Fall Final Review

advertisement

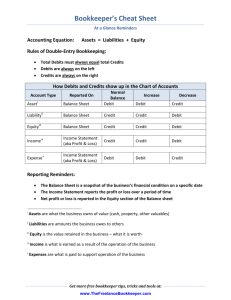

1. Classify the following as: Asset, Liability, Owner’s Equity, Revenue or Expense and give the Normal Balance Cash Accounts Receivable Accounts Payable Drawing Sales Rent 2. When cash is paid on account, Accounts Payable is? a. Increased by a debit b. Decreased by a credit c. Increased by a credit d. Decreased by a debit 3. When cash is received on account a. AR is decreased and cash is increased. b. Sales is increased and cash is increased. c. AR is increased and cash is increased. d. Sales is decreased and cash is increased. 4. The journal entry when an owner invests in the business is a. debit Capital, credit cash b. debit Cash, Credit Accounts Payable c. debit Cash; credit Capital d. debit Cash; credit Drawing 5. Match the following Account Number 500 200 300 100 400 Classification Asset Liability Capital Revenue Expense 6. A debit may signify a. a decrease in an asset. b. an increase in a liability. c. an increase in an asset. d. a decrease in an expense 7. The normal balances of assets, liabilities and owner’s equity are respectively, a. debit, debit and credit. b. debit, credit and debit. c. credit, debit and debit. d. debit, credit and credit. 8. If net sales is $10,000 and operating expenses are $7,500 your component percentage for net income is a. 75% b. 100% c. 25% d. 20% 9. The recording of debit and credit parts of a transaction is called a. matching revenue to expense b. double-entry accounting c. closing the books d. objective evidence 10. The Petty Cash account is debited a. when you replenish the Petty Cash Account b. when you establish the Petty Cash Account 11. What is the ending balance on the bank reconciliation using a $10 bank fee, $250.00 in outstanding checks and $500.00 outstanding deposit Checkbook Balance $5,010 Bank Balance $4,750 12. Net Income is entered in the worksheet’s? a. Income Statement Debit and Balance Sheet Credit sides b. Income Statement Credit and Balance Sheet Debit sides 13.The adjusting entry for insurance is a. Credit Insurance Expense; Debit Prepaid Insurance b. Debit Insurance Expense; Credit Cash c. Debit Insurance Expense; Credit Prepaid Insurance d. Debit Cash; credit Prepaid Insurance 14. To close the sales account a. Debit Sales; credit Cash b. Debit Income Summary; credit Sales c. debit Sales; credit Income Summary d. Debit Cash; credit Sales 15. Revenue from Services would appear on the worksheet in the a. Income Statement Cr. column. b. Adjusted Trial Balance Dr. column. c. Balance Sheet Cr. column. d. Adjustments Dr. column. 16. Temporary accounts closed at the end of the accounting cycle a. Cash and Capital. b. Revenue and expense accounts and the owner’s drawing account. c. contra accounts. d. open accounts. TRUE OR FALSE 17. Only the person a check is made out to can own the check. 18. If the person a check is made out to simply signs their name on the back of the check that is called a blank endorsement. 19. A blank endorsement transfers ownership to whoever is in possession of the check 20. A Balance Sheet reports a business’s financial condition on a single date. 21. When the owner withdraws cash the owner’s drawing account should be posted with a credit. 22. The formula for calculating Net Income component percentage is Net Income/Net Sales. 23. Proving cash means comparing the cash balance in the general ledger to the cash balance in your check book. 24.Permanent accounts accumulate balances while temporary accounts are zeroed out at the end of the fiscal period. 25. If Sales are greater than expenses you have Net Income therefore for Net Income on the Income Statement credits to sales would be greater than debits to expenses. 26.Closing entries are made at the end of the accounting period to transfer balances of temporary accounts to the owner’s capital account, closing Sales, Expense, Net Income and Drawing). 27. A worksheet is used to plan adjustments and sort financial information after publishing financial statements 28.A balance sheet reports a business’s financial progress over a period of time. 29.Temporary accounts will begin each fiscal period with a zero balance. 30.A journal entry or transaction is a business activity with a debit and credit that will change assets, liabilities or owner’s equity. 31. Assets are what you owe and liabilities are what you own. 32. In the Accounting Equation Assets=Liabilities + Owner’s Equity, Owner’s Equity can not be negative. 33. A chart of accounts is a list of accounts used by a business and only lists the account name and number. 34. The left side of the T-account is the credit side. 35. Transactions are recorded in chronological order in a journal and the accounting system will post each entry immediately to the individual ledger and every ledger will keep a running balance of each account. 36. Double lines rules across a journal or worksheet indicate the amounts have been verified as correct 37. An cash payment entry was posted in error to Rent Expense instead of Repair Expense. The correction would be to Debit Repair Expense and credit Rent Expense 38. Assets are listed on the Balance sheet in Alphabetical order and Expenses are listed on the Income Statement in Chronological Order. 39. A check with a future date is called a post-dated check, if it is submitted before the date on the check the bank may refuse to pay and it would be considered a dishonored check. 40.Closing entries make all revenue, expense and drawing accounts zero 41.A business owned by one person is called a proprietorship. 42.The Father of Accounting is known to be Mario Luigi 43. Match the following Source Doc C R T S M A. B. C. D. E. Classification Sale on Account, Dr. AR, Cr. Sale Receipt, Debit Cash Tape, Dr. Cash, Cr. Sale Memorandum Check, Credit Cash