Lesson 4 PowerPoint

The Income Statement and

Comprehensive Income

I N T ERMEDIATE ACCOU N T I NG I

CHA PT ER 4

This presentation is under development.

INCOME STATEMENT

The income statement displays a company’s operating performance during a particular reporting period.

Single-step

– lists all revenues and gains grouped together and all expenses and losses grouped together.

The advantage of the single-step income statement is simplicity of preparation

Multiple-step – includes a series of intermediate subtotals

An advantage of the multiple-step income statement is that it separates operating and nonoperating items and allows for better analysis of income and expense items.

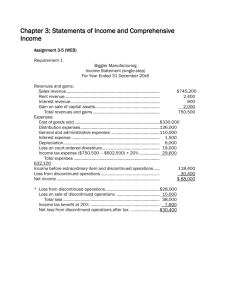

Single-step Income Statement

MAXWELL GEAR CORPORATION

Income Statement

For the Year Ended December 31, 2013

Revenues and gains:

Sales

Interest and dividends

Gain on sale of investments

Total revenues and gains

Expenses and losses:

Cost of goods sold

Office salaries

$302,371

47,341

Depreciation

Miscellaneous

24,888

16,300

Interest

Total expenses and losses

Income before income taxes

Income tax expense

Net income

14,522

$573,522

26,400

5,500

605,422

405,422

200,000

80,000

$120,000

Multiple-step Income Statement

MAXWELL GEAR CORPORATION

Income Statement

For the Year Ended December 31, 2013

Sales revenue

Cost of goods sold

Gross profit

Operating expenses:

Selling Expenses

General and Administrative Expenses

$47,341

24,888

Restructuring Costs

Total operating expenses

Operating income

16,300

Other income (expense):

Interest and dividend revenue

Gain on sale of investments

26,400

5,500

$573,522

302,371

271,151

88,529

182,622

Interest expense

Total other income, net

Income before income taxes

Income tax expense

Net income

(14,522)

17,378

200,000

80,000

$120,000

The Income Statement:

Income from Continuing Operations

Includes revenues, expenses, gains, and losses that will probably continue in future periods.

• Revenue – inflows of resources resulting from providing goods or services to customers

• Expenses – outflows of resources incurred in generating revenue

• Gain – increase in equity from peripheral or incidental transactions

• Loss – decrease in equity from peripheral or incidental transactions

Gross profit is Sales less Cost of Goods Sold.

A distinction is often made between operating and nonoperating (other) income.

Income tax expense is shown as a separate expense.

Matching Principle – revenues and the expenses incurred to generate those revenues should be matched together in the same accounting period.

Gains and Losses

Income from Continuing Operations

Includes revenues, expenses, gains, and losses that will probably continue in future periods.

Gross profit is Sales less Cost of Goods Sold.

Income tax expense is shown as a separate expense.

A distinction is often made between operating and nonoperating income.

Revenue – inflows of resources resulting from providing goods or services to customers

Expenses – outflows of resources incurred in generating revenue

Gain – increase in equity from peripheral or incidental transactions

Loss – decrease in equity from peripheral or incidental transactions

Operating vs. Nonoperating Income

Operating Income

Includes revenues and expenses directly related to the primary revenuegenerating activities of the company.

• Sales revenue

• Services income

• Gains and losses from selling operating assets

Nonoperating Income

Relates to peripheral or incidental activities of the company

• Gains and losses from selling investments

• Interest Revenue and Expense

EARNINGS QUALITY

The ability of reported earnings to predict a company’s future earnings.

• To enhance predictive value, analysts try to separate a company’s permanent earnings effects from its transitory earnings (result from transactions or events that are not likely to occur again in the foreseeable future.)

Not all items included in operating income should be considered indicative of a company’s permanent earnings.

• Restructuring costs include costs associated with shutdown or relocation of facilities or downsizing of operations. GAAP requires these costs to be expensed in the period(s) incurred.

• Asset impairment losses, inventory write-down charges, losses from natural disasters such as earthquakes and floods, and gains and losses from litigation settlements are other operating expenses that call into question the issue of earnings quality.

Restructuring Costs

Costs associated with

•

Reorganizing operations for greater efficiency

•

Shutdown or relocation of facilities

•

Downsizing of operations

Reported as a separate line item in operating income

Recognized only in the period incurred

Disclosure notes should describe the situation

Exercise 4-5

Earnings per Share Disclosure

Earnings per share should be disclosed on the face of the income statement

Calculate EPS for

• income from continuing operations

• discontinued operations

• net income

Calculated by dividing each earnings figure by the outstanding common stock shares

Brief Exercise 4-5

Discontinued Operations

Involves the disposal or planned disposal of a component of an entity. A component is any part of the company, such as an operating segment or subsidiary, that includes operations and cash flows that can be clearly distinguished, operationally and for financial reporting purposes, from the rest of the company.

•

Reported separately, below income from continuing operations

•

Income tax expense or benefit is shown on a separate line

1. When the component has been sold, the income effects of a discontinued operation includes (1) the operating income or loss of the component from the beginning of the reporting period to the disposal date, and (2) the gain or loss on disposal.

2. When the component is considered held for sale, the income effects of a discontinued operation includes (1) operating income or loss of the component from the beginning of the reporting period to the end of the reporting period, and (2) an impairment loss if the book value, sometimes called carrying value or carrying amount, of the assets of the component is more than fair value minus cost to sell.

Discontinued Operations - Sample Problem A

The Duluth Holding Company has several operating divisions.

In October 2016, management decided to sell one of its divisions that qualifies as a separate component according to generally accepted accounting principles.

The division was sold on

December 18, 2016 for a net selling price of $14,000,000. On that date, the assets of the division had a book value of $12,000,000.

For the period January 1 through disposal, the division reported a pre-tax loss from operations of $4,200,000.

The company’s income tax rate is 40% on all items of income or loss. Duluth generated after-tax profits of $22,350,000 from its continuing operations.

Income from continuing operations

Discontinued operations:

Loss from operations of discontinued component

Income tax benefit

Loss on discontinued operations

Net income

(2,200,000)

880,000

$22,350,000

(1,320,000_

$21,030,000

Discontinued Operations - Sample Problem B

The Duluth Holding Company has several operating divisions. In October of 2016, management decided to sell one of its divisions that qualifies as a separate component according to generally accepted accounting principles. On December 31, 2016, the end of the company’s fiscal year, the division had not yet been sold. On that date, the assets of the division had a book value of $12,000,000 and a fair value, minus anticipated costs to sell, of $9,000,000. For the year, the division reported a pre-tax loss from operations of $4,200,000. The company’s income tax rate is 40% on all items of income or loss. Duluth generated after-tax profits of $22,350,000 from its continuing operations.

Income from continuing operations

Discontinued operations:

Loss from operations of discontinued component (7,200,000)

$4,200,000

2,880,000

$22,350,000

Net income

Book Value

$9,000,000

12,000,000

Loss from operations of Discontinued Component

(3,000,000)

($7,200,000)

(4,320,000)

$18,030,000

Other Comprehensive Income

Brief Exercise 4-9

Exercise 4-4

The Income Statement and

Comprehensive Income

I N T ERMEDIATE ACCOU N T I NG I – CHA PT ER 1

E N D OF P R ESENTATION