Analyzing the Firm

advertisement

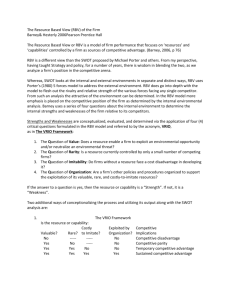

INTERNAL ANALYSIS Professor William Wan OBJECTIVES Introduce Core Competence Analysis: 1st Component Value Chain 2nd Component: RBV 4 Criteria Finally: Combination of the Two Why conducting a Firm (Internal) Analysis? Analysis helps understand what is strategically possible and choose the best strategy. A firm cannot successfully implement any strategy without the appropriate set of resources and capabilities. Weaknesses—the firm’s resource and capability deficiencies that make it difficult for the firm to complete important tasks Strengths—resources and capabilities that allow the firm to complete important tasks. 1st Component: Value Chain The Value Chain Consists of the structure of activities that firms use to implement their strategy. Firms analyze their value chain to understand how activities contribute to creating value for customers. Value-Chain Sequential process of value-creating activities Firm is profitable to the extent the value it receives exceeds the total costs involved in creating its product or service. All activities are intended to create value. Support Activities The ValueChain Chain Firm Value Primary Activities FIRM INFRASTRUCTURE HR MANAGEMENT TECHNOLOGY DEVELOPMENT PROCUREMENT INBOUND LOGISTICS OPERATIONS OUTBOUND LOGISTICS MARKETIN G & SALES SERVICE Industry Value Chain Supplier Value Chains Firm Value Chain Buyer Value Chains Adapting Value Chain Framework Sometimes, conducting value chain analysis may require adapting the value chain activities to suit the particular type of business the company pursues. For example, Best Buy Retail: Primary Value-Chain Activities 2nd Component : Resource Based View (RBV) Draw a sharp distinction between a portfolio of businesses & a portfolio of resources/capabilities. Conventional conceptualization of a firm is defined by its business(es); but this recent line of thought proposes that a firm should be defined by what resources & capabilities it possess. If just focusing on end products, miss the real strengths of a company Products Core Competencies Roots = Resources & Capabilities Businesses “Tree” Analogy The products we see made by a company is the outcomes of the “roots” of the company. We don’t normally see the roots (resources & capabilities) of a company, but they are the most important. The roots grow the trunk of a tree. HOW DOES A TREE GROW WITH A LARGE TRUNK, GREEN LEAVES, AND SWEET FRUITS, ETC. ? Types of Resources: Tangible Resources Financial resources (e.g., cash accounts) Physical resources (e.g., favorable locations) Technological resources (e.g., patents) Types of Resources: Intangible Resources Human capital (e.g., experience, trust, firm-specific practices and procedures) Reputation (e.g., brand name; relationship with suppliers/buyers) Capabilities Combinations of tangible and intangible resources Outstanding customer service Excellent product development capabilities Innovativeness of products and services Ability to hire, motivate, and retain human capital RBV 4 Criteria Is the activity… Valuable? Rare? Inimitatable? Nonsubstitutable? STRATEGIC IMPLICATIONS Valuable? Rare? Inimitable? Nonsubstitutable? Implications for Competitiveness No No No No Competitive Disadvantage Yes No No No Competitive Parity Yes Yes No No Temporary Competitive Advantage Yes Yes Yes Yes Sustainable Competitive Advantage Finally: Combination Core Competencies Activities that the firm emphasizes and performs especially well. Activities provide products/services to customers that are superior to those provided by competitors. Help leads to sustainable competitive advantage. WHAT IS THE BASIS OF AN ACTIVITY? Resources & Capabilities SEARCHING FOR CORE COMPETENCE Step 1: Use a Value Chain to organize where value adding activities reside in a company. ***What are the resources/capabilities leading to those activities? Step 2: Use the RBV 4 criteria to assess if the company has any core competence(s) by assessing each value chain activity and the corresponding resources/capabilities ***Are the core competences broad or narrow (if there is any at all)? IN ESSENCE, A firm’s internal environment (strengths and weaknesses) informs us what opportunities it can capture and what threats it can deal with. Similar to Five Forces for industry analysis, value chain analysis can assist us to conduct a firm analysis. Use the RBV 4 criteria to assess which activities (through a firm’s resources & capabilities) of the value chain are a firm’s core competences.