FINANCE 729 FINANCIAL RISK MANAGEMENT

advertisement

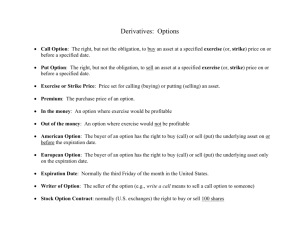

BASICS OF FINANCIAL RISK MANAGEMENT CAS / ARIA Financial Risk Management Seminar -- Denver, CO April, 1999 Rick Gorvett, FCAS, Ph.D. The College of Insurance BACKGROUND AND MOTIVATION WHY SHOULD WE STUDY FINANCIAL RISK MANAGEMENT? • To better understand the nature and volatility of financial markets • To understand the development of new financial products -- e.g., derivatives and hybrid securities • To understand how these products can be used to change a firm’s risk profile and protect its financial condition UNPREDICTABILITY • Interest rates – Inflation, cash flows (investing / lending), asset and liability values – Late 1970s -- Volcker / FED policy change • Commodity prices – Costs, substitute products – Price shocks -- OPEC, Kuwait • FX rates – International cash flows, relative competitiveness – Early 1970s -- Breakdown of Bretton Woods FINANCIAL RISKS -EXAMPLES • Interest rates – Savings & Loans – Inversion of yield curve around 1980 • Commodity prices – Continental Airlines – Price of fuel after Iraq invaded Kuwait • Foreign exchange – Laker Airlines – Strengthening of US$ relative to pound in 1981 FINANCIAL RISK MANAGEMENT: A BROAD FRAMEWORK • FRM can take several (familiar and unfamiliar) forms – – – – – Asset hedges Liability hedges Asset-liability management Contingent financing Post-loss financing and recapitalization WHY DO CORPORATIONS USE FINANCIAL DERIVATIVES? • Transaction hedges – FX; debt – Currency and interest rate risk • Strategic (economic) hedges – Protect cash flows or company value from movements in financial prices • Reduce funding costs – FX; synthetic debt • Trading derivatives for profit WHY DON’T CORPORATIONS USE MORE DERIVATIVES? • • • • • • Credit risk No suitable instrument Lack of knowledge Accounting / legal issues Transaction costs Resistance by Board / upper management VOCABULARY • Financial derivative: a financial instrument whose value is a function of another (“underlying”) financial instrument • Financial engineering: the creation and use of financial derivatives to aid in the management of risk • Risk profile: describes the effect of changes in a financial price on the value of a firm FORWARDS AND FUTURES FORWARD CONTRACTS • Obligation / agreement to buy/sell in the future • Contract price is the “exercise price”; no payment until maturity • Physical delivery or cash-settled • Buyer (holder) is “long”; seller (writer) is “short • OTC -- can be tailored • Two-sided risk FUTURES CONTRACTS • • • • Obligation; agree to a future transaction Traded on organized exchanges Standardized Daily settlement (marking to market) – Reduces default risk: essentially, a series of oneday contracts • Margins (performance bonds) – Initial margin – Maintenance margin – Margin call • Exchange clearinghouse EXCHANGES VS. OTC Exchanges • Advantages – Clearinghouse – Liquidity – Standardization • Disadvantages – – – – Lack of flexibility Regulation Trading costs Public OTC Markets • Disadvantages – Credit risk – Low liquidity – Non-standardization • Advantages – – – – Flexible Less regulation Lower regulatory costs Private TYPES OF CONTRACTS • Agricultural commodities – Wheat, corn, soybeans – Farmer (supplier) can lock in sales price before harvest (short futures) – Consumer (user) can lock in purchase price (long futures) • Other commodities – Metals, petroleum • Financial assets – FX, stock market indices, interest rates EXAMPLE • Ann agrees to buy from Bill one barrel of oil, five months from now, for $20 – Ann is in the “long” position – Bill is in the “short” position • If the price of oil is $25 five months from now, who pays to whom, and how much? • If the price of oil is $12 five months from now, who pays to whom, and how much? OPTIONS OPTIONS • Option to buy or sell the underlying asset • Right, not obligation • Call option: right to buy the U/L asset • Put option: right to sell the U/L asset • Buyer = holder = long position (option to exercise) • Seller = writer = short position PARAMETERS OF OPTIONS • Exercise price = strike price = price at which the holder of the option can exercise the option (and thus buy or sell the underlying asset) • Expiration date • Premium = amount paid for the option • American option: can exercise any time up to and including expiration date • European option: can exercise only on expiration date EXAMPLES OF OPTIONS -THEY’RE EVERYWHERE • Traded options – On stocks, indices, FX, interest rates, futures, swaps, options,... • Convertible bonds • Call provisions on bonds • On projects – To expand, abandon, postpone • Insurance EXAMPLE • Amy sells Bob a January European call option on one share of Compaq stock • Suppose Compaq stock is trading at 32.5 • Exercise price = 35 • Premium = 3 • In January, suppose:ST=30 ST=40 Total payoff [profit/loss] Amy: 0 [3] -5 [-2] Bob: 0 [-3] 5 [2] OPTION VALUES (cont.) • Prior to expiration: – In-the-money – At-the-money – Out-of-the-money Call St > X St = X St < X Put St < X St = X St > X • Intrinsic value - profit that could be made if the option was immediately exercised – Call: stock price - exercise price – Put: exercise price - stock price • Time value - the difference between the option price and the intrinsic value OPTION VALUES: PAYOFF CHART • Call -- long position Payoff ST X • Call -- short position • Put -- long position • Put -- short position PUT-CALL PARITY • Arbitrage implies a certain relationship between put, call, and underlying asset prices • Two portfolios have, at payoff, identical values: – One European call option + cash of PV(X) – One European put option + one share of stock • C + PV(X) = P + S BLACK-SCHOLES FORMULA VC = S N(d1) - X e-rt N(d2) d1 = [ln(S/X)+(r+0.5s2)t] / st0.5 d2 = d1 - st0.5 PURPOSES OF DERIVATIVES • Speculative – Highly risky – Highly leveraged – Very volatile • Hedging – Combine with other securities – Hedge (minimize) risk from other securities HEDGING • “Hedge”: Take a position that offsets a risk • Risk: Uncertainty regarding the value of the underlying asset • By hedging, one changes the risk inherent in owning the underlying asset • The return distribution of the underlying asset is not changed USING OPTIONS TO HEDGE • Combine the underlying asset with an option or options • Can reduce or eliminate downside risk while retaining upside potential • Can protect against falls in held asset values, or against increases in input prices OPTION STRATEGIES • Protective put – Own stock (long position) – Own put (long position) • Covered call – Own stock (long position) – Sell call (short position) • Straddle • Spread PROTECTIVE PUT • Investor owns asset • Investor also buys (holds) a put on the asset • Guarantees investment portfolio proceeds at least equal to the exercise price of the put + = PROTECTIVE PUT EXAMPLE • Suppose you own a share of stock, and you purchase a put option with an exercise price of 22.5 on that stock, for a premium of $ 0.75 ST : 30 Premium: -0.75 Put Payoff: 0 === Overall: 29.25 25 -0.75 0 === 24.25 20 -0.75 2.50 === 21.75 15 -0.75 7.50 === 21.75 COVERED CALL • Investor purchases stock • Investor also sells (writes) a call option on the stock • Option position is “covered” by owning the underlying stock itself • (vs. “naked option”) • Provides additional (premium) income + = COVERED CALL EXAMPLE • Suppose you own a share of stock, and you write a call option with an exercise price of 35 on that stock, for a premium of $ 2.00 ST : 30 Premium: 2 Call Payoff: 0 === Overall: 32 35 2 0 === 37 40 2 -5 === 37 45 2 -10 === 37 STRADDLE • (Long) Straddle: buy both a call and a put on a stock • Each option has the same exercise price and expiration date • Believe stock will be relatively volatile • Worst-case: no movement in stock price SPREAD • Combination of options – Two or more calls, or – Two or more puts • Vertical spread: simultaneous sale and purchase of options with different exercise prices • Horizontal spread: sale and purchase of options with different expiration dates INTEREST RATE OPTIONS • Cap: a call option on an interest rate • Floor: a put option on an interest rate • Collar: simultaneously buying a cap and selling a floor • These options can be used to hedge ratesensitive debt and assets INTEREST RATE OPTIONS: TERMINOLOGY • Underlying index: interest rate being hedged or speculated upon; e.g., LIBOR, prime rate • Strike rate: determines cash flows (similar to exercise price) • Settlement frequency: how often the strike rate and underlying index are compared • Notional amount: principal to which the interest rate is applied • Up-front premium: paid by purchaser to seller for the option INTEREST RATE CAPS • At each settlement date, check whether index rate is greater than strike rate • If not, cap purchaser does not receive cash flows • If so, purchaser receives from seller: [ (index rate - strike rate) x (days in settlement period / 360) x notional amount ] INTEREST RATE CAPS: EXAMPLE • $20,000,000 two-year quarterly interest rate cap on 3-month LIBOR with a strike rate of 8% • Cost: 150 basis points • Up-front premium = 0.015 x $20M = $300,000 • If 3-month LIBOR = 9%, seller pays (.09-.08) x 90/360 x $20M = $50,000 (for that quarter) INTEREST RATE FLOORS • At each settlement date, check whether index rate is greater than strike rate • If so, floor purchaser does not receive cash flows • If not, purchaser receives from seller: [ (strike rate - index rate) x (days in settlement period / 360) x notional amount ] INTEREST RATE COLLARS • Purchase a cap to hedge floating-rate liabilities • Sell a floor at a lower strike rate • Sale of floor helps finance purchase of cap • Net result: Interest expense will be limited on both ends -- will float between the cap and floor strike rates • Can achieve zero-premium collar SWAPS SWAPS • Agreement between two parties – “Counterparties” – Exchange sets of future cash flows • Two major types – Interest rate swaps – Currency swaps • Relatively new FRM tool SWAPS VS. FUTURES • Futures – Standardized – Exchange-traded – Short horizons • Swaps – Custom tailored between counterparties – Little regulation; potential for privacy – Term flexibility INTEREST RATE SWAPS • One party pays a fixed interest rate and receives a floating rate • The other party pays a floating rate and receives a fixed rate • Floating rates involve greater exposure to interest rate risk • “Notional principal” is amount on which the interest payments are determined INTEREST RATE SWAPS (cont.) • Principal is not actually exchanged -- only interest payments • Generally, only net interest payments are transacted – Avoids unnecessary transactions – Helps credit risk • At each “settlement date,” a net payment is made, based on the difference between the two interest rates (applied to the notional principal) CURRENCY SWAPS • One party holds one currency, and desires a different currency • Three sets of cash flows: – Exchange principal at inception of swap – Periodic interest payments – Exchange principal at termination of swap • Interest rates fixed ==> only change in value is from FX change • Generally, only make net payments LIMITATIONS OF SWAPS • Counterparties must find each other – Meet specific needs – Cost, time; facilitators • Lack of “liquidity”; difficult to unwrap / trade / change without consent of other party • Credit risk of counterparty DEVELOPMENT OF SWAP MARKET • Originally: – Unique contracts – Had to search for counterparty – Investment banks were dominant intermediaries • More recently: – More standardized and liquid – Intermediaries accept contract, then lay off risk – More highly capitalized firms -- e.g., commercial banks