Corporations: Paid-in Capital and the Balance Sheet Chapter 13

advertisement

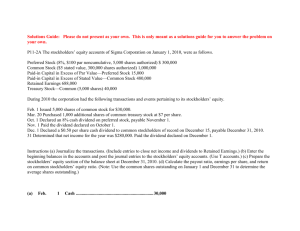

Corporations: Paid-in Capital and the Balance Sheet Chapter 13 Objective 1 Identify the Characteristics of a Corporation. Characteristics – – – – – – – separate legal entity continuous life and transferability of ownership no mutual agency limited liability of stockholders separation of ownership and management corporate taxation government regulation Organizing a Corporation • The process of creating a corporation begins when the organizers (incorporators) obtain a charter from the state. • The charter authorizes the corporation to issue stock and conduct business in accordance with state law and the corporation’s bylaws. Organizing a Corporation • Stockholders elect the board of directors. • The board sets policy, appoints the officers, and elects a chairperson. • The board also designates the president, who is the chief operating officer. Authority Structure in a Corporation Stockholders Board of Directors Chairperson of the Board President Various Vice-Presidents and Secretary Controller Treasurer Capital Stock • Corporate ownership is evidenced by a stock certificate which may be for any number of shares. • The total number of shares authorized is limited by charter. Stockholders’ Equity Owners’ equity in the corporation has two components: Paid-in capital Retained earnings Stockholders’ Equity Example On June 1, the Bloom’s Corporation issued stock valued at $10,000. June 1 Cash Common Stock Issued stock 10,000 10,000 Stockholders’ Equity Example Bloom’s Corporation net income for the year was $800,000. December 31 Income Summary 800,000 Retained Earnings 800,000 To close net income to Retained Earnings Stockholders’ Rights • The ownership of stock entitles stockholders to four basic rights, unless specific rights are withheld by agreement. 1 Vote 2 Dividends 3 Liquidation 4 Preemption Classes of Stock • Common stock is the most basic form of capital stock. • Preferred stock gives its owners certain advantages over common stockholders. Classes of Stock • What is par value? • It is an arbitrary amount assigned to a share of stock. • Most companies set the par value of their common stock quite low to avoid legal difficulties from issuing their stock below par. Classes of Stock • No-par stock does not have a par value. • Some have a stated value. • Stated value is an arbitrary value assigned to a share of common stock. • This is similar to par value. Objective 2 Record the Issuance of Stock. Issuing Stock Example • On January 13, Martin Corporation, which manufactures skateboards, issues 10,000 shares of common stock for $10 per share. Issuing Stock Example The shares were issued at par of $1. January 13 Cash (10,000 shares @ $1) 10,000 Common Stock Issue common stock at par 10,000 Issuing Stock Example The shares were issued at a premium of $9 per share. January 13 Cash (10,000 shares @ $10) 100,000 Common Stock 10,000 Paid-in Capital in Excess of Par-common 90,000 Issue common stock at a premium Issuing Stock Example The $1 stated value shares were issued at a premium of $9 per share. January 13 Cash (10,000 shares @ $10) 100,000 Common Stock 10,000 Paid-in Capital in Excess of Stated Value 90,000 Issue common stock at a premium Issuing Stock Example Assume the shares were no-par common stock. January 13 Cash (10,000 shares @ $10) Common Stock Issue no-par common stock 100,000 100,000 Issuing Stock Example • On September 11, Martin Corporation issued 15,000 shares of its $1 par common stock for a building worth $100,000. • What is the journal entry? Issuing Stock Example September 11 Building 100,000 Common Stock (15,000 @ $1) 15,000 Paid-in Capital in Excess of Par-common ($100,000 – $15,000) 85,000 Issued common stock in exchange for a building Issuing Preferred Stock • Accounting for preferred stock follows the pattern illustrated for common stock. • Stockholders’ equity on the balance sheet lists preferred stock, common stock, and retained earnings – in that order. Objective 3 Prepare the Stockholders’ Equity Section of a Corporation Balance Sheet. Review of Accounting for Paid-In Capital Stockholders’ Equity Paid-in Capital: Preferred stock, 5%, $100 par, 5,000 authorized, 400 shares issued Paid-in capital in excess of par–preferred Total paid-in capital, preferred stockholders $40,000 14,000 $54,000 Review of Accounting for Paid-In Capital Stockholders’ Equity Paid-in Capital: Common Stock, $10 par, 20,000 shares authorized, 4,500 issued Paid-in capital in excess of par–common Total paid-in capital Retained earnings Total stockholders’ equity $ 45,000 72,000 $171,000 85,000 $256,000 Review of Accounting for Paid-In Capital • Paid-in capital and retained earnings represent the stockholders’ equity (ownership) in the assets of the corporation. • Paid-in capital comes from the corporation’s stockholders who invested in the company. • Retained earnings come from the corporation’s customers. Review of Accounting for Paid-In Capital • Which is more permanent, paid-in capital or retained earnings? • Paid-in capital is more permanent because corporations use their retained earnings for declaring dividends to the stockholders. Dividend Dates • A corporation must declare a dividend before paying it. • The board of directors alone has the authority to declare a dividend. Dividend Dates Three relevant dates for dividends are: Declaration date Date of record Payment date Objective 4 Account for Cash Dividends. Cash Dividends Example • On April 1, the board declares a dividend of $1 per share payable June 15 to stockholders of record on May 15. • There are 60,000 shares outstanding. Cash Dividends Example April 1 Retained Earnings 60,000 Dividends Payable Declared a cash dividend June 15 Dividends Payable Cash Paid a cash dividend 60,000 60,000 60,000 Cash Dividends Example $50,000 dividends declared Preferred stock, 6%, 1,000 shares, $100 par Common stock, 25,000 shares, $100 par Cash Dividends Example Preferred dividend 6% × $100 ×1,000 = $6,000 Common dividend $50,000 – $6,000 = $44,000 Cash Dividends Example Suppose there were 10,000, 6%, par value preferred shares Preferred dividend 6% × $100 ×10,000 = $60,000 Common shareholders receive nothing. Cumulative and Noncumulative Preferred • If the preferred stock is cumulative, the $10,000 shortage must be paid before any dividend is paid to common shareholders. • If noncumulative, a passed dividend is simply lost. Objective 5 Use Different Stock Values in Decision Making. Stock Values • The business community refers to different stock values in addition to par value. – market value – book value Stock Values Example Book value per share = Total stockholders’ equity ÷ Total shares outstanding Book value common = (Stockholders’ equity – Amount allocated to preferred) ÷ Number of shares outstanding Stock Values Example Stockholders’ Equity Paid-in Capital: Common Stock, $20 par value, 10,000 shares authorized, issued, and outstanding Paid-in capital in excess of par–common Total paid-in capital Retained earnings Total stockholders’ equity $200,000 100,000 $300,000 100,000 $400,000 Book value per share: $400,000 ÷ 10,000 = $40 Objective 6 Evaluate Return on Assets and Return on Stockholders’ Equity. Return on Assets Rate of return on total assets = (Net income plus Interest expense) ÷ Average total assets It is a measure of a company’s ability to generate profits from the use of its assets. Return on Equity Rate of return on common stockholders’ equity = (Net income – Preferred dividends) ÷ Average common stockholders’ equity It is a measure of the income earned from the common stockholders’ investment in the company. Objective 7 Account for the Income Tax of a Corporation. Accounting for Income Taxes by Corporations Income tax expense = Income before income tax (from the income statement) × Income tax rate Income tax payable = Taxable income (from the tax return filed with the IRS) × Income tax rate Accounting for Income Taxes by Corporations • Deferred tax liability is the difference between income tax expense and income tax payable for any one year. • Revenues and expenses may be reported in different periods for income statement and tax return purposes. • Alternative depreciation methods may be used for book and tax purposes. End of Chapter 13