The Dow Chemical Company Headline Case

advertisement

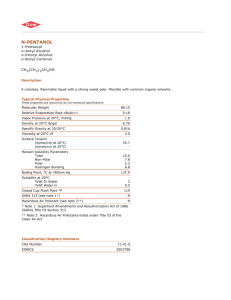

The Dow Chemical Company Headline Case Study Megan Phillips York College of Pennsylvania Megan Phillips About Dow Chemical Dow is a company that serves over 180 countries by combining science and technology to innovate in specialty chemicals, advanced materials, agrosciences and plastic businesses. Incorporated in 1897, Dow began with the purpose of manufacturing and selling bleach on a commercial scale (“History,” 2014). In 2013, the company had profits of $57 billion and employed 53,000 across the world. In addition, it produced over 60,000 products that were manufactured in 36 countries at 201 sites, making it a formidable force ("The DOW Chemical," 2014). It has product segments of Electronic and Functional Materials, Coatings and Infrastructure Solutions, Agricultural Sciences, Performance Materials, Performance Plastics and Feedstocks and Energy ("The DOW Chemical," 2014). The overall strategy of the company is to “invest in a market-driven portfolio of advantaged and technology-enabled businesses that create value for our shareholders and customers ("The DOW Chemical," 2014).” SWOT Analysis Strengths Weaknesses - Experience - Large company - Resources -Leaving Original Market - Diverse Portfolio - High Margin Products Focus - Reputation SWOT Anaysis Opportunities - New Markets/Products - Global Market -Environmentally Friendly Operations Threats - Economy -Raw Materials - Costs A SWOT Analysis, as featured above, is essential in understanding the internal and external factors that affect a long-running company, such as Dow. Internally, the Dow Chemical Company has strengths and weakness, which indicate a successful past and a promising future. The company has 120 years of experience in operations, access to monetary resources, and a diverse portfolio of goods in varying industries ("The DOW Chemical," 2014). Weaknesses within the company are its relatively large size, the recent departure from their original bleach product, and reputation as an environmentally irresponsible company (Rallis, 2012). The main weakness to Dow Chemical is that they have recently announced their original departure from the chlorine manufacturing industry. Dow is planning to sell off at least $5 billion of their low- Megan Phillips margin businesses, which is about 10% of their business ("The DOW Chemical," 2014). This could be problematic for the company with such a lengthy history. They have held a market leader position within the minds of the consumers for quite some time, thus repositioning the company in the near future could present difficulties. Whereas, the strengths and weaknesses are relative of internal operations, opportunities and threats reflect the external environment. Opportunities abound for Dow Chemical with new products and the expansion of global markets, will result in additional markets for the company ("The DOW Chemical," 2014). One of the main reasons that Dow is exiting the chemical bleach industry is because there is a high level of competition and therefore low profitability in the market. The company is refocusing on higher margin products that will create higher returns for shareholders (“DOW Selling Chlorine Chemicals Businesses”, 2013). Threats to Dow include the consistently fluctuating domestic and global economy, the availability of raw materials for products, and variable costs of materials ("The DOW Chemical," 2014). Porter’s 5 Forces Model is also essential in understanding the nature of competition within an industry. Dow Chemical operates in several industries due to its wide product portfolio. The model below examines the Inorganic Chemical Manufacturing industry. Porter’s 5 Forces Model Threat of New Entrants Power of Suppliers Level of Competiion Power of Buyers Substitutes Threat of New Entrants The barriers to enter the Inorganic Chemical Manufacturing industry are medium, but increasing. There is a high need for capital as specialized equipment and workforce is necessary to operate in the industry (Phillips, 2014). Additionally, in this industry investment in research is necessary as new products are imperative to businesses. However, the most prominent barrier to entry is the regulation of operations by governmental and environmental groups—these combined barriers make the threat of new entrants low (Phillips, 2014). As Dow entered this industry over 100 years ago, they had a relative advantage over new competitors because the Megan Phillips level of technological change and fixed costs were low. However, the recent volatility of the industry proved reason to executives that the low cost and low margin no longer proved valuable to Dow Chemical. Power of Buyers Companies must establish a relationship with buyers in the manufacturing and construction sectors, which are generally the end users (Phillips, 2014). This means the power of the buyers is high in this industry—as it was reflected with the recession of 2008. From 20082009, revenues dropped a staggering 16.3%, but have steadily increased in the years after the recession (Phillips, 2014). The volatility of this industry may explain why Dow Chemical is selling off their equipment and technology in favor of high-margin products. Substitutes There is opportunity for substitutes in the Inorganic Chemical Manufacturing industry, such as soda ash manufacturers in comparison to glass substitutes (Phillips, 2014). This industry is globalizing at a higher than average rate, so companies are also competing with imported chemicals. These chemicals are produced at facilities that are large-scale and low cost, making them a viable substitute (Phillips, 2014). The amount of substitutes could also be a reason that Dow Chemical made the decision to exit the industry. Power of Suppliers The “Power of Suppliers” is strong in the Inorganic Chemical Manufacturing industry because access to competitively priced raw materials is essential to staying competitive. Economies of scale are also favorable to the purchaser as large volumes of production reduce costs (Phillips, 2014). The result of this is that suppliers have a high power because they rely on these industries to do business (Phillips, 2014). The variable supply of costs and reliance on supplies resulted in low margins in the inorganic chemical industry, which was another contributing factor of Dow exiting the industry. Level of Competition The level of competition within the Inorganic Chemical Manufacturing industry is high, the main competitors: Dupont and Dow Chemical only make up 7.4% and 5% of the industry (Phillips, 2014). The industry is in the mature portion of the product life cycle and is in a relatively fragmented market (Phillips, 2014). As a result, competitors receive low margins resulting in a price war because the industry’s technology and quality has not changed (Phillips, 2014). As Dow operates within this industry, the company and senior leaders have had to maximize on opportunities and reduce the presence of threats. These opportunities and threats will require quick thinking and strategy reformulation by the company. Megan Phillips Organizational Situation Opportunities The opportunities that Dow Chemical should exploit in the future will be in new global markets and new higher margin products ("The DOW Chemical," 2014). For example, the company is refocusing on the ‘Electronic and Functional Materials’ segment because of its commitment to continuously innovate and rapidly produce new products. Therefore, this segment will have a better chance to maximize opportunities in emerging geographical areas, such as China and India, along with high-growth industries ("The DOW Chemical," 2014). The sales grew by 5% from 2012-2013 and with the global recovery on pace, emerging economies should be a source of growth as their interest grows in home and personal care products, along with an increase in demand for higher “specialty biocides and for cellulosics used in food and pharmaceutical applications ("The DOW Chemical," 2014).” Threats The global economy is one of the greatest threats to Dow Chemical. The company attributed 67% of its sales and 47% of its property investment outside of the United States ("The DOW Chemical," 2014). This means that the company is vulnerable to elements such as fluctuation in currency exchange values or the unstable nature of politics in emerging countries ("The DOW Chemical," 2014). The company attributes two-thirds of its sales to countries outside of the United States, which makes them vulnerable to factors such as legislation of a respective country. However, Dow Chemical’s management has implemented several measures to reduce these threats, as discussed later. Company Reaction Opportunities The company is capitalizing on the opportunity by adding production facilities and eliminating their low-margin chlorine-related products. As noted by Dow’s Global Director of Energy and Climate Change Policy, Russel Mills, “It will be especially important to address mutually beneficial sustainable growth opportunities for developing nations (Mills, 2012).” Dow executives have also committed to growth in high-margin technologies which will enhance its financial strength ("2012 Annual Report," 2013). As pictured below from the 2012 Annual Report, Dow has developed their portfolio for the purposes of integration, which will allow the company to grow in the future by developing technology ‘downstream ("2012 Annual Report," 2013).’ Thorough planning will give the company a consistent vision and provide a guideline for Dow to capitalize on the opportunities of developing economies and new technologies. Megan Phillips Threats Dow Chemical is minimizing the threats of the global economy in multiple ways, even though their 2014 business plan assumes a similar macroeconomic environment as 2013 “The DOW Chemical Company”, 2014). Foremost, they are committing to paying down on debt to reduce the risk that creditors would call in outstanding debts ("2012 Annual Report," 2013). They have also increased investments in enterprise growth projects in the U.S. Golf Coast and the Sadara joint venture in the Middle East ("2012 Annual Report," 2013). By establishing jointventures in overseas operations, Dow Chemical receives access to new markets, distribution networks, increased capacity, shared costs/risks, and access to resources (employees, financing, and technology. Management reduces these threats by generally starting bought or new technology—especially if overseas—as joint ventures. Additionally, to manage the global economy risk, Dow Chemical enters into hedging transactions—using options and futures— pursuant to established guidelines and policies (“The DOW Chemical Company”, 2014). Personal Recommendations Although the Dow Chemical Company officials are managing their opportunities and threats with due diligence, there is room for improvement. For example, due to the global economy, Dow has little price power—they lost 1.3 billion in lost price in the 2nd half of 2012 ("2012 Annual Report," 2013). My recommendations for top officials and managers include eliminating, raising, reducing, and creating certain factors within the company. Eliminating lower margin products, such as the chlorine and polypropylene, will allow the company to focus on new technology (“The DOW Chemical Company”, 2014). Raising prices and releasing new technology will benefit the company by positioning it as a high-quality product; the company has recently been subject to downward prices globally (“The DOW Chemical Company”, 2014). In order to limit the effects of a global economy, the company should reduce new joint ventures Megan Phillips and/or attempt to establish more control of processes in current joint ventures where they have 50% or less ownership of the company (“The DOW Chemical Company”, 2014). As they are currently in the process of creating higher-margin products, the company should invest more in the Research & Development sector of the business. The global economy is recovering, but overall it is unstable so investments should only have a moderate increase ("2012 Annual Report," 2013). A visual representation of my recommended actions for Dow Chemical is below in a Four Actions Framework. Four Actions Framework Eliminate Raise Low Margin Segments Price A New Value Curve Reduce Create Joint Ventures High Margin Segments Dow Chemical Strategy Canvas 8 7 6 5 4 3 2 1 0 Old Strategy New Strategy Industry The “New Value Curve” is represented in the Strategy Canvas shown in the graphic above. Traditionally, this industry has high purchase and wage costs due to the materials and skill of workers needed (Phillips, 2014). However, by establishing themselves as a market leader in quality and buying for economies of scale, the company should retain lower-cost purchase Megan Phillips contracts (Phillips, 2014). Long-term contracts and good relationships with suppliers and buyers are vital in this industry as there is a limited amount of each (Phillips, 2014). Although higher buying prices may turn away customers of lower-margin products, that is the desired effect. The company should move towards higher-margin products as it develops new technology. However, this price increase should reflect an increase in quality, which would result in the reduction and/or increase of control in joint ventures. By establishing standards throughout the company, it delivers a consistent product or service to the customer, which increases customer loyalty. Additionally, as a company with less-than-ideal image to the environmentally aware, Dow needs an increase their environmental reputation (Rallis, 2012). Increasingly, end-users are looking for a high quality product that is environmentally friendly, so it would be beneficial for them to regain control in companies that are hurting the company’s reputation with consumers. Senior managers should implement changes that optimize the opportunities that they have created by eliminating poor-performing and low-margin products. In total, Dow Chemical has a very promising future as they shed their image of low-margin products and move towards highermargin technology. Megan Phillips References 2012 annual report. (2013, February 15). Retrieved from http://www.dow.com/investors/pdfs/161-00784_2012_Annual_Report.pdf Dow selling chlorine chemicals businesses. (2013). TCE: The Chemical Engineer, (870/871), 7. History. (2014). Retrieved from http://www.dow.com/company/aboutdow/history/timeline.htm Mills, R. (2012). Green chemistry. OECD Observer, 98-99. Phillips, J. (2014, February). Inorganic chemical manufacturing in the us. Retrieved from http://clients1.ibisworld.com.ezproxy.ycp.edu:8000/reports/us/industry/competitivelandsc ape.aspx?entid=463 Rallis, D. (2012, November 5). Yet another leak at dow chemical. Retrieved from http://www3.gmiratings.com/home/2012/11/yet-another-leak-at-dow-chemical/ U. S, Securities And Exchange Commission, (2014). The dow chemical company (1-3433). Retrieved from website: http://phx.corporate-ir.net/phoenix.zhtml?c=80099&p=irolSECText&TEXT=aHR0cDovL2FwaS50ZW5rd2l6YXJkLmNvbS9maWxpbmcueG1sP2l wYWdlPTkzOTQxOTMmRFNFUT0wJlNFUT0wJlNRREVTQz1TRUNUSU9OX0VO VElSRSZzdWJzaWQ9NTc%3d