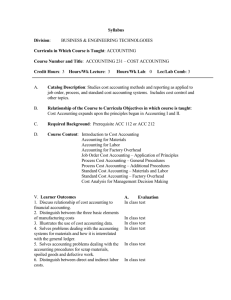

Document

advertisement

CHAPTER 15 Job Order Costing & Analysis Cost Accounting Systems determine the costs associated with products (or services). • ________ Cost System (this chapter) – used for unique or custom ordered products • ________ Cost System (next chapter) – is used for mass produced items Job-Order Costing • ____ or job lots are used as the means of collecting costs. – Used for production of large, unique, or high-cost items. – Built to order rather than mass produced. – Many costs can be directly traced to each job – Jobs are easily distinguished from one another • Examples: professional services, printing, construction, custom furniture, jumbo jet airplanes, hospitals, law firms… Events in Job Costing Receive order from customers Predict cost to complete job Schedule the job Negotiate a sales price and decide whether to pursue the job. Uses of Cost Information • We can use the job costs to help with the following types of activities. – pricing the job – controlling cost – budgeting Job Order Cost Flows • You must understand the ____ of costs through the accounting system • Remember the elements of cost of products from the previous chapter • You can use T-Accounts and/or journal entries to understand the flow. Cost Flows in Job Costing Indirect Materials Direct Indirect Factory Allocate Overhead Labor Direct Goods in Process Finished Goods Cost of Goods Sold Factory (direct) Labor • This account is used to account for all wages paid to workers within the _______. • We debit Factory Labor as labor costs are incurred and recognized – What’s the credit? • We determine what portion of this is ______ labor and which represents ______ labor – Direct labor goes into ______________ • Why? – Indirect labor goes into ____________ • Why? Factory Overhead (OH) • We use the ________ account for two reasons: • We debit it as the overhead items are incurred and recognized in the accounting system. • We credit it as we apply (______) overhead to individual jobs – WIP – OH $X $X Applying OH to Jobs • How do we know how much overhead to apply to the various jobs in process? • We determine an application base and a rate to use in applying the OH. • ? = ?_____________ (POHR) ? • where the activity level is usually some measure of direct labor hours, direct labor cost or machine hours (i.e. the ________) Under or Over Applied Overhead • _____________ = OH rate * actual activity (POHR) for the period • At the end of the year, the OH account may have a debit or a credit balance – amount incurred during the year did not equal the amount applied to individual jobs – In other words, our estimates aren’t perfect! • We will close out this account at the end of the year to _____. Why allocate OH instead of using actual? • Reasons for using a predetermined OH rate – Overhead is not incurred _______ throughout the year – Actual overhead rate might _____ from month to month – Predetermined rates make estimating job costs ________ – Actual overhead is _______ until after it has been incurred (i.e. at the end of the year) Predetermined Factory Overhead Rates Estimated total factory overhead costs Estimated activity base Activity base examples 1. Direct labor hours 2. Direct labor dollars 3. Machine hours 4. Direct materials 5. Other = Predetermined factory overhead rate Predetermined Factory Overhead Rates Estimated total factory overhead costs = Estimated activity base $50,000 estimated factory overhead costs 10,000 estimated direct labor hours = Predetermined factory overhead rate $5 per direct labor hour Predetermined Factory Overhead Rates Estimated total factory overhead costs = Estimated activity base $50,000 estimated factory overhead costs 10,000 estimated direct labor hours Direct Factory Labor Overhead Hours Applied Job 71 350 x $5 = $1,750 Job 72 500 x $5 = $2,500 = Predetermined factory overhead rate $5 per direct labor hour For each direct labor hour worked, factory overhead applied is $5. Recording Factory Overhead Factory Overhead $4,400 ACTUAL Based on actual costs incurred Recording Factory Overhead Factory Overhead $4,400 ACTUAL Based on actual costs incurred $4,250 APPLIED Based on estimated rate ($5 x 850 hrs) Is factory overhead overapplied or underapplied? What account is charged (debited)? Recording Factory Overhead Factory Overhead $4,400 ACTUAL Based on actual costs incurred $150 BALANCE Underapplied How would this balance be closed at year end? $4,250 APPLIED Based on estimated rate ($5 x 850 hrs) Work in Process is charged (debited). Recording Factory Overhead Factory Overhead $4,400 ACTUAL Based on actual costs incurred $4,250 APPLIED Based on estimated rate ($5 x 850 hrs) $150 BALANCE Underapplied An immaterial balance is closed to Cost of Goods Sold at year end. Work in Process is charged (debited). Job Cost Sheets • A __________ is prepared for each and every job undertaken. The job sheet is used to keep track of all the costs applied to that job – direct materials, direct labor, OH • When a job is complete, we – decrease ___ inventory and – increase __ inventory by the cost of the job that is done. • When jobs are sold, we transfer the costs to ____ Purpose of Job Cost Information and Sheets • Job Cost sheets are maintained to aid in the following: – Tracking the cost of ____________ – Transferring costs from ___ to __ to ____ – Serving as a subsidiary ledger of information for WIP and FG. • Any time you make an entry to WIP, then you should also enter information on the related job cost tickets. Reporting of Cost Data • The balance sheet will contain the _____ _______ of the various inventory accounts. • The income statement will show the COGM and the COGS as described in the previous chapter, with one exception. COGM = WIP, beg + (DM used + DL + actual OH) + overapplied overhead (or – underapplied overhead) - WIP, end. Cost of Good Sold • ____________is still equal to: FG inventory, beg + COGM = Goods Available for Sale - FG inventory, end = Cost of Goods Sold Review the Flow of Costs • • • • • • • • 1. 2. 3. 4. 5. 6. 7. 8. Purchase raw materials Incur factory wages Incur overhead Raw materials used Factor labor is applied to jobs Overhead is applied to jobs Completed jobs are recognized Cost of goods sold is recognized. P3 Summary of Cost Flows Dr Cr Raw Materials Material Purchases Direct Material Indirect Material Dr Cr Factory Overhead Actual Overhead Costs Dr Cr Goods in Process Direct Material P4 Summary of Cost Flows Factory Payroll Incurred Direct Labor Indirect Labor Factory Overhead Actual Overhead Overhead Applied Costs to Work in Process Goods in Process Direct Material Direct Labor Overhead When Actual Applied factory = factory overhead overhead / an adjustment is needed. P4 Summary of Cost Flows Goods in Process Direct Material Direct Labor Overhead Cost of Goods Mfd. Finished Goods Cost of Goods Mfd. Cost of Goods Sold Cost of Goods Sold Cost of Goods Sold