07.Chapter Seven 2009

advertisement

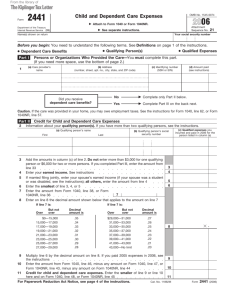

Liberty Tax Service Online Basic Income Tax Course. Lesson 7 1 HOMEWORK CHAPTER 6 HOMEWORK 1: Clarence D. (SSN 174-67-4443, born 10/14/1971) Eastwood is not married and lived all year at 1242 Castro Rd., Carmel, CA 93922 with his son, Harry, (SSN 345-12-7878, born 12/25/1991). Clarence provides all of his son’s support and all of the cost of keeping up the home. Clarence signed Form 8332 which allows Harry’s mother to claim him as a dependent. Clarence worked as a chef during the week and as a tour guide on the weekends. He also received $5,000 alimony and $6,000 of child support from his former wife. He will not itemize in 2008. His itemized deductions in 2007 were $8,650 and his filing status was single. His W-2 forms and other reported tax information follow. Prepare a return for Clarence. 2 HOMEWORK CHAPTER 6 3 HOMEWORK CHAPTER 6 4 HOMEWORK CHAPTER 6 5 HOMEWORK CHAPTER 6 6 HOMEWORK CHAPTER 6 7 HOMEWORK CHAPTER 6 8 HOMEWORK CHAPTER 6 9 HOMEWORK CHAPTER 6 10 HOMEWORK CHAPTER 6 11 Tax Credits Chapter Content: Child Tax Credit Credit for Child and Dependent Care Expenses Earned Income Credit Due Diligence for Tax Preparers Key Ideas Objectives: Be Able to Explain the Difference Between Nonrefundable and Refundable Credits Know How to Figure and Report the Child Tax Credit, the Credit for Child and Dependent Care, and the Earned Income Credit 12 Tax Credits Tax Credits Reduce tax liability dollar-fordollar. Two types of credits: 1. Nonrefundable credits 2. Refundable credits 13 Tax Credits Nonrefundable Credits 1. Subtracted from income tax liability on line 46 of Form 1040. 2. Can reduce income tax liability to zero. 3. If the credit is greater than tax liability, no refund of the additional amount of the credit. 14 Tax Credits Refundable Credits 1. Treated as payments 2. Subtracted from total tax liability on line 61 of Form 1040 3. Can reduce tax liability to zero and result in a refund if the credit is greater than the tax liability. 4. Credit amount is refunded even if no tax liability and no tax withheld. 15 Tax Credits The most common types of credits are: CHILD TAX CREDIT CHILD AND DEPENDENT CARE CREDIT EARNED INCOME CREDIT 16 CHILD TAX CREDIT 17 CHILD TAX CREDIT Child tax credit A nonrefundable credit. 1. Line 52 on Form 1040 2. Up to $1,000 per qualifying child 3. If you cannot use the entire amount of the credit on line 52 you may be eligible to take the refundable Additional Child Tax Credit, Form 8812, on line 66 of Form 1040. (See Chapter 10) 18 Qualifying Child Qualifying Child 1. Did not provide over half of his or her own support 2. Your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, or a descendant of any of them. a. An adopted child qualifies even if adoption is not final if the child has been placed with you by an authorized agency for legal adoption. An adopted child is always treated as your own child. b. Grandchild includes any descendant of your child including great-grandchildren, great-great grandchild, etc. c. Eligible foster child is any child placed with you by an authorized placement agency or by judgment decree or any other order of any court of competent jurisdiction. 19 Qualifying Child 3. A citizen or resident of the United States. 4. Under age 17 on the last day of the tax year (age 16 or younger). 5. Generally, must be claimed as a dependent. 6. Lived with you for more than half the year (the noncustodial parent of a child of divorced or separated parents may be able the child tax credit if able to claim the exemption). 20 Qualifying Child On Form 1040, Page 2 Example: Ed and Marcie have two qualifying children and are eligible to take the child tax credit of $1,000 for each child ($2,000). Their tax on line 46 of Form 1040 is $320. The child tax credit is used to reduce their tax to zero. Their child tax credit is $320. They do not get the additional $1,680 ($2,000 - $320) unless they are able to claim part or all of the $1,680 as an additional child tax credit on line 66 of Form 1040. 21 Qualifying Child – Problem 1 Dan claims his two sons as dependents. Adam was 16 on October 10, 2008. Todd was 17 on December 31, 2008. Which son(s) is/are a qualifying child for the child tax credit? a. Todd b. Adam 22 Qualifying Child – Problem 1 Dan claims his two sons as dependents. Adam was 16 on October 10, 2008. Todd was 17 on December 31, 2008. Which son(s) is/are a qualifying child for the child tax credit? b. Adam Adam is a qualifying child for the child tax credit. Todd is not a qualifying child because he was not under age 17 at the end of 2008. 23 Qualifying Child – Problem 2 Courtney age 13 lives with her father Calvin. Calvin has signed a written declaration that he will not claim an exemption for Courtney. Will Courtney be a qualifying child for the child tax credit for Calvin? Yes or No? 24 Qualifying Child – Problem 2 Courtney, age 13, lives with her father Calvin. Calvin has signed a written declaration that he will not claim an exemption for Courtney. Will Courtney be a qualifying child for the child tax credit for Calvin? No Courtney is not a qualifying child for the child tax credit for Calvin. She is a qualifying child for his former wife and she can claim the credit on her return because she will also claim the child’s exemption. 25 Qualifying Child – Problem 3 Tom and Tina have a son (age 13) and a daughter (age 12). They have also cared for their 14-year-old nephew since his parents died 2 years ago. They provide all of the support for their nephew and can claim him as a dependent. How many children are qualifying children for the child tax credit on Tom and Tina’s return? a. 1 b. 2 c. 3 26 Qualifying Child – Problem 3 Tom and Tina have a son (age 13) and a daughter (age 12). They have also cared for their 14-year-old nephew since his parents died 2 years ago. They provide all of the support for their nephew and can claim him as a dependent. How many children are qualifying children for the child tax credit on Tom and Tina’s return? c. 3 Tom and Tina have three qualifying children for the child tax credit on line 52 of Form 1040. 27 Qualifying Child In the Exemptions Section of Form 1040, you must provide the child’s social security number and the relationship. If you do not provide a valid social security number, the IRS may disallow the credit. An ITIN is allowed for the child tax credit. 28 Figuring the Credit Figuring the Credit You must reduce the amount of the credit if the: 1. Tax liability is less than the credit 2. Modified AGI is above the amount allowed for your filing status. a. MFJ - $110,000 b. H/H, QW, or single - 75,000 c. MFS - 55,000 29 Claiming the Credit Claiming the Credit Must file Form 1040 or Form 1040A. Provide child’s SSN in the exemption section or IRS may disallow. Complete the Child Tax Credit Worksheet. Keep the worksheet with your records, do not file. 30 Claiming the Credit – Problem 1 Harold and Donna are married and file a joint return. They have four children under the age of 17 that they claim as dependents. In 2008 Harold and Donna have a modified adjusted gross income of $108,498. Is their modified adjusted gross income under the phase-out threshold? Yes or No? 31 Claiming the Credit – Problem 1 Harold and Donna are married and file a joint return. They have four children under the age of 17 that they claim as dependents. In 2008 Harold and Donna have a modified adjusted gross income of $108,498. Is their modified adjusted gross income under the phase-out threshold? Yes And depending on their tax they are entitled to the full credit of up to $4,000 on line 52 of Form 1040. 32 Claiming the Credit Child Tax Credit Worksheet and Form 1040, Page 2 Wanda’s tax on line 46 of her 2008 tax return is $593. Her son, age 5, and her daughter, age 8, live with her and she claims them as dependents. Her filing status is head of household. She has no other credits on lines 47 through 54 of Form 1040. Wanda would fill in her child tax credit worksheet and her Form 1040 as follows: 33 Claiming the Credit 34 Claiming the Credit 35 CREDIT FOR CHILD AND DEPENDENT CARE EXPENSES 36 CREDIT FOR CHILD AND DEPENDENT CARE EXPENSES A nonrefundable credit. 1. Line 48 on Form 1040 2. Work-related expenses. 3. Do not confuse this credit with the child tax credit. 4. To claim the credit for child and dependent care expenses, you have to pay someone to care for your child or other dependent so you can work. On Form 1040, Page 2 37 Qualifying Person Who Is A Qualifying Person? 1. A child under age 13 (12 or younger) when the care was provided whom you can claim as a dependent (special rules apply if you are divorced or separated). 2. Your spouse who was physically or mentally incapable of self-care. 3. Your dependent who was physically or mentally incapable of self-care and for whom you can claim a dependent exemption (or could claim an exemption except the person had a gross income of $3,500 or more). 38 Qualifying Person – Problem 1 Blair pays someone to care for her husband Tom so she can go to work. Tom is physically unable to care for himself. Blair also pays someone to care for her son Eddie while she works. Eddie turned 13 on August 10, 2008. Which dependent care expenses can Blair use to figure her credit? a. b. c. d. Tom’s expenses only Eddie’s expenses only All of Tom and Eddie’s expenses All of Tom’s expenses and Eddie’s expenses through August 9, 2008. 39 Qualifying Person – Problem 1 Blair pays someone to care for her husband Tom so she can go to work. Tom is physically unable to care for himself. Blair also pays someone to care for her son Eddie while she works. Eddie turned 13 on August 10, 2008. Which dependent care expenses can Blair use to figure her credit? d. All of Tom’s expenses and Eddie’s expenses through August 9, 2008. Tom is a qualifying person, but Eddie is not for the time he was not under age 13. If Eddie was 13 on August 10, 2008, Blair can use the expenses she paid through August 9 to figure her credit. 40 Qualifying Person – Problem 2 Maria (age 28) is not mentally able to care for herself. Her brother pays someone to care for her while he works. He supports her and can claim her as a dependent. Is Maria a qualifying person for brother? Yes or No? 41 Qualifying Person – Problem 2 Maria (age 28) is not mentally able to care for herself. Her brother pays someone to care for her while he works. He supports her and can claim her as a dependent. Is Maria a qualifying person for brother? Yes Maria is a qualifying person. Her brother can claim the expenses he paid. 42 Qualifying Person If you are divorced or separated and are the CUSTODIAL PARENT (during the year, the child lived with you longer than the child lived with the other parent), you can treat the child as a qualifying child even if you cannot claim the dependent exemption for the child. You must have signed Form 8332 or a statement agreeing not to claim the child’s exemption. If you are the NONCUSTODIAL PARENT, you cannot treat the child as a qualifying person even if you can claim the child’s exemption. 43 Qualifying Person – Problem 3 Alan and Samantha are divorced. Their daughter Judy, age 11, lives with Samantha nine months of the year. The remaining three months she lives with Alan. Samantha has signed a statement allowing Alan to claim the exemption for Judy. She pays for day care for Judy so she can work. Who can claim Judy as a qualifying child for child care expenses? a. Alan b. Samantha 44 Qualifying Person – Problem 3 Alan and Samantha are divorced. Their daughter Judy, age 11, lives with Samantha nine months of the year. The remaining three months she lives with Alan. Samantha has signed a statement allowing Alan to claim the exemption for Judy. She pays for day care for Judy so she can work. Who can claim Judy as a qualifying child for child care expenses? b. Samantha Because she is the custodial parent, Samantha can treat Judy as a qualifying child for the credit for child care expenses even though Samantha cannot claim an exemption for Judy. 45 Requirements To Claim The Credit 1. The care is for one or more qualifying persons. 2. You (and your spouse if married filing jointly) have earned income for work performed during the tax year a. Earned income includes employee compensation and net earnings from self-employment b. Your spouse is treated as having earned income for any month he or she is: a full-time student (a student for some part of each of 5 calendar months during the year); or physically or mentally incapable of self-care. 46 Requirements To Claim The Credit – Problem 1 Barbara pays for day care for her daughter so she can go to her job as an attorney. Her husband Grant is a full-time medical student. He began school in August 2008 and was a student through December. Are both Barbara and Grant treated as having earned income during the year? Yes or No? 47 Requirements To Claim The Credit – Problem 1 Barbara pays for day care for her daughter so she can go to her job as an attorney. Her husband Grant is a full-time medical student. He began school in August 2008 and was a student through December. Are both Barbara and Grant treated as having earned income during the year? Yes 48 Requirements To Claim The Credit 3. The care is provided for the qualifying person so you (and spouse) can work or look for work. a. You must be paid for the work. b. Work includes actively looking for paid work as long as you have earned income during the year. 49 Requirements To Claim The Credit – Problem 2 Maxine has two children. She pays a day care center to take care of her children three days a week. Maxine does not work outside the home. Can Maxine claim the credit? Yes or No? 50 Requirements To Claim The Credit – Problem 2 Maxine has two children. She pays a day care center to take care of her children three days a week. Maxine does not work outside the home. Can Maxine claim the credit? No Because Maxine is not paying these expenses so she can work or look for work, she cannot claim the credit. 51 Requirements To Claim The Credit – Problem 3 Dave and Dora are married and have one child, age 11. They pay child care expenses so that Dave can work and Dora can attend school full time. Are Dave and Dora eligible to claim the credit? Yes or No? 52 Requirements To Claim The Credit – Problem 3 Dave and Dora are married and have one child, age 11. They pay child care expenses so that Dave can work and Dora can attend school full time. Are Dave and Dora eligible to claim the credit? Yes If they meet the other conditions, they are eligible to claim the credit. 53 Requirements To Claim The Credit 4. The taxpayer makes payments for dependent and/or child care payments to someone who is not your spouse, your child under the age 19, or a dependent claimed by you on your tax return. 5. Your filing status is single, H/H, QW, or MFJ. 54 Requirements To Claim The Credit – Problem 4 At the end of 2008, Connie was married. Her husband moved out in April 2008. He refused to file a joint return. Connie has paid the costs of keeping up the home for herself and her dependent daughter age 4. Does Connie qualify to claim the credit? Yes or No? 55 Requirements To Claim The Credit – Problem 4 At the end of 2008, Connie was married. Her husband moved out in April 2008. He refused to file a joint return. Connie has paid the costs of keeping up the home for herself and her dependent daughter age 4. Does Connie qualify to claim the credit? Yes She will meet the requirement because she can file as head of household. 56 Requirements To Claim The Credit 6. You must identify the care provider on your tax return. 7. Receive dependent care benefits from employer. The total amount you exclude or deduct must be less than the dollar limit for qualifying expenses. 57 Figuring the Credit Work-related expenses: 1. For the care of a qualifying person while you (and spouse) work or look for work. 2. For the qualifying person's well being and protection. 3. Can count expenses for a child in a grade below kindergarten. The amount paid for food and schooling can be included if the amount is small and cannot be separated from the total cost of care. 58 Figuring the Credit – Problem 1 Claudia’s older child attends first grade at a private school for which Claudia pays tuition. After school the child goes to a day care center. Claudia’s younger child attends a nursery school that provides some educational activities. Which, if any, of Claudia’s children can she claim child care expenses for? a. b. c. d. The youngest The oldest Both Neither 59 Figuring the Credit – Problem 1 Claudia’s older child attends first grade at a private school for which Claudia pays tuition. After school the child goes to a day care center. Claudia’s younger child attends a nursery school that provides some educational activities. Which, if any, of Claudia’s children can she claim child care expenses for? c. Both The day care for the oldest counts, private school tuition does not. 60 Figuring the Credit LIMITS ON WORK-RELATED EXPENSES The amount of work-related expenses eligible for the credit is limited to the lowest of: 1. Actual expenses. 2. Earned income ( cannot exceed the income of the lower paid spouse) a. Income for nonworking spouse who is a student or disabled is considered to be $250 with one qualifying person and $500 with two qualifying persons for each month the spouse is a student or disabled. 3. A dollar limit: $3,000 for one qualifying person; or, $6,000 for two or more qualifying persons, reduced by excluded employer-paid dependent care benefits shown in box 10 of Form W-2. 61 Figuring the Credit – Problem 2 Barbara Scott earned $50,000 in 2008. She and her husband Grant paid child care expenses of $4,500 for their 3 year-old daughter Susan so Barbara could work and Grant could attend school. Grant was a full-time student from August through December. Grant’s earned income would be considered to be $1,250 (5 months as a full time student x $250). What are the Scott’s eligible work-related expenses for figuring the credit? a. $3,000 b. $1,250 c. $4,500 62 Figuring the Credit – Problem 2 Barbara Scott earned $50,000 in 2008. She and her husband Grant paid child care expenses of $4,500 for their 3 year-old daughter Susan so Barbara could work and Grant could attend school. Grant was a fulltime student from August through December. Grant’s earned income would be considered to be $1,250 (5 months as a full time student x $250). What are the Scott’s eligible work-related expenses for figuring the credit? b. $1,250 The dollar limit for Barbara and Grant’s child care expenses is $3,000 because they have one child. Their eligible work-related expenses to figure the credit cannot exceed $1,250 which is considered to be Grant’s income and is the lowest of the three limits. 63 Figuring the Credit – Problem 2 Form 2441 is for Barbara and Grant Scott 64 Figuring the Credit – Problem 2 65 Figuring the Credit – Problem 3 Sam has one dependent child, Becky. He can claim the child and dependent care credit. Box 10 of his W-2 form shows Sam received $1,200 in dependent care benefits from his employer. His care expenses were $3,200. He earned $25,800. What is the total amount of Sam’s work-related expenses for figuring his credit? a. $3,200 b. $1,200 c. $1,800 66 Figuring the Credit – Problem 3 Sam has one dependent child, Becky. He can claim the child and dependent care credit. Box 10 of his W-2 form shows Sam received $1,200 in dependent care benefits from his employer. His care expenses were $3,200. He earned $25,800. What is the total amount of Sam’s work-related expenses for figuring his credit? c. $1,800 Sam would figure his credit on work-related expenses of $1,800, which is the lowest amount of the dollar limit, his earned income or his actual expenses. (his dollar limit is reduced to $1,800 ($3,000$1,200)). 67 Figuring the Credit The amount of the actual credit is a percentage of eligible work-related expenses. (See Table 7-1) 1. Ranges from 35% to 20% of eligible expenses 2. Based on AGI. 68 Figuring the Credit Table 8-1 69 Figuring the Credit – Problem 4 Sam, in our previous problem, can figure the credit on $1,800 of his eligible expenses. In addition to his wages of $25,800 he reported $350 in interest on line 8a of his tax return. His tax liability is $1,118. Determine Sam’s AGI. Then using Table 7-1, how much credit Sam be able to claim? a. $540 b. $522 c. $504 70 Figuring the Credit – Problem 4 Sam, in our previous problem, can figure the credit on $1,800 of his eligible expenses. In addition to his wages of $25,800 he reported $350 in interest on line 8a of his tax return. His tax liability is $1,118. Determine Sam’s AGI. Then using Table 7-1, how much credit Sam be able to claim? b. $522 He checks the chart and finds that based on his AGI of $26,150, he can take 29% of his eligible expenses as his credit. The amount of the credit Sam can claim is $522 ($1,800 x 29%). AGI = $25,800 + $350 71 Claiming the Credit 1. Complete Form 2441 to report information and figure the credit. 2. On Form 2441, identify with SSN or employer identification number (EIN) all persons or organizations that provided care. 3. If information is incomplete or incorrect, IRS may disallow the credit unless you can show due diligence in trying to provide the information. 4. Form 2441 is also used to figure the excludable amount of dependent care benefits provided by your employer. 72 Claiming the Credit The total amount of dependent care benefits you can exclude is limited to the smallest of: The total amount of the benefits (box 10 of Form W2), The total amount of qualified expenses you incurred, Your earned income, Your spouse’s earned income, or $5,000 ($2,500 if married filing separately). Benefits in excess of the excludable amount are taxable income and must be added to the amount you report on Form 1040, line 7. 73 Claiming the Credit In 2008, Betsy will file as head of household. Her wages were $25,000 and she paid $2,000 for day care for her child so she could work. She received $2,500 in dependent care benefits. Betsy’s W-2 form and Part III of her Form 2441 (shown on the next slide) would look like this: 74 Claiming the Credit 75 Claiming the Credit 76 Claiming the Credit 77 Claiming the Credit Betsy must add the $500 that is not excluded from her income to the amount of wages shown in box 1 of her W-2 form and enter the total compensation of $25,500 on line 7 of Form 1040. She does not claim a credit, as she has no eligible expenses. All her child care costs were paid for by the dependent care benefits provided by her employer. 78 EARNED INCOME CREDIT 79 EARNED INCOME CREDIT The earned income credit (EIC) is a tax credit for certain people who work and have earned income under $38,646 ($41,646 if MFJ). Because the earned income credit is a refundable credit, you can receive a refund even if you have no tax liability and had no income tax withheld. 80 EARNED INCOME CREDIT On Form 1040, Page 2 The EIC is available to taxpayers who have qualifying child(ren) and taxpayers who do not have a qualifying child. 81 Qualifying Child (See diagram on page 7-17) 1. RELATIONSHIP TEST - your son, daughter, stepchild, eligible foster child, your brother, sister, stepbrother or stepsister or their descendant. a. An eligible foster child for purposes of the EIC must be a child placed with you by an authorized agency. 2. AGE TEST - under age 19 (18 or younger) at the end of the tax year, under age 24 (23 or younger) at the end of the tax year and a full-time student, or permanently and totally disabled at any time during the tax year regardless of age. 3. RESIDENCY TEST - must live with you in the United States for more than half the year. 82 Qualifying Child – Problem 1 Todd was age 19 at the end of 2008 and he lived with his mother and father who supported him. Todd does not go to school and he is not disabled. Is Todd a qualifying child? Yes or No? 83 Qualifying Child – Problem 1 Todd was age 19 at the end of 2008 and he lived with his mother and father who supported him. Todd does not go to school and he is not disabled. Is Todd a qualifying child? No Todd does not meet the age test because he is not under age 19 and does not meet either of the exceptions. 84 Qualifying Child 85 Eligibility for the EIC All requirements must be met whether or not you have a qualifying child. 1. You must have a valid social security number for yourself, your spouse and your qualifying child(ren). If your social security number (or that of your spouse or qualifying child) says “Not valid for employment” or is an ITIN, you are not eligible for the EIC. 2. Your filing status cannot be married filing separately. If you are married and your spouse did not live with you at anytime during the last six months of the year, you may be able to file as head of household . 3. You must be a U.S. citizen or resident alien all year . 4. You cannot file Form 2555 or 2555EZ (relating to foreign earned income). 86 Eligibility for the EIC 5. Your investment income (taxable and nontaxable interest income, dividend income, net capital gains income) cannot exceed $2,950. 6. You must have earned income which includes all income you get from working. a. If married, at least one spouse must work and have earned income. Lance’s only income is from his social security benefits and investments. No matter what the other circumstances of Lance’s life, he does not qualify for the earned income credit because he has no earned income. 87 Eligibility for the EIC The income section of Al’s Form 1040 follows. He does not qualify for the earned income credit because the total of lines 8a, 8b, 9a and 13 is $2,959. 88 Eligibility for the EIC Nontaxable combat pay election. You can elect to have your nontaxable combat pay included as earned income for the earned income credit. Electing to include nontaxable combat pay in earned income may increase or decrease EIC. Linda is in the military and provides a home for her only child. Her only income is from her Form W-2 which shows $2,000 in box 1 and code Q of $23,000 in box 12. The EIC computation without the combat pay election would be $689. If she makes the election to include nontaxable combat pay in earned income, the EIC would be $1,433. Linda should make the election. 89 Eligibility for the EIC 7. You cannot be a qualifying child of another person. You are a qualifying child if you meet the relationship, age, and residency tests for that person. If you are a qualifying child of another person, you cannot claim the EIC even if the other person does not claim the credit or does not meet all the rules to claim the credit.. 8. You Your earned income and your adjusted gross income must be under certain limits. Your earned income and AGI must be less than: $38,646 ($41,646 for married filing jointly) if you have more than one qualifying child, $33,995 ($36,995 for married filing jointly) if you have one qualifying child, or $12,880 ($15,880 for married filing jointly) if you do not have a qualifying child. 90 Eligibility for the EIC – Problem 1 Donna is age 22 and was a full-time college student in 2008. She and her 2-year-old son lived with Donna’s mother for the entire year. Donna meets all the relationship, age, and residency tests and therefore is a qualifying child for her mother. Her mother’s 2008 investment income of over $3,000 is too high to allow her mother to claim the credit. Can Donna claim the earned income credit? Yes or No? 91 Eligibility for the EIC – Problem 1 Donna is age 22 and was a full-time college student in 2008. She and her 2-year-old son lived with Donna’s mother for the entire year. Donna meets all the relationship, age, and residency tests and therefore is a qualifying child for her mother. Her mother’s 2008 investment income of over $3,000 is too high to allow her mother to claim the credit. Can Donna claim the earned income credit? No Because she is a qualifying child for her mother, Donna cannot claim the earned income credit either. 92 Eligibility for the EIC – Problem 2 Clark has two qualifying children and files head of household. He has $36,000 in wages on line 7 of his Form 1040 and his AGI is $39,500. For EIC purposes, his earned income is $36,000 (taxable wages of $36,000). Can Clark claim the earned income credit? Yes or No? 93 Eligibility for the EIC – Problem 2 Clark has two qualifying children and files head of household. He has $36,000 in wages on line 7 of his Form 1040 and his AGI is $39,500. For EIC purposes, his earned income is $36,000 (taxable wages of $36,000). Can Clark claim the earned income credit? No Because his AGI is NOT less than $38,646 Clark cannot claim the earned income credit even if he meets all the other requirements. 94 Eligibility for the EIC If you have a qualifying child, you must meet these additional rules: 1. Your child must meet the relationship, age, and residency tests. 2. Your qualifying child cannot be used by more than one person to claim the EIC. 95 Eligibility for the EIC If you and someone else have the same qualifying child, you and the other person(s) can decide who can claim the credit using that qualifying child. The taxpayer claiming the child can take all of the following tax benefits based on the qualifying child. The child’s exemption The child tax credit Head of household filing status The credit for child and dependent care expenses The exclusion for dependent care benefits The EIC The other person cannot take any of these five tax benefits unless he or she has a different qualifying child. 96 Eligibility for the EIC 3. If two or more persons can claim the same qualifying child you and the other person(s) can choose who will claim the credit using that qualifying child. If you and the other person(s) cannot agree and more than one person qualifies to claim the credit using the same child, the tie- breaker rule applies. Refer to Table 7-2. 4. You cannot be the qualifying child of another person 97 Eligibility for the EIC 98 Eligibility for the EIC – Problem 3 Wanda, age 24, and her 4-year-old son lived with Wanda’s mother for the entire year. Wanda would not meet the age test so she would not be a qualifying child for her mother. Wanda’s son is a qualifying child for both Wanda and her mother. He is Wanda’s son and her mother’s grandson, he is under age 19, and he resided with Wanda and her mother for more than half the year in the United States. However, only one of them can use him to claim EIC. Wanda’s only income for 2008 is $14,000 from her job and her mother’s only income is $20,000 from her job. Who can claim Wanda’s son, Wanda or her mother? a. Wanda b. Wanda’s Mom 99 Eligibility for the EIC – Problem 3 Wanda, age 24, and her 4-year-old son lived with Wanda’s mother for the entire year. Wanda would not meet the age test so she would not be a qualifying child for her mother. Wanda’s son is a qualifying child for both Wanda and her mother. He is Wanda’s son and her mother’s grandson, he is under age 19, and he resided with Wanda and her mother for more than half the year in the U.S. However, only one of them can use him to claim EIC. Wanda’s only income for 2008 is $14,000 from her job and her mother’s only income is $20,000 from her job. Who can claim Wanda’s son, Wanda or her mother? a. Wanda OR b. Wanda’s mom Wanda and her mother can choose who will treat the child as a qualifying child to claim the EIC. If they cannot agree, Wanda, as the child’s parent will be the only one allowed to claim the credit using this child. She will also qualify to claim all of the other tax benefits for this child. Wanda’s mother cannot claim either Wanda or her son as a dependent. If she has no other qualifying person, she also cannot claim head of household, the child tax credit or the100 credit for child and dependent care benefits. Eligibility for the EIC If you do not have a qualifying child, you must meet these additional rules. 1. Your age must be between 25 and 65 at the end of the tax year. 2. You (and spouse if filing a joint return) cannot be another person’s dependent. 3. You cannot be a qualifying child of another person. 4. You must have lived in the United States more than half of the year. 101 Eligibility for the EIC – Problem 4 Dan is age 25 and single. His parents provide over half of his total support. Dan’s earned income in 2008 was $2,875. Because he meets all the dependency tests, his parents can claim him as a dependent on their tax return. Who can claim the earned income credit, Dan or his parents? a. Dan b. His parents c. Both d. Neither 102 Eligibility for the EIC – Problem 4 Dan is age 25 and single. His parents provide over half of his total support. Dan’s earned income in 2008 was $2,875. Because he meets all the dependency tests, his parents can claim him as a dependent on their tax return. Who can claim the earned income credit, Dan or his parents? d. Neither Dan cannot claim EIC because he is eligible to be claimed as a dependent (qualifying relative) by his parents. Dan is not a qualifying child for EIC purposes, so his parents cannot claim EIC. 103 Claiming the Credit 1. Answer the eligibility questions in the tax form instruction booklet. 2. If eligible, complete the Earned Income Worksheet. 3. Use the Earned Income Credit Table to find the amount of your credit. 4. If the amount of your earned income and AGI are different, look up the credit for each amount and claim the lower credit. 5. If you have qualifying children, complete Schedule EIC and attach to your tax form. 104 Claiming the Credit – Problem 1 Walter is single and has one qualifying child. In 2008, his earned income was $17,270 and his AGI was $17,352. Using the EIC Table, he finds that the credit for the amount $17,270 for one child is $2,672 and the credit for the amount $17,352 for one child is $2,592. Which is the credit amount that Walter should take? a. $2,672 b. $2,592 105 Claiming the Credit – Problem 1 Walter is single and has one qualifying child. In 2008, his earned income was $17,270 and his AGI was $17,352. Using the EIC Table, he finds that the credit for the amount $17,270 for one child is $2,672 and the credit for the amount $17,352 for one child is $2,592. Which is the credit amount that Walter should take? b. $2,592 Walter’s earned income credit is $2,592, the lower credit amount. 106 Earned Income Credit 107 Earned Income Credit Tim (SSN 544-45-3333) and Lorrie (SSN 54432- 2222) Martin have two children. Aggie (SSN 233-45-6789, born 12/12/1996) and Lon (SSN 233-66- 5431, born 8/2/1994). Their filing status is married filing jointly. The amount on line 7 of their Form 1040 for 2008 is $22,225. Their only other taxable income is $1,400 in unemployment giving them an AGI of $23,625 on line 38. Tim and Lorrie can claim the earned income credit. Tim and Lorrie answered the eligibility questions and filled out the worksheet and Schedule EIC as shown on the following slides and on pages 7-23 thru 26 in your book. 108 109 110 111 112 113 114 Form 1040 115 DUE DILIGENCE FOR TAX PREPARERS Paid tax preparers who file EIC claims on behalf of their taxpayers must meet four due diligence requirements: Complete Form 8867, Paid Preparer's Earned Credit Checklist. The information must be provided by the taxpayer or obtained in another reasonable manner. It is important to ensure that the questions are asked. 116 DUE DILIGENCE FOR TAX PREPARERS Complete the appropriate EIC worksheet found in Form 1040, 1040A or 1040EZ instructions or in Publication 596, or an equivalent paper or electronic form. 117 DUE DILIGENCE FOR TAX PREPARERS The tax preparer must not know, or have reason to know, that any information used by the tax preparer in determining the taxpayer's eligibility for, or the amount of, the EIC is incorrect. The tax preparer may not ignore any implications of information furnished to, or known by, and he/she must make reasonable inquiries if the information furnished to, or known by him/her appears to be incorrect, inconsistent, or incomplete. 118 DUE DILIGENCE FOR TAX PREPARERS Keep Form 8867 and the EIC worksheet (or equivalent of each), and a record of how, when and from whom the information used to prepare the form and worksheet(s) was obtained. These documents (paper or electronic) must be kept for three years after June 30 following the date the return or claim for refund was presented to the taxpayer for signature. 119 DUE DILIGENCE FOR TAX PREPARERS Example 1 During the interview process, the taxpayer informs the tax preparer that she is separated from her spouse. A child lives with her and the taxpayer wants to claim the EITC. In reviewing the taxpayer's records it is apparent the taxpayer earns a minimal amount of income, which is not sufficient to support a household (Pay rent/mortgage, utilities, food, clothing, school supplies, are a few examples). The tax preparer should ask the appropriate questions to determine the correct filing status for the taxpayer in order to meet the third EIC knowledge requirement. 120 DUE DILIGENCE FOR TAX PREPARERS Example 2 During the interview process, the taxpayer, who is 18 years old, mentions that she and her daughter live with her parents. She has earnings of $3,000 from a part time job. She wants to claim EIC. In order to meet the third EIC knowledge requirement the tax preparer should ask the appropriate questions to determine if this taxpayer is a qualifying child of her parents and therefore ineligible to claim EIC. In this example, the income level should alert the tax preparer to ask additional questions even if the client did not mention her living arrangements. 121 DUE DILIGENCE FOR TAX PREPARERS Example 3 The taxpayer comes in to have his return prepared. He is 25 years old. He is claiming that he has two sons ages 10 and 11 that are his qualifying children for EIC. In order to meet the third EIC knowledge requirement the tax preparer should ask the appropriate questions and request adequate documentation if necessary to determine if these children are really his. The ages of the children appear inconsistent with the client's age. 122 DUE DILIGENCE FOR TAX PREPARERS Example 4 The taxpayer comes in to have her return prepared. She states that she is head of her household and has two children ages 13 and 14. Mary states that she is self-employed as a babysitter. She states that she made $12,000 and had no expenses. The tax preparer should ask the appropriate questions about expenses related to Mary's babysitting business, what records Mary has kept, etc. to determine that it is a business. It is inconsistent that she would have no expenses and it appears that the information she is giving the tax preparer is incomplete. 123 DUE DILIGENCE FOR TAX PREPARERS To comply with the knowledge requirement, tax practitioners should: Apply a common sense standard to client provided information. Evaluate whether the information appears to be complete; identify missing facts. 124 DUE DILIGENCE FOR TAX PREPARERS Determine whether the information is consistent; recognize contradictory statements or statements that are inconsistent with what you know to be true. Conduct a thorough, in depth interview with every client, every year. Ask questions when client information appears to be incomplete, incorrect or inconsistent. Ask enough questions to ensure the return is correct and complete. 125 Tax Credits KEY IDEAS ♦ A tax credit is subtracted dollar-for-dollar from your tax. ♦ A nonrefundable credit reduces or eliminates your income tax but will not give you an additional refund. ♦ A refundable credit reduces or eliminates your total tax and also gives you a refund of any amount of the credit that is more than your tax liability. ♦ The child tax credit is a nonrefundable credit (the additional child tax credit will be covered later). The credit for child and dependent care expenses is a nonrefundable credit. The earned income credit is a refundable credit. 126 Tax Credits KEY IDEAS ♦ The rules for the qualifying child or person for each credit generally concern the age of the person, their relationship to you and where they live. However, the rules are different for each credit. ♦ The amount of the child tax credit is $1,000 per qualifying child. To claim up to the full $1,000 for the child tax credit, your modified adjusted gross income must be below a certain amount for your filing status. ♦ The amount of the child and dependent care credit is a percentage of your eligible expenses. You can claim the child and dependent care credit only for workrelated care expenses. 127 Tax Credits KEY IDEAS ♦ You have to have earned income (usually wages or salary) to claim the earned income credit. The amount of the earned income credit is found in the EIC Table. ♦ You can elect to include or not include nontaxable combat pay as earned income when determining the earned income credit. ♦ You should ask sufficient questions to comply with due diligence. 128 Tax Credits CLASSWORK ONE: True or False. (1) To be eligible to claim the earned income credit, you must have a qualifying child. (2) A refundable credit reduces your total tax liability and can result in a refund if the credit is greater than the tax owed. (3) Generally, a qualifying child for the child tax credit must be claimed as your dependent. (4) Sue’s 7-year-old child attends private elementary school. Sue can use the tuition she paid as a qualified expense to figure the child and dependent care credit. (5) A tax credit is subtracted from adjusted gross income. (6) To be a qualifying child for the earned income credit, your child must be claimed as your dependent. 129 Tax Credits CLASSWORK ONE: True or False. (7) Eddie, age 12, lives with his mother who supports him. His mother is divorced and has agreed in writing that Eddie’s father can claim Eddie as a dependent. Eddie is not a qualifying child for his mother for the child and dependent care credit. (8) Paulette’s parents pay for after school care for Paulette so they can work. Paulette turned 13 on October 10, 2008. None of Paulette’s 2008 care expenses are eligible for the child and dependent care credit. 9) You can claim EIC if your filing status is Married Filing Separately. 130 Tax Credits CLASSWORK ONE: True or False. (10) In 2008, Connie paid work-related childcare expenses of $3,100 for her qualifying child. She earned $24,000. The amount of her work-related expenses that she will use to figure the child and dependent care credit is $3,100. (11) Amy’s 25-year-old son lives with her because he is totally and permanently disabled. He is a qualifying child for Amy for the earned income credit. (12) Roberta (born 1984) is single and has no children. Because her 2008 AGI and earned income are both less than $12,880 she is eligible for the earned income credit for 2008. 131 Tax Credits CLASSWORK ONE: True or False. (1) To be eligible to claim the earned income credit, you must have a qualifying child. F (2) A refundable credit reduces your total tax liability and can result in a refund if the credit is greater than the tax owed. T (3) Generally, a qualifying child for the child tax credit must be claimed as your dependent. T (4) Sue’s 7-year-old child attends private elementary school. Sue can use the tuition she paid as a qualified expense to figure the child and dependent care credit. F (5) A tax credit is subtracted from adjusted gross income. F (6) To be a qualifying child for the earned income credit, your child must be claimed as your dependent. F 132 Tax Credits CLASSWORK ONE: True or False. (7) Eddie, age 12, lives with his mother who supports him. His mother is divorced and has agreed in writing that Eddie’s father can claim Eddie as a dependent. Eddie is not a qualifying child for his mother for the child and dependent care credit. F (8) Paulette’s parents pay for after school care for Paulette so they can work. Paulette turned 13 on October 10, 2008. None of Paulette’s 2008 care expenses are eligible for the child and dependent care credit. F 9) You can claim EIC if your filing status is Married Filing Separately. F 133 Tax Credits CLASSWORK ONE: True or False. (10) In 2008, Connie paid work-related childcare expenses of $3,100 for her qualifying child. She earned $24,000. The amount of her work-related expenses that she will use to figure the child and dependent care credit is $3,100. F (11) Amy’s 25-year-old son lives with her because he is totally and permanently disabled. He is a qualifying child for Amy for the earned income credit. T (12) Roberta (born 1984) is single and has no children. Because her 2008 AGI and earned income are both less than $12,880 she is eligible for the earned income credit for 2008. F 134 Tax Credits CLASSWORK TWO: Answer the questions for each of the following situations. Explain each answer. 1. Rose is 12-years-old. She came to live with her grandmother Violet in March 2008. Rose’s father supports Rose, but does not live with her. Violet’s earned income is $21,320, which is the same as her AGI. Violet claims Rose as a dependent. a. Can Violet claim the EIC? b. Can Violet claim the child tax credit? 135 Tax Credits 2. Kent (born in 1980) and his 3-year-old son live with Kent’s grandmother. Kent provides all of the support for his son. His earned income and AGI are both $12,354. His grandmother has earned income of $14,671 and an AGI of $16,721, which includes $2,150 in interest from savings. a. Can Kent claim the EIC? b. Can Kent’s grandmother claim the EIC? c. Can either of them claim the child tax credit? If yes who can claim the credit? 136 Tax Credits 3. Mary Jane and Riley send their 9-year-old daughter to day care so Riley and Mary Jane can work. In 2008, Riley’s taxable earned income was $23,660 and Mary Jane’s was $2,100. They had no other income. Their work-related childcare expenses were $2,450. a. b. What is the amount of their work-related expenses eligible for the child and dependent care credit? What percentage of the eligible expenses can they take as the credit? 137 Tax Credits 4. Mike and Maureen have a son Ted (born 12/12/1991), a son Richard (born 4/8/1996), a daughter Melissa (born 7/12/1992) and a daughter Laurie (born 2/14/1999). Their nephew Gordie (born 8/11/1998) also lived with them all year. They support their nephew and claim him as a dependent on their tax return. Mike and Maureen’s modified adjusted gross income in 2008 was $46,460. Their 2008 income tax on Form 1040, line 46 was $1,198. a. Which children are qualifying children for the child tax credit? b. What is the amount of the credit Mike and Maureen will enter on Form 1040, line 52? 138 Tax Credits 5. Brad is divorced. His two children live with him. His daughter Sadie was born in 1991 and his son Noah was born in 1998. Brad has signed a written agreement allowing his former wife to claim the dependent exemption for Noah. Noah goes to day care after school so Brad can work at his job as a plumber. His earned income and AGI are both $26,379. a. Which tax credits will Brad be eligible to claim? 139 Tax Credits CLASSWORK TWO: Answer the questions for each of the following situations. Explain each answer. 1. Rose is 12-years-old. She came to live with her grandmother Violet in March 2008. Rose’s father supports Rose, but does not live with her. Violet’s earned income is $21,320, which is the same as her AGI. Violet claims Rose as a dependent. a. Can Violet claim the EIC? Yes, Rose meets all the requirements to be her qualifying child for EIC. b. Can Violet claim the child tax credit? Yes, Rose meets all the requirements to be her qualifying child for child tax credit. 140 Tax Credits 2. Kent (born in 1980) and his 3-year-old son live with Kent’s grandmother. Kent provides all of the support for his son. His earned income and AGI are both $12,354. His grandmother has earned income of $14,671 and an AGI of $16,721, which includes $2,150 in interest from savings. a. Can Kent claim the EIC? Yes, Kent meets all the rules and has a qualifying child (his son). b. Can Kent’s grandmother claim the EIC? Yes, Kent’s grandmother also meets all the rules and has a qualifying child (Kent’s son). c. Can either of them claim the child tax credit? If yes who can claim the credit? Yes, Kent because he can claim the child as a dependent. 141 Tax Credits 3. Mary Jane and Riley send their 9-year-old daughter to day care so Riley and Mary Jane can work. In 2008, Riley’s taxable earned income was $23,660 and Mary Jane’s was $2,100. They had no other income. Their work-related childcare expenses were $2,450. a. What is the amount of their work-related expenses eligible for the child and dependent care credit? $2,100, Mary Jane’s earned income is $2,100. Work related expenses cannot exceed the earned income of the lower paid spouse. b. What percentage of the eligible expenses can they take as the credit? 29%, Their AGI is $25,760. 142 Tax Credits 4. Mike and Maureen have a son Ted (born 12/12/1991), a son Richard (born 4/8/1996), a daughter Melissa (born 7/12/1992) and a daughter Laurie (born 2/14/1999). Their nephew Gordie (born 8/11/1998) also lived with them all year. They support their nephew and claim him as a dependent on their tax return. Mike and Maureen’s modified adjusted gross income in 2008 was $46,460. Their 2008 income tax on Form 1040, line 46 was $1,198. a. Which children are qualifying children for the child tax credit? Richard, Melissa, Laurie, Gordie. Ted was 17 at the end of 2008 so he is not a qualifying child. The others are qualifying ages and the nephew is an eligible qualifying child. b. What is the amount of the credit Mike and Maureen will enter on Form 1040, line 52? $1,198. Line 52 is a nonrefundable credit. The amount of the credit cannot exceed the tax liability. 143 Tax Credits 5. Brad is divorced. His two children live with him. His daughter Sadie was born in 1991 and his son Noah was born in 1998. Brad has signed a written agreement allowing his former wife to claim the dependent exemption for Noah. Noah goes to day care after school so Brad can work at his job as a plumber. His earned income and AGI are both $26,379. a. Which tax credits will Brad be eligible to claim? Child and dependent care credit and earned income credit; Sadie is too old for the child tax credit and Brad can’t claim Noah as a dependent. Noah is a qualifying child for the child and dependent care credit because Brad is the custodial parent. Both children are qualifying children for EIC and Brad meets all the other rules. 144 Tax Credits CLASSWORK THREE: Multiple Choice. 1. Harry’s and Louise’s three nephews ages 12, 14 and 17 came to live with them on March 20, 2008. Line 46 of their 2008 Form 1040 is $798 and they have no other credits. Harry and Louise can claim a child tax credit on line 52 of: a. $1,000 b. $2,000 c. $798 d. $0 145 Tax Credits CLASSWORK THREE: Multiple Choice. 2. If you can claim the child and dependent care credit you can receive: a. an additional refund b. a reduction in your taxable income c. a reduction in your income tax d. all of the above 146 Tax Credits CLASSWORK THREE: Multiple Choice. 3. Paul and Pam are married and have two children ages 10 and 17. In 2008, Paul had earned income of $21,775. Pam had earned income of $3,425. They also received $500 in interest from a bank account and they had no other income. What is the amount of earned income they must use to figure the earned income credit? a. $25,700 b. $25,200 c. $21,775 d. $3,425 147 Tax Credits 4. Fred sends his dependent child (age 8) to after school day care so he can work. In 2008, he paid $2,200 for the care. He received wages of $23,740 and $1,360 of taxable interest. He had no other income. What is the amount of the child and dependent care credit he can claim? a. $616 b. $682 c. $660 d. $638 148 Tax Credits CLASSWORK THREE: Multiple Choice. 1. Harry’s and Louise’s three nephews ages 12, 14 and 17 came to live with them on March 20, 2008. Line 46 of their 2008 Form 1040 is $798 and they have no other credits. Harry and Louise can claim a child tax credit on line 52 of: c. $798 2. If you can claim the child and dependent care credit you can receive: c. a reduction in your income tax 149 Tax Credits CLASSWORK THREE: Multiple Choice. 3. Paul and Pam are married and have two children ages 10 and 17. In 2008, Paul had earned income of $21,775. Pam had earned income of $3,425. They also received $500 in interest from a bank account and they had no other income. What is the amount of earned income they must use to figure the earned income credit? b. $25,200 4. Fred sends his dependent child (age 8) to after school day care so he can work. In 2008, he paid $2,200 for the care. He received wages of $23,740 and $1,360 of taxable interest. He had no other income. What is the amount of the child and dependent care credit he can claim? d. $638 150 Questions & Answers 151