2006 Volunteer Tax Preparation

advertisement

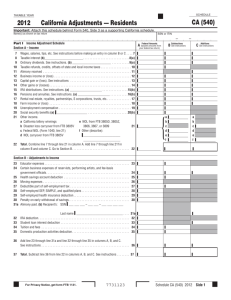

2011 Volunteer Tax Preparation NJ Division of Taxation www.njtaxation.org Important Contact Information • Regional Information Centers • Customer Service Center – 609/292-6400 • Division of Revenue E-File Unit – 609/633-1132 • Training & Outreach – Outreach.tax@treas.state.nj.us www.njtaxation.org New for 2011 • Emancipation Day!!! – Returns due April 17th, 2012 • Charitable Contributions – One new charity • New Jersey Lung Cancer Research Fund Reminders • Roth IRA Conversions done in 2010 – 2011/2012 Tax Reporting • Form NJ-1040-H – Property Tax Credit • No Tenant Rebate Application – Suspended by the State Budget • Form 1099-G no longer mailed Important Processing Information • Do not staple, clip or otherwise attach pages together • Place only 1 return for each envelope • You may not report a loss on Form NJ-1040 • Leave unused lines ‘Blank’ Form NJ-1040 Identifying Information Page 1 Civil Union / Domestic Partner • Civil Union Couples – Filing Status – “Married” under NJ Law – IRS does not recognize CU’s • Domestic Partner – Exemption – Not Married – Line 6 Exemption may apply • If partner does not file NJ-1040 Line 11: Dependents Attending College • Must be a dependent – Line 9 or 10 • Full-time College Student – Defined by Institution • Under age 22 – For Entire Tax Year Form NJ-1040 Reportable Income Page 2 Tax-Exempt Income • Social Security • Unemployment Compensation • Debt Cancellation – Form 1099-C • Military Pensions Refer to page 21 Wages (Line 14) • Use W-2 Box 16, ‘State Wages’ • State wages often differ from Federal wages (Box 1) • All W-2s received must be included with the NJ-1040 W-2 Sample Tax-Exempt Interest (Line 15b) • Obligations of the State of New Jersey and/or any of its political subdivisions • Direct Federal Obligations • Pub GIT-5, Exempt Obligations Refer to page 23 Must enclose an itemized schedule if line 15b is over $10,000 Net Profits from Business (Line 17) • Federal Schedule C – Use Federal Expenses and Deduction – 100% Meal/Entertainment Deduction – Line 17 ‘Blank’ if Net Loss – See page 23, NJ Instruction Booklet Reporting Pension, Annuity, and IRA Income Line 19 Retirement Plans Contributory Non-Contributory fully taxable Three-Year Rule / General Rule • NJ accounting methods – No ‘Simplified’ Method • Client needs Contribution Records • Often varies from Federal Treatment Three-Year Rule • If employee contributions recovered within 36 months of date of first pension payment • Pension income is not reported until contributions are recovered IRS no longer allows three year rule General Rule • Percentage is used based on proportionate share of Contributions to Total Value of the Pension • This is applied each year to the Pension amount received Use Worksheet A, pg 24, to determine which pension method to use 2010 Conversions to Roth • NJ Following the IRS • Deferred until 2011-2012 • NJ/Fed reporting must be the same IRA Withdrawals • Use Worksheet C, Page 26 • Client Record Keeping – IRA Contributions – Prior Year Worksheet C • Roth Distributions – Exempt if ‘Qualified’ – page 27 Taxable Pension (Line 19) • Line 19 is for the total of: – Taxable Pensions (after reduction by Three-year or General Rule) – Taxable Annuities – Taxable IRAs Gambling Winnings (Line 23) • Include Casino and Track Betting • Include NJ Lottery Winnings – Only with prizes exceeding $10,000 • Substantiated Losses – Can be used to Net total winnings Record Keeping - Losses Substantiated through: • Daily log • Journal • Canceled check • Losing race track pari-mutuel tickets • Losing Lottery Tickets Pension Exclusion (Line 27a) • Eligibility: – Age 62/older or Disabled – Total income of $100,000 or less • Amounts Based on Filing Status – $20,000 – MFJ/HOH/Widow – $15,000 – Single – $10,000 - MFS Retirement Exclusion (Line 27b) Taxpayer may deduct unused Pension Exclusion from Line 27a if: Line 14 ___ Line 17 ___ Earned Income Line 20 ___ Line 21 ___ Total less than $3,000 Gross Income (Line 28) No Filing Required if: • $10,000 or less – Single – Married/CU - Filing Separate • $20,000 or less – Married/CU Filing Joint – Head of Household – Qualifying widower Medical Expenses (Line 30) • Unreimbursed medical expenses – Include MSA Contributions (Archer) • Expenses in excess of 2% of line 28 Gross Income Worksheet E, Page 31 Property Tax Deduction/Credit • Enter total property taxes paid (or 18% rent) on line 36a • Include Homestead Benefit received as a credit • PTR applicants – use base year amount • Residency Status – Line 36b – Homeowner/Tenant Property Tax Deduction/Credit • Worksheet F – determines the greater benefit • Deduction Limited to $10,000 – $5,000 MFS • Enter Property Taxes Paid on Line 36c or a flat $50 credit on Line 48 Tax (Line 38) • Show NJ Tax amount based on taxable income • Tax Tables (Pg 53) • Tax Rates (Pg 62) Form NJ-1040 Calculating Tax and Payments Page 3 Credit for Taxes Paid (Line 40) • Used for NJ Residents who have income subject to tax out of the state • Schedule A must be completed Note: Income must be reported on the NJ-1040 Use Tax (Line 44) • Purchases out of state – No NJ Sales Tax • Estimated Use Tax Chart (pg 39) – Absent of Purchase Records Enter 0.00 if no Use Tax is due NJ Income Tax Withheld (Line 47) • Form W-2, Box 17 (State Income Tax Withheld) • Form 1099-R (Pensions, etc) • Include amounts from all W-2s & 1099s received Note: Be sure W-2, Box 15 Shows ‘NJ’ Earned Income Tax Credit (Line 50) • Eligibility – All NJ Residents who qualify for Federal EITC are eligible to apply – subject to review • Calculated Amount – 20% of Federal EIC amount Excess UI/DI/FLI (Lines 51 - 53) • For people with: – Multiple employers – Multiple W-2s – With excess UI/DI/FLI contributions • Must complete and include Form NJ-2450 with NJ-1040 Underpaid or Overpaid • Compare Total Payments (Line 54) to Total Tax (Line 46) • If Line 54 is greater than line 46, the difference is an overpayment • If Line 54 is less than line 46, the difference is due to the state Refund Amount (Line 65) Overpayments can be: – Left as a credit for next year; – Donated (all or in part) to various charitable designations; or – Refunded to the Taxpayer Be sure to include requested refund amount on Line 65 Part-Year Residents • Resident only Part of the Tax Year • Complete ‘Residency Status’ – Page 1, Form NJ-1040 • Allocate Income – Just NJ Residency Period • Pro-Rate Exemptions and Deductions – by Number of Months in NJ Property Tax Relief Programs • Form NJ-1040-H – Certain filers only • Homestead Benefit – Only Homeowners • Property Tax Reimbursement – Homeowners/Mobile Home Owners Form NJ-1040-H • Property Tax Credit ($50) – Age 65/Ovr or Disabled – No NJ Income Tax Return Filed • Under Filing Threshold – Did not own Residence on 10/1/11 Homestead Benefit • Owned/Occupied Residence – On 10/1/11 • Gross Income Under – regardless of filing status – $150,000 – 65/Ovr or Disabled – $75,000 – Everyone else • Paid as Direct Property Tax Credit • No Tenant Rebate Application – Suspended by the State Budget PTR - Eligibility • Must be Age 65/ovr or Disabled by 12/31/2010 • NJ Resident for at least 10yrs • Owned and lived in the home for at least 3 years • Have fully paid property taxes due – by June 1st of following year Property Tax Reimbursement Income Eligibility Limits • 2010 – Single/Married $80,000 • 2011 – Single/Married $80,000 PTR – Income Limits • Virtually all gross income is included for PTR eligibility – Social Security – Unemployment – Military Pension – NJ Lottery Winnings This will often vary from the income tax form PTR – First Time Filers • Form PTR-1 – available online – Establishes 2010 and 2011 Eligibility • Reserves Base Year at 2010 Level • Difference of 2011 & 2010 Taxes Proof of Property Taxes must be included with all PTR applications PTR – 2nd and Later Years • File Form PTR-2 – Comes Pre-Printed with Base Year • Verifies 2011 Eligibility • Difference of 2011 and Base Year Proof of Property Taxes must be included with all PTR applications Budgetary Approval • All Property Tax Relief Benefits are Subject to Change • NJ FY 2013 Budget – Passed by June 30th, 2012 Property Tax Relief Assistance… • Homestead Benefit – 1-888-238-1233 • Property Tax Reimbursement – 1-800-882-6597 • NJ Tax Hotline – 609-292-6400 www.njtaxation.org Thanks to our volunteers!