and U.S. investors follow – rise of BRICs Depositary banks increasingly act as consultants 2001 to 2002 –Markets Consolidate 1,500 Technology bubble implosion Corporate Governance reemphasis (Enron, WorldCom) Greater demands placed on a depositary banks 1990 to 2000 – Explosive Growth in the DR Market 1,000 Structural changes, decimalization and tighter spreads DRs used in privatizations, capital raisings and M&A Depositary role largely administrative and operational 500 1930 to 1989 –DR Market largely unsponsored and investor driven Depositary role totally administrative and operational 0 1930 '35 '40 '45 '50 Source: BNY Mellon; December 31, 2008 19 '55 '60 '65 '70 '75 '80 '85 '90 '95 '00 2007 2008 BNY Mellon Depositary Receipt Leader in All Relevant Markets •63% of Global DR Programs •74% of Latin American DR Programs •78% of Brazil DR Programs 28 273 18 10 46 276 241 All DR Programs From Brazil All DR Programs From Latin America All DR Programs Global 1331 206 BNY Mellon 20 J.P. Morgan Citibank 102 Deutsche Bank Section IV. Introduction to Level I ADR Programs 21 What Are Depositary Receipts? Negotiable securities issued by a depositary bank that represent a non-U.S. company's publicly traded equity. American DRs G lobal • Can be used to list on stock exchanges around the world • Can be used to raise capital (IPOs or follow-on offerings) • Can be adapted to meet specific marketing needs 22 Creating Depositary Receipts from Local Market Instructs Brazilian Broker to Purchase Ordinary Shares U.S. Broker DTCC Delivers DRs to Broker’s Custodian or Euroclear / Clearstream credits participants account Depositary Creates DRs and Delivers to Depositary Trust & Clearing Corporation or Euroclear / Clearstream 23 Brazilian Broker T+3 Settlement Broker Purchases Ordinary Shares on Bovespa and Delivers Ordinary Shares to Local Custodian Local Custodian Takes Delivery and Confirms to Depositary Depositary Receipt Benefits Issuer Benefits Access deep international capital markets Increase share valuation and liquidity Diversify and broaden shareholder base Prepare for future acquisitions Express international commitment Heighten profile for products and services 24 Depositary Receipt Benefits Investor Benefits Access over 2,000 DRs from 76 countries Obtain quotes in U.S. dollars Receive dividends in U.S. dollars Clear and settle in globally recognized systems Overcome foreign investment restrictions Access improved information in English 25 DRs Provide Access to Deep Capital Markets Level II & III DR Level I DR (OTC) 144A/RegS - Bovespa - Brazilian Institutions - Brazilian Retail - US and European Institutions with presence in Brazil Qualified U.S. Institutional Buyers (QIBs – with over $100 MM in assets) and European investors with clearing and settlement structures in Brazil - (SEC Registered & Listed) US and European Institutions that don’t have clearing and settlement structures in Brazil but seek Brazilian equity opportunities - Mutual/Pension Funds that are required to hold U.S. DTC securities - Sophisticated US Retail Investors DRs will increase access to institutional and retail investors 26 - US and European Institutional Investors that prefer SECregistered securities and familiar trading and settlement structures - Mutual/Pension Funds that are required to hold U.S. securities - US Retail Investors Introduction - Level I DR Program Level I DRs: Level I DR programs offer an easy method for reaching U.S. investors. Level I DRs trade in the “Over the Counter” (OTC) market with prices published in Pink Sheets and on some exchanges outside the U.S. A sponsored Level I program allows non-U.S. issuers to realize the benefits of issuing a U.S. publicly traded security without changing their reporting processes. In order to establish a Level I program, the Company does NOT have to: • Comply with the Sarbanes-Oxley Act. • Reconcile to U.S. GAAP • Change its current financial and disclosure reporting procedures. (U.S. SEC disclosures) • Issue any new shares for the DR program Size of the Market: The sponsored Level I DR market is the fastest-growing segment of the DR business. Of the approximately 2,100 DR programs available more than 700 of these are Level I facilities. 27 OTC Depositary Receipts Enhance Valuation and Liquidity Oxford Metrica, an Oxford University-based independent strategic advisor, conducted research on the DR marketplace which provided “empirical insight on the extent of the value and additional liquidity generated by DRs, and the key drivers of this process.” The research resulted in a few conclusions relating to “Sponsored” OTC DRs: • After year one, OTC DRs raised ordinary share liquidity by 23% on average • OTC DRs increased ordinary share price by an average of 10% • BNY Mellon, both by its dominance and advantage in driving both issuer and investor value and increasing the liquidity of local shares Value Added - Level I 10.0 8.0 6.0 4.0 2.0 0.0 Value Reaction (%) scope of services, holds a comparative -20 0 20 40 60 80 100 120 140 160 180 200 220 240 260 Event Trading Days Value Added - Level I 28 Level I DR Program Many of the world’s largest and most respected companies currently have sponsored Level I ADR programs trading in the U.S. OTC market. International Level I Issuers Latin American Level I Issuers Country Heineken Volkswagen Wal-Mart de Mexico Mexico BNP Paribas Lukoil Grupo Modelo Mexico SAB Miller Mitsubishi Corp. JBS Brazil Deutsche Lufthansa Nestle Cyrela Brazil Realty Brazil Foster's Nintendo Usiminas Brazil Gazprom Societe Generale MMX Brazil adidas BASF Inv. Aguas Metropolitanas (IAM) Chile Rolls Royce Roche Sivensa Venezuela L’Oreal BAE Systems Cementos Lima Peru Air China Olympus Banco Hipotecario Argentina Zurich Financial Serv Air France-KLM ISA Colombia Clarins El Al Israel Airlines Ltd. Graña y Montero - GyM Peru Sega-Sammy Antofagasta Sare Holding Mexico Hipermarc Chile Sharp 29 Establishment – Level I DR Program Benefits: Simple to establish and maintain No cost to the Issuer Minimal reporting No additional disclosure Access to broad and diversified shareholder base – European and U.S. institutions as well as U.S. retail Cost efficiencies for investors Creates shareholder value 30 Establishment – Level I DR Program Establishing a Level I DR Program is Easy: A Level I DR program is easy to establish and does not require extensive management time or commitment. To establish a sponsored Level I DR program, three principal documents are required: 12g3-2(b) Information Exemption - Is the principal provision used by Foreign Private Issuers to claim exemption from U.S. registration and reporting requirements. Deposit Agreement - A standard service contract between the Company, BNY Mellon and DR holders which details the responsibilities of each party. Form F-6 - This is a simple registration statement of DRs which includes the signatures of a majority of the Company's board of directors. The Level I establishment process takes approximately 6 weeks, and can be achieved at no cost to the issuer. 31 Establishment Timetable – Level I DR Program Level I ADR Establishment Timetable Item Appoint depositary bank and U.S. lawyers Confirm automatic 12g3-2(b) exemption compliance Prepare DR certificates, obtain CUSIP number, request DTC eligibility Prepare / submit Deposit Agreement and form F-6 to SEC NASD and DTC are notified of effectiveness DR trading commences Broker notifications are sent and posted on Internet Distribute announcements to financial community and media Week Party Responsible 1 2 3 Issuer Issuer & Lawyers Depositary, Issuer & Lawyers Depositary, Issuer & Lawyers Depositary Brokers, Investors Depositary Depositary * Above timetable refers to US portion of documentation. CVM approval generally takes 30 days 32 Section V. Market Demand for Level I ADRs 33 Opportunity to Diversify Shareholder Base & Improve Liquidity Expanded universe of potential “target” investors Additional investment by larger institutions Smaller, long-term institutional investors Managed Account Managers Retail Investors Improve Liquidity More investors potentially entering and exiting your stock/DR Arbitrage traders – provide base of increased liquidity 34 U.S. Investor Tiers Access to the Full DR Investment Market Tier Equity AUM 1 2 3 4 DR Opportunity > $50b $11.0 trillion invested by 77 U.S. firms. $2.2 trillion international of which $358 billion is in DRs (16% DRs). $10b - $50b $3.6 trillion managed by 163 U.S. firms. $628 billion international of which $173 billion is in DRs (28% DRs). $1b - $10b $2.2 trillion managed by 727 U.S. firms. $378 billion international of which $98 billion is in DRs (26% DRs). < $1b $628 billion managed by 3,126 U.S. firms. $76 billion international of which $26 billion is in DRs (34% DRs). Larger institutions tend to invest in both the home market and DRs. Many smaller institutions use DRs to diversify internationally. 35 Largest DR Holders and Level 1 Investments 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Institution Name Capital World Investors (U.S.) Fisher Asset Management, LLC Tradewinds Global Investors, LLC Thornburg Investment Management, Inc. Barrow Hanley Mewhinney & Strauss, Inc. Barclays Global Investors N.A. Wellington Management Company, LLP Van Kampen Asset Management The Vanguard Group, Inc. BlackRock Investment Management (U.K.), LTD Fidelity Management & Research Company Delaware Investments Aberdeen Asset Management, LTD (U.K.) Brandes Investment Partners, LLC Templeton Asset Management, LTD AllianceBernstein, L.P. (U.S.) Dodge & Cox Schroder Investment Management (UK), LTD Lazard Asset Management, LLC (U.S.) Capital Research Global Investors (U.S.) ADR Value ($mm) 15,938.5 7,959.6 8,293.3 4,632.9 2,345.7 13,576.8 13,670.6 4,093.4 2,005.0 4,868.1 20,109.2 4,080.0 2,829.8 10,081.4 2,413.2 10,909.5 17,327.2 1,985.2 5,622.2 12,158.2 OTC Value ($mm) Share (%) 2,252.7 14.1 2,202.4 27.7 2,033.3 24.5 1,347.7 29.1 1,212.2 51.7 1,005.7 7.4 804.4 5.9 697.1 17.0 676.3 33.7 576.7 11.8 560.2 2.8 544.1 13.3 511.0 18.1 487.2 4.8 444.7 18.4 441.7 4.0 429.6 2.5 318.7 16.1 251.7 4.5 248.7 2.0 Of the top 50 institutions holding DRs, almost $18.5 billion is invested in Level I companies. 36 Access to Additional Investor Segments Retail (individual investors): At the end of 2008, U.S. retail investors held $5.5 trillion in equities, either directly or through mutual funds. Of this, $2.7 trillion were foreign equities. Managed Accounts: At the end of 1Q09, managed accounts assets under management was $675.5 billion Some of the largest managed accounts institutions include: 37 Legg Mason ($32.7 billion AUM) Blackrock, Inc. ($29.4 billion AUM) Allianz Global Investors ($24 billion AUM) Lord Abbett & Co. ($13.1 billion AUM) Brandes Investment Partners ($12.4 billion AUM) Investor Demand for International Level I Programs Director of Managed Accounts ($2.2 billion AUM): “Yes, we would like to see more OTC DR programs. Anything that expands the universe of DRs is a good thing.” Portfolio Manager ($26.6 billion AUM): “We would like to see more OTC DRs. We manage private accounts, which in some cases are ADR-only, and in that case it would be beneficial to have them.” Trader ($7.4 billion AUM): “We would like to see OTC or listed DRs because it would benefit accounts that cannot hold ordinary shares. Also, it would help our non-QIB accounts with increased investment choices.” 38 Sell-side Sell-side will not initiate coverage because of a Level I program. However, the sell-side can look positively upon the establishment of a Level I because of the liquidity upside: When an issuer recently started trading OTC, UBS published a report stating that the move to an OTC DR program is a “positive for the stock as it should improve the liquidity of the shares.” 39 BNY Mellon Support 25 global capital market experts (largest team in the industry) Located in major business centers of New York, London and Hong Kong Specialists help you navigate the capital markets efficiently and effectively 40 Increase exposure and liquidity of Issuer DR Programs Provide global best practice Investor Relations advisory services Leverage sell-side and buy-side intelligence and contacts Produce Investor Relations/Thought Leadership studies