Chapter 13

advertisement

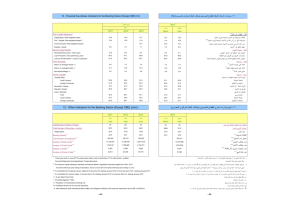

THE BUSINESS OF BANKING Chapter 11 Transactions Costs • Debt serves a useful purpose in matching those who currently have greater income than consumption to those with greater consumption than income. • However, matching buyers and sellers involves some costs. Intermediaries develop to reduce these costs. 1. Pooling Savings 2. Providing Liquidity 3. Reduce Information Costs •Take advantages of economies of scale •Diversify Risks • Safekeeping of Assets •Reduce transactions costs by allowing depositors to convert assets into cash. •Ameliorate asymmetric information Link Hong Kong Banking Industry • Three Tier Structure Link Fully Licensed Banks -22 Locally Incorporated -164 Foreign Incorporated Restricted License Banks: Securities Companies - 20 RLB’s Deposit Taking Corporations: Finance Companies - 23 DTC’s Licensed banks incorporated in Hong Kong At 17 October 2014 BANK OF EAST ASIA, LIMITED (THE) HONGKONG & SHANGHAI BANKING CORPORATION LIMITED (THE) SHANGHAI COMMERCIAL BANK LIMITED CITIBANK (HONG KONG) LIMITED DBS BANK (HONG KONG) LIMITED OCBC WING HANG BANK LIMITED PUBLIC BANK (HONG KONG) LIMITED STANDARD CHARTERED BANK (HONG KONG) LIMITED BANK OF CHINA (HONG KONG) LIMITED CHINA CITIC BANK INTERNATIONAL LIMITED CHINA CONSTRUCTION BANK (ASIA) CORPORATION LIMITED INDUSTRIAL AND COMMERCIAL BANK OF CHINA (ASIA) LIMITED NANYANG COMMERCIAL BANK, LIMITED CHIYU BANKING CORPORATION LIMITED CHONG HING BANK LIMITED DAH SING BANK LIMITED FUBON BANK (HONG KONG) LIMITED HANG SENG BANK, LIMITED TAI SANG BANK LIMITED TAI YAU BANK, LIMITED WING LUNG BANK LIMITED 1 1 1 2 2 2 2 2 3 3 3 3 3 4 4 4 4 4 4 4 4 1. Modern Local 2. International 3. China State 4. Native +Bank of Communication 3 1. 2. 3. 4. Historical Origins Modern Local Banks: Pre-war banks. (HSBC, Bof EA,). International Banks –. (Citibank, StanChart, DBS) Chinese State Banks – Chinese government set up banks in HK in pre-war era. After the revolution, these were taken over by PRC. Due to the isolation of PRC, these banks were the main link between the mainland and the world financial system (Bank of China, Nanyang Commercial) Native Banks – Banks that serviced the rapidly growing retail markets for small deposits and loans during the immediate post-war migration of immigrants from the mainland (Hang Seng, Wing Lung, Dao Heng and many others) Licensed Banks Aggregate Balance Sheets Sep-15 Assets (AS) Notes and Coins Amount Due from Authorized Inst in HK Amount Due from Banks Abroad Loans and Advances to Customers NCD Held Negotiable Debt Instruments (NDI) Investments in Shareholdings Interest in Land and Buildings Other Assets HKD Million $19,064,516 $31,730 $879,642 $4,233,518 $7,560,040 $369,791 $3,699,709 $163,743 $200,183 $1,926,161 Liabilities (LB) Amount Due to Authorized Institutions in HK Amount Due to Banks Abroad Deposits from Customers NCD Outstanding Other Debt Instruments Outstanding Capital, Reserves and Other Liabilities HKD Million $19,064,516 $1,039,478 $3,786,284 $10,659,279 $729,320 $300,271 $2,549,885 Multiple Currency Deposits • Hong Kong banks 5000 4000 3000 2000 1000 0 01-Jan-91 01-Jun-92 01-Nov-93 01-Apr-95 01-Sep-96 01-Feb-98 01-Jul-99 01-Dec-00 01-May-02 01-Oct-03 01-Mar-05 01-Aug-06 01-Jan-08 01-Jun-09 01-Nov-10 01-Apr-12 01-Sep-13 01-Feb-15 HKD Billion accept large amounts of foreign currency deposits. • Small market for Foreign currency loans in Hong Kong. • HK banks lend money to banks overseas, multinational banks lend money to firms overseas. 6000 HK$: LB: Deposits from Customers HK$: Loans and Advances to Customers FC: Loans and Advances to Customers FC: LB: Deposits from Customers Link Bank Assets 1. 2. 3. 4. Cash Items Primary Reserves (Vault cash + Clearing Balances), Current Balances at Other Banks. Loans Interbank Lending, Advances to Customers Securities Government Bonds, MBS, Corporate Debt, Large CD’s, Stocks. Other Assets Land, Buildings, etc. p. 31 Checkable & Non Transactions Deposits: Checking accounts, current accounts, demand deposits,savings deposits, time deposits, certificates of deposit. Borrowings: Discount window borrowing, borrowing in interbank market. 3. Other Liabilities: Subordinated debt, deferred tax liabilities 1. 2. Hong Kong Interbank Market • Hong Kong deposit market dominated by big branch networks many smaller banks raise funds by borrowing from big banks. • Until 2001, HK limited branch networks of foreign banks. Foreign banks finance HK lending with loans from overseas parent. • HK banks accept many foreign currency deposits. Lend that F.C. to banks overseas. Bank Net Worth/Shareholder Funds: Funds put at risk by the owners of the bank. • Share Capital: Money raised by selling equity shares in Primary Markets • Retained Earnings : Profits not (yet) paid as dividends. • Balance sheet typically includes some proposed dividend. • For tax purposes, some retained earnings are classified as other reserves PROFIT = NII + NFI +PLL-OE + NOE -TAX Investment Income, etc. Changes in Value of Subsidiaries etc. Profits of Banking: Interest Income • Net Interest Income is the interest rate earned on assets (mainly loans) minus the average interest paid on liabilities (mainly deposits). • Net Interest Margin Net Interest Margin: Net Interest Income divided by Interest Earning Assets. Net Fee Income Mar, 1997 Aug, 1997 Jan, 1998 Jun, 1998 Nov, 1998 Apr, 1999 Sep, 1999 Feb, 2000 Jul, 2000 Dec, 2000 May, 2001 Oct, 2001 Mar, 2002 Aug, 2002 Jan, 2003 Jun, 2003 Nov, 2003 Apr, 2004 Sep, 2004 Feb, 2005 Jul, 2005 Dec, 2005 May, 2006 Oct, 2006 Mar, 2007 Aug, 2007 Jan, 2008 Jun, 2008 Nov, 2008 Apr, 2009 Sep, 2009 Feb, 2010 Jul, 2010 Dec, 2010 May, 2011 Oct, 2011 Mar, 2012 Aug, 2012 Jan, 2013 Jun, 2013 Nov, 2013 Apr, 2014 Net Interest Margin: Local & Foreign Retail Bank 2.5 2 1.5 1 0.5 0 Fee Income Capital Adequacy Management • • • Compared to non-financials, banks have low capitalization. Bank capital is the funds invested by the owners of banks in the bank. Three factors affect the decisions of bank owners to finance with equity capital: 1. 2. 3. Bank capital protects against bank failure. Bank capitalization affects returns to shareholders Government regulations affect capitalization (next chapter) Bank Failure • Bank failure occurs when a bank cannot pay its depositors in full. • Riskier and less liquid assets make bank failure more likely. • Banks with high levels of capital can have some negative profits and still avoid failure. • Bank owners need to invest their own funds to offset its own moral hazard issues. How Bank Capital Prevents Bank Failure • Consider two banks with identical balance sheets except that Bank A is well capitalized while bank B is poorly capitalized. Assets Liabilities Assets Liabilities Reserves $10 Deposits $90 Reserves $10 Deposits $96 Loan $90 Capital $10 Loan $90 Capital $4 How Bank Capital Prevents Bank Failure • Bad economic times cause borrowers to default on $5 million in loans. This wipes out the capital of the weakly capitalize bank but leave the highly capitalized bank in business. Assets Liabilities Assets Liabilities Reserves $10 Deposits $90 Reserves $10 Deposits $96 Loan $85 Loan $85 Capital -$1 Capital $5 USA HK Ja Ja Ja Ja Ja Ja Ja Ja Ja Ja Ja Ja Ja Ja n14 n13 n12 n11 n10 n09 n08 n07 n06 n05 n04 n03 n02 n01 Equity to Asset Ratio Commercial Banks 0.14 0.12 0.1 0.08 0.06 0.04 0.02 0 Equity Multiplier ROA/ROE • This is assets relative to ASSETS EM EQUITY CAPITAL shareholders equity (i.e. net worth less loan capital) PROFITS • A measure of the returns ROA earned on assets is Return TOTAL ASSETS on Assets PROFITS • Owners of equity are ROE ROA EM EQUITY CAPITAL concerned with the pay-off they earn per each dollar originally invested in the bank: Return on Equity • Equity returns are a Assets 1,263,990 EM 9.0808 positive function of ROA Liabilities 1,124,797 ROA 0.0120 and leverage Net Worth 139,193 ROE 0.1087 Profits 15,131 Capital Management • Banks face a trade-off with • Capital constrained banks leverage. • If ROA is typically positive, leverage multiplies ROE. • Leverage increases the volatility of ROE and increases probability of default risk or reaching regulatory boundaries. either raise new capital or slow lending growth, usually the latter. Credit Risk: • • • Credit Risk: The risk arising from the possibility that the borrower will default. Financial Intermediaries in general and banks in particular exist because of their efficiency in dealing with credit risk. Much of credit risk in financial markets occurs due to asymmetric information and its associated phenomena, adverse selection and moral hazard. Managing Banks: Balance Risks and Returns • Banks must take risks as part of their business. • Often most profitable activities of a bank will generate most risks for the banks. • Bank managers must manage risk return trade-offs. Principles for Maximizing Returns while dealing with credit risk Diamonds in the rough • Banks try to find borrowers who will pay high interest rates but who are unlikely to default. • Borrowers who are well known to be good credit risks will have many sources of funds. • Banks need to find information about certain borrowers not publicly available. Strategies for Managing Credit Risk Credit-Risk Analysis – A loan officer manages banks relationship with borrowers and evaluate potential borrowers. 1. • • 2. Loan officers may have some specialization with certain industries or businesses. Loan officers also use credit scoring systems which use statistical data to measure default probabilities and charge interest rate commensurate with risk. Monitoring – Loan agreements may contain restrictions on borrower behavior or value of assets. Loan officers monitor behavior and may recall loans if covenants are violated. Strategies for Managing Credit Risk (cont.) 3. Collateral – Loans identify physical assets which may be taken by the bank in case of default. 4. Long-term Relationships – Banks often have relationships with certain businesses which reduces information problems. elationships have value to businesses which they are loathe to jeopardize by engaging in moral hazard behavior. Strategies for Managing Credit Risk (cont.) 5. 6. • Credit Rationing - Borrowers must seek additional sources of finance for their projects including equity. Diversification – Banks can limit the likelihood of default by reducing exposure to a particular borrower or class of borrower. Sometimes there is a trade-off between diversification needs and strategies for finding diamonds in the rough, such as specialization or long-term relationships which may tend to reduce Measures of Credit Risk • 1. 2. 3. Assessing a bank’s exposure to credit risk, we could ask 3 questions: What is the historical loss rates on loans and investments? What are the expected losses in the future? How is the bank prepared to weather the losses? Historical Loss Rate • Loan losses/charge-offs are the loans written off as uncollectible in any period. • Releases & Recoveries refer to loans written off in the past but collected or collateral repossessed. • Net loan losses are gross loan losses less recoveries. Expected Future Losses Measures • Past Due Loans: Borrowers have not made a scheduled payment. • Nonperforming Loans: Loans past due for 90 days are more. -1 Overdue > 3 month & Rescheduled Loan: Local & Foreign Retail Bk(LF) Bad Debt Charge to Average Total Assets: Local & Foreign Retail Bank Apr, 2014 Nov, 2013 Jun, 2013 Jan, 2013 Aug, 2012 Mar, 2012 Oct, 2011 May, 2011 Dec, 2010 Jul, 2010 Feb, 2010 Sep, 2009 Apr, 2009 Nov, 2008 Jun, 2008 Jan, 2008 Aug, 2007 Mar, 2007 Oct, 2006 May, 2006 Dec, 2005 Jul, 2005 Feb, 2005 Sep, 2004 Apr, 2004 Nov, 2003 Jun, 2003 Jan, 2003 Aug, 2002 Mar, 2002 Oct, 2001 May, 2001 Dec, 2000 Jul, 2000 Feb, 2000 Sep, 1999 Apr, 1999 Nov, 1998 Jun, 1998 Jan, 1998 Aug, 1997 Mar, 1997 Hong Kong Credit Performance 10 9 8 7 6 5 4 3 2 1 0 Net Chargeoff Rates by Loan Type Source: FDIC Statistics on Banking 4.00% 3.50% 3.00% 2.50% 2004 2003 2.00% 2002 2001 1.50% 1.00% 0.50% 0.00% Total loans & Total real estate Commercial & leases loans industrial loans Loans to individuals All other loans & leases (including farm) Net Charge-off Rates by Loan Type Source: USA FDIC Statistics on Banking Link Net Chargeoff Rates 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% 2013 Net loans and leases 2011 All real estate loans 2009 Commercial and industrial loans 2007 Loans to individuals Dec, 1990 Sep, 1991 Jun, 1992 Mar, 1993 Dec, 1993 Sep, 1994 Jun, 1995 Mar, 1996 Dec, 1996 Sep, 1997 Jun, 1998 Mar, 1999 Dec, 1999 Sep, 2000 Jun, 2001 Mar, 2002 Dec, 2002 Sep, 2003 Jun, 2004 Mar, 2005 Dec, 2005 Sep, 2006 Jun, 2007 Mar, 2008 Dec, 2008 Sep, 2009 Jun, 2010 Mar, 2011 Dec, 2011 Sep, 2012 Jun, 2013 Mar, 2014 Loans in HK by Type 100% 90% 80% 70% 60% 50% Financial Concerns Other Individual 40% Individual Residential Construction&Development Commercial&Industrial 30% 20% 10% 0% Protection Against Future Losses • Loan Loss Reserve (Allowances for Loan Impairment): Quantity of gross value of loans that have been recognized as being likely to not be repaid. • Net Loans (which appears as an asset on balance sheet) = Gross Loans – Loan Loss Reserve. • When banks add to their loan loss reserve, they will deduct from profits. • When banks charge-off bad loans, they deduct from gross loans and loan loss reserve and net assets are unchanged.. Loan Provisions are a contra-asset (i.e. netted out on asset side of the balance sheet) Credit Derivatives Risk Management Tools Used to transfer risk from one party to another. • Credit Default Swaps (CDS) – A bank with credit risk exposure will pay X basis points per year and counterparty will make payment if there is a pre-determined credit “event” such as default or credit downgrade, etc. Credit Default Swap Bank A Fee Payment Payment if negative credit event Bank B All counterparties (gross) 50000000 45000000 40000000 35000000 30000000 25000000 20000000 15000000 10000000 5000000 0 Source: BIS Derivative Statistics Liquidity Management • Majority of Bank liabilities (deposits) are very Liquid. 1. Banks provide payment mechanism to customers and are able to raise funds at low interest as a result. 2. Liquidity advantage of depositors helps overcome asymmetric information advantage of bankers. • Most profitable bank assets, loans, are illiquid. 1. Banks particular expertise is in analyzing and monitoring long-term investment projects. Often expertise about a given project is specific to the bank itself and can’t be transferred. Banks loan portfolios are highly illiquid. Liquidity Risk: The possibility that creditors may collectively decide to withdraw more funds than the bank has on hand. Managing Liquidity • A bank faces withdrawals of $5 million. Assets Liabilities Cash - $5 Checkable Deposits -$5 • This reduces liquidity. The bank can Liabilities restore liquidity by managing assets or Assets liabilities. Liquidity can be restored by Cash +$5 converting secondary reserves (market Securities -$5 securities) into primary reserves (cash). • The bank can also engage more short-term liabilities by increasing borrowings from other banks or central bank. Assets Liabilities Cash +$5 Borrowings+$5 Core Deposits vs. Managed Liabilities • 1. 2. • Bank Liabilities can be divided into two parts. Core Deposits – Demand Deposits, Savings Accounts, Small Time Deposits (Retail Funds) Managed Liabilities – Borrowings from Other Banks, Commercial Paper, Large CD’s and Time Deposits (Wholesale Funds) Retail funds have lower interest costs and are thought to be more stable. They take much longer time to raise and have greater non-interest costs. Measuring Liquidity Risk Loan to Deposit Ratio – Ratio of illiquid loans to liquid deposits. High measure of loan-to-deposit ratio indicates high liquidity risk. Interest Rate Risk: Income Side • • • • Interest Rate Risk – The risk to an institution's income resulting from adverse movements in interest rates Many bank liabilities are of very short maturity (such as saving deposits) whose interest changes with market interest rates. Many bank assets are long-term and interest income may not change as market interest rate rises. When market interest rates rise, NIM will decline. Managing Interest Rate Risk • A bank which has a large stock of assets which will pay a fixed interest rate may face losses if market interest rates rise. • Since deposits must be redeemed at any time, the bank must offer market interest rates. If market interest rates rise, loan spreads will be cut. • Banks may use asset and liability management to match the sensitivity of assets and liabilities to interest rates. Interest Rate Risk: Balance Sheet Perspective • An asset (or a liability) represents a set of payments that must be made at times in the future. • Define PVT as the present value of a future payments made to an asset or a set of assets in T periods. • Useful Approximation FACE T 100 100 100 100 100 1 2 3 4 5 PV i= .1 90.90909 82.64463 75.13148 68.30135 62.09213 FACE PV (1 i )T I = .11 90.09009 81.16224 73.11914 65.8731 59.34513 PV i T PV 1 i ΔPV ΔPV/PV ΔPV/PV/Δi/(1+i) Δi/(1+i) 0.009091 -0.819 -0.00901 -0.99099 0.009091 -1.48238 -0.01794 -1.97305 0.009091 -2.01234 -0.02678 -2.94627 0.009091 -2.42825 -0.03555 -3.91072 0.009091 -2.747 -0.04424 -4.86648 Duration Measure of Interest Rate Risk • Define market value, MV, of an T asset or a set of assets as the sum MV PVt of present values derived from t 1 payments made in each future period. • Define the duration of an asset as d T PVt d t MV t 1 • The % change of the market value of an asset to a change in the interest rate is approximately proportional to the duration of an asset. MV i d MV 1 i Measuring Interest Exposure • Calculate the duration of a banks assets, dA. Calculate the duration of a banks liabilities, dL. • An increase in the interest rate will have the following effect on assets and liabilities. • Calculate the GAP as a function of duration of assets and liabilities. A i d A A 1 i L i d L L 1 i L D GAP d A d L A An increase in interest rates changes the value of a banks assets and liabilities. NW A L A L L A A A A L A i i L L i d A dL d A d L 1 i 1 i A A 1 i NW NW NW i GAP A NW A 1 i NW i EM GAP NW 1 i Floating Rate Loans • Fixed payment loans have a constant payment based on a fixed interest rate. • Floating rate loan payments are based on an interest rate that changes as some benchmark interest rate changes • Floating rate loans protect NIM from interest rate margins. • Almost all mortgages in HK are floating rate. Swaps • Basic (plain vanilla) interest rate swap is agreement by two parties to exchange interest rate payments on a notional principal. • One party pays a fixed interest rate for a pre-determined period of time. Another party pays a floating rate equivalent to some benchmark interest rate (LIBOR, etc.) Swaps and Hedging • If a bank has long-term fixed rate assets and short-term liabilities, they face interest rate risk. Solution: Swap income from fixed rate assets for floating rate from dealer. • A pension fund with long-term obligations may like to lock in fixed income at a higher rate than LT treasuries. They may also swap income from floating rate assets for fixed income from a dealer. Interest Rate Swaps Total contracts Billions US$ 700000 600000 500000 400000 300000 200000 100000 0 Source: BIS International Financial Statistics http://www.bis.org/statistics/derstats.htm Banks as Risk Taking Institutions • Banks may specialize in ameliorating effects of asymmetric information. • But there is still asymmetric information between banks and depositors. Banks info advantages are offset in at least 2 ways. 1. Bank Capital – Owners of banks put some of their own funds into banks and these funds are at risk. 2. Liquidity Advantage of Depositors – Depositors can withdraw funds very quickly from banks.