The Analysed Cash Book

advertisement

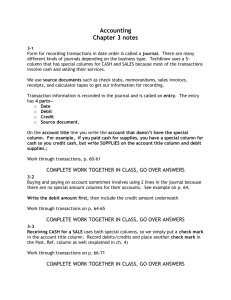

The Analysed Cash Book: Basic Cash Accounts In the last chapter (Budgets), we learned how important it is to plan ahead with regards to our income and expenditure so that we live within our means and do not overspend. The analysed cash book now allows us to record our actual income and expenditure that happens in a given period (example a week in March) by preparing household accounts. These household accounts will allow us to compare our actual income and expenditure with our budgeted income and expenditure (similar to our actual v difference budgets) Bookkeeping rule 1: When completing cash accounts we: Record money coming in on the left side and call it a DEBIT Record money going out on the right side and call it a CREDIT Our accounts are recorded in a T- Account style Debit (+) this is anything we receive. Credit (-) this is anything we pay out. Let’s take a look at a basic cash book for a family for the week 01-08 of March. Debit: Money Coming In + Date 01/03 06/03 08/03 Details Wages Child Benefit Wages F Total 600 350 600 1050 09/03 Balance B/D Credit: Money Going Out Date 02/03 04/03 Details Groceries Esb 07/03 08/03 Mortgage Balance C/D F Total 60 150 300 1040 1550 1040 Here you can see that all money received is on the debit side, and all payments or money going out is on the credit side. The balance c/d figure is the amount left over (closing cash for that time period). It is calculated by subtracting the total in the debit column from the total in the credit column and is then used to balance this account. As you are familiar with from doing budgets, this closing cash (balance c/d)will be the next month’s opening cash (balance b/d). Now let’s attempt a simple T- Account question in our copies for the Smith Family for the week 14th -21st of October 2013. 14/10 Cash on Hand €300 (Balance b/d from last month) 15/10 Received Wages €1200 16/10 Payed for Insurance €100 17/10 Payed Groceries €100 17/10 Child Benefit €150 18/10 Childcare €140 20/10 Wages 600 21/10 Car Repayments €550 *Remember to use appropriate headings and columns Bookkeeping Rule 2: Asset: Anything you own-e.g. your house Liability: Anything you owe, e.g. mortgage payments *Debit Assets, Credit Liabilities* The Analysed Cash Book: How to prepare them We have just completed an example of a simple cash account, now we must move on to look at how we are going to complete the Analysed Cash Books. The analysed cash book is used to record all money received and all money paid out by a household or business. We still follow the simple rules of the cash accounts from above, however this time we have to create actual accounts for each transaction we make. The date column is the date of the transaction The details column is the description of transaction The Receipt Number or Cheque Number will be given in the question if relevant The F column is for reference numbers The bank/cash columns: Debit is money we received. All our debit transactions go in the bank account Credit is money we pay out. All our credit transactions go in the bank account and the other account (e.g. bank €1100 and van €1100 from above). *Note: (If there is a cash column, and the question states that we pay out by cash rather than the bank, similar rules apply to the bank columns) The remaining columns are our analysis columns. You will be asked in the question to give these headings on the debit and credit side. These are used to keep a record of all your transactions Sample Analysed Cash Book 2011 Junior Cert Question and Solution. We will work on this question in class. N.B. Now please have a read of pages 38/39 of textbook for a talk through another example of a cash account. Bookkeeping Rule 3: Contra Entries: These are entries that require us to make a debit entry and a credit entry for the one transaction. For example, if you walk up to an ATM and withdraw €20 from your bank account, you would debit your own cash account (cause it to increase) as you now have an increase of €20 and credit your bank account (this is paid out of the bank) as it has now reduced by €20. You would need to show this in a cash account using appropriate headings. Can you give this a try using cash and bank headings on both the debit and credit side? Budgets Revisited: Actual v Difference Now that your cash account is complete, you may be asked to compare your actual figures with your budgeted figures and record the difference. What you need to do in this example is examine the completed cash account and then compare your actual figures with your budgeted figures and then mark in the difference using + or – signs. Please note that you are not being asked to create a budget in this instance so will not need closing cash or opening cash or even complete total income and expenditure columns. Let’s look at wages as an example from our cash account above. All our wages totalled up to be €2580, our budget was €3500, so this is a difference of -920. As you know, Actual- Budget = Difference. In your copy, try and complete the table now using the 2011 question from above.