Self Supporting Budget Training Workshop Power Point Slides

advertisement

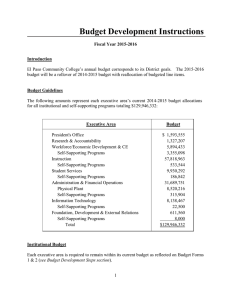

Planning, Budget & Analysis Self-Supporting Budget Training Workshop Page 1 What’s New Workday: October 1, 2016 There will be budget changes Will not effect the way you budget for FY17 PBA will take care of integration from Advantage to Workday Page 2 Overview & Quick Reference What is a budget? Why do we budget? When do we need to budget? Who prepares the budget? How is a budget built? Page 3 What is a budget? A Budget is a list of planned revenue and expenditures used as a tool for assessing performance and providing for internal management controls. Page 4 Why do we budget? Budgets create a structure for both planning operations (hiring, major equipment purchases, moves, etc.) for the coming year and assessing actual performance throughout the year. Page 5 When do we need to budget? There are three primary ‘budget triggers’: Board of Regent Requirements Position Control Requirements Fund (the first four digits of the account number) Requirements Page 6 Board of Regents requirements Each fiscal year all self-supporting budgets with total budgeted expenditures greater than $25,000 must be approved by the Board of Regents. For budgeting purposes, ‘total budgeted expenditures’ excludes expense objects 39 (recharge), VT (voluntary transfers out) and 79 (reserves). All other expense objects (10,11,12...25,30 and so on) are included in the $25,000. In other words, if the amount on Form 1, Part 2, line 19 is over $25,000, the budget will be submitted to the Board of Regents. Page 7 Self-Supporting Budget Request Back Page 8 Position Control requirements A budget must be in the system before any wages or salaries can be paid from expense object codes: 10 (Letter of Appointment with or without benefits) 11 (Professional) 12 (Graduate) 14 (Classified) 15 (Student Wages/Temporary Labor). Remember fringe (obj. 16) must be budgeted Page 9 Fund requirements The following funds require that a budget be in place before any expenditure activity can be processed: 1201, 1202, 1204, 1206, 1208,1210, 1211,1212, 1213,1300,1317,1318, 1319, 1407, 1504, 1505, 1506, 1700,1701, 1702, 1703, 1704, 1705, 1708, 1709, 1711, 1712 Once an account is part of a budget required fund, it remains in that fund, even if activity decreases below $25,000 per year. Page 10 Fund requirements Continued… The Controller’s Office can only change an account to a budget required fund as part of the ‘fiscal year opening’ procedures. You may request that an account be moved to a ‘budget required’ fund if you find expenditures or encumbrances are frequently occurring before revenues are received. The Budget Office may request that an account be changed to a ‘budget required’ fund if both current year actual expenditures and projected expenditures are > $25,000 or if the trend over the past few years indicates the account will be reportable to the Board of Regents Please remember to change the account numbers on all employment documents and in the comprehensive position lists (via CBE) if the fund is changed to a ‘budget required fund’. Page 11 Who prepares the budget? Preparing an effective budget requires a joint effort between the people responsible for managing the fiscal operations (tracking purchases, making deposits, processing PAFs and budget revisions) and those who understand and manage the non-financial activities giving rise to the account. These nonfinancial activities include generating the revenues, managing projects, determining when renovations, relocations or equipment replacements will occur. Page 12 Steps to building a budget Forward original to the appropriate office for review, typically the Dean’s or Budget offices Review and print the budget Complete budget request form Gather financial reference reports Gather position data Download budget form from PBA website Page 13 Getting to the PBA website WWW.UNR.EDU/BUDGET Fiscal Year 2017 Long Form for Accounts > $25,000 Page 14 Download Selfs Long Form Selfs16long(2).xlsx Page 15 Saving Form Click on Enable Editing. Then save form to your directory. Page 16 Gather position data PLEASE NOTE..SOME PEOPLE DO NOT HAVE ACCESS TO THIS APPLICATION Page 17 Getting Position data Page 18 Getting Position data Comprehensive Position listing Page 19 Getting Position data continued… 1. Curr Yr 3. Get Report 2. Your Account Page 20 Getting Position data continued… CPL DATA Page 21 Getting Position data continued… FY POSNO FAO_ACCOUNT VPRES DEAN DEPT FULL_NAME JOB_TITLE EARN_CD CONT_TYPE RANK_GRADE_STEP ADDL_DUTIES CL_MERIT_DT EPR ANNUAL_FTE SALARY FRINGE UPLOAD NOTE EMP_TYPE 2015 41… YOUR ACCT # VP DEAN YOUR DEPT EMPLOYEE NAME EMPLOYEE TITLE CODE GRADE/STEP MERIT DATE EPR? 1 38483.58 13834.55 NO EMPL TYPE 2015 42… YOUR ACCT # VP DEAN YOUR DEPT EMPLOYEE NAME EMPLOYEE TITLE CODE GRADE/STEP MERIT DATE EPR? 1 34019.61 14367.24 NO EMPL TYPE Open and Print the CPL Page 22 TENURE_STATUS Getting Financial Reference Reports Page 23 Getting Financial Reference Reports Page 24 Getting Financial Reference Reports 1. Most Current Period 3. Get Report Organizational Summary by Object 2. Your Account Number Page 25 Getting Current Year Account Activity Print this report Page 26 Getting Operating Detail Organizational Summary by Object and Sub-Object Page 27 Getting Operating Detail 1. Current FY 3. Get Report 2. Your Account Page 28 Current year operating detail Print this report Page 29 Self-Supporting Budget Request Form 1 – Part 1 Forecasting Methods Page 30 Self-Supporting Budget Request Form 2 Forecasting Methods • Straight three year average: • ($200,000(YR1) + $220,000(YR2) + $215,000(YR3)) / 3 = $211,667 • Three year weighted average: • ($200,000(YR1) x .5) + ($220,000(YR2) x .3) + ($215,000(YR3) x .2) = $209,000 • Current YTD plus previous year actual: • $150,000(Current year to date as of end of February) + $45,000(Previous year actual March-June) = $195,000 • Current YTD annualized: • $150,000 YTD at end of February / 8 months x 12 months = $225,000 • Current YTD: • Sometimes, revenue/expense occurs in a very compressed time frame so current YTD is a reasonable amount. These are just a few forecasting methods. You may develop one that works well for your particular budget. BACK Page 31 Self-Supporting Budget Request Form 1 – Part 2 Page 32 Self-Supporting Budget Request Form 1-Part 2 Page 33 Self-Supporting Budget Request Form 2 Your Best Guesstimate Page 34 Self-Supporting Budget Request Form 3A Your Best Guesstimate Page 35 Self-Supporting Budget Request Page 36 Self-Supporting Budget Request Form 2 Auto Populates Page 37 Notes Page Difference of 25% or > Form 4 – Explanation Same reference letter as in Form 4 Page 38 Self-Supporting Budget Request Form 2 Total Revenue must equal Total Expenditures Sign, date and send the forms to your Dean’s Office when completed. Page 39 Self-Supporting Budget Request 1311 Funds ONLY revenue source for fund 1311. This represents the total funds available to budget. This amount must be equal to or less than the Current Appropriation. These columns are not meaningful in a 1311(Foundation) account. = A – (B + C) A B C Page 40 Self-Supporting Budget Request Recharge Recharge Accounts: Recharge accounts are used to account for services charged by one department to another department. We put the reimbursement amounts in an expense object (39) so we don’t double count revenue in our financial statements. Each recharge account may carry two months of operating cash without having to adjust recharge rates or justify them to the Controller. For this account, this limitation would be calculated as follows: The sum of A(expenses in objects 10-30)/12 mos x 2 mos.=$62,479. This means that up to $62,479 may be budgeted in reserves(object 79) in addition to any “prepaid” amounts relating to ongoing operations. A This is the budget submitted to PBA by the original due date. At the start of each August, PBA makes automatic budget revisions to all budgeted accounts to make the budgeted balance forward equal to the current appropriation. Page 41 Self-Supporting Budget Request We at PBA are here to assist you should you have difficulty completing these forms. However, it is important that each of you complete a budget request form on your own. If you continue to have difficulty, feel free to contact your budget officer for assistance: Vince Johnson 682-8807 Dane Apalategui 682-8808 Christy Sireika 682-8815 Rozann Wood 682-8809 Amanda Evans 682-6771 Peggy Bohn 682-8814 Page 42 Budget Calendar April 15, 2016 – Merit information due in the Contract and Budget Entry(CBE) system. May 6, 2016 - Signed hard-copy selfsupporting budget forms due in Planning, Budget & Analysis, mail stop 0118. May 6, 2016- Budget Account Lines are frozen in the Contract and Budget Entry system. Page 43 Le Fin This concludes our presentation. If you have any questions or need additional assistance, please call your budget officer. Thank you and Happy Budgeting. Page 44