Pension Benefits Administration

advertisement

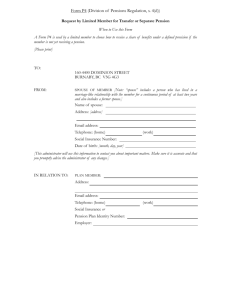

Article 3 Police Pension Funds Article 4 Firefighters’ Pension Funds Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Presented by Allison R. Barrett, Partner Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Calculation of Benefits (tab 1) Service Purchases (tab 1) IRS Reporting (tab 2) Contributions (tab 3) QILDROs (tab 3) Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Calculation of Benefits - COMPONENTS Benefit is a percentage of salary Retirement: percentage is determined by length of creditable service Disability: percentage is fixed, regardless of length of service Salary = “Pensionable Salary” (see IDOI webpage) Includes - base salary attached to rank, longevity Excludes – clothing or car allowances, spikes ??? – Holiday pay, overtime Creditable Service “Give to Get” theory Excludes some unpaid leaves of absence Felony conviction Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Calculation of Benefits – CALCULATOR IDOI web page Requires input of components Exceptions Dependent benefits for Fire (Duty or Occupational Disease Disability) Conversions Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Calculation of Benefits – THINGS TO KNOW Tier 1 versus Tier 2 Member FIRST HIRED by a pension fund under this article after 01/01/11 = Tier 2 Subsequent slides reference Tier 1 Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Q: TRUE or FALSE? You must be 50 years old and must have completed 20 years of active service to be eligible for a retirement pension Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration A: False Police 8 – 19 years of service Age 60 Fire 10-19 years of service Age 60 Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Q: TRUE or FALSE? A line of duty disability pension is granted at 65% of pensionable salary Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration A: False GREATER OF 65%, or The retirement amount the member is eligible for at time of disability (max 75%) REMEMBER First 65% is tax-free; anything above 65% is taxable Fire: Additional benefit paid for dependent Benefit paid directly to member but Report on IDOI report under dependent Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Calculation of Benefits – THINGS TO KNOW Nonduty Disability Pension 50% of pensionable salary Taxable Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Calculation of Benefits – THINGS TO KNOW Initial Increases Retirement Effective: Later of month after turn 55 or month after retired for one year Amount: (1/12) of (3% of original benefit) times (# of full months between retirement date and effective date of initial increase) Disability Effective: January 1st after reach age 60 Amount: (3% of original benefit) times (# of full years between disability date and effective date of initial increase) Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Calculation of Benefits – THINGS TO KNOW Subsequent Increases (COLAs) Retirement Effective: Every January 1st after the initial increase has been received Amount: 3% compounded Disability Effective: Every January 1st after the initial increase has been received Amount: 3% of original benefit Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Calculation of Benefits – THINGS TO KNOW COLAs Spousal – NONE! Dependents for Fire Duty or Occupational Disease Disability 3% compounded Every January, regardless of age of pensioner Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Calculation of Benefits – THINGS TO KNOW Survivor benefits Eligible Spouse Police – married at time pension began Fire – married at least one year prior to death Dependent Child(ren) Under age 18 Legally handicapped (mentally or physically) – for life Dependent Parent(s) Estate if pension withdrawn is less than contributions made Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Calculation of Benefits – THINGS TO KNOW Minimum Gross Benefit Police - $1,000 (01/01/01) Fire - $1,159.27 (07/01/08) Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Calculation of Benefits – CONVERSIONS “Disability Pension Option” Requirements Age 50 20 years of service (active or active+disability) Initial benefit should be calculated using statute in effect at time of disability SALARY???? - if at least 20 years of active service, use salary at time of conversion Calculator not available - ask IDOI for assistance Consider taxability (gross may be more but net may be less) Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Q: TRUE or FALSE? Pension benefits should be paid monthly at any time during the month Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration A: False Department of Insurance written opinion Fiduciary responsibility not to prepay benefits Should be paid on last business day of month for the month (August benefits paid 08/31) Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchase – Disability Buy Back Up to 3 years of disability time Must pay contributions that would have been withheld Using salary at time of disability Interest – 6% compounded from each missed pay date to repayment date Must return to active service for a period of time equal to the time being purchased Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchase – Military Service (after hired) Can purchase up to 5 years (if hired before 07/01/73, no limit) Must pay full contributions due as if remained active employee Employer pays difference between full wages and military wages Employer can withhold full contributions, partial contributions, or no contributions NO INTEREST! Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchase – Military Service (before hired) Can purchase up to 24 months Must pay full amount of new unfunded liability Use salary at date of hire Employee AND Employer contributions, using “Percent of Total Normal Costs” from tax levy Interest Reserve time? Document procedures in your Rules & Regs!!! Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchase – PORTABILITY (police only) Article 3 to Article 3 “Moves” service time Must have at least 2 years of service with Prior Fund Unless left due to lay-off Unless left prior to 08/17/97 Must transfer 100% of service time Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchase – PORTABILITY (continued) 3 calculations 1. Repay contribution refund, plus 6% interest (Prior Fund does) 2. Prior Fund sends to Current Fund (Prior Fund does) 3. A. Employee contributions B. Interest calculation – 6% from date of each payroll deduction to date of transfer (THIS IS NOT THE SAME INTEREST CALC AS #1 ABOVE!) C. Match of A and B True Cost calculation (by certified actuary) (Current Fund does) Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchase – PORTABILITY (continued) If True Cost is greater than amount from Prior Fund Option #1 Officer pays difference to Current Fund (within 5 years) Receives credit for 100% of Prior Fund service Option #2 Officer pays nothing to Current Fund Receives partial credit (amount from Prior Fund divided by Total True Cost) If True Cost is less than amount from Prior Fund, Current Fund keeps difference Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchase – PORTABILITY (example) Option #1 – example Prior Fund service time 4 years, 2 months, 18 days Prior Fund sends $63,800 True Cost is $145,000 Balance due to Current Fund from officer $145,000 – $63,800 = $81,200 Lump sum or installments (within 5 years) Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchase – PORTABILITY (example) Option #2 – example Prior Fund service time 4 years, 2 months, 18 days (= 50.6 months) Prior Fund sends $63,800 True Cost is $145,000 63,800 / 145,000 = .44 .44 x 50.6 months = 22.27 months Additional service granted of 1 year, 10 months, 8 days No additional cost to officer Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchase – RECIPROCITY (fire only) Article 4 “Combines” service time – does not “move” Must have at least 1 year of service with Prior Fund(s) Must have at least 3 years of service with Final Fund Must be 50 years old and have at least 20 years of service between funds If hired after 07/01/04, must notify funds of intent within 21 months Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchase – RECIPROCITY – cost to member 3 calculations 1. 2. 3. Repay contribution refund (to all Prior Funds) Plus 6% interest 10 years to repay Additional 1% contribution (to all Prior Funds) 6% interest Lump sum / installments Additional 1% contribution (to Current Funds) 6% interest prior to “Declaration Date” Employer withholds additional 1% from paycheck as of “Declaration Date” Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchase – Reciprocity – PENSION BENEFIT Retirement Prior Fund(s) 1/12 of 2.5% of final monthly salary for each month of service in that fund(s) Final Fund Calculate benefit as if ALL service was with this fund, using salary of this fund Subtract amount(s) paid by prior fund(s) Mutliple 1099R forms Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchase – Reciprocity – PENSION BENEFIT Nonduty Disability, Duty Disability Full benefit paid by Current Fund Occupational Disease Disability Benefit paid by all funds to whom payment has been completed Each fund pays a prorated share based upon length of service Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Service Purchases – Final Thoughts Credit received once all payments made by all parties Good record keeping is a must! Deductions made from payroll for purchase of service must be AFTER- TAX (even if regular contributions are pre-tax) Update Department of Insurance Report Status Hire Date Length of Service COST PROHIBITIVE!! Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration HELPS (“Healthcare Enhancement for Local Public Safety) Effective January 2007 Reduce taxable earnings by $3,000/year Insurance premiums Deducted from pension check Paid directly to provider Do not withhold pre-tax (limits pensioner’s filing options on their 1040 form) DO NOT REFLECT ON 1099R FORM!!!! Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Social Security Windfall Elimination Provision Spousal / widow benefits Contact local SSA office www.ssa.gov (calculator) Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Taxability of Pension Benefits - REPORTING New pensions first paid after 12/31/97 Replaces Safe Harbor Method with “Simplified Method” Divide total after-tax contributions by the number of months of life expectancy Number of months provided by one of two IRS tables (marital status) Pension Fund responsible for reporting taxability on 1099R form Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Taxability of Pension Benefits - REPORTING Taxability of pension transfers to spousal pension Tax-free pensions should not be reported to the IRS Killed in the line of duty 65% duty/occupational disease disability If awarded for cancer (4-110.1) – IS taxable Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Taxability of Pension Benefits – TAX FORM #1 SS-4 – Application for Employer Identification Number IRS needs to know pension fund is a separate entity from municipality/district www.ssa.gov Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Taxability of Pension Benefits – TAX FORM #2 W-4P – Withholding Certificate for Pension or Annuity Payments Determines the amount of federal tax to withhold from pension check Marital status / number of exemptions Cannot request a flat dollar amount! Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Taxability of Pension Benefits – TAX FORM #3 945 – Annual Return of Withheld Federal Income Tax Pension Fund lists tax liability dates and amounts due IRS uses to reconcile against tax deposits to determine if paid timely Due February 945-A may be required Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Taxability of Pension Benefits – TAX FORM #4 1099R In lieu of W-2 Taxable pension payments Contribution refunds Due January 31st to payee; due February 28th to IRS Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Taxability of Pension Benefits – TAX FORM #5 1099MISC Vendor payments All legal services All medical services All non-incorporated vendors to whom paid at least $600 during the calendar year Due January 31st to payee; due February 28th to IRS Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Taxability of Pension Benefits – TAX FORM #6 1096 – Annual Summary and Transmittal of U.S. Information Returns “Cover page” Use with 1099R and 1099MISC forms Due February 28th to IRS Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Taxability of Pension Benefits – TAX NOTES Circular E (Publication 15) Federal tax withholding tables Deposit schedule (safest pay taxes on pay day!) EFTPS (www.eftps.gov) Tax liabilities Federal withholding tax – yes IL withholding tax – no Other state withholding tax – maybe Social Security / Medicare – no Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Coalition for Qualified Plan Status AFFI / IGFOA / ILFOP / IMTA / IPFA / IPPFA / MAP (IDOI, Lauterbach & Amen) To maintain “Qualified Plan” status with IRS Tax-free pension benefits Pre-tax contribution deductions / roll-overs No tax due on interest from investments IRS grants “Determination Letter” 5-year cycle IDOI webpage Cost savings As individual pension fund = $40,000+ As part of Article 3 or Article 4 = $400 (did you contribute?) Annual review of IL statutes to ensure compliance with IRS code Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Contributions – EMPLOYER PICK-UP PLAN Option presented by IRS in mid-1980’s Pre-tax contribution deductions (increases net pay) Employer Resolution Determination Letter covers Fund Irrevocable Not required for employer, but if implemented, mandatory participation by employees Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Contributions – Rates Police 9.91% Effective 01/01/01 Fire 9.455% Effective 07/01/04 Additional 1% for reciprocity Pensionable earnings ONLY Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration Contributions – Refunds After-tax contributions Paid directly to member No taxes withheld Pre-tax contributions Paid directly to member Must withhold 20% in federal tax IRS notification of potential penalties / taxes when file 1040 Roll-over to another Qualified Plan No tax withheld Payable and sent to Qualified Plan (not member) Reflect refund on 1099R Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration QILDRO Qualified Illinois Domestic Relations Order Effective 07/01/06 Only applicable against contribution refund or retirement pension 3 pieces All must be filed in court Have Board Attorney review before implementing Available on DOI webpage (with reference manual) Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration QILDRO – Components QILDRO Order Names parties Allocates benefit as a percentage of the “marital portion” of the pension Consent To Issuance form Required if hired prior to 07/01/99 Calculation Form Completed by member, ex-spouse, their attorneys Can’t be completed until creditable service is done Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration QILDRO – Taxability 1099R Reporting Alternate Payee List benefit as fully taxable Member Gross benefit (Box 1) - no effect Taxable benefit (Box 2a) – reflect QILDRO paid in this box Gross less QILDRO (less recovered after-tax contributions) Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Pension Benefits Administration QILDRO – Cessation If Alternate Payee dies If Member dies Not applicable to survivor pension Lauterbach & Amen, LLP 630.393.1483 * www.lauterbachamen.com Allison R. Barrett Lauterbach & Amen, LLP 27W457 Warrenville Rd Warrenville, IL 60555 630.393.1483 / 866.952.6329 abarrett@lauterbachamen.com www.lauterbachamen.com