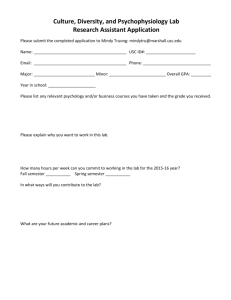

Cornmarket Smart Money Seminar and

advertisement

Cornmarket Presentation Cornmarket Group Financial Services Ltd. is regulated by the Central Bank of Ireland. Friends First Life Assurance Company Ltd. is regulated by the Central Bank of Ireland. Telephone calls may be recorded for quality control and training purposes. Our History With over 40 years' experience, we are the largest financial services broker serving the Public Sector in Ireland. We currently administer over 50 Union, Association and Employer endorsed Schemes. We are now a member of the Great-West LifeCo group of companies. 95% of customers that we surveyed said we were extremely/quite helpful & knowledgeable* *Source: feedback collated from 1,347 online surveys completed by Cornmarket customers in 2014. Some our clients Agenda 1. 2. 3. 4. 5. Tax & Budget update Group Life Plan Review Money Saving Tips Car and Home Insurance Budgeting. Tax How many people here do tax returns? 82% of PAYE workers overpaid in tax last year In 2014, the average tax rebate was €1,200! Source: Midas PAYE customer statistics, 2015. Midas is a tax based service and not a regulated financial product. Cornmarket Retail Trading Ltd. is a whollyowned subsidiary of Cornmarket Group Financial Services Ltd. Telephone calls may be recorded for quality control and training purposes. Why Public Sector Employees Overpay Tax Factors Repercussions x Not sharing credits and cut-off points in a tax efficient manner Change Job x Not claiming the appropriate tax credits, reliefs, rate bands, etc Agency Work x Not availing of all allowances & entitlements x Tax Credit Certificate details incorrect x Incorrect allocations accumulate year on year. Married Income changes Birth of child Human error when calculating and deducting tax. 5. Check your deductions 1.Check your Point on the Salary Scale 2. Check your PRSI class (A1 / D) 6. Not taxable 3. Standard Rate Cut-Off point: Should be at least €1,300 4. Should be at least 128 if PAYE The Payslip Analysis in action Louise is a secondary school teacher who was: • on the wrong point of the salary scale • missing 3 increments Thanks to Cornmarket and the Department of Education and Skills, Louise was reimbursed €13,214 gross in arrears. Seán was: • on the wrong point of the salary scale since 2004 • missing 5 increments. Thanks to Cornmarket and the Department of Education and Skills, Seán received back €14,236 gross in arrears. *Missing increments are most likely to occur where a teacher has been job sharing, taken maternity leave or a career break. Tax Credit Cert It instructs your employer on the amount of Tax to deduct. If it’s wrong…… YOU PAY too much or too little! How to calculate Income Tax Gross Salary/Pension/Other Income - (PRSI & USC) Less Superannuation/Pension Levy/AVC/NSP/PHI = Taxable Income Apply Rate Bands - 20% & 40% Deduct Credits = Income Tax Liability Check your Tax Credits & Rate Bands Rate bands • First €33,800 taxed at: 20% • Earnings over €33,800 taxed at: 40% 2015 example - A Public Sector Employee earning €40,000 pays €9,240 in tax before they apply their credits and €5,940 after applying their tax credits. Tax credits The more credits you accumulate, the less tax you pay. ….they are worth money and shouldn’t be ignored! Standard Rate Bands - 2015 Personal Circumstances 2015 Single €33,800 @ 20% Balance @ 40% Lone Parent €37,800 @ 20% Balance @ 40% Married with one income €42,800 @ 20% Balance @ 40% Married with two incomes* €67,600 @ 20% Balance @ 40% *transferrable between spouses, maximum of €42,800 with one spouse. Personal Tax Credits - 2015 Personal Circumstances Single Person Credit 2015 €1,650 Married Person Credit €3,300 PAYE Credit €1,650 Single Parent €1,650 Other Tax Credits Home Carer - €810* Incapacitated Child - €3,300 Dependant Relative - €70** Age Credit - Single €245 / Married €490 *Cannot have an annual income in excess of €5,080 **Cannot be claimed in conjunction with Home Carer’s Credit Maximise your Allowances & Reliefs Flat Rate Expenses Agreed between Revenue and your Union for expenses incurred directly related to the nature of your employment. Relief at your marginal tax rate Professor, Heads of Schools/Departments: €608 Lecturer on full hours: €518 Part-time lecturer (not on full hours): €279 How much is this allowance worth to you? €207 per year if you are earning €40,000!* *for a lecturer on full hours claiming the flat rate expenses tax credit €518. Tuition Fees • Relief for Tuition Fees in approved 3rd Level Colleges • Primary 2 year+ / Masters 1 Year + • Ireland and EU based courses • Limits: €7,000 total fees per person p.a. • Exemption (per household): – First €3,000 for full time course not claimable – First €1,500 for part time course not claimable. Claim relief on your Medical Expenses 1. Make your medical insurance claim (www.hia.ie) Tax relief at source, unless paid by employer. 2. Avail of the Drug Payments Scheme - max €144 pm (www.hse.ie) 3. Apply for your tax relief through Form Med 1. Qualifying Health Expenses Doctor, GP, consultant or hospital fees Items or treatments prescribed by a Doctor Approved nursing home fees (40%) Non-routine Dental Treatments Prescribed medicines Certain dietary products, e.g. Coeliac/Diabetic. Keep the receipts for 6 years. Rent Rent Credit • Renting in a private residential property • Must have been renting on 7th December 2010 • 2015 Credit: – €480 if aged 55 or over – €240 if under age 55 • To be phased out by 2017. Rent a Room Relief Scheme from Jan ‘15 • Tax-free income where owner occupier • Maximum is €12,000 per annum including meals, laundry etc. • Must still be declared to Revenue. Earning more than €3,174 outside of PAYE Income If you earn more than €3,174 of income from any source outside the PAYE system you are obligated to file a return annually. If you don’t file a return, penalties and late fees apply. Other Income Rental Income Income - Expenses = Taxable Profits Example of allowable expenses • Mortgage interest (75%) • Insurance • Mortgage protection • Management Fees • Letting Fees • Repairs & Maintenance • Advertising • Accountancy fees • Painting & Decorating • PRTB • Utility bills • Wear & Tear on Fixtures & Fittings. Rental Income Taxpayer’s View Revenue’s View Monthly Rental Income €1,000 €1,000 Mortgage repayment / interest (€1,200) (€720)* Profit / (Loss) (€200) €280 * Assuming 80% of repayment is interest, restricted to 75% allowable. Other Income • Landlord • Self Employment • Deposit Interest where DIRT paid • Foreign Income • Irish Dividends where 20% tax deducted. Remind me why we should file regular tax returns? 20 Age Considerations Multiple Jobs, e.g. Subbing Rent Relief 30 Pension Contributions Sharing Credits Mortgage Relief 40 Tuition Fees AVC’s 50 Last Minute AVC’s CAT/CGT Parent Nursing Home Fees 2nd Spouse Retirement DIRT Refund Inheritance Planning Last Minute AVC’s Tuition Fees 50 Parent Nursing Home Fees 55 60 65 State Pension 70 66 Cap on USC PRSI Exemption ARF Distributions Age Credit 1st Spouse Retirement CAT/CGT Age Considerations Organising Your Affairs Request & review your Tax Credit Certificates. Ensure correct allocation of Standard Rate Band between spouses. Notify amendments to Inspector. File Tax Returns annually. Review previous Tax years. Make sure you claim for any S & C/training & temporary/marriage gratuity interest and other superannuation deductions. ***Seek professional advice*** Budget 2016 Budget 2016 A quick guide on the increase in take home pay from 1st January 2016. If you have dependent children or a spouse who is self-employed, you will get a bit more back in your pocket. Table is based on a single, PAYE Public Sector worker and only takes into account the reduction in the Universal Social Charge (USC). Figures are for illustrative purposes only and do not account for tax relievable compulsory deductions, e.g. Superannuation and Spouses’ and Children’s Scheme deductions. Effective from 1st January 2016. For example A married Public Sector employee married to a self-employed person. • • • • Public Sector employee earning €38,000 Spouse is self-employed with a taxable profit of €7,000. They have 2 dependent children and are jointly assessed. Public Sector employee will see an increase in annual take home pay of €421 due to the changes in USC. • Spouse will now benefit from the ‘Earned Income Tax Credit’ of €550 on self-employed income. The spouse can also claim the increased ‘Home Carer Tax Credit’ of €1,000, as income does not exceed €7,200. • They will get an increase of €120 per year (€10 per month) in Child Benefit. As a family, they will get an extra €2,091 per annum. For example Retired Public Sector employee • Will get an increase in the Social Welfare Pension of €3 per week, resulting in an extra €156 per year. • The Christmas bonus has also been reintroduced at 75% of the weekly payment. This means a Pensioner on the current rate of €230 per week will receive a bonus of €173. • People aged 70 and over and/or medical card holders, with income under €60,000 will have a maximum rate of 3% USC. If you fall into this category and have an income over €60,000, you be liable to the standard USC rates. Budget Highlights • • Changes to Universal Social Charge (USC): The entry threshold for USC was increased from €12,012 to €13,000. In addition, the USC rates were decreased as follows: Earning €0 - €12,012:.......................Pay USC at 1% (reduced from 1.5%). Earning €12,013 - €18,668:.............Pay USC at 3% (reduced from 3.5%). Earning €18,669 - €70,044: ........Pay USC at 5.5% (reduced from 7%). Retired people aged 70 and over/medical card holders, with income under €60,000 will only be liable to USC at 3%. Retired people aged 70 and over/medical card holders, with income over €60,000 will be liable to the standard USC rates. Budget Highlights PRSI Employee’s PRSI: There was a tapered PRSI credit introduced with a maximum level of €12 per week. Relief commences at income of €352.01 per week and tapers out at a rate of 1/6th of income in excess of this threshold. Relief fully tapers out as income reaches €424 per week. Employer’s PRSI: An increase from €356.01 to €376.01 in the weekly threshold at which liability to Employer’s PRSI will increase from 8.5% to 10.75% on all earnings. Budget Highlights • Child Benefit: Increased by €5 to €140. • FREE Pre-School Programme: Announced for children aged 3 to 5½ years old (or school-going age). • FREE GP Care: To be extended to children under age 12 (subject to successful negotiation with doctor representatives). Budget Highlights • Home Carer Tax Credit: This will increase by €190 to bring it up to €1,000 per year plus there will also be an increase in the home carer’s income threshold from €5,080 to €7,200. • Paternity Leave: Statutory Paternity Leave of two weeks will be introduced from September 2016. Budget Highlights • State Pension: To increase by €3 per week in 2016. • Pension Levy: Will end this year and will not apply in 2016. Note: this applies to Private Sector Pensions only. • Capital Acquisitions Tax: The “Group A” taxfree threshold, which broadly applies to transfers between parents and their children, is being increased from €225,000 to €280,000. Budget Highlights Self-employed • A new “Earned Income Tax Credit” to the value of €550 was announced for self-employed people that do not have access to the PAYE credit. • Entrepreneurs will benefit from a new, reduced Capital Gains Tax (CGT) rate of 20%. This reduced rate of CGT applies to disposals of businesses up to a maximum ceiling of €1 million in chargeable gains. • Additional CAT Agricultural Relief for Farmers: Two family members can now enter into a partnership with a profit sharing arrangement which allows for the transfer of the farm to the younger farmer at the end of a specified period. This partnership will qualify for an income tax credit of €5,000 per year for 5 years. This will be allocated according to the Profit Share Agreement. • Commercial Motor Tax: The maximum rate of Commercial Motor Tax will be €900 from January 2016. Budget Highlights • Fuel Allowance: Will increase by €2.50 per week to €22.50 per week. • Respite Care Grant: This will be restored to €1,700 and will be paid to carers in receipt of the carer’s allowance/benefit. • Local Property Tax: It was announced that there will be no increase in this tax for 2016, 2017 or 2018. • Home Renovation Incentive: Extended to 31st December 2016. Budget Highlights • Social Welfare Recipients: An increase in the Christmas bonus from 25% to 75% of a total weekly payment. For example, a Pensioner currently receiving a weekly payment of €230 will get a Christmas bonus of €173. • Family Income Supplement: An increase in the threshold by €5 per week for families with one child and by €10 per week for families with two or more children. 2016 Budget updates will be effective for the 2016 and subsequent Tax years only. 2015 tax returns (to be filed by 31/10/2016) will not be affected by these changes. http://www.cornmarket.ie/university-of-limerick Group Life Plan 2015 Review Cornmarket has been appointed to administer the Plan & Friends First have been retained as the underwriters. As a result of the review benefits now include: • Death Benefit of 2.5 times your annual salary up to age 65 or the date that you retire, if earlier (separate to any Life Cover under the UL Pension Scheme). • Reduction in cost: from 0.558% to 0.53% of gross salary (0.32% of net salary based on a member paying tax at the 40% rate). • 5 year rate guarantee: The new reduced rate is guaranteed for the next 5 years (until 1st May 2020). • Enhancements announced: the Plan is now more beneficial than ever before with new enhancements. Who can join the Plan? All pensionable employees of the University of Limerick, who are under age 65, are entitled to join the Plan. IMPORTANT: You must remain an employee of UL to remain an eligible member of the UL Group Life Plan. If you leave employment with UL you must inform Cornmarket in writing, as you can no longer stay in the Plan and you will not be able to claim from it. Half Price Offer for new members under age 45! JOIN NOW and pay That’s just HALF PRICE for the first 0.26%! 12 MONTHS of your membership! Terms and conditions: Offer available to new entrants who apply to join the Plan for the very first time between 1st June 2015 and 31st December 2015. To avail of the half price offer for the first 12 months*, you must be under age 45 and a NEW ENTRANT to the Plan. *The first 12 months means 12 consecutive months from the 1st of the month following the date that you are accepted as a member of the Scheme by the Insurance Company. Cost of Membership with Half Price Offer • Salary of €40,000 – cost €1.20 per week • Salary of €50,000 – cost €1.50 per week • Salary of €60,000 – cost €1.79 per week. Net cost is 0.16% of salary after tax relief is applied, assuming income tax @ 40% (gross cost is 0.26% of salary). How Can I Join? To apply to join the Plan or for more information on the benefits available, Call : (01) 470 8054 Email: pensions@ul.ie Phone UL on: (061) 202930. Money Saving Tips Life Insurance How much cover do you and your family need? What type of cover is right for you? Are you over/under-insured? What types of cover are available? Life Insurance Mortgage Protection Serious Illness Cover How to find the best price cover for your needs? Cornmarket’s FREE Life Insurance Comparison Service Get the cheapest price on the market, PLUS a 5% discount!* *Lowest Pricematch we offer is €13.13 for Mortgage Protection plans and €15.15 on Term Level plans per month. The 5% discount on the lowest price quoted is subject to a minimum premium of €20 per month. Example of Savings Saving figure is based on a male whose age attained is 40 years and 1 month (01/06/1975), is a non-smoker, looking for Life Cover of €175,000; switching from Irish Life Convertible Term Policy to Aviva Convertible Term Policy. The quote is for a 30 year Level Convertible Term with benefits and premiums not increasing. Saving figure correct as at 09/06/2015. Aviva Life & Pensions UK Limited, trading as Aviva Life & Pensions Ireland, is authorised by the Prudential Regulation Authority in the UK and is regulated by the Central Bank of Ireland for conduct of business rules. Irish Life Assurance plc is regulated by the Central Bank of Ireland. Life Cover – DOs & DONTs • DO carefully consider what you can pay in and need out • DO consider writing in trust • DO live a healthier life, it makes things cheaper • DO answer questions accurately • DO quit smoking and requote. (minimum 1yr after quitting) • DO only get cover for as long as it's needed - and no longer. • DO consider writing in trust •DON'T over- or under-cover yourself •DON'T take out a critical illness policy without good advice •DON'T think you're stuck with old, expensive insurance •DON'T assume joint cover is the same as two singles - get quotes for both Spiralling cost of college education Parents face enormous costs once children start in college education: College fees (rising) + Rent/accommodation + Living expenses… Etc. Can all add up to approximately €800+ per month OR up to €10,000+ per child per annum! Tailor-made plans to help ensure you have enough money to fund your children’s college education. 4 steps to a brighter financial future 1. Review your finances 2. Identify your savings need 3. Tailor a savings plan to your own particular circumstances 4. Start your savings plan Why do you need to save? Deposit for house purchase, holiday, education expenses, weddings etc. 20% Deposit required Build a savings record Will you get credit? How much will it cost you? Would you be better off if you saved? Maximise your savings Deposit rates very low so its vital to get your money working for you. Tailored savings plans for public sector employees Educational Saving House Deposit New Car Sources: The Sunday Business Post 29/01/13 & 10/03/13 Car and Home Insurance Cornmarket General Insurance Client Numbers Over 75,000 Clients Over 54,000 Clients Over 19,000 Clients Over 2,000 Clients The Broker Process Bulk Buying Power Quarterly Service Reviews Quarterly Rate Reviews Quarterly Benchmarking Car Insurance Proposal • Breakdown • DAS Legal • Reduced Excess with approved repairer • Full NCB • Stepback NCB • Malicious Damage • Driving of other cars: Comprehensive • Breakdown • DAS Legal • Reduced Excess with approved repairer • Optional: Stepback NCB • Windscreen Cover • Driving of other cars: 3rd Party only Build your Own The Service 80% of calls answered within 20 seconds. Over 20,000 car & home calls handled monthly 70% of quotes issued on the spot via email What Challenges do unions face? 98% of certs issued within 2 days 33% of customers renew on-line Special offer: UL €75 Discount available to all UL members who purchase a new motor insurance policy. when you switch your car insurance to Cornmarket between 01/09/15 & 31/12/15 (subject to a minimum premium of €309.70, inclusive of Government levy) 3 months free offer on Allianz home insurance policies. when you switch your home insurance to Cornmarket between 01/02/15 & 31/12/15 (subject to a minimum premium of €328). Budgeting Where do I start? • Keep a spending diary • Calculate how much you are actually spending • What is an absolute necessity? • What isn’t an absolute necessity? e.g. cosmetics/weekend trips/eating out, etc • Manage your debt. Get your finances on track • Identify and write down your financial goals • List your expenses in order of priority e.g. debt payments first • Use a budget planner • Print it, keep it in a place that’s easily visible, e.g. fridge/wallet. • Regularly check you are still on track. Specific Measurable Setting your financial goals How much you want to save? Attainable Realistic Time-bound How long it will take? Setting your financial goals Short-term < 1 year Mid-term 1 to 3 years Long-term 3 years + Keep your finances under review as your circumstances change. Managing Debt • List your debts in order of priority • Know the APR and how much you have left to pay on all debts e.g. mortgage, utility bills, medical costs, credit cards, overdraft, personal loans. • The highest APR loans should be paid after your mortgage, utility bills and medical costs. • Know your facts and figures - devise a realistic monthly budget of what you can repay • Contact your lender/bank to discuss your options if you are finding it difficult to meet repayments, e.g. debt consolidation, payment breaks, extending your loan term, etc. don’t bury your head in the sand! http://www.cornmarket.ie/university-of-limerick Thank you for your attention Questions? Please be advised that while Cornmarket has referenced websites in this presentations, we cannot be held responsible for the content of these websites. Cornmarket Group Financial Services Ltd. is regulated by the Central Bank of Ireland. A member of the Irish Life Group Ltd. Friends First Life Assurance Company Ltd. is regulated by the Central Bank of Ireland. Allianz plc is regulated by the Central Bank of Ireland. RSA Insurance Ireland Ltd is regulated by the Central Bank of Ireland. Telephone calls may be recorded for quality control and training purposes.