Debit balance

advertisement

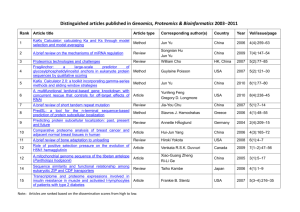

Closing Balances and the Trial Balance What’s Inside ? Learning Objectives hink Corner Balancing the account Trial Balance uiz Corner Balancing the account Trial Balance Learning Objectives After reading this chapter, you will be able to: Close accounts at the end of a month. Close accounts at the end of a financial year. Prepare accounts using the running balance method. Prepare a trial balance and state its uses and disadvantages. hink Corner Up to this stage, all you see from the account is a list of entries. Take the bank account as an example, after entering ten debit entries and twenty credit entries in the account, do you know how much is left in the bank? No. We need to find the difference nswer between the debit side and the credit side to see how much is left. This procedure is called closing the accounts and the difference is called the balance. There are two stages of account closing: 1. Month-end closing 2. Year-end closing Month-end closing Firms need to monitor their accounts regularly to see if there is any problem. For example, owners need to know whether they have enough cash in the bank, whether debtors are slow making payments or whether they owe creditors too much. Because of the above reasons, firms usually close month After the accounts at the end of each _____. balance closing the accounts, the owners know the ______ of each account and they can make decisions accordingly. Month-end closing Take a bank account as an example. Shown below is how the account is closed at the end of a month: Bank 20X7 Nov 1 Capital “ 25 Cash $ 200,000 30,000 $230,000 20X7 $ Nov 3 Motor vehicles 60,000 “ 14 Rent 10,000 “ 22 Purchases 40,000 $110,000 Step 1 Add up the debit side and the credit side separately. Step 2 If the total of the debit side and the total of the credit side differ, the difference is the balance of the account. Month-end closing Take a bank account as an example. Shown below is how the account is closed at the end of a month: Bank 20X7 Nov 1 Capital “ 25 Cash $ 200,000 30,000 $230,000 20X7 $ Nov 3 Motor vehicles 60,000 “ 14 Rent 10,000 “ 22 Purchases 40,000 $110,000 Difference between the debit side and the credit side = $230,000 – $110,000 = $120,000 Month-end closing Take a bank account as an example. Shown below is how the account is closed at the end of a month: Bank 20X7 Nov 1 Capital “ 25 Cash $ 200,000 30,000 Closing balance Step 3 20X7 Nov 3 “ 14 “ 22 “ 30 $ Motor vehicles 60,000 Rent 10,000 Purchases 40,000 Balance c/d 120,000 Put this balance on the side with the smaller total. This closing balance is called the balance carried down (abbreviated as balance c/d). Month-end closing Take a bank account as an example. Shown below is how the account is closed at the end of a month: Bank 20X7 Nov 1 Capital “ 25 Cash $ 200,000 30,000 230,000 Step 4 20X7 Nov 3 “ 14 “ 22 “ 30 $ Motor vehicles 60,000 Rent 10,000 Purchases 40,000 Balance c/d 120,000 230,000 Enter the totals on both sides at the same level. Now the debit-side total equals the credit-side total. Month-end closing Take a bank account as an example. Shown below is how the account is closed at the end of a month: Bank 20X7 Nov 1 Capital “ 25 Cash $ 200,000 30,000 Dec 1 Balance b/d 230,000 120,000 Step 5 20X7 Nov 3 “ 14 “ 22 “ 30 $ Motor vehicles 60,000 Rent 10,000 Purchases 40,000 Balance c/d 120,000 230,000 Opening balance The closing balance of the current month is the opening balance of the next month. This is called the balance brought down (abbreviated as balance b/d). Month-end closing Take a bank account as an example. Shown below is how the account is closed at the end of a month: Bank 20X7 Nov 1 Capital “ 25 Cash $ 200,000 30,000 Dec 1 Balance b/d 230,000 120,000 20X7 Nov 3 “ 14 “ 22 “ 30 $ Motor vehicles 60,000 Rent 10,000 Purchases 40,000 Balance c/d 120,000 230,000 The balance of $120,000 means that there is $120,000 left in the bank at the end of November. At the beginning of December, the bank account will start with $120,000. Month-end closing From the above example, the balance c/d is on the credit side of the bank account. This means that the debit total is greater than the credit total. We call debit balance this balance a ___________. $ $ When the credit total is greater than the debit total, the balance c/d would be on the debit side. balance This is a credit ___________. $ $ Month-end closing When the debit total is equal to the credit total, zero balance there would be no balance c/d. This is a __________. $ $ Debit total > Credit total Debit balance Debit total < Credit total Credit balance Debit total = Credit total Zero balance Note: Assets and expenses accounts usually have debit balances. Capital, liabilities and revenues accounts usually have credit balances. Learning Objectives uiz Corner Year-end closing At the end of a financial year, businesses will close final accounts including the accounts and prepare the ___________, trading and profit and loss account and the the ____________________________ balance sheet ___________. Final accounts Trading and profit and loss account This allows owners to find out whether there is a profit or loss. Balance sheet This allows owners to know the financial situation of the business. Year-end closing The method of closing the accounts at the year end is the same as that for the month end, except that closed at the year end and some accounts will be _____ carried forward to the their balances will not be _____________ next financial year. ______, Assets _______ liabilities and ______ capital accounts will still have their balances carried forward to the next accounting year, and their balances will also appear balance sheet on the ___________. Revenues and expenses _______ _______ accounts will be closed at the year end. Balances will not be carried forward to the next accounting period. They will be transferred to trading and profit and loss account the ____________________________. Year-end closing Year-end closing for revenues and expenses At the year end, the sales and purchases accounts will be closed and their balances will be transferred to the trading account while other revenues and expenses _____________, accounts will be closed and their balances transferred profit and loss account to the __________________. Example 1: JC Company’s financial year ended on 31 December 20X8. The sales account and the electricity account on that date would appear as: Year-end closing Sales 20X8 Dec 31 Trading $ 150,000 20X8 Dec 1 Balance b/f $ 150,000 Electricity 20X8 Dec 1 Balance b/f “ 21 Bank $ 40,000 20,000 60,000 20X8 Dec 31 Profit and loss $ 60,000 60,000 You can see that the only difference between month-end closing and year-end closing is that the balances in the not revenues and expenses accounts at the year end are ___ carried forward to the next period but are transferred to the ____________ trading account or the ___________________. profit and loss account Learning Objectives Computerised account When accounting records are kept on computers, the accounts are usually drawn up in three columns instead of in debit entries one for _____ credit T form: one column for ___________, ______, and the last one for the ______. entries balance Using this kind of account, the balance is calculated after running balance each entry. Therefore, it is called the _____________ method ______. Example: Sally Tong 20X7 $ Sep 15 Bank 15,000 “ 18 Returns outwards 5,000 “ 30 Balance c/f 20,000 40,000 20X7 Sep 1 Purchases “ 7 Purchases “ 25 Purchases $ 10,000 20,000 10,000 40,000 Computerised account The running balance method will appear as: Sally Tong 20X7 Sep 1 Purchases “ 7 Purchases “ 15 Bank “ 18 Returns outwards “ 25 Purchases Debit $ Credit $ 10,000 20,000 15,000 5,000 10,000 Balance $ 10,000 30,000 15,000 10,000 20,000 Cr Cr Cr Cr Cr The balance will be ________ the same using either method. Learning Objectives hink Corner After the year-end closing, businesses will prepare their final accounts. Should we do this immediately after closing the accounts? Or should we do something else before preparing the final accounts? nswer We should prepare a trial balance after closing the accounts at the year end and before preparing the final accounts. A trial balance is a list of all debit balances and credit balances in the books. It is used to check the accuracy of entries in the accounts and identify errors in the books. Trial balance We can use a trial balance to check whether any _____ error has been made in the accounts by comparing the total debit balances and the _________________. total credit balances ________________ Recall the accounting equation, Assets = Capital + Liabilities. We have mentioned that assets usually debit balances while capital and liabilities have ____________, balances To have the accounting usually have credit ____________. equation remain in balance, total debit balances to total credit balances. should be equal ______ Assets = Capital + Liabilities Total debit balances = Total credit balances Trial balance Example: Record the following transactions of Margaret Wong for the month of June 20X8. Balance off the accounts at the end of the month, and then extract a trial balance as at 30 June 20X8. Jun 1 Margaret Wong started business with $100,000 cash and $200,000 in the bank. “ 2 Bought goods on credit from Nicolas Tam for $50,000. “ 4 Bought a van by cheque for $60,000. “ 6 Returned defective goods worth $1,000 to Nicolas Tam. “ 9 Sold goods on credit to Benson Chow for $80,000. “ 11 Bought another van by cheque for $40,000. “ 15 Received a cheque from Benson Chow for $80,000. “ 18 Paid rent of $20,000 in cash. “ 22 Bought goods with cash for $40,000. “ 25 Sold goods on credit to Daniel Ng for $60,000. “ 27 Daniel returned goods totalling $3,000 to Margaret. “ 30 Margaret took goods worth $1,000 as a birthday gift for her husband. Trial balance Capital 20X8 $ 20X8 Jun 1 Cash “ 1 Bank $ 100,000 200,000 Cash 20X8 Jun 1 Capital $ 100,000 20X8 $ Bank 20X8 Jun 1 Capital $ 200,000 20X8 $ Trial balance Purchases 20X8 Jun 2 Nicolas Tam $ 50,000 20X8 $ Nicolas Tam 20X8 $ 20X8 Jun 2 Purchases $ 50,000 Trial balance Bank 20X8 Jun 1 Capital $ 200,000 20X8 Jun 4 Van $ 60,000 Van 20X8 Jun 4 Bank $ 60,000 20X8 $ Trial balance Nicolas Tam 20X8 $ Jun 6 Returns outwards 1,000 20X8 Jun 2 Purchases $ 50,000 Returns Outwards 20X8 $ 20X8 Jun 6 Nicolas Tam $ 1,000 Trial balance Sales 20X8 $ 20X8 Jun 9 Benson Chow $ 80,000 Benson Chow 20X8 Jun 9 Sales $ 80,000 20X8 $ Trial balance Bank 20X8 Jun 1 Capital $ 200,000 20X8 Jun 4 Van “ 11 Van $ 60,000 40,000 Van 20X8 Jun 4 Bank “ 11 Bank $ 60,000 40,000 20X8 $ Trial balance Bank 20X8 Jun 1 Capital “ 15 Benson Chow $ 200,000 80,000 20X8 Jun 4 Van “ 11 Van $ 60,000 40,000 Benson Chow 20X8 Jun 9 Sales $ 80,000 20X8 Jun 15 Bank $ 80,000 Trial balance Cash 20X8 Jun 1 Capital $ 100,000 20X8 Jun 18 Rent $ 20,000 Rent 20X8 Jun 18 Cash $ 20,000 20X8 $ Trial balance Cash 20X8 Jun 1 Capital $ 100,000 20X8 Jun 18 Rent “ 22 Purchases $ 20,000 40,000 Purchases 20X8 Jun 2 Nicolas Tam “ 22 Cash $ 50,000 40,000 20X8 $ Trial balance Sales 20X8 $ 20X8 Jun 9 Benson Chow “ 25 Daniel Ng $ 80,000 60,000 Daniel Ng 20X8 Jun 25 Sales $ 60,000 20X8 $ Trial balance Daniel Ng 20X8 Jun 25 Sales $ 60,000 20X8 Jun 27 Returns inwards $ 3,000 Returns Inwards 20X8 Jun 27 Daniel Ng $ 3,000 20X8 $ Trial balance Purchases 20X8 Jun 2 Nicolas Tam “ 22 Cash $ 50,000 40,000 20X8 Jun 30 Drawings $ 1,000 Drawings 20X8 Jun 30 Purchases Step 1 $ 1,000 20X8 Balance off all the accounts. $ Trial balance Capital 20X8 Jun 30 Balance c/f $ 300,000 20X8 Jun 1 Cash “ 1 Bank 300,000 $ 100,000 200,000 300,000 Credit balance: $300,000 Cash 20X8 Jun 1 Capital $ 100,000 100,000 Debit balance: $40,000 20X8 Jun 18 Rent “ 22 Purchases “ 30 Balance c/f $ 20,000 40,000 40,000 100,000 Trial balance Bank 20X8 Jun 1 Capital “ 15 Benson Chow $ 200,000 80,000 20X8 Jun 4 Van “ 11 Van “ 30 Balance c/f 280,000 $ 60,000 40,000 180,000 280,000 Debit balance: $180,000 Purchases 20X8 Jun 2 Nicolas Tam “ 22 Cash $ 50,000 40,000 90,000 Debit balance: $89,000 20X8 Jun 30 Drawings “ 30 Balance c/f $ 1,000 89,000 90,000 Trial balance Nicolas Tam 20X8 $ Jun 6 Returns outwards 1,000 “ 30 Balance c/f 49,000 50,000 20X8 Jun 2 Purchases $ 50,000 50,000 Crebit balance: $49,000 Van 20X8 Jun 4 Bank “ 11 Bank $ 60,000 40,000 100,000 Debit balance: $100,000 20X8 Jun 30 Balance c/f $ 100,000 100,000 Trial balance Returns Outwards 20X8 Jun 30 Balance c/f $ 1,000 20X8 Jun 6 Nicolas Tam $ 1,000 Crebit balance: $1,000 Sales 20X8 Jun 30 Balance c/f $ 140,000 140,000 Crebit balance: $140,000 20X8 Jun 9 Benson Chow “ 25 Daniel Ng $ 80,000 60,000 140,000 Trial balance Benson Chow 20X8 Jun 9 Sales $ 80,000 20X8 Jun 15 Bank $ 80,000 Zero balance Rent 20X8 Jun 18 Cash $ 20,000 20X8 Jun 30 Balance c/f $ 20,000 Debit balance: $20,000 Returns Inwards 20X8 Jun 27 Daniel Ng Debit balance: $3,000 $ 3,000 20X8 Jun 30 Balance c/f $ 3,000 Trial balance Daniel Ng 20X8 Jun 25 Sales $ 60,000 60,000 20X8 $ Jun 27 Returns inwards 3,000 “ 30 Balance c/f 57,000 60,000 Debit balance: $57,000 Drawings 20X8 Jun 30 Purchases Debit balance: $1,000 $ 1,000 20X8 Jun 30 Balance c/f $ 1,000 Trial balance Step 2 List all debit balances and credit balances separately. Margaret Wong Trial Balance as at 30 June 20X8 Capital Cash Bank Purchases Nicolas Tam Van Returns outwards Sales Rent Daniel Ng Returns inwards Drawings Dr $ 40,000 180,000 89,000 100,000 20,000 57,000 3,000 1,000 Cr $ 300,000 49,000 1,000 140,000 Trial balance Step 3 Find the total of debit balances and the total of credit balances and see if they are equal. Margaret Wong Trial Balance as at 30 June 20X8 Capital Cash Bank Purchases Nicolas Tam Van Returns outwards Sales Rent Daniel Ng Returns inwards Drawings Dr $ 40,000 180,000 89,000 100,000 20,000 57,000 3,000 1,000 490,000 Cr $ 300,000 49,000 1,000 140,000 490,000 Trial balance Uses of a trial balance: 1. As a basis from which the final accounts are prepared. 2. To identify error(s) in the books. 3. To check whether the total debit balances and the total credit balances are equal. Disadvantage of a trial balance: Some errors may still exist even if the trial balance agrees. uiz Corner

![[#DASH-191] Replace JERSEY REST implementation by](http://s3.studylib.net/store/data/005918124_1-33fb89a22bdf4f7dbd73c3e1307d9f50-300x300.png)