Chapter 7

advertisement

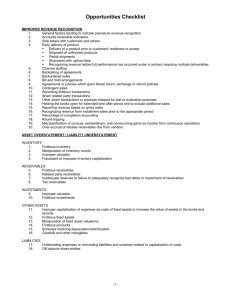

Chapter 7 Revenue and Collection Cycle Accounting 408 Chapter 7 1 Accounting 408 Chapter 7 2 1. Internal Control (cont’) Accounting 408 Chapter 7 3 1. Internal Control Internal control over sales separate functions: receiving customer order, credit approval, filling and shipping sales order, billing customers, recording the sales documents and records: customer order, sales order, shipping documents, sales invoice, approved customer list, authorized price list, sales journal, A/R subsidiary ledger, A/R general ledger account Accounting 408 Chapter 7 4 1. Internal Control (cont’) Internal control over cash receipts general rules for handling cash separate functions: receiving cash, depositing cash, recording the transactions controls over cash sales, payments received through the mail documents and records: remittance advice, cash receipts list, daily cash summary, deposit slip Accounting 408 Chapter 7 5 1. Internal Control (cont’) Internal control over sales adjustments type of sales adjustments cash discounts sales returns and allowances writing off uncollectible accounts separate functions: cash handling, cash recording, sales adjustments documents and records: credit memos, write-off authorization memo Accounting 408 Chapter 7 6 10. Financial Statement Assertions (Con’t) Account Balances Existence * Transactions Occurrence * Rights and obligations * Completeness * Disclosures Occurrence Rights and obligations Completeness Valuation and allocation * Accuracy Completeness Valuation and allocation Accuracy Cutoff Classification Classification* Understandability * * PCAOB Assertions ACCT-4080 Chapter 1 7 1. Internal Control (cont’) Sales transactions audit objectives Recorded sales transactions actually occurred Existing sales transactions are recorded Sales transactions are recorded accurately Sales transactions are classified correctly Sales transactions are recorded on correct dates Accounting 408 Chapter 7 8 Accounting 408 Chapter 7 9 2. Substantive Tests Accounts receivable balance objectives recorded A/R exist client has rights to A/R existing A/R are included A/R is stated at realizable value Accounting 408 Chapter 7 10 2. Substantive Tests Accounts Receivable Confirmations requirements controlling process requests not to confirm types - positive, negative, others balances, transactions effectiveness returned mail improving response rates disclaimers and other restrictions in confirmation responses Examination of subsequent cash collections Inquiry of sales or factoring of A/R (evaluate client’s rights to A/R) Vouching and tracing transactions Cutoff tests - sales and cash Analytical procedures (often use SAP for revenue accounts) (examples) Evaluate adequacy of allow. for uncollectibles Search for related party receivables Accounting 408 Chapter 7 11 Positive Confirmation Accounting 408 Chapter 7 12 2. Substantive Tests Accounts Receivable Existence and Occurrence Rights and Obligations confirmation, vouching, cut-off tests vouching, confirmation, determine if factored or assigned Completeness Accounting 408 analytical procedures, tracing, cut-off tests, confirmation Chapter 7 13 2. Substantive Tests Accounts Receivable Valuation evaluate adequacy of allowance, subsequent cash collections, vouch recorded receivables Presentation and Disclosure Accounting 408 compare statement presentation to GAAP related party transactions, pledged, assigned, or factored receivables Chapter 7 14 3. Fraudulent Revenue Recognition Schemes Obvious accounting violations Fictitious sales or fake customers Premature recording of sales Inflated sales Accounting 408 Chapter 7 15 3. Fraudulent Revenue Recognition Schemes Earnings management - At what point does managing earnings become fraud? Pushing the limits of accounting standards Changing accounting policies and estimates midstream with positive impact Exploitation of accounting methods to distort actual performance of organization Accounting 408 Chapter 7 16 3. Fraudulent Revenue Recognition Schemes Transactions lacking integrity Quality of earnings issues The following often have an element of collusion Roundtrip transactions Channel stuffing Bill and hold transactions Related party transactions Accounting 408 Chapter 7 17 3. Fraudulent Revenue Recognition Schemes Non-top line income sources methods Investments and related income Sales of investments or fixed assets Factoring receivables Sale of obsolete inventory Any other asset sales representing unsustainable revenue sources Accounting 408 Chapter 7 18 3. Fraudulent Revenue Recognition Schemes Cover up methods Backdating invoices, agreements Manipulation of dates shipped on docs Customer statements – hold, destroy, alter Falsify customer confirmations Delay recording credit memos Ship goods to third party warehouse Lapping receivable transactions Accounting 408 Chapter 7 19 3. Fraudulent Revenue Recognition Schemes Detection methods Vouch supporting documents Review cutoff of large sales near YE Perform analytical tests Review transactions after YE (returns, cancelled orders) Determine methods and consistency of reserves, contras Accounting 408 Chapter 7 20 3. Fraudulent Revenue Recognition Schemes Detection methods Confirm customers Review shipments to warehouses Examine shipping document signatures Compare ship dates to customer order and requested delivery date Review customer complaints Accounting 408 Chapter 7 21 Review Questions for Discussion Chapter 7 7.2 7.3 7.5 7.8 7.16 7.17 ACCT-4080 7.18 7.19 7.20 7.21 7.22 Chapter 1 22