Professional Judgment & Dependency Overrides

advertisement

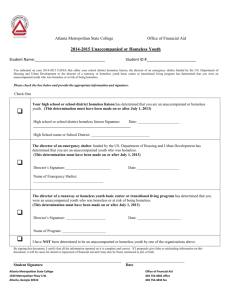

Jon Erickson, Director of Financial Aid | The College of St. Scholastica Jody O’Connor, Senior Counselor of One Stop Student Services | University of Minnesota Duluth Higher Education Act provides authority for financial aid administrators to exercise discretion in a number of areas Often used in cases of either dependency overrides or income/data element adjustments. Allows the financial aid administrator to treat a student individually when the student has special circumstances that are not sufficiently addressed by the standard application approach. Special circumstances are conditions that differentiate an individual student from a class of students, rather than conditions that exist across a class of students. “(a) IN GENERAL---Nothing in this part shall be interpreted as limiting the authority of the financial aid administrator, on the basis of adequate documentation, to make adjustments on a case-by-case basis to the cost of attendance or the values of the data items required to calculate the expected student or parent contribution (or both) to allow for treatment of an individual eligible applicant with special circumstances” Dependency Overrides Cost of Attendance Expected Family Contribution (Special Circumstance) Unsubsidized loan eligibility The federally mandated regulations are based on the premise that the student and family have the primary responsibility to meet the educational costs of a post secondary education. The level of contribution is based on ability to pay vs. willingness to pay Financial Aid administrators may do case-by-case basis for students with unusual circumstances. PJ is used by the aid administrator. “”Unusual circumstances”” Abusive family environment Abandonment by parents You may make an otherwise dependent student, independent. You may NOT make an independent student, dependent. Every year an appeal must be processed to affirm that the unusual circumstance still exists; even if student is still attending your institution. 46. Were you born before January 1, 1991? 47. As of today, are you married? (Also answer “Yes” if you are separated but not divorced.) 48. At the beginning of the 2014-2015 school year, will you be working on a master’s or doctorate program (such as an MA, MBA, MD, JD, PhD, EdD, graduate certificate, etc.)? 49. Are you currently serving on active duty in the U.S. Armed Forces for purposes other than training? 50. Are you a veteran of the U.S. Armed Forces? 51. Do you now have or will you have children who will receive more than half of their support from you between July 52. Do you have dependents (other than your children or spouse) who live with you and who receive more than half 53. At any time since you turned age 13, were both your parents deceased, were you in foster care or were you a 1, 2014 and June 30, 2015? of their support from you, now and through June 30, 2015? dependent or ward of the court? 54. As determined by a court in your state of legal residence, are you or were you an emancipated minor? 55. As determined by a court in your state of legal residence, are you or were you in legal guardianship? 56. At any time on or after July 1, 2013, did your high school or school district homeless liaison determine that you 57. At any time on or after July 1, 2013, did the director of an emergency shelter or transitional housing program 58. At any time on or after July 1, 2013, did the director of a runaway or homeless youth basic center or transitional were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless? funded by the U.S. Department of Housing and Urban Development determine that you were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless? living program determine that you were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless? Parents refuse to contribute to the student’s education Parents are unwilling to provide information on the FAFSA or for verification Parents do not claim the student as a dependent for income tax purposes Student demonstrates total self-sufficiency (page 123 of FSA Handbook) Effective with the 2009-2010 aid year, a financial aid administrator “may” rely on a dependency override performed by another institution for the same aid year. ~Section 480(d)(2) College Cost Reduction and Access Act of 2007~ Can I collect too much documentation?? No! Not! Never! No way! Not a chance! Never in a million years! A clear record of the FAA’s decision making process, reached decision, and every action taken MUST ALWAYS be documented and date stamped! Materials collected usually come on a “signed” 3rd party letterhead document in support of student’s request for consideration of that circumstance. (PJ) Counselor includes: high school teacher, principal, guidance officer, psychiatrist, psychologist etc… Clergy-pastor-minister Government agencies Medical personnel (Doctor, social worker etc..) Court system (lawyer, judge, case worker, police) Prison administrators ”Unusual circumstances” per definition are: Rare Extraordinary Uncommon Unexpected Distinctive Unemployment/loss of income of dependent family member or independent student Medical, dental, or nursing home expenses of extended family member, not covered by insurance Elementary or secondary school tuition expenses Unusually high child care or dependent care costs **FAA are not limited to above circumstances; they are types of conditions schools might consider** Exercising professional judgment is at the discretion of the school and a matter of policy. It is conceivable that a student may attend a school and adjustments are made in accordance with a PJ and attend a different school in the same aid year and those adjustments are denied. It is within a schools rights to refuse all professional judgments as a matter of policy. A policy must be in place at that institution. Medical bills, not reimbursed by insurance Elementary/secondary school tuition bills Child care or dependent care bills Last pay stubs Loss of SSI Unemployment documentation Termination papers Tax returns Divorce decrees Death certificates Parents enrollment in a degree seeking school for retraining, due to loss of employment Etc… Must be “special circumstances” Must be individual (not a class of students) Must have adequate documentation Cannot use PJ to waive eligibility requirements or circumvent the intent of the statute Vacation expenses (i.e. purchase of cabin rental at Maddens ) Gambling winnings Maintenance of car, home, lawn, utilities etc.. Credit card bills, cell phone family plans Inheritance, Insurance settlements One time income (early distribution of retirement accounts) FAA may offer a dependent student an unsubsidized loan without parental data being provided on the FAFSA if the FAA verifies… The parents of such student have ended financial support of the student The parents refuse to file the FAFSA No other type of federal can be offered All of the above requires a signed and dated statement from parents Unsub Stafford loans would be eligible by grade level & additional $2000 per year Freshman Sophomore Junior/Senior $5500 ($3500 + $2000) $6500 ($4500 + $2000) $7500 ($5500 + $2000) Create an Appeals Office Committee to meet weekly. (always nice to have a 2nd opinion) Application and Verification Guide 2014-2015 • Chapter 5: Special Circumstances • Chapter 4: Verification, Updates, & Corrections Higher Education Act of 1965, as amended • Section 479 A Discretion of Student Financial Aid Administrators (PJ data elements) • Sections 428 H and Section 482 (unsub) Dear Colleague Letter GEN 03-07 (2009) (Section 480(d)(7) (other overrides)480(d)(2) Dear Colleague Letter GEN 11-15 (2011) Jon Erickson College of St. Scholastica 218.723.6725 jerickso@css.edu Jody O’Connor University of MN Duluth 218.726.7160 joconnor@d.umn.edu