license fees, user charges, and sales by public monopolies

advertisement

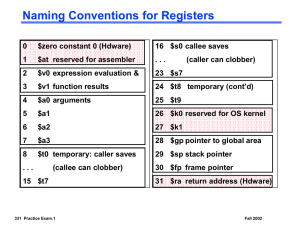

USER CHARGES and SALES by PUBLIC MONOPOLIES Know: When to Use Them Their Advantages and Disadvantages How Much to Charge Next page License Fees are not User Fees Next page TWO KINDS of LICENSE FEES • Those intended primarily to generate revenue for government - no monitoring or inspection required, applicants rarely denied -- e.g., business licenses • Those based on government authority to regulate certain activities -- usually intended to offset, partially or completely, the the cost of the activities involved Jump to first page USER CHARGES Are appropriate where governments provide private goods -- including most public monopolies • Make the users recognize that provision of those service is not costless • Promotes conservation and efficient use • Provides signals to government as to the level and kinds of service to provide Automatically matches burdens to Benefits received Jump to first page When to Use User Fees Next page When to Use • The good is both excludable and potentially exhaustible • Lumpy goods are usually toll goods • Monopoly supply is appropriate where toll goods are concerned • Government provision may, therefore, be appropriate for toll goods • Publicly provided toll goods that are prone to congestion are especially good candidates for user fees • Any publicly-provided, excludable good that wouldn’t otherwise be provided might also be a good candidate for user fees (under provision is better than no provision) Jump to first page Advantages of Making Users Pay • Make the service to a degree self financing. Transparency • User fees register and record public demand for service. Transparency • Equity is enhanced when some users who wouldn’t be liable for taxes pay. Fairness • Citizens who don’t value services don’t have to pay for them. Fairness • User fees correct price/cost signals to private users, often leading them to modify their behavior. Efficiency Jump to first page Drawbacks to Making Users Pay • Not appropriate for some public or commons type goods (lumpy public goods are toll goods). Efficiency • Not appropriate where public provision in intended to promote redistribution (the fact that some users are poor is not a good argument against User Charges). Fairness/Efficiency • Not appropriate where too costly to collect. Efficiency • Service providers and clients will usually oppose (they normally reduce service demands). Politics Jump to first page Pricing Philosophy “The only economic function of price is to influence behavior … But of course price can only have this effect on the buyer’s side only if bills do indeed depend on the volume [and kind] of purchases. For this reason, economists … are avid meterers.” Fred Kahn Jump to first page Pricing Guidelines • Know what drives cost -- prices should reflect cost and its behavior • Understand demand -- prices should reflect demand (willingness and ability to pay) • Use multi-part tariffs where appropriate • Practice inverse-elasticity pricing and price discrimination where feasible Guidelines apply to ALL government services that are sold to citizens Jump to first page What Price to Charge Users The fundamental pricing rule How to price discriminate Next page The fundamental pricing rule Produce up to the point where MR=MC, where MR = P[1-(1/|e|)] For a price taker: MR = P[1-(1/|e|)] = P, hence P=MC For a price searcher MR = MC implies P = MC/[1 - (1/|e|)], hence (P- MC)/P = 1/|e| And P/(P- MC) = |e| Jump to first page The fundamental pricing rule P/(P- MC) = |e| Elasticity |1.5| Marginal Revenue 1 Price 3 |2| |3| 1 2 1 1 1.5 1.33 Jump to first page |4| (P-MC)/P = 1/|e| The higher the elasticity, the lower the markup of price over marginal cost. The lower the elasticity, the higher the markup. (Elasticity tends to be higher when there are many competitors and substitutes.) Jump to first page QUESTION True or false: the optimal price will always be on the elastic portion of the residual demand curve? Jump to first page QUESTION True or false: the optimal price will always be on the elastic portion of the residual demand curve? Jump to first page True. If |e| is less than 1, raising price will both increase revenue, and decrease costs. QUESTION When will the optimal price be set where the |e| of the residual demand curve is = 1 Jump to first page QUESTION When will the If |e| is 1, MC optimal must equal price be set zero. where the |e| P/[P-MC] = |e| of the residual P/[P- 0] = 1 demand curve is = 1 Jump to first page QUESTION: Given a linear demand curve that intersects the Y axis at a price of $10, and a marginal cost of $2 per unit, what is the optimal price? Jump to first page ANSWER: P = $6. 1/|e| = (Pmax - P)/P = ($10 - P)/P. (P - MC)/P = (P-2)/P. Equating the right side of the equation to the left, ($10-P)/P = (P - $2)/P or ($10 - P) = (P - $2). Jump to first page Price discrimination Definition: A single organization price discriminates when it charges different prices to different consumers that are not proportional to differences in marginal cost, i.e., when for two different consumers (1 & 2), p1/MC1 ≠ p2/MC2 (of course, MR1/MC1 = MR2/MC2). Jump to first page Necessary conditions At least two consumer groups exist with different elasticities, i.e., different demand curves. The organization can identify consumers in each group, and set prices differently for consumers in the two groups. • The organization must be able to prevent consumers in one group from selling to consumers in the other (no arbitrage). Jump to first page Price discrimination: Note P1 is 3 times MC; P2 is twice MC. Solving for |e|: (3 - 1)/3 = 1/|e| = 1.5; (2 - 1)/2 = 1/|e| = 2. The more inelastic the demand, the higher the markup: inverse elasticity pricing rule or, where subject to a revenue constraint, Ramsey optimal pricing. Jump to first page Examples of price discrimination Senior citizen and children’s discounts offer lower prices to those with more elastic demands for municipal pools. Universities offer lower prices in the form of financial aid (“need” based aid) to those with higher elasticities of demand (note: it is easier to discriminate where services are concerned than where goods are concerned and where consumables are concerned than durables). Tying supplies to use of a durable piece of equipment, sometimes called Barbie Doll Marketing: give away the dolls but charge a lot for the dresses. Jump to first page One of the most effective price-discrimination mechanisms is the multi-part tariff. Multi-part tariffs decompose product/services to their fundamental attributes and charge users for their actual consumption of each. The best example of a multi-part tariff is your phone bill. Multi-part Ramsey-optimal tariffs are also commonly used in internal transfer pricing, initially for IT services, now more widely in intra-net based organizations Jump to first page Lotteries, State-Run Liquor Stores Next page State Liquor Monopolies • Voluntary and enjoyable approach to government finance • Can be thought of a tax on addictive behavior • Disproportionate quantities of alcohol are purchased by poor and ill-educated • Receipts tend to increase over time; they are very stable (which tends to reduce the volatility government income somewhat) Jump to first page LOTTERIES & VIDEO POKER • Voluntary and enjoyable approach to government finance • Can be thought of a tax on statistical naiveté (addictive behavior) • Disproportionate number of lottery tickets are purchased by poor and ill-educated • Receipts tend to decline over time; they are also very volatile (however, their volatility tends to reduce the volatility government income somewhat) Jump to first page