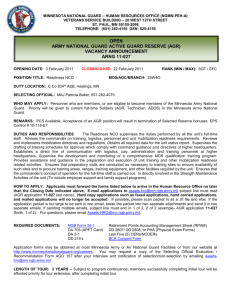

(AGR) is the

advertisement

Western Center for Risk Management Education Risk Management – AGR-Lite Workshop for the Florida Association of Extension Professionals September 26, 2007 Washington State University Extension John G. Nelson, Risk Management Coordinator Disclaimer For Illustration Purposes Only This material does not change the content or the meaning of current policy provisions, filed actuarial documents, or approved procedures Refer to the Appropriate Basic Provisions, Crop Provisions, Policy Provisions, Manager Bulletins and the Loss Adjustment Manual www.rma.usda.gov Five Major Areas of Risk Marketing Risk Production Risk Legal Risk Human Resource Risk Financial Risk FSA Uninsured NAP Program Risk Management Tools Southeast Production Actual Production History Revenue Group Risk Plan Group Risk Income Plan Dollar Plan Income Protection (IP) Group Risk Revenue Assurance (RA) Idaho only Crop Revenue AGR Coverage (CRC) AGR-Lite Revenue Protection Introducing a new and exciting risk management tool for Southeastern Producers Adjusted Gross Revenue-Lite Where is AGR-Lite Available? X X ALASKA IDAHO, OREGON, WASHINGTON All counties X - Excluding the North Slope and Northwest Artic boroughs What does AGR Cover? Risk Management Plans: revenue based, non-traditional, whole farm risk management tool; uses a producer’s historic Schedule F tax form information as a base to provide a level of guaranteed revenue for the insurance year. Exceptions include: Timber, Forest or Forest Products Animals for sport, show or pets What am I insured for? Loss of revenue from the sale of agriculture commodities produced during the insurance year due to: Unavoidable natural disasters Market fluctuations during insurance year What is an Insurance Year? Insurance Year = Producer’s Tax Year Either: Calendar Year Tax Filer or Fiscal Year Tax Filer Either: Cash or Accrual Accounting Method Coverage Options Coverage Options: Coverage Levels 65%, 75%, 80%* * 3 commodities required for 80% coverage Payment Rates 75% or 90% Subsidy Portion of Total Premium Paid by USDA Coverage Level Premium Subsidy 65 Percent 59 Percent 75 Percent 55 Percent 80 Percent 48 Percent Determine 5 year average farm revenue Project 2008 expected crop revenue Determine Approved AGR AGR revenue guarantee minus actual crop revenue = loss paid How AGR Works Decide what percentage of AGR to guarantee Taxes filed / possible claim calculated Harvest: Actual crop revenue determined Determine 5 year average farm revenue Project 2008 expected crop revenue Determine “adjusted gross revenue” (AGR) Decide what percentage of AGR to guarantee Actual revenue determined Taxes filed / possible claim calculated Loss paid How AGR Works Determine 5 - year average farm revenue 2002 2003 2004 2005 2006 = = = = = 596,000 594,000 597,000 596,000 595,000 5 Year History Avg = $ 595,600 Determine 5 - year average farm revenue Project 2008 expected crop revenue How AGR Works Project 2008 expected crop revenue Determine “adjusted gross revenue” (AGR) Commodity Decide what percentage of AGR to guarantee Actual revenue determined Taxes filed / possible claim calculated Loss paid Alfalfa Amt Unit Yield 150 ac Cattle: Cow/Calf 575 hd Value 9 ton 650 Expected Revenue $125 $ 168,750 lbs $ 1.15 $429,813 $ 598,563 Determine 5 - year average farm revenue Project 2008 expected crop revenue Determine “adjusted gross revenue” (AGR) Decide what percentage of AGR to guarantee Actual revenue determined Taxes filed / possible claim calculated Loss paid How AGR Works Determine “adjusted gross revenue” (AGR) Compare: • 5 year farm average farm revenue • $ 595,600 • Intended commodity report for coming crop year • $598,563 adjusted gross revenue (AGR) is the “lesser” of the two above numbers = $595,600 Determine 5 - year average farm revenue Project 2008 expected crop revenue Determine “adjusted gross revenue” (AGR) Decide what percentage of AGR to guarantee How AGR Works Decide what percentage of AGR to guarantee $595,600 75% $446,700 Actual revenue determined Taxes filed / possible claim calculated Loss paid 90% $402,030 Approved AGR Coverage level (deductible) Trigger point - where loss payment begins Payment rate (deductible) Asset Protection (m axim um am ount of loss payable) Determine 5 - year average farm revenue Project 2008 expected crop revenue How AGR Works Actual 2006 revenue determined Determine “adjusted gross revenue” (AGR) Commodity Decide what percentage of AGR to guarantee Actual revenue determined Taxes filed / possible claim calculated Loss paid Amt Unit Yield Alfalfa 150 ac 8.5 ton Cattle: Cow/Calf 575 hd 615 lbs Value Actual Revenue $95.00 121,125 $0.75 265,219 $386,344 Major changes from projected revenue to actual revenue: Alfalfa: production loss due to 3 out of 4 cuttings rained on Calves: excessive heat slowed gain and market decline Determine 5 - year average farm revenue Project 2008 expected crop revenue Determine “adjusted gross revenue” (AGR) Decide what percentage of AGR to guarantee Actual revenue determined Taxes filed / possible claim calculated Loss paid How AGR Works Taxes filed / possible claim calculated $595,600 75% Approved AGR Coverage level (deductible) 446,700 Trigger point -386,344 2008 crop revenue 60,356 Revenue shortfall Determine 5 - year average farm revenue Project 2008 expected crop revenue Determine “adjusted gross revenue” (AGR) Decide what percentage of AGR to guarantee Actual revenue determined Taxes filed / possible claim calculated Loss paid How AGR Works Loss Paid $595,600 75% Approved AGR Coverage level (deductible) 446,700 Trigger point -386,344 2008 crop revenue 60,356 Revenue shortfall 90% $54,320 Payment rate (deductible) Loss paid How do you decide? FARM COSTS: Crop expenses from budget Non-crop expenses from budget Debt payments Living expenses TOTAL FARM COSTS Less: Non-farm income available Liquid assets available TOTAL COSTS TO BE COVERED 90,000 50,000 20,000 30,000 190,000 10,000 20,000 160,000 How do you decide? FARM EQUITY: Liquid assets Long-term assets Short-term debt Long-term debt Total Farm equity 80,000 350,000 (120,000) (200,000) 110,000 TOTAL PERSONAL EQUITY Liquid assets Long-term assets Farm Equity Debt Total Personal equity 5,000 350,000 110,000 (150,000) 315,000 How do you decide? AGR-Lite MPCI Your Farm risks: Frost Price Frost Frost Price Frost Risks covered by policy: Loss paid per crop Loss paid per block No No Yes Yes Claim paid Post-Crop During Year Year How do you decide? Revenue/Production Coverage level AGR-Lite 170,000 75% MPCI 200,000 50% Loss Inception Point Payment Rate 127,500 75% 100,000 100% Insurance liability Total costs 95,625 (160,000) 100,000 (160,000) Range of shortfall Best (32,500) (60,000) (64,375) (60,000) (160,000) (160,000) 2,000 5,500 Worst Uncovered loss Premium Cost How do you decide? No Crop Insurance Revenue Expenses Gain/Loss Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 230,000 210,000 200,000 210,000 40,000 140,000 60,000 190,000 160,000 160,000 160,000 160,000 160,000 160,000 160,000 160,000 Average 160,000 160,000 70,000 50,000 40,000 50,000 (120,000) (20,000) (100,000) 30,000 - How do you decide? With Crop Insurance Revenue Expenses Gain/Loss Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 230,000 210,000 200,000 210,000 115,000 140,000 95,000 200,000 160,000 160,000 160,000 160,000 160,000 160,000 160,000 160,000 70,000 50,000 40,000 50,000 (45,000) (20,000) (65,000) 40,000 Average 175,000 160,000 12,000 Cost & Obtaining Coverage? What does is cost? -- Depends: -- County -- Number and diversity of crops -- Types of crops Insured Where do I get more information? -- RMA Program Delivery -- Crop & Livestock Insurance Agents -- Programs & Policies -- Premium Calculations Log on to: www.rma.usda.gov Important Dates to Remember: Sales closing date: March 15 for new applicants. Policy change and cancellation dates for all policies is January 31. THANK YOU Darel L. Thompsen, CPA of LeMaster and Daniels, PLLC for the farm example in How do you decide? 28 Special Thank You To Jo Lynne Seufer Risk Management Specialist 112 N. University Road, Suite 205 Spokane, WA 99206 509-353-2147 www.rma.usda.gov