What is the dollar price of the Krups coffee maker?

advertisement

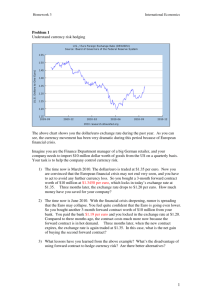

International Trade and Exchange Rates Outline •Balance of payments accounting •Exchange rates—how are they determined? •Exchange rates and the price of imported and exported goods. Balance of payments accounting BOP accounting is the recording of transactions between domestic and foreign economic agents. Any transaction that results in a receipt of money by domestic agents from abroad is recorded as a credit in the BOP accounts. Any transaction that entails the payment of money by domestic units to foreigners is recorded as a debit in the BOP accounts. The current account records foreign transactions involving merchandise and services. The capital account records foreign transactions involving financial assets and land. An exchange rate is the price of one national currency expressed in terms of another national currency. For example, the dollar price of the British pound is $1.71-meaning it takes $1.71 to buy 1 pound If the dollar price of the British pound is: 1.45 dollars = 1 pound Then the pound price of the dollar is given by the reciprocal of the dollar-pound exchange rate. That is: 1 0.69 pounds Pounds per dollar = 1.44 Exchange Rates are Determined by the Supply & Demand for Foreign Exchange Supply of euros Dollars per Euro 1.15 Demand for euros 0 E* Euros Why do agents want to exchange dollars for euros ? •To purchase European-made goods and services. •To purchase stocks in European companies companies or other euro-denominated assets. •To speculate on future exchange rate movements. Dollar Depreciates Against the Euro (and euro appreciates against the dollar) Supply of euros Dollars per Euro 1.30 1.15 D1 0 E* D2 Euros Currency Cross Rates New York Trading, July 25, 2003 Dollar Canada 1.38 Euro Pound Peso Yen Can.Dlr. 1.59 0.13 0.01 … 11.34 … 86.14 2.24 Japan 118.85 136.80 192.61 Mexico 10.48 12.06 16.99 … 0.09 7.60 U.K. 0.62 0.71 … .06 0.005 0.97 Euro 0.87 … 1.41 .08 0.007 0.63 U.S. … 1.15 1.62 .10 .008 0.72 Source: Wall Street Journal Exchange Rates and the Prices of Imported Goods Question: Suppose the dollar price of a new Harley Davidson is $22,000. How much would a German buyer have to pay in euros? Euro price of the Harley Euro price = dollar price of the Harley × euro price of the dollar Thus, at the current exchange rate (€ 0.87 = $1) we have: Euro price = $22,000 × 0.87 = € 19,140 An appreciating dollar makes U.S.-made goods and services less price-competitive Example: Let the dollar appreciate against the euro The new exchange rate is € 1 = $1 Thus we have: Euro price = $22,000 × 1.00 = €22,000 Exchange rates and the Affordability of Imported Goods The euro price of a Krups coffee maker is €45.00 Question: What is the price of the coffee maker expressed in dollars? If the dollar price of one euro is $1.15, then: $Price = (1.15)(45) = $51.75 Effect of an appreciating dollar on the price of imported goods What if the dollar should appreciate, or gain value, against the euro? Let the dollar price of the euro to decrease to $1.00 . Question: What is the dollar price of the Krups coffee maker? $ price = (1.00)(45) = $45.00 The preceding examples should make clear why those who export goods or services want a weak domestic currency; whereas those who purchase imports or travel abroad prefer a strong domestic currency.