PowerPoint - Comptroller and auditor general of India

advertisement

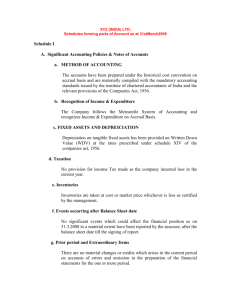

Session 4 & 5 Session Title Government Accounting System in India, Government Accounting – Principles & Practices, Deficiencies and limitations in present government accounting system, Accrual Basis of Accounting, Advantages of Accrual Accounting System, and Difference between cash based single entry system and accrual based double entry system. Budgeting in Government (i) Present system of budgeting (ii) What will be possible nature of budgeting if it is prepared on accrual basis? Session overview: The cash basis of accounting has been traditionally followed by the Government because it has the advantage of focusing Government’s attention on its financing constraints, which are viewed as its most binding priority. There has been, however, growing dissatisfaction with the system. This stems from various deficiencies in and limitations with the system. Due to global economic integration, public demand that government should be fully accountable to the community for the resources entrusted, forced the countries to adopt: • Radical economic reforms including involvement of private sector in delivery of public services; • Radical changes in the management tools, information technology, ways of decision-making, performance measurements, accounting procedures, accounting systems etc. Session overview: (continued…) The International Monetary Fund’s Second Edition of the Government Finance Statistics manual, 2001 (GFS) aims at improving Government accounting and transparency operations, envisages accrual accounting, balance sheet and complete coverage of Government’s economic and financial activities to meet the new requirements of formulating and evaluating Governments Fiscal policies. The GFS system uses the accrual basis in preference to the cash basis of accounting primarily because the time of recording matches the time of actual resource flow. As a result, the accrual basis provides the best estimate of the macro economic impact of the Government fiscal policies. In this case, the time of recording will not diverge from the time of economic activities and transactions to which they relate. The accrual basis provides the most comprehensive information. Several international accounting agencies (Internal Federation of Accountants, International Public Sector Accounting Standards board) also suggest that all Governments should adopt the accrual basis. However, the move to accrual basis for public sector financial reporting has yet to gain universal acceptance. Session overview: (continued…) 12th Finance Commission (TFC) recommended adoption of accrual basis for the Government accounting. The recommendations have been accepted by the Government of India in principle. Migration to accrual accounting has been accepted by Government of India and most of the State Governments. The 13th Finance Commission also endorsed the adoption of accrual basis of accounting in India. Pursuant to the decision of the Government of India, the Government Accounting Standards Advisory Board (GASAB) was set up in August 2002, in the office of the Comptroller & Auditor General of India. The GASAB has suggested an operational framework and roadmap for migration to accrual accounting. GASAB shall have to set itself to the task of providing distinctive set of accounting policies including those on income and liability recognition, depreciation and valuation of assets. GASAB has to issue accounting standards in the Indian context. It would consistently reconsider, refine and amend the standards Session Structure: 1.Government Accounting System in India (i) What is accounting? (ii) Basis of Accounting – Cash Based and Accrual Based Accounting System. (iii) Book Keeping methods – Single entry system and double entry system 2. Government Accounting – Principles & Practices (i) Basis of Government Accounting in India (ii) Features of Government Accounting (iii) Structure of Budget and Accounting. (iv) Form of Accounts (v) Suspense Accounts (vi) HCGA and HCB Account (vii) Financial Reporting – Appropriation and Finance Accounts 3. Deficiencies and limitations in present government accounting system. 4. Dr C. Rangarajan Committee report on effective management of Public Expenditure. 4. Accrual Basis of Accounting (i) Main Features of Accrual Accounting. (ii) Advantages of Accrual Accounting System (iii) Difference between cash based single entry system and accrual based double entry system. 5. Budgeting in Government (i) Present system of budgeting (ii) What will be possible nature of budgeting if it is prepared on accrual basis? Exercise and Group discussion. GOVERNMENT INDIA: ACCOUNTING SYSTEM IN Though this is a vast area, in this session we will discuss only the important aspect of Government Accounting. What is Accounting? 1. Accounting is the recording and reporting of transactions and events of an entity/ government which involves: (a) Decision regarding WHAT to account i.e. which transactions are amenable to accounting treatment: (i) Material, Measurable, Reasonably estimable. (ii) Compliance to rules and laws of the land. (iii) Budgetary requirements and legislative compliance. (b) Decision regarding WHEN and HOW to account & report? • (i) Recognition It is a process of incorporating in the accounts (Balance sheets or income statement) an item which can be measured reliably and is material. Regarding transactions or events in the books of account at which point of time. o When actually paid or incurred o When actually received or due • Recording a transaction or events in the books of account for which period of time • Recording which type of transactions/events? Only cash receipts and payments and cash balances, or Revenue/expenses All events, liabilities, and commitments including non-cash transactions (ii) Measurement • It is a process of determining the monetary value at which an item/element is carried in the book of accounts and may involve various bases of measurement including: o Historical cost- cost paid/amounts received. o Fair value at the time of acquisition o Current cost – cost to be paid for acquiring same or an equivalent item or cost to settle the obligation currently. o Fair value/ market value o Realizable cost- amounts that could be obtained on disposal/ settlement value o Nominal cost (iii) Classifications • Recognition of transactions and events as per standard classification. Revenue Expenses Assets o Physical assets, financial assets, billspayable, provisions o Contingent liabilities/ assets & commitments, etc. (iv) Disclosure (v) Reporting Whose accounts we are talking about? Union Departments/ Ministries •Civil Ministries/Departments •Defence •RailwayDepartments State Departments •All Departments including Works, Forest & Irrigation s •Posts Autonomous Bodies Autonomous Bodies PSUs PSUs Union Territories Local Bodies Bases/Models of Accounting: • Cash • Modified Cash • Accrual • Modified Accrual Book Keeping Methods: (i) Single entry (ii) Double entry Government Accounting (Principles and Practices) Form of Accounts: 1. Article 150 of the Constitution of India, reads “The Accounts of the Union and of the States shall be kept in such form as the President may, on the advice of the Comptroller and Auditor General of India, prescribes” 2. Form of Accounts: As per Article 150, the Form of accounts of government are: (i) Division and structure of accounts (ii) Classification of transactions (iii) Basis of accounting (iv) Format of financial reporting (v) Principles of recognition, measurement, classification and disclosure. Basis of Government Accounting in India 1. 2. 3. 4. 5. 6. 7. 8. Accounting Rules provides Cash Basis (Government Accounting Rules 21 and General Financial Rules 68) which states that “With the exception of such book adjustments as may be authorized by these rules or by any general or special orders issued by the Central Government on the advice of the Comptroller and Auditor General of India, the transactions in the Government accounts shall represent the actual cash receipts and disbursements during the financial year as distinguished from amounts due to or by Government during the same period.” Accounts are designed to focus mainly on expenditure control vis-à-vis budget allotment, i.e more tuned to financial integrity rather than efficient resource allocation and utilization. These do not reveal accrued assets and liabilities but mere cash transactions over the years. The budget preparation is on cash basis consistent with the basis of accounting. The Finance Accounts, the Government’s annual financial statements, present the accounts of receipts and disbursements of the Government for the year. The Appropriation accounts for the year for the grants and charged appropriations supplement these accounts. Appropriations and expenditures are inter-related and only the amounts, which are legally authorized, are supposed to be spent during the year. Appropriations remaining unused lapse at the end of the fiscal year and are not available for the next year. Appropriations for the next year include the un-discharged liabilities as well. “Cash Basis” has the advantage of focusing Government’s attention on its financing constraints, which are viewed as its most binding priority. Features & principles of Government Accounting: 1. Budgetary accounting (i) The steps are: Budget Appropriation Sanction Expenditure Accounting (ii) Accounts follows budget and budgetary and accounting classification are similar. (iii) Cash based budgeting and accounting (iv). Uniform accounting at Union and State level. • Chart of Accounts • Government Accounting Rules • Reporting Formats (v) Accounting based on codes & manuals containing accounting principles (vi) Rule based accounting and absence of explicit government accounting standards unlike the commercial accounting. Structure of Budget & Accounts: Government Account Consolidated Fund of India Revenue Account Receipts Contingency Fund of India Capital Account Receipts Tax Revenue Non-Tax Revenue Grants-in-aid & Contributions Public Account of India Small savings Expenditure General Services Social services Deposits & Advances Reserve Funds Suspense & Misc. Economic Services Remittances Grants-in-aid & Contributions Cash Balance Expenditure General services Social Services Economic Services Grants-in-aid & Contributions Public Debt Loans & Advances Form of Accounts: Division of Accounts: Divisions of government accounts are as follows: Divisions Sections Sectors Sub-Sectors Functions Programmes Schemes Object (PUA) Six-Tier Classification Schemes: Major Head (4 digit) Functions of the Government Sub- Major Head (2 Digit) Sub-Functions Minor Head (3 Digit) Programmes Sub-Head (2 Digit) Schemes Detailed Head (2 digit) Sub-Scheme Object Head (2 Digit) Primary unit of Appropration (PUA) Reporting Requirements: Expenditure Classifications: (i) Capital & Revenue (a) Revenue & Others (Art.112) (ii) Charged and Voted (Art. 112) (iii) Planned and Non-Planned (Statutory Requirements- Heads of Development) Cash Balance: Cash Balance – Union Government Proforma balancesRailways Proforma balancesDefence Proforma balancesP&T Note: Cash Balance of State Government has no such Concepts Ledger balancesCivil Ministries Plan & Non- Plan Expenditure Heads of Development: Plan ► ► ► ► Investment outlays to replace worn out or over-aged capital stock New development programmes or projects or schemes on capital account which involves creation of assets New development programmes or projects or schemes on capital account Spill over schemes or previous plan to be completed. Non-Plan ► ► All expenditure connected with the maintenance of development schemes completed during the Five Year Plan period All expenditure connected with the maintenance of existing institutions and establishments Suspense Accounts: 1. Suspense in Public Accounts is adjusting heads. 2. Operated as means to account transactions (receipt and payments) ‘temporarily” awaiting final accountal in respective functional heads. 3. While adjusting to final heads of account, initial Cr/Dr as the case may e, is cleared from the Suspense Head by minus credit/minus debit. 4. As a matter of account being giving true & fair view, suspense balance should be adjusted by the end of the year. 5. Huge balances remaining gives a distorted view of the accounts. Head Close to Government Accounts (HCGA) & Heads Close to Balances (HCB): In Government accounting, distinction is made between certain heads which close every year and whose balances are not carried forward. These heads do not represent transactions whereby Government has receivables and payables and they close to ‘Government Account’. Government Accounts – ► ► ► ► Represents cumulative deficit and surplus of the past under heads whose balances are not carried forward. There are certain other heads which close to balances and their balances as represent receivables and payables. Continued…. ► Heads under the following sectors close to Government Account Receipt Heads (Revenue Account) Receipt Heads (Capital Accounts) [4000] Expenditure Heads (Revenue Account) Expenditure Heads (Capital Account) Inter State Settlement (7810) Misc (Net) ► Appropriation to the Contingency Fund(7990) ► Reserve Bank Deposits (RBD) ► Misc. Government Account (8680) Adding Opening balance of last year and net effect of Prior Period of Adjustment Account to the above balances, the debit and credit of the Government Account is reached. Heads under Debt, Loans, Deposit, Advances, Suspense and Remittances heads close to balance. Adding to Government Account, the balances of heads closing to balances and the Contingency Fund, net amount of closing cash balance at the end of the year is reached. Financial Reporting: ► Objectives of Financial Reporting: ► 1. It provides information to ► Primarily legislature and its committees, budget and decision makers, auditing and government agencies. ► And also to other stakeholders such as lending bodies, credit rating agencies, research and academic institutions, media, tax payers and public at large. ► 2. It determines ► Whether the Government did what it said, it would do and the cost of its activities. ► 3. Helps the reader in understanding ► The nature and scope of government activities ► Financial position and how it finances its activities. ► Effect of its activities on the economy, development and other sectors. ► 4. Typical Financial Reporting includes: ► Compliances and accountability reporting Ensures executive accountability to legislature ► ► e.g. Appropriation Accounts provides information on compliance with budget approved (excess and savings, rush of expenditure, unnecessary appropriations). General purpose financial reporting Information on all aspects of government activities and finances and effect of government operations Finance Accounts exhibit the following: e.g. how much expenditure on health, defence, education, social welfare, etc, and how much on capital expenditure. ► Source wise receipts of governments – tax and non-tax ► Debt and financial assets of government. ► Appropriation Accounts: • It is the Grants-wise report on the expenditure showing excess/saving. • Corresponds with Appropriation Act. • Exceptional Report viz. Excess/savings • It is Budgetary compliance mechanism and not a financial reporting tool • Does report on Public Account. • Prepared upto detailed heads. • Civil, Defence, Postal and Railways prepared their appropriation accounts separately. Reconciliation between Appropriation & Finance Accounts: Finance Accounts is on net basis while Appropriation Accounts is on gross basis. Total Expenditure (AA) – Total Recoveries = Net Total (FA) Indicators and Parameters: Summary of Operations Disbursements Receipts Revenue Expenditure (RE) Revenue Receipts (RR) Ratios/ Indicators/ Parameters Revenue Deficit = RE-RR Capital Expenditure (CE) Misc. Capital Receipts Head 4000 (CR) Loans and Advances Recovery of Loans Total Expenditure (TE) Total Non-Debt Receipts (TNDR) Public Debt Public Debt Total CF (1) Total CF (2) Surplus in CF= 1-2 Total Public Account (PA) Total Public Account (PA) Deficit/ Surplus in Public Account Opening Cash Opening Cash Increase in Cash Fiscal Deficit=TE-TNDR Revenue Expenditure/ Total Non Debt Receipts = Operational Sustainability (also Interest Payments/ Total Expenditure) Capital Expenditure/ Public Debt = Percentage use of borrowings for asset creation Total Expenditure/ Public Debt = Intergenerational Equity. Financial Statements of Government:Financial Reporting (Union & States): State Details ment No. Remarks 1. Summary of Transactions Receipt and Payment Accounts/ Statement of Cash Flows 2. Capital Outlay- Progressive Capital Outlay (to the end of the year) Statements of Progressive Capital Expenditure 3. Financial Results of Irrigation Works Only State 4. Summary of Debt Position •Statement of Borrowings •Other obligations •Service of Debt Statement of liabilities 5. Loans and Advances by Union/ State Financial Assets of the Governments Government •Statement of Loans and Advances •Recoveries in arrears (Disclosures) Financial Statements of Government:Financial Reporting (Union & States): Continued…. State Details ment No. Remarks 6. Guarantees given by Governments Disclosure of Contingent Liabilities 7. Cash balances and investment of Cash Balances Cash balance of Account 8. Summary of Balances under Consolidated Fund, Contingency Fund and Public Account Statement of Financial Position 9. Statement of Revenue and Analytical Statements Expenditure for the year expressed as percentage of total revenue/ total expenditure 10 Statement showing distribution between Charged and voted expenditures Statement to comply with constitutional requirements Financial Statements of Government:Financial Reporting (Union & States): Continued…. State Details ment No. Remarks 11 Detailed Account of Revenue by Minor Head (Revenue Heads) Statement of Revenue 12. Detailed Account of Expenditure by Minor Heads Statement of Expenditure 13. Detailed statement of Capital Expenditure during and to the end of the year Statement of Assets 14. Statement showing details of Investments of Government Government Financial Assets 15. Statement showing Capital and other Expenditure (outside Revenue Account) ---- Financial Statements of Government:Financial Reporting (Union & States): Continued…. State Details ment No. Remarks 16. Detailed statements of Receipts, Fund wise details Disbursements and Balances under Position of NSSF- OB, Receipts, heads of account relating to Debt, Payments & Investments Contingency Fund and Public Account. Note: Statement showing position of NSSF (UNION) 17. Detailed Statements of Debt and Other Interest Bearing Obligations of Government 18. Detailed Statement of Loans and Advances made by Government Financial Assets 19. Statement showing details of earmarked balances (States) Statement of Balances in Reserve Fund/Deposits Statement of Liabilities Deficiencies in the present Government Accounting System: 1. Cash transactions do not capture timing of the action or the impact of the economy. Revenues and expenses are recognized when received or paid respectively without regard to which period they apply. 2. Non-monetary flows are not recorded because the focus is on cash management rather than resource flow. 3. The accounts do not include receivable or payables and the financial statements give revenue receipts rather than revenue earned and expenses paid rather than expenses incurred. 4. There is no information on receivable and payables unless a separate compilation is made. 5. No information about capital work-in-progress like dams, power plants, roads and bridges etc., is available. 6. Unit cost and total cost of services provided by the Government departments like health, education, water supply, transportation etc., is not ascertainable (as depreciation, interest etc., are not apportion able). 7. It gives wrong pictures about advance tax, as advance tax receipts are recognized as income. Deficiencies in the present Government Accounting System: 8. Assets constitute the money raised by Government which has been used for assets formation purposes and whose ownership vests with the Government. 9. These assets are shown at book value and do not take into account depreciation in their value as per current market rates. Assets and liabilities are not integrated with the accounts. 10. No disclosure is made about contingent assets and liabilities which may turn into committed ones on account of guarantees given or letter of comforts issued by the government. 11. No information is provided about existing net liabilities of public enterprises and agencies outside the government, although the later cannot escape such liabilities. 12. It provides room for fiscal opportunism e.g., tax revenues can be collected in excess during a particular period followed by high incidence of refunds together with interest, payments can be easily deffred and passed on to the next financial year, revenue due in the future could be compromised by providing for one time payments. Deficiencies in the present Government Accounting System: 14. The main shortcomings of Government Accounting System are : (i) The Hidden liabilities: there may be opportunity to manipulate the deficit. (ii) It does not provide the total cost of services as it is based only on cash elements. As a result: • It is not cost effective (the depreciation and interest costs are not accounted for while these costs are important for performance evaluation, control, public contracts policy and price fixing policy, and to measure the efficiency and the effectiveness of the governmental entities) • Inadequate for control and comparison purposes. • No performance measurement possible. (iii) The total value of stocks is not disclosed because the accounts are not concerned with recording the usage; they are rather concerned with the cash outflow, which has been paid for purchases. • Strong potential for over-spending. Deficiencies in the present Government Accounting System: (iv). Of the seven objectives identified by Public Sector Committee (PSC) of the International Federation of Accountants (IFAC), only the first three objectives are met by a cash-based government accounting system: • Indicating whether resources were obtained and used in accordance with the legally adopted budget. • Indicating whether resources were obtained and utilized in accordance with legal and contractual requirements, including financial limits established by appropriate legislative authorities. • Providing information about how the government or unit financed its activities and met its cash requirements. • Providing information about the sources, allocation and uses of financial resources. • Providing information that is useful in evaluating the government’s or unit’s ability to finance its activities and to meet its liabilities and commitments. • Providing information about the financial condition of the government or unit and changes in it. • Providing aggregate information useful in evaluating the government’s or unit’s performance in terms of costs, efficiency and accomplishments. Deficiencies in the present Government Accounting System: 15. Deficiencies in present financial reporting are as follows: (i) The present Accounting and financial reporting of Government is cash based. • Expenditures and receipts are recognized and reported when actually paid or received and not when due or accrued. (ii) The Finance Account is considered as a complete document, but at the same time it does not contain all relevant information. • Voluminous but information on object level, such as salaries and non-salaries (maintenance, work-in-progress, and asset creation), commitments (supply against purchase order received), subsidies etc, are not readily available in accounts. • Due to certain expenditure kept under suspense, the figures of expenditure are distorted. • There are no disclosures of accounting policies on the basis of which Financial Statements are prepared. (iii) While any informed individual can draw reasonable conclusions from a company’s Balance Sheet and Profit and Loss Account, this is not always possible from government financial statements. Deficiencies in the present Government Accounting System: (iv). Present system of financial reporting does not report: • Accrued expenses and revenues , e.g., expenditure incurred but payment not made or revenue earned but not received (e.g., bills payable, tax in arrears, non-tax revenue due) • Actual position of assets (Current assets including receivables, inventories etc) and liabilities ( e.g., current such as payables and pension liability). • Depreciation (erosion in physical assets, financial assets) and appreciation (land) not available. • No comprehensive information is available about government liabilities (Pensionary commitments, interest due, bills payable, depreciation for replacement of assets etc.) • Provisions against future liability not available. Dr. C. Rangarajan Committee Report on Effective Management of Public Expenditure: The main features are as follows: ► Prime Minister’s Economic Advisory Council (PMEAC) Chairman C Rangarajan, who head a high level committee set up by the Planning Commission suggested measures for effective management of Public Expenditure. ► The committee consisted of 18 members and mainly focused on the anomalies and inconsistencies that arise out of the present classification of expenditure into Plan and Non Plan expenditure categories. Other members of the committee included the Planning Commission Secretary, a Reserve Bank of India deputy governor and expenditure secretary, among others. National Institute of Public Finance and Policy Director M.G.Rao and Icrier Honorary Professor Nitin Desai was also the part of the committee. ► The expert committee has submitted its report to the Prime Minister. The full Planning Commission under the chairmanship of the Prime Minister approved the draft paper on August 20,2011. ► The committee has suggested the abolition of the “age-old distinction between Plan and Non-Plan expenditure, thereby a fundamental shift in the approach of public expenditure management from segmental view to a holistic view of expenditure, from input-based budgeting to the budgeting linked to outputs and outcomes. Dr. C. Rangarajan Committee Report on Effective Management of Public Expenditure: ► ► ► ► The committee also recommended that there should be just two classifications of expenditure --- capital and revenue. Capital will account for all the developmental expenditure like investment. Expenditure on salary for government employees, interest payments and subsidy outgo will be placed under revenue expenditure. The committee also suggests the need to classifying revenue expenditure by endues for the purpose of Fiscal Responsibility and Budget Management (FRBM). The committee recommended amendments to the FRBM Act, that lends some rigidity to the concept of revenue deficit, to provide scope for adjustment. An ‘adjusted revenue deficit’ may be considered for FRBM compliance, adjusting the revenue deficit to the extent of grants for creating assets. The committee also suggest a proper framework for taking a comprehensive view of the total transfer of resources from the Centre to the States, including ensuring its accounting and reporting in a uniform manner. ACCRUAL BASIS OF ACCOUNTING: Main features of accrual accounting: 1. The main basis of book keeping in accrual accounting is ‘double entry’ system rather than single entry system as adopted in cash basis of government accounting. 2. Accrual based double entry accounting system provides correct and real financial position of the entity and is helpful to provide correct information to all the concerned parties. Therefore, accrual based double entry accounting system may be appropriate for the Government. 3. In accrual accounting, a transaction is accounted for when it is earned and when incurred ( in cash basis, transaction is accounted for when cash is received or payment is made). Some examples of accrual accounting are: • Tax assessed but not received will be accounted for (unlike in cash system) • Licence fee/ royalty due but not received will be accounted for. • Liabilities accrued but not paid will be accounted for. 4. Accrual accounting reflect assets and liabilities adequately, for example • Short term and long term liabilities • Pensionary liabilities • Depreciation cost etc. ACCRUAL BASIS OF ACCOUNTING: 4. In case of reporting in accrual basis of accounting, it can be categorized as follows: (i) Statement of Operating Performance is the financial performance. (ii) It exhibits the financial position in the form of ‘Statement of Asset and Liability’. (iii) The Cash Flow Statement shows • Operating, financing and investing activities. • Receipts and Payments (iv). The reporting in accrual basis of accounting helps executive in assessment of: • Financial Performance in recognition of transactions comprehensively including depreciation. • Financial position of complete record of asset and liability. Treatment of Elements of Accounting in present Cash Basis and Accrual Basis: This can be summarized as follows: Elements Present Cash Basis New Accrual Basis Expenditure Due and paid: •Cash •Cheque •Book Adjustments Due but not paid: •Bills payable •Accrued liability Revenue Due and received: •Cash receipts •Book adjustments Due but not received: •Tax assessed but not received •Licence fee/ royalty due- not received Liability •Debt All liability: •Long terms •Current •Pension Assets •Capital only depicted expenditure progressive All assets: •Capital •Depreciation ADVANTAGES OF ACCRUAL SYSTEM OF ACCOUNTING: 1. Recognition: (i) Revenue is recognized when it is earned and the income constitutes both revenue received and receivable. Thereby it is assisting decision maker in taking correct financial decision. (ii) Expenditure is recognized as and when the liability for payment arises and thus it constitutes both amounts paid and payable. 2. Matching: (i) Expenses are matched with the income earned in that period, thus it provides very effective basis to understand true performance of the organization for the operation conducted in that period. (ii) A distinct difference is maintained between items of revenue nature and capital nature, this helps in proper presentation of the financial statement. (iii) In Accrual Based accounting system also the accuracy of the accounting can be established, through the device of the Trial Balance. 3. Comparison: (i) The surplus and deficit during a period can be ascertained together with details. It helps in assessment of financial performance by correctly reflecting surplus/deficit as all expenses weather paid or not and all income weather received or not are duly accounted for. (ii) The financial position of the Entity concerned can be ascertained at the end of each period by preparation of a Balance Sheet. (iii) The system permits accounts to be kept in as much details as necessary and provides significant information for the purpose of controls etc. (iv) Results of one year can be compared with those of previous years and reasons for the change can be ascertained. ADVANTAGES OF ACCRUAL SYSTEM OF ACCOUNTING: 5. Adequacy to meet short term and long term liability: (i) It gives information on weather income streams are adequate to meet short and long term liabilities so that their early payment keeping in view their payment period (short term and long term) and nature (cheap or costly loan) can be better managed. 6. Ascertaining future sustainability of the programmes: (i) It provides comprehensive information on expenses which helps in knowing the cost consequences of policies and enables comparisons with alternative policies. Also information about calculation of subsidy can be extracted from the accounts, which helps in its rationalization. This ensures the adoption of best policy, which in turn assures optimal use of scarce resources. It also helps in ascertaining the future sustainability of programmes. 7.Impact of Financial Performance: (i) Since information relating to both cash flow as well as non-cash flow transactions are recorded, the impact of transactions where cash has not been received or paid can be ascertained. (ii) Since full information are recorded on expenses, it helps in knowing the cost consequences of policies and we can compare with alternative policies. (iii) Implicit subsidy from the accounts helps in rationalization of subsidy policy. ADVANTAGES OF ACCRUAL SYSTEM OF ACCOUNTING: 8. Financial Position of Current Stock of Assets and Liabilities: (i) Comprehensive information on current stock of assets and liabilities are available in accrual accounting system, hence we are in a position to take financial decision can be taken not merely from the point of view of cash outgo or inflow but their impact on: • The asset and liability position of the Government. • Future sustainability of the programmes. • Future funding requirements of the asset maintenance and replacement • Planning the repayment of liabilities. 9. Under the accrual basis of accounting, the financial transactions are recorded, when they occur, even though actual receipts or payments of money may not have taken place at that time. Hence, the major difference between accrual accounting and cash accounting is in timing of recognition of revenues, expenses, gains and losses. 10. Under accrual basis of accounting, entries are made on the dates when revenue or expenses fall due and not on the date, when they are paid or received. Therefore, Accrual basis of accounting is a scientific system for reporting income and expenditure and also the preparation of financial statements. 11. Under accrual basis of accounting system, financial performance and financial results are obtained from two important financial statements noted as below: (i) Income and Expenditure Statement: to determine the financial performance of the entity. (ii) Balance Sheet: To assess the financial status of the Entity. Why Transition to Accrual Accounting System considered Inevitable? 1. Due to shortcomings of cash based accounting system and advantages of accrual system as discussed in previous paragraphs. 2. Due to global economic integration resulting in public demand that government should be fully accountable to the community for the resources entrusted forced the countries to adopt: Radical economic reforms including involvement of private sector in delivery of public services; Radical changes in the management tools, information technology, ways of decisionmaking, performance measurements, accounting procedures, accounting systems etc. 3. The International Monetary Fund’s Second Edition of the Government Finance Statistics manual, 2001 (GFS) aims at improving Government accounting and transparency operations, envisages accrual accounting, balance sheet and complete coverage of Government’s economic and financial activities to meet the new requirements of formulating and evaluating Governments Fiscal policies. The GFS system uses the accrual basis in preference to the cash basis of accounting primarily because the time of recording matches the time of actual resource flow. 4. As a result, the accrual basis provides the best estimate of the macro economic impact of the Government fiscal policies. In this case, the time of recording will not diverge from the time of economic activities and transactions to which they relate. Why Transition to Accrual Accounting System considered Inevitable? 5. The accrual basis provides the most comprehensive information. Several international accounting agencies (Internal Federation of Accountants, International Public Sector Accounting Standards board) also suggest that all Governments should adopt the accrual basis. However, the move to accrual basis for public sector financial reporting has yet to gain universal acceptance. 6. In India, the 12th Finance Commission (TFC) recommended adoption of accrual basis for the Government accounting. The recommendations have been accepted by the Government of India in principle and migration to accrual accounting has been accepted by Government of India and most of the State Governments. 13 th Finance commission has also endorsed the recommendation of 12th Finance commission. 7. Pursuant to the decision of the Government of India, the Government Accounting Standards Advisory Board (GASAB) was set up in August 2002, in the office of the Comptroller & Auditor General of India. The GASAB has suggested an operational framework and roadmap for migration to accrual accounting. GASAB shall have to set itself to the task of providing distinctive set of accounting policies including those on income and liability recognition, depreciation and valuation of assets and in due course, issue accounting standards in the Indian context. It would consistently reconsider, refine and amend the standards. Difference between cash based single entry system and accrual based double entry system: Basis of Distinction Single Entry Cash Based Accounting Double Entry Accrual Based Accounting Recognition of the transactions All cash receipts and payments during the Accounting Period are recorded whether or not the transactions actually belong to that accounting period. All income and expenses relating to the Accounting period are recorded, whether or not received or paid. Accounts Only personal accounts and Personal, Real and Nominal cash book are prepared. accounts are prepared. Accuracy of results Accuracy of transactions cannot be verified since the transactions are recorded on single entry basis and no trail balance is prepared As all the transactions are recorded based on double entry system of book keeping, a Trial Balance is prepared to check the arithmetical accuracy of the transactions. Difference between cash based single entry system and accrual based double entry system: Basis of Distinction Single Entry Cash Based Accounting Double Entry Accrual Based Accounting Financial Performance Financial Performance cannot be ascertained as Income and Expenditure Account is not prepared Financial Performance of an entity can be ascertained as Income and Expenditure Statement is prepared. Financial Position Only a statement of affairs is prepared which does not give the true and fair state of affairs. A Balance Sheet is prepared on going concern basis which gives a true and fair picture of financial status. Authenticity This system is not considered authentic by the Financial Institution, lending agencies and other outside bodies. This system of accounting is well accepted by the Financial Institutions, lending agencies and all other outside bodies. Budgeting in Government: (A). Present System of Budgeting: 1. It is the Annual Financial Statements which is a constitutional responsibility under Article 112 & 202 of Constitution of India. 2. Annual Financial Statement is a statement of estimated receipts and expenditure of the Government of India, which is laid before the Parliament in respect of every financial year. Similar is the case with State Governments. 3. It shows receipts and payments of the Government. 4. Revenue Budget consists of the revenue receipts of the Government (tax revenues and other revenues) and the expenditure (or rather payments) met from these revenues. 5. Capital budget consists of capital receipts and payments. Budgeting in Government: (B). What will be the possible nature of budgeting if it is prepared on Accrual Basis? 1. It becomes a full set of forecast financial statements, including assumptions used in preparing those statements. 2. Formal budget appropriations (cash) to be consistent or linked with forecast financial statements. 3. In accrual budgeting, estimates would reflect the complete liability based on expenditure for the year; ideally the difference should be minimal. 4. Similarly in case of receivables, the entire revenue relating to the year is accounted in accrual budget and not merely the amount collected/collectible. 5. It requires shifting the budgeting from cash flows (money received and payments made) to revenues earned and liabilities incurred. 6. The most important aspect is that the accrual basis would align budgeting and financial reporting and both would be on the same accounting basis. However, implementing reforms simultaneously in both accounting and budgeting system is very complex, and the task of managing the change is extremely difficult, but needs to be continued to its logical conclusion. Budgeting in Government: Is accrual budgeting a pre-condition for accrual accounting? 1. It is feasible to report in terms of accruals and the budget on a cash basis. 2. If budgeting were continued on the cash basis, financial reports would be analytic tools in accrual basis. 3. If budgeting were shifted to the accruals, accounting principles would become decision rules in budgeting. 4. Financial reports are subject to audit; budget are not. 5. Full benefits of accrual accounting can be gained only when it goes hand in hand with accrual accounting. 6. In public sector accounting cannot be divorced from budgeting. 7. There would be on-going initiatives with regard to asset Registers (needs change in GFR & Budget Speech) 8. It is ideal when we migrate to accrual accounting, accrual budgeting should also follow. Budgeting in Government: (C) Accrual Accounting: Some disclaimers Accrual Accounting in Government: (i) Is not a Private Sector Accounting which uses certain commercial principles to meet its own objectives? (ii) It is a mean or tools for decision making and not and end. (iii) It provides more comprehensive, accurate and reliable financial information. (iv) It is not entirely novel. (v) It is to be adapted to the requirements of social policy and commitments of the government, public goods, budgetary requirements and government as going concern.