CGT Withholding Tax - Chartered Accountants Ireland

advertisement

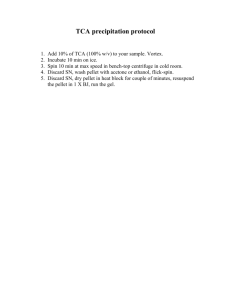

Chartered Tax Consultant Stage 3 Module 10 Withholding Taxes Fiona Dunlevy – Chartered Accountants House www.charteredaccountants.ie EDUCATING SUPPORTING REPRESENTING Withholding Taxes • Learning Objectives • Withholding Taxes on – – – – Distributions Interest Royalties Rent • Risks and Requirements • Managing withholding taxes • Reliefs and Exemptions – minimise cash flow and compliance costs Overview • • • • Withholding taxes = Collection Mechanism Tax not collected from beneficiary Tax collected from other person 3 Categories 1. Payments to non residents 2. Fiduciary Withholding Taxes 3. Enforcement Withholding Taxes (1) Payments to Non Residents • Avoids non payment of tax in cross border situations • Financial and HR investment for cross border collection mechanisms avoided Withholding taxes more efficient (2) Fiduciary Withholding Taxes • PAYE, VAT and DIRT • Collection and payment obligations devolved to businesses • Administration and collection burden falls on business community • Likely to reduce tax fraud (3) Enforcement Withholding Taxes • Withholding tax on payments to certain businesses • PSWT – Professional Services Withholding Tax – State and State owned companies • RCT – Relevant Contracts Tax – Construction, Forestry and Meat Processing – Principal Contractor Withholding Taxes • • • • • • • Levied on Gross Income Rents – not on net Case V Gross/net distinction Major tax risk if not operated Exemptions available Matter of procedures No tax cost and no risk to accountable person if operated correctly Dividend Withholding Tax • Common internationally – OECD Model Treaty – source country 5%/15% on dividends – High dividend withholding tax for non residents • • • • Extensive DWT exemptions for non residents Exception to international norm Introduced in 1989 Exemptions for non residents to encourage inward investment Company Distributions • DWT applies to distributions – actual and deemed • Distributions S.130 TCA 1997 - includes much more than dividends • Returns from resident companies – taxable as income in hands of shareholders • Liable to DWT unless exemption applies • Date of payment determines: – date of DWT payment and filing – timing of tax liability for recipient Shares • • • • • Ordinary Shares Preference Shares Rights Issue Bonus Issue Scrip Dividends Shares Type Description Tax Treatment Ordinary Shares •Entitlement to dividends as declared •Return of assets on liquidation after creditors and preference shareholders •Right to fixed dividend – may accumulate •Return of amount subscribed on liquidation Dividends paid out of income and capital taxable as income Preference Shares Dividends taxable as income Shares Rights Issues Bonus Issue Scrip Dividends •Allotment of new shares in proportion to shareholding •Right to subscribe at discount •Reorganisation of share capital •Additional shares issued •No consideration •Capitalisation of company’s reserves •Election for shares in lieu of dividends •CGT event •Enhancement Expenditure •Sale of rights •Tax neutral •Cost for CGT per share adjusted •Sec 816 TCA 97 •Sch D Case IV on dividend foregone Example 1 Kwick Plc, an Irish registered and tax resident company, announces a rights issue where every shareholder is given an opportunity to subscribe for one new share for every five held, at a price of €15. Where the rights are not exercised, the right may be sold by the shareholder and the proceeds liable to CGT. Example 2 Kwick Plc, had a very profitable year and wishes to issue bonus shares to its shareholders. Each shareholder will be allotted one bonus share for every four shares held. The receipt of bonus shares is not liable to income tax or CGT. Example 3 John Murphy holds 5,000 shares in Goldhills plc which is an Irish tax resident quoted company. He has the option of being paid a dividend of 15 cent per share or a scrip dividend of one new share for each 50 shares held. John elects to receive the scrip dividend and is allotted 100 new shares. His income is taxable under Schedule D Case IV is €750. What is a distribution? • Section 130 TCA 1997 • Section 135 TCA 1997 (Distributions: supplemental) Sec 130 Distributions Section 130(1)TCA1997 Sec 436 TCA 1997 Close company expense payments Sec 437 TCA 1997 Close company interest Sec 816 TCA 1997 Shares paid in lieu of dividends Sec 130(2) TCA 1997 A Any dividend paid by the company B Distributions out of company assets in respect of shares – not capital C Redemption of bonus securities not connected to new consideration D Certain interest paid by the company E Transfer of assets to shareholders - consideration < value Liabilities of s/holder assumed by co > assets contributed F Bonus issue following repayment of share capital Repayment of share capital following a bonus issue G Qualifying payment to ESOT member linked to an APSS Distributions – S.130(2)(a) TCA 97 • S.130(2)(a) TCA 1997 - Dividends • S.4(5) TCA 1997 – dividends shall be treated as paid on the date when they become due and payable • Murphy v The Borden Co Ltd – Interim dividend paid when credited to intercompany account • Final dividend: Due and payable when declared • Interim dividend: Actual payment • DWT : Due and payable date for rate, payment and declarations Example The directors of Sunday Limited declared an interim dividend on 5 December 2010 but it was not actually paid until 3rd March 2011. For tax purposes the dividend is not regarded as paid until 3rd March 2011 with the follow-on payment and filing dates for DWT. Distributions – S.130(2)(b) TCA 97 • S.130(2)(b) TCA 1997 – Other distributions out of assets of the company in respect of shares • Return of capital > par value and premium paid • Buyback of shares • Repayment of redemptions of share capital • Reduction of capital • Exclusions – S.175 and 176 TCA 1997: share buybacks liable to CGT • Distribution = redemption less subscription Example Apple Limited has 10,000 ordinary shares and 2,000 A ordinary shares in issue, originally subscribed at a premium of €6 per share in 1990. It redeems the 2,000 A ordinary shares on 1 Jan 2011 at €10 per share. The difference between the redemption amount of €10 and the original subscription price of €6 per share is a distribution. Distributions – S.130(2)(c) TCA 97 • S.130(2)(c) TCA 1997 – Redemption of bonus shares or debentures • Issued out of revenue reserves = distribution • Share or debentures issued out of new consideration excluded • “new consideration” defined in S.135 TCA 1997 Example Bell Limited has 10,000 ordinary shares in issue and has substantial revenue reserves. On 1st January 2010 it issues a bonus debenture of €1,000 carrying interest at 5% and repayable on 1st January 2015. When the debentures are redeemed on 1st Jan 2015, Bell Ltd is treated as making a distribution of €1,000 per share and the shareholders are taxable on this distribution. Distributions – S.130(2)(d)TCA 97 • • • • • • S.130(2) (d) TCA 1997 – Interest reclassified Anti avoidance provision Interest treated as a distribution No tax deduction for interest payment Exclusions for certain interest Very important to understand when this section applies and when the exclusions are met Interest as a distribution Bonus securities issued on or after 27th November 1975 Unquoted securities convertible into shares Unquoted securities with rights to receive shares/securities Securities where interest dependent on result of company or > reasonable •Tax Briefing 43 – exclusions for “ratchet loans” •Exclusions for S.110 companies Shares held by 75% non resident company –S.130(2)(d)(iv) Exemptions available Securities connected to shares Loan note and attached warrant Exclusions from deemed distributions • S.452 TCA 1997 • Trading company may make election • Interest will not be treated as distribution if – – – – Paid to 75% non resident parent – S.130(2)(d)(iv) Paid to recipient in treaty country or is annual interest Paid in ordinary course of company’s trade Otherwise allowable as a Case I deduction • S.845 TCA – exemption for banks – S.130(2)(d)(iv) interest – elect with CT Return – Bona fide banking business and interest otherwise deductible – Not> reasonable commercial rate of return Exemptions • S.130(2B) TCA 1997 – – – – S.130(2)(d)(iv) interest Interest paid to foreign parent in EU country Article 49 TREU – freedom of establishment Applies to interest deductible as a charge on income Examples Interest of €100,000 By to Irish Trading company Irish Holding company Irish Bank French Parent Italian Parent Taiwanese Parent Bermudan Parent Irish Trading Company Treatment S.452 election – tax deduction Interest not a distribution S.130(2B) – deductible as a charge - not a distribution S.845A election – deductible Interest not a distribution S.452 election if annual interest 12.5% CT v 20% withholding no election Not annual interest distribution Distributions – S.130(2)(e) TCA 97 • • • • • • • S.131 TCA 1997 – Bonus Issues Bonus issue following repayment of share capital Repayment of share capital following bonus issue Later event treated as a distribution Capped at value of capital repayment made Anti avoidance provision Prevents receipt of retained profits being taxed as capital • Exception for non close company – bonus issue of non redeemable shares • >10 years after capital repayment Distributions – S.130(2)(f) TCA 97 • S.130(2)(f) TCA 1997 – ESOT Beneficiaries • Payments made out of dividends received by ESOT • Deductions allowed for interest and trust expenses • Distributions by ESOT to members treated as dividends • Dividends taxable in hands of ESOT members Distributions – S.130(3) TCA 97 • S.130(3) TCA 1997 –T/f of assets to s/holders • Treated as distribution if value of assets > contribution by shareholder • Amount of undervalue = distribution • Liabilities assumed by shareholder are distributions • Sec 130(3) & (4) TCA 1997 exclusion • Transfers between resident companies where on is a subsidiary of the other • Applies also where both subsidiaries have parent in EU or DTA country • Sec 130(5) TCA exclusion – non cash transfers between tax resident companies Close Company • S.130(1) TCA 1997 – deemed distributions • S.436 – expenses for participators and associates • S.437 – excess interest paid to directors and associates • Living accommodation; entertainment expenses • Other benefits and facilities • No deduction for CT • Taxable as distribution Close Company • Exclusions for deemed distributions: • BIK under S.118 TCA 1997 • Pension or similar benefit for spouse, children or dependents on death or retirement • Close company and participator are companies – Both resident in Ireland – 51% subsidiaries – Transfers of assets and liabilities only • S.236 – art object on public display • Anti avoidance – S.436(6) TCA 1997 Close Company • Where a company transfers assets or liabilities to its members, or under the close company provisions (i.e. expenses for participators), the amount by which the market value of the amount or benefit of the transfer exceeds the amount or value of any new consideration given is treated as a distribution or the expense paid on behalf of the participator is a deemed distribution. Consequences: – Income tax under Schedule F – S20(1) TCA 97 – Non deductible for corporation tax purposes - S.76(5) TCA 97 – DWT (may need to re-gross under S172B(3) TCA 97 Taxation of Distributions Individuals •Schedule F – S.20 TCA 1997 •Liable at marginal tax rate and PRSI/Levies •Shares in lieu– S.816(2) TCA 97 Companies •Divs paid by Irish resident company to an Irish resident company – tax exempt •S.129 CTA 1976 •S.156(1) TCA 1997 – FII •Anti Avoidance – Sch D Case IV •S.129A TCA 1997 – div out of foreign profits •Distributions paid on or after 3rd April 2010 •Off shore companies migrating to Ireland •S.138 TCA 1997 – div paid on certain preference shares – Sch F Franked Investment Income • FII = distributable estate and investment – Close companies – 20% surcharge – Not distributed within 18 months of AP • Sec 434(3A) TCA election – No reduction in distributable income of payor – Payor may have surcharge – Avoids multiple surcharges Capital Distributions • Includes distribution on winding up • Not a distribution for S.130 TCA 1997 • Interim or final payment by liquidator to shareholders • Liable to CGT in hands of shareholders • Company buyback under S.175 & 176 TCA 1997 • Capital distribution – liable to CGT Dividend Withholding Tax • DWT applies to resident companies making distributions to shareholders • 1999 – move from imputation to classical system • Introduction of 12.5% CT rate • Company pays CT on profits • Shareholder pays income tax on dividend • “Double tax” on shareholder • DWT @ standard rate • All or part of tax due is collected through DWT DWT • Ss. 172A-172M TCA 1997 • DWT Rate = standard rate of tax • “Relevant distribution” – S.130 TCA distributions – S.436 and 437 expense and interest payments – S.816 scrip dividends of quoted and unquoted companies – reduce value by 20% for DIRT • Excluded relevant distributions to – – – – An Irish resident company where payor is 51% sub Government Ministers (in that capacity) National Pension Reserve – as specified NAMA and companies owned by NAMA plus 75% subs DWT • Stapled-stock arrangements • Shareholders in two different countries • Facility to source dividend from country of residence • DWT not operated where dividend is sourced from non resident country • S.172L TCA 1997 • Revenue filing – details of Irish recipient and paying company within 14 days DWT Statements • S.172I TCA 1997 • Statement to be issued showing – – – – Company name and address Recipient name and address Date of distribution Amount of distribution and DWT • Dividend warrant can contain details plus – Amount of dividend or interest – Period for which dividend made – Disclose amounts from capital DWT Exemptions • Irish Resident shareholders • S.172C TCA 1997 excluded person – – – – – – – – Irish resident companies ESOTs Pension Schemes CIUs Charities Sporting bodies Incapacitated individuals and trusts – if exempt from IT Managers of ARFs, AMRFs and SSIAs • Composite Resident Form V3 • Retain for 6 years DWT Exemptions • Foreign shareholders • “Qualifying non resident persons” • Companies in EU or DTA country –not under control of Irish resident persons • Non resident companies ultimately controlled by persons resident in EU or DTA country • Non resident companies traded on stock exchange of EU/DTA country/approved by Minister • Other non resident persons – not Irish resident or ordinarily resident, resident in EU/DTA country Non Resident Companies • • • • Non-Resident Form V2B Made by non resident company Valid in year made plus 5 years S.172D(3)(b)(ii) TCA 97 – show territory or residence • S.172D(3)(b)(iii) TCA 97 –Stock Exchange address Parent Subsidiary Directive • • • • No 90/435/EEC No withholding tax S.831 and 831A TCA 1997 Excludes dividends on winding up – not liable to DWT • Divs to 5% EU parent – Directive applies • Swiss parent – 25% shareholding required • Majority of voting rights cannot be controlled by residents of non relevant territory unless BF test met Non Resident Exemptions Others • Form Non-Resident V2A – foreign individuals • Form Non-Resident V2C- others • Signed by non resident person and foreign tax authority of residence (unlike companies) • Discretionary Trusts – certified by Revenue • Valid until 31st December five years following issue Filing of DWT Declarations • 14th of month following month in which distribution paid • Interest on late payment – S.172K(6) TCA 97 • Details to be filed where no DWT payable • Electronic filing DWT Refunds • Excluded persons and qualifying non residents • Appropriate declaration not in place at time of payment • DWT Section in Revenue • Include Composite Resident Form V3 or NonResident Form V2A, V2B or V2C • Declarations from foreign Revenue authority • Claims by shareholders in DTA country where no refund under domestic law Recap • • • • • What is a distribution? What are the consequences? How is tax levied? What are the DWT implications? What are the documentation requirements? Patents and Royalties • S.237 TCA 97 – withholding tax on annual payments made as a charge • S.238 TCA 97 – withholding tax on annual payments made out of income not in charge to Income Tax – Includes income liable to CT • Yearly interested excluded under both sections • Withholding tax applies to annual payments made inside and outside Ireland • Annual payment – “pure income profit” • Earl Howe v IRC - Patents and Royalties • • • • • Annual payment – “pure income profit” Earl Howe v IRC – recipient does not incur costs Made for period that may exceed one year Payments under Deed of Covenant Royalties – If made for intellectual property – licensor has costs not annual payment – Some royalties may be annual payments – book royalties to estate of author • S.237 & 238 TCA apply to patent royalties • Withholding applies to Irish and foreign patent royalties Exemptions 1. Payments by Irish company to EU/Treaty resident company 2. Payments covered by SP CT 01/10 3. Interest and Royalties Directive 4. Where recipient eligible for Treaty benefits • 1-3 apply to Irish companies making payments to non resident companies • 4 applies to individuals and companies paying and receiving patents and annual payments Exemptions S.242A TCA 97 •Irish company or Irish branch of foreign company •Pays royalty in ordinary course of business •To company resident in EU/DTA with similar tax on royalties SP-CT/01/10 •Royalty paid on foreign paten to foreign company •No branch in Ireland •Revenue grant exemption on the foreign source income Interest and Royalty Directive •Ss. 276G-276K TCA 1997 •Exemption on royalties and interest •Both companies resident in different EU States •Recipient beneficial owner •Associated companies – 25% relationship Treaty Benefits •Recipient entitled to benefit of Treaty Article •Residence of taxpayer •Exemption where domestic law not available •Form IC6 Administration • • • • Withholding tax rate 20% Part of Preliminary Tax for individuals “Relevant payment” for companies – preliminary tax Includes income tax on annual payment to participator • Form R185 – used for credit/repayment • S.950(1)(c) TCA 1997 – payor is chargeable person • Self assessment provisions apply – Part 41 TCA 97 Annual Interest • S.246(2) TCA 1997 • Withholding tax on yearly interest – Paid by companies – Paid by other persons to non residents • Applies to interest only – not discounts Annual v Short Interest • CIR v Duncan Hay – – – – – – Series of short loans treated as a single loan Yearly interest arises on loans: Which do not run for less than a year Have permanence and are investment in nature Not repayable on demand Have a “tract of future time” • Mink & Others v IOT – Loan not repayable on demand not important factor – Commercial loans where covenants breached • Revenue practice – credit card interest is yearly Exemptions - Residents S.246(3) •Interest paid to a bank in the State S.410(4) •Interest paid to Irish company by 51% group member S.739B •Interest paid in the State to investment undertaking S.246(3)(cc) •Interest paid in the State to Sec 110 company securitisation S.246(3)(f) •Interest paid gross to Credit Unions S.246(5)(a) •Interest paid by a company to another company which lends as part of its trade – Revenue notification S.246(3)(g) •Interest which is a distribution under Sec 437 TCA 97 S.246(3)(ea)&(eb) •Interest paid to NAMA and 75% subs Exemptions – Non Residents S.267I •EU Interest and Royalties Directive •Interest paid by associated company S.246(3)(d) •Revenue authorisation to pay interest gross •DTA •Commercial paper and certificates of deposits •Wholesale debt instruments S.246A S.64 •Interest paid on quoted Eurobonds S.246(3)(c) •CIU paying interest to non resident S.246(3)(CCC •Sec 110 company paying interest to EU or DTA country ) resident S.246(3)(h) •Paid by Irish company to DTA/EU resident country which applies tax on interest •Exempt under DTA – ratified or signed Exemptions • Exemptions to residents and non residents – S.130 TCA 97: interest that is a distribution – S.246(3)(b)TCA 97: interest paid by bank in ordinary course of business – S.246(3)(e) TCA 97: interest on Sec 36 securities – S.246(3)(h) TCA 97: wide exemption – Interest payable by Irish company in course of trade or business – Applies where lender is not Irish based – No advance clearance needed – Not applicable to interest paid in connection with trade or business carried on in Ireland – Filing requirement for payor – with CT Return Rents • S.1041(1) TCA 1997 • S.238 TCA 1997 withholding tax applies to Case V income paid to non residents • Usual place of abode outside the State • S.1041(2) TCA 1997 – deduction for rental expenses • Tax withheld allowed as credit/refund • Exemption where rent paid to agent • Collection agent liable – register for tax • Onus to collect on tenant – Form R185 Trustees • • • • Payment made by trustees Made out of taxed income Form R185 issued to beneficiary Beneficiary taxed at personal rates – credit for tax deducted • Where beneficiary receives income directly – no Form R185 DTAs and Withholding Tax • • • • • • • • • Royalties Article 12 Interest Article 11 Rent Article 6 Treaty has precedence over national law Treaty may provide exemption if none under national law Royalty to Cyprus resident company Exempt under Article 11.1 DTA if paid by individual Revenue approval to pay gross Form IC6 – certified by foreign tax authorities EU Directives • • • • No 2003/49/EC Sections 267G-267K TCA 1997 Common system of tax to interest and royalties On interest and royalties paid between associated companies • Direct 25% shareholdings – voting rights • Swiss tax resident companies included • No relief where: – No bona fide commercial reason for payment – Interest on debt is >50 years – Royalties exceed arm’s length amount Savings Directive • • • • No 2003/48/EC Limits withholding tax Exchange of information between EU States Interest earned by individuals – Option of withholding or exchange information • • • • • Applies to all EU countries Individuals opening bank accounts – PPSN S.898F-898G TCA 1997 Isle of Man and Channel Islands – withholding tax Rate – 20% to July 2011 and now 35% Fiduciary Withholding Taxes • • • • • • • PAYE and VAT Reg 4 PAYE Regulations Employer liable to deduct tax from employee S.984 TCA 1997 – PAYE applies to emoluments Income assessable under Sch E PAYE Exclusion Orders PRSI and Levies included PAYE • S.983 TCA 1997 • Employer paying emoluments to employee • Employer – Any person paying emoluments • Emoluments – Anything assessable to tax under Schedule E • Employee – Any person in receipt of emoluments • Hearne v O’Cionna – employer has broad meaning PAYE • S.985C TCA 1997 • Intermediary paying emoluments • Employer liable to PAYE – unless deducted by intermediary • Sec 997A TCA • Proprietary directors (15%) – no credit for PAYE if not paid to CG PAYE • Difficulties for employers – Directors’ Fees – non residents – PAYE always applies to Irish office – PRSI Class A and Class S distinction for proprietary directors – PAYE exclusion order needed where payment of emoluments made to non resident employees • Audit controls and monitoring procedures VAT • S.5(1) VATCA 2010 • “Accountable person” – taxable person who engages in the supply of taxable goods or services within the State • Taxable person is a person carrying on a business in the EU or elsewhere • Person making taxable supplies in the State is accountable for VAT VAT • Accountable person is not the person buying the goods or services • Purchaser bears the cost of VAT • Exceptions to supplier being the accountable person – Some property transactions – Some international services • Register for VAT where thresholds exceeded • Non commercial bodies • Exempt and partially exempt input credits Interest on PAYE & VAT • PAYE/PRSI – S.991 TCA 1997 – Daily interest 0.0274% • VAT – S.114 VATCA 2010 – Daily interest 0.0274% • Interest on IT, CT and CGT is 0.0219% • Higher rate for fiduciary taxes since 1st July 2009 • 2010 Revenue Audit Code – “deliberate behaviour” category for failure to operate fiduciary taxes Financial Institutions • DIRT • Gross Roll Up Funds withholding tax • Sch C and D encashment tax DIRT • • • • Deposit Interest Retention Tax Current rate is 25% S.256(1) TCA 1997 “Relevant deposit taker” – Holder of license under Section 9 Central Bank Act 1971 or similar EU license – Building Society – Trustee Savings Bank – Credit Union – Specified Intermediary in relation to specified deposit – Post Office Saving Bank DIRT • DIRT applies to interest arising on relevant deposits • Held by relevant deposit takers • Excluded deposits – – – – – – – – Relevant deposit takers NTMA National Pensions Reserve Fund Commission National Development Finance Agency NAMA PRSA provider deposits Deposits in branches outside Ireland Listed deposits ranking as a debt on security Exempt Deposits • S.263 TCA 97 – non residents declaration • Tax Exempt Charities • S.263A TCA 97 – Over 65s exempt from Income Tax • Companies • Pension Schemes • All of the above must have relevant documentation in place • Default position is for DIRT to be deducted Administration of DIRT • S.258 TCA 1997 • Deposit taker to make return and pay within 15 days of end of year of assessment • Payment on account within 15 days of 5th October • Individual’s Income Tax liability satisfied • PRSI and Health Contribution may apply • Exempt from Income Levy S.819B TCA 1997 • Banks, investment fund and life assurance companies • Returns to Revenue on annual basis • Whether DIRT deducted or not • Where interest >€635 paid in a tax year • Name, address, DOB, registered office, tax reference number and interest paid • SI No 136 of 2008 • SI No 254 of 2009 Exit Tax on Gross Roll Up Funds • Single premium investment in life company • Income, gains and losses accumulated in fund • Similar products from regulated investment undertakings • Unit Trusts, UCITS, investment companies and partnerships • “Gross Roll Up” exit tax • 8 year anniversary charge Life Assurance Products • • • • Income/gain not taxable to CT on life company Accumulated for benefit of policy holders Exit tax @28% on growth Personal Portfolio Life Policies – “wrappers” liable @ 48% - Sec 730BA TCA 1997 Life Assurance Products • • • • • Chapter 5, Part 26 TCA 1997 Sec 730C TCA 1997- “chargeable event” (CE) B = Value payable under policy at CE T = tax payable at 8 year anniversary P = Premiums paid on life policy not allowed against previous gains • Premiums taken into previous gains = – Surrenders: lesser of B and (PxB)/V – Assignments: lesser of A and (PxA)/V • V = value of policy immediately before CE • A = Value of part of rights assigned Life Assurance Products CE TCA 97 GAIN TCA Maturity 730C(1)(a)(i) B+T-P 730D(3)(a) 730D(1A)(a)&(b) Assignment 730C(1)(a)(ii) V+T-P 730D(3)(b) 730D(1A)(a)&(b) Part Surrender 730C(1)(a)(iii) B-((P-T)xB) V 730D(3)(c) 730D(1A)(a)&(c) Partial Assignment 730C(1)(a)(ii) A-((P-T)xA) V 730D(3)(d) 730D(1A)(a)&(c) 8 Year from inception 730C(1)(a)(iv) V-P 730D(3)(da) Subsequent 8 years ending 730C(1)(a)(v) V-P 730D(3)(da) Life Assurance Products • • • • • • • Sec 730F(1A) TCA 1997 Reduce tax payable by tax on prior event No additional tax for investor No CGT or IT relief on loss Life company deducts tax on proceeds Assets of fund reduced where no encashment Returns to Revenue – Policies encashed 1st Jan – 30th June due 30th July – Policies encashed 1st July – 31st Dec due 30th Jan Exemptions TCA 1997 Policy Holder 730D(2)(b)(i) Another Life Company 730D(2)(b)(ii) Investment Undertaking 730D(2)(b)(iii) Charities 730D(2)(b)(iv) PRSA Provider 730D(2)(b)(v) Credit Union 730D(2)(b)(vi) Court Service 730D(2)(b)(vii) NAMA Companies – exemption if non resident Individuals – exemption if not resident and not ord resident Relevant declarations to be filed by policy holder for all exemptions Regulated Investment Undertakings • • • • • Chapter 1A, Part 27 TCA 1997 Similar exit tax regime for CIUs 25% tax on annual payments 28% tax on other payments Exemptions for – Units switched between sub funds of umbrella fund – Units switched between different classes in the fund – Units held in clearing system recognised by Revenue Encashment Tax Sch C & D • Sch C: chargeable on profits from public revenue • Sch D: chargeable on dividends from foreign corporates • Operated by banks in receipt of public revenue and foreign dividends – rate 20% of dividend • S.17(3) TCA 97 – exemption for clearing cheques • Public revenue includes Irish and foreign governments and public authorities • Exclusions where security owned by non residents or issued under Minister for Finance Enforcement Withholding Tax • PSWT -Professional Services Withholding Tax • RCT - Relevant Contracts Tax PSWT • Part 18 Chapter 1 TCA 1997 • S.521 TCA 1997 – accountable persons • Sch 13 TCA 1997 includes – – – – – – All Government departments HSE An Garda Síochána DPP RTE Authorised insurers to medical practitioners, eg VHI, Aviva, Quinn Services for PSWT • S.520(1) TCA 1997 – Medical, dental, pharmaceutical, optical, aural or veterinary – Architectural, engineering, quantity/other surveying and related services – Accountancy, auditing, finance – Services of financial, economic, marketing advertising and other consultants – Solicitor or barrister and other legal services – Geological services – Training provided on behalf of FÁS Payment not within PSWT • Payments subject to PAYE • Payments liable to RCT • A payment made to reimburse a relevant payment by one accountable person to another • Payment to exempt charities • Certain payments by foreign based branch/agency of Irish resident company Computation of PSWT • PSWT applies to gross payment plus expenses • Exclude: – – – – – – VAT Stamp duties Land Registry Fees Deeds of registration fees Companies Office fees Court fees Administration • Payor issues F45 to service provider • F45 shows gross payment, net payment and PSWT • F45s needed for claiming credit and refunds • Claim credit in period in which PSWT deducted • IT – claim deduction in year income is taxable • CT – claim in AP in which income is taxable • Daly v Revenue – law amended to current year • Include PSWT in Preliminary Tax computation Interim Refunds • Interim refunds – S.527 TCA 1997 – Profit for immediately preceding period is finalised – Tax payable for preceding period paid in full – Form F45s submitted • • • • PSWT refund = PSWT – prior year liability S.527(3) – VAT and PAYE up to date PAYE/VAT arrears deducted from refund IT19 Revenue statement for hardship cases – – – – Once off unusual receipt Once off deduction or permanent reduction in income Delay due to illness etc in finalising liabilities PSWT + IT liability is higher than income @41% New Business • S.527(4) TCA 1997 • No liability in previous year • Interim refund formula: 20% x (E x A x C) B P A = Est payments for PSWT in period B = Est income for the period C = Est no of months in refund period E = Est total amount of wholly and exc expenditure in period P = Est no of months in accounting period Example • Commenced 2nd January 2010 • Interim refund claim in June 2010 • Estimated Income & Expenditure 2010 – – – – Local Authority Fees Other Fees Total Costs €500,000 A €250,000 €750,000 B €600,000 E • Interim Refund – 20% x (600 x 500 x 6(C)) = €40,000 750 12(P) Non Residents • Professional Services provided to accountable persons by non resident companies or individuals • Claim for refund of PSWT to International Claims Branch • No taxable presence in Ireland • Certification from foreign tax authority of residence • Cert valid for 5 years • Questionnaire issued by Claims Branch Relevant Contracts Tax • S.530 to 532 TCA 1997 • Significant source of tax risk • RCT applies to payments – By principal contractor – To sub contractor – For construction, forestry or meat processing operations – Rate of 35% where no C” and Relevant payments card • PC issues RCT Deduction Card • Monthly payments • Annual Return – C35 Principal Contractor • S.531(1) TCA 1997 • A person in the construction, forestry and meat processing industry who takes on a sub contractor and • Who carries on a specified business or is listed a specified person for RCT purposes Specified Business •Erection of buildings •Land development •Manufacture, treatment or extraction of materials for construction operations •Meat processing operations in approved establishment –EU Regs 1996 •Forestry operations •Processing of wood in sawmills from thinned or felled trees •Supply of thinned or felled trees for processing •Principal contractor is connected to a company carrying on above operations Specified Person •Local authority or public utility society •Certain housing authorities •Government Minister •Board established under statue •Board or body established under Royal Charter and funded by Oireachtas funds •Person carrying on gas, water, electricity, hydraulic power, dock, canal or railway undertaking Exclusions • Term “principal contractor” excludes: • S.531(2) – where buildings will be used by his employees • Person who is connected with a PC is excluded where – That person is not engaged in business of land development or construction – Groups of companies – Individual or company connected with PC retains subcontractor to work on his private residence or business premises Construction Operations •Construction, alteration, repair, extension, demolition or dismantling of buildings or structures •Construction, alteration, repair, extension or demolition •Walls, road works, power lines, telecommunication apparatus, aircraft runways •Docks and harbours, railways, inland waterways, pipelines, reservoirs, water mains, wells, sewers, industrial plant and installations for land drainage •Installation in buildings of heating, lighting, air conditioning, sound proofing, ventilation, power supply, drainage, sanitation, water supply, burglar and fire protection •Installation in building of telecommunication systems •External cleaning of buildings, internal cleaning where part of construction work •Operations integral or preparatory to all above e.g. site clearance, excavation, scaffolding erection, landscaping, provision of roadways and access •Integral and preparatory works for extraction of minerals, oil, natural gas and exploration for natural resources •Haulage for hire of materials, machinery or plant for use in above Meat Processing • List of operations is very broad and includes – – – – – Slaughter of animals and fowl Processing or preservation of carcasses Loading and unloading of carcasses Haulage and/or rendering of carcasses Cleaning down of establishments where meat processing carried on – Grading, sexing and transport of day old chicks – Haulage for hire of animals and fowl for meat processing operations Forestry Operations • Planting, thinning, lopping or felling of trees in woods, forests or other plantations • Maintenance of woods, forests or other plantations and preparation of lands for planting • Haulage or removal of thinned, lopped or felled trees • Processing of wood from thinned, lopped or felled trees in sawmills • Haulage for hire of materials, machinery or plant for use in above operations Sub Contractor • Employee or subcontractor? • Code of Practice for determining Employment Status or Self Employment Status • Henry Denny Case • “Facts and realities of the situation on the ground” • Covered in Module 3 Administration of RCT • Registration as PC on Form TR1 or TR2/P33 • Form RCT 1 – Principal contractor and sub contractor – Details of each party and contract • PC deliver Form RCT 1 to Revenue if – – – – First contract with subcontractor PPSN of subcontractor not shown Subcontractor not registered for CT/IT Subcontractor not VAT registered or number not provided – Subcontractor employing others but no PAYE reg no – Subcontractor using sub but not registered as PC Administration of RCT • Principal not required to submit RCT1 to Revenue is obliged to keep it for 6 years • Same RCT 1 will cover rolling contract with same contractor • Exclusion from RCT1 where sales in previous 3 years > €6.34m • Apply on Form RCTI-E • Exemption certificate valid for 3 years RCT deduction • • • • • • SC with no C2 = uncertified contractor RCT operated on full payment SC applies for C2 Form RTCDC given by PC on payment Payment recorded by PC on Form RCT 48 PC applies on Form RCT 46 for Relevant Payments Card when SC has a C2 • Issue of RCT 47 authorises gross payment • Form RCT 30 filed monthly – within 14 days • Annual Return on RCT 35 due 14th February Failure to Comply with RCT • PC liable if he fails to deduct the 35% RCT • Interest on penalties for non deduction or RCT incorrectly operated • Daily interest 0.0274% • Deemed due in first month of year Sec 531(3B) • Exception where RCT paid within 1 month of Revenue demand Failure to Comply • S.531(14) TCA penalties for non compliance – Fine of €5,000 for improper use or obtaining C2; improper use of RCT 47 – Fine of €5,000 –failure to supply RCTDC to SC; failure to keep documents or notify Revenue re changes in control of company possessing C2 • Major risk area for Principal Contractors • Large settlements with Revenue • Quarterly defaulters list Clearance Procedures • Withholding Tax • CGT • Government Contracts CGT Withholding Tax • • • • S.980 TCA 1997 Withholding tax where consideration> €500,000 Withholding tax 15% Assets (“Specified Assets) a) Land in the State b) Minerals in the State or any rights or other assets in relation to mining or searching for minerals c) Exploration or exploitation rights located in Ireland d) Goodwill of trade carried on in Ireland e) Shares of a company deriving greater part of value from (a),(b) or (c) CGT withholding • Exclusion where: – Vendor produces CG50A at closing – Sale of new dwelling house and vendor produces C2 – Disposal by Sch 15 TCA 97 Body – State bodies not liable to CGT • Vendor applies on Form CG50 • Clearance granted where either: – Vendor is Irish resident – No CGT payable – CGT paid • Withholding tax due within 7 days • Vendor given Form CG50B CGT Clearance • • • • Non resident vendors CGT must be paid Revenue may accept undertaking from solicitor CGT to be paid out of sale proceeds Share Purchase Agreements • Simultaneous signing and closing of contracts • CG 50 clearance needed if > greater part of value of shares derived from land, buildings or exploration rights in Ireland • Revenue will accept unsigned contracts for CG50 purposes • Revenue request final copies to be submitted on completion Liability of Agent • Liability to deduct CGT falls on person handling the funds • Normally the solicitor for property sales • S.980(4)(a)(i) TCA 1997 “person by or through whom any payment is made shall deduct …15 per cent..” • Risk for solicitor Inter Group Transfers • CG50As required when assets transferred within a group • No exemptions for group members • Applies to property and shares >50% from land or buildings etc in Ireland • Transfer of shares deriving >50% value from goodwill of trade carried on in Ireland not subject to CGT withholding • Sale of goodwill within CG50 procedures • Care needed with European or international sale with trade in Ireland Government Contracts & Licenses • S.1095 TCA 1997- general scheme for tax clearance • Right of appeal where TC refused • S.1094 TCA 1997 – licence tax clearance • Public sector contracts – >€10,000 VAT inclusive annually – Provision of goods and services – Valid C2 or TCC • Grant payments > €10,000 by State bodies Government Contracts & Licenses • Licenses and other schemes – – – – – – Liquor licence Bookmakers licence Mortgage or credit intermediaries authorisation Taxi and hackney licences Private security services Charities applying for State funding • See Revenue Guidelines for Tax Clearance Government Contracts & Licenses • Online application for residents • Non residents apply to: – Own tax district if PE in State – CGS of no tax registration or PE – Dublin City Centre District if tax registration and no PRE Standards in Public Office Act 2001 • Tax Clearance certificate needed by: – – – – Members of the Oireachtas Senior public officials Candidates for judicial appointments Senior appointment in local authority, health board and public body controlled by Government Minister Accounting for Withholding Tax • Withholding taxes are on gross income • Key accounting issue: • Present as deductions from payments or Present items as a charge to taxation? Accounting for Tax Investment Income •Dividends •Rental •Royalty income Withholding Taxes from payments made •Entity obliged by law to deduct •Liabilities and Expense •Withholding taxes deducted •Recognise as income tax expense •Recognise income on gross basis •Account for deductions on same basis as indirect taxes Accounting for Distributions • • • • • • Irish GAAP and IFRS Accounting classification of instruments Equity instruments Debt instruments Compound instruments – part equity/part debt Obligation on company to deliver cash or another financial asset to holder • Identical with IAS 32 Financial instruments • Adopted into GAAT as FRS 25 Accounting for Distributions • Financial liability classification – contractual obligation to transfer cash or financial asset to holder • Obligation to repay principal, interest or dividends • Equity instrument – residual interest in assets of entity after deducting liabilities Accounting for Distributions • Equity Instruments – dividends and distributions made shown as deductions from distributable reserves • Debt Instruments – dividends and distributions made shown directly in profit or loss account • Liability for dividends and distributions recognised when legal obligation to pay arises • Memo and Arts for discretionary dividends • Ireland – final dividends ratified at AGM interim dividends declared by directors Accounting for Distributions • • • • • Dividends on shares classified as distributions Presented as a finance cost Not recognised directly in equity Effective interest method DWT recognised directly in equity as part of distribution to shareholders Preference Shares • Instruments evaluated – equity or finance liability • Classified as financial liabilities where payments to holders in cash is unavoidable • Preference shares redeemable at option of holder – check dividend rights • If dividends are discretionary equity • If dividends are not discretionary financial liability • Contingent dividend rights – classify as liability Bonus and Scrip Issues • Irish GAAP and IFRS – no adjustment to total equity for simple split or bonus issue • May be impact on EPS • Transfer of reserves being capitalised with no change in total equity • Scrip Issue – record liability at time right to receive dividend • Reduce when shareholder elects to receive dividend • Liability settled when shares issued and credit to equity recognised as sale proceeds Round Up • • • • • • Dividend Withholding Tax Characteristics of share types and transactions Treatment of FII Section 130 distributions and exclusions Deemed distributions DWT –exemptions for residents and non residents • Administration Round Up • Withholding tax on Patent Royalties and Annual Payments • Pure income profit • Exemptions – residents and non residents • Annual interest and Short Interest • Administration Round Up • • • • • • • • • Withholding Tax on Rent Exemptions – appointment of agent Trustee obligations DTAs and withholding tax EU Directive on Interest and Royalties Fiduciary Withholding – PAYE and VAT Financial Institutions and Withholding Taxes DIRT Exit Tax – gross roll up funds Round Up • • • • • • • • Encashment Tax – Sch C and D Enforcement withholding taxes PSWT RCT CGT Clearance procedures Tax Clearance Certs Government Contracts and Licences Accounting for Withholding Taxes